Labour’s new revenue spokesperson Deborah Russell believes it might be time to “seriously” look at a capital gains tax (CGT).

Russell, a former tax lecturer who was last week appointed to the revenue role now that Labour is in Opposition, says she believes a CGT would be simpler to implement than a wealth tax, which both the Greens and Te Pāti Māori campaigned on at the election.

She said she believed wealth taxes “are largely unknown” and it would be “complicated to explain it to people”.

NO! NO! NO!

Why the fuck is Deborah fucking Russell already setting the goal so fucking low?

The Greens managed to overcome their alienating woke dogma and sell the Wealth Tax, why the Christ can’t Labour?

Why is Deborah losing the tax debate before even starting it?

Inheritance taxes

Japan 55%

South Korea 50%

France 45%

United Kingdom 40%

United States 40%

Spain 34%

Ireland 33%

Belgium 30%

Germany 30%

Chile 25%

Greece 20%

Finland 19%

Denmark 15%

Iceland 10%

Turkey 10%

Poland 7%

Switzerland 7%

NZ 0%

ENVY the Rights scream at any challenge of their rigged capitalism.

Bernard Hickey has argued, “We could have gotten $200 billion in extra tax revenues if only there had been a fair tax system which meant that capital gains were taxed at the same rate as every other type of income.”

In a liberal progressive democracy, it doesn’t matter what role you play in the complex super structure of our society and economy.

It doesn’t matter of you are a garbage collector, a dr, a nurse, a drain layer, teacher or tradie – if you all stopped doing your jobs the system can’t work.

Everyone deserves to share the collective harvest of civil society with public services and policies focused on the public good enshrined in the intrinsic civil liberties each individual has.

Wealthy individuals who become mega rich thanks to the landscape generated by those values are required to pay more back into the system they have benefited from beyond the bare necessity of ruthless accountancy practices.

These rich pricks have designed the system for themselves, ‘you can’t tax unrealised capital gains’ the Right scream, like bullshit we can’t!

If it means the mega rich have to sell a mansion or two to pay the tax bill, so fucking be it!

The obligation of the Government is to regulate Capitalism so that we the people benefit from the competitive dynamics of competition!

We are not an over taxed, over regulated economy!

Our top tax rate is the 39th highest in the world behind all the Scandinavian countries plus Germany, the United Kingdom, Ireland, France and South Africa!

Australia’s top tax rate is 47cents!

Our GST rate doesn’t even get us into the top 50 and our corporate tax rate is 40th while Government spending against GDP ranks 56th!

And we are voted easiest to do business by the World Bank!

Total hours spent at work per year (OECD):

Germany- 1330

Denmark- 1346

Japan- 1598

Australia- 1683

Canada- 1644

UK- 1367

New Zealand- 1739

I’m not looking for socialism here folks, just basic garden variety regulated capitalism!

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals, let’s start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry.

You should be angry, NZ Capitalism is a rigged trick for the rich and powerful. The real demarcation line of power in a western democracy is the 1% + their 9% enablers vs the 90% rest of us!

Do not allow their smears of ‘Envy’ dilute the righteous rage you should all be feeling!

There’s no point making workers pay more to rebuild our resilience, tax the rich!

-Sugar Tax

-Inheritance Tax

-Wealth Tax

-Financial Transactions Tax

-New top tax rate on people earning over $300 000 per year.

-Capital Gains Tax

-Windfall profit taxes

-First $10 000 tax free

Lift the tax yoke from the workers and the people and place it on the mega wealthy and have them pay their fair share for once!

The true demarcation off power in a liberal progressive democracy is the 1% wealthy + their 9% enablers vs the 90% rest of us.

Stand. Stand now and demand more from this rigged capitalism!

The political project of National and ACT is to starve the State of revenue so that it can’t redistribute wealth in the first place.

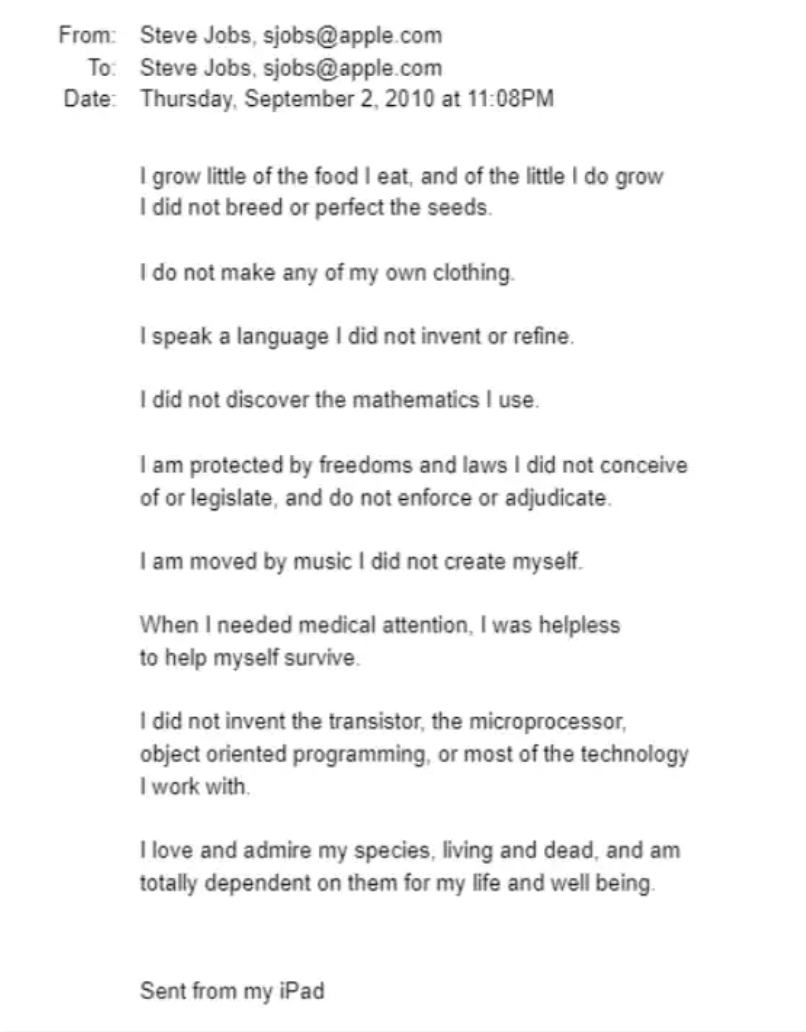

For those rich pricks screaming they are self made and fuck us for wanting a slice of their bread to properly fund society, let’s remember the email Steve Jobs sent to himself before he died…

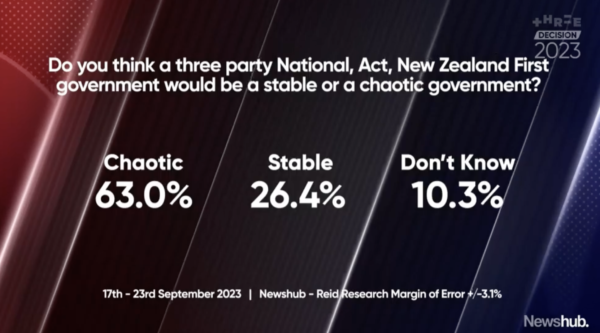

As for this…

…you all know it’s true!

So why is Deborah already surrendering before we have even gotten into the boxing ring?

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice going into this pandemic and 2020 election – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media.

Because neoliberal Labour is National Lite. Until the current iteration of the Labour Party shows signs that it understands there are alternatives to orthodox neoliberal economics (as there always have been) they will remain part of the problem, not the solution.

They won’t go as far as to admit they were wrong to unleash Rogernomics on Aotearoa NZ and say sorry, but they need gene therapy. Neoliberalism seems to be part of their DNA.

I see almost no hope for Labour. Especially while Hipkins with his captains calls remains at the helm.

Our hope for a better, fairer ANZ seems to lie elsewhere.

O.M.G! @ Grey Area? Are we brothers/sisters/clones?

You, have directly hit the dubious nail on its twisted little head.

The current political matrix has the rogernome effect coursing through it’s blue, bloodless little veins. ( Yeah-yeah. I know. How can something bloodless course? Well, use your imagination for Gods sake.) I can hear it! It sounds like someone who smells like bacon who’s rubbing paper money all over its testicles while mumbling something about Mommy! Who could that be? What goes ‘Oink’ then spends 40 years fucking the country beyond the imaginings of even the director of ‘Deliverance’. Wikipedia. https://en.wikipedia.org/wiki/Deliverance

Hey boy! Roger Douglas? You horrible fucker! Is this you?

Squeal like a pig boy!

https://youtu.be/bbcUsOfZTVI?si=Y5tpr2GzpGD6r3eR

Deborah has a poor economic vision because the Labour party has tried to upskill but forgot the people is was supposed to look after in the process. They need fresh thinking which will probably require new leaders since the current lot has demonstrated a total lack of ability to learn.

“So why is Deborah already surrendering before we have even gotten into the boxing ring?”–Bomber…

Because Labour’s Caucus is largely intellectual light weights in class left, “sticking it to the man” terms.

They know they fucked up with the Captain’s calls on CGT and Wealth Tax, but will still take the softest option they can get away with, which is why pressure has to be maintained on them from all directions, including ordinary members being consulted and having a vote. Jeeee-zus, polls showed even a number of Natzo voters supported a wealth tax!

The obvious way forward is for a Green, Te Pāti Māori, NZ Labour united position on wealth tax/CGT. TPM led from the front with the day of action, organised labour needs to be next up with regional workers meetings, with non union members welcomed.

“-Sugar Tax”

YES for health reasons, tax the manufacturers/importers. Tax anything above safe levels for diabetics (OR all ADDED sugar), make manufacturers/retail think twice before arbitrarily adding sugar to everything.

“-Inheritance Tax”

NOT without a 0% threshold and/or family home exemption. Let’s not arbitrarily kick people out of their homes.

“-Wealth Tax”

I’m not sure what this is, you say the Greens explained it but I never saw a press release or got a flyer during campaigning. Sounds like taxing people just for having stuff, I’m against that. Luxury tax maybe.

“-Financial Transactions Tax”

FUCK YES.

“-New top tax rate on people earning over $300 000 per year.”

I prefer flat+UBI for income, but I guess a second band just for mega salaries makes sense.

“-Capital Gains Tax”

No. LAND TAX, but not this, it’s well and truely dead – Labour themselves killed it.

“-Windfall profit taxes”

Envy tax seems like a crude mechanism to discourage parasiteism, but I guess it has the benefit of being blunt and hard to avoid.

“-First $10 000 tax free”

~$15k UBI + flat tax.

I don’t know she is surrendering – rather she acknowledges what she is up against (in terms of wealth, spin and influence) and just how dumb most of those who could and should support this philosophy (taxing wealth and capital) actually are, as illustrated by the phenomenally low turn out at this years general election.

It is well known that if the percentage turn out is low then right wing and centre-right parties benefit – as again evidenced at this years election. Getting past all the fucktard conspiracy mentality that appears to have impacted those more likely to vote left has resulted in an environment this group of people will hate even more but lack the insight to acknowledge their role in the establishment of this situation.

Because Labour are PUSSIES and will NEVER EVER EVER get my Party vote again.

Agreed

Very shallow Geoff.

A tax academic lecturing us on how not to pay tax. Let’s not do this, not in it for you.

-Sugar Tax -Yes

-Inheritance Tax -Yes

-Wealth Tax-Yes, better described as a Capital Tax. The Greens proposal could be improved by dropping the threshold. All capital should be taxed at the same rate. Like GST no exceptions.

-Financial Transactions Tax- Yes.

-New top tax rate on people earning over $300 000 per year. – No (income and wealth are different, you can have a high income and not be wealthy, but someone who is wealthy is wealthy). This is described well in “The Big Kahuna: Tax and Welfare – Susan Guthrie”. If you tax wealth (capital) then the need to tax income is reduced considerably. A point to consider regarding income tax- why are these people earning $300k+, typically because their services are in demand (Medical specialists, CEO’s, technical specialists,…). Generally we want people to supply more of these services, increasing the tax on them reduces supply. Taxing capital rather than income will encourage more of these “in demand” services to be supplied – everybody wins.

-Capital Gains Tax (No- ineffective and unfair, also not required if you tax capital). Again described well in “The Big Kahuna: Tax and Welfare”.

-Windfall profit taxes (No- ineffective and unfair due to business cycles, not required if you tax capital)

-First $10 000 tax free – If you taxed as noted above, you could do more than the first $10k. However it would be better to all drop the rates rather than have a tax free threshold. Dropping the rates is inflation proof. A threshold is not unless indexed to inflation.

Plastic Tax – Much like a sugar tax. Try to internalise the costs of pollution.

Norway 0%, Sweden 0%, Australia 0%, every other country in the world other than the 17 listed 0%.

Here. This is from the newbie Act polly. A beginner polly.

“ACT deputy leader Brooke van Velden has been accused of misquoting Simon Upton, the Parliamentary Commissioner for the Environment.

Upton publicly rebuked van Velden, in a letter published to the Parliamentary Commissioner for the Environment’s website.

The allegation came after Van Velden appeared on TVNZ’s breakfast show last Tuesday in which she said,

“And when the Parliamentary Commissioner for the Environment looked at this ban after the fact, he said it’s likely to increase global emissions because we still need electricity as a source”.

Upton said this was both incorrect and misleading.

He also pointed out a comment that came from ACT’s Energy Policy which claimed Upton had found that the offshore oil and gas exploration ban would “actually increase global emissions by forcing activity offshore.”

In his letter, Upton said “I most definitely did not say that the ban would increase global emissions. In fact, I said that those opposing the ban must acknowledge that: “There is no firm basis for claiming that it will increase global emissions.”

Oh well, Act isn’t a Climate Denier at all! They’re just BS artists. Just like the last government!

Labour – in an advanced civilised nation would have been convicted long ago for their many transgressions against their kaupapa. They don’t need to have the courage of conviction, they know they will get off scot-free?

From Middle English scotfre, from Old English scotfrēo (“scot-free; exempt from royal tax or imposts”), equivalent to scot (“payment; contribution; fine”) + -free.26 Oct 2022

Scot-free – Language Log

Language Log https://languagelog.ldc.upenn.edu › nll

and/or

The expression ‘Scot-free’ originates from the Scandanavian word, ‘Skat,’ which means “tax” or “payment.” The word mutated into ‘scot’ as the name of redistributive taxation meant to provide relief to the poor during the 10th century.

Scot-Free | Phrase Definition, Origin & Examples

Ginger Software https://www.gingersoftware.com › content › phrases

That’s why ACT appointed van der Velden to this important role – because wimin can never be wrong. They are the earth goddesses who have come into their own power at last. Good and merciful heaven===

Giving the government the right to possess people’s assets – I can’t see that going wrong.

Having spent my whole life struggling to pay a mortgage, while bailing boomers out of their ponzi retirement system, the thought of the generation behind me passing a law to repossess what little I’ve managed to save for my own pensionless retirement fills me with so much joy.

CGT – how exactly are we going to calculate that when NZ governments halve the value of our money every seven years. Assets just compensate for that little con trick. The thought that I’d then have to pay tax on that purely numerical gain is also another winner.

I wonder if the left or the right can come up with an economic policy that doesn’t rely on stealing wealth from people. Maybe we could actually try and, you know, generate wealth?

Giving the government the right to possess people’s assets – I can’t see that going wrong.

Having spent my whole life struggling to pay a mortgage, while bailing boomers out of their ponzi retirement system, the thought of the generation behind me passing a law to repossess what little I’ve managed to save for my own pensionless retirement fills me with so much joy.

CGT – how exactly are we going to calculate that when NZ governments halve the value of our money every seven years. Assets just compensate for that little con trick. The thought that I’d then have to pay tax on that purely numerical gain is also another winner.

I wonder if the left or the right can come up with an economic policy that doesn’t rely on stealing wealth from people. Maybe we could actually try and, you know, generate wealth?