The sheer magnitude of the Māori Party Tax Policy is so enormous it has done that very unique thing in Politics, create a new gravity for voters outside the immediate electoral base.

By sticking to their values and principles, the Māori Party have demanded out of fairness that the wealthiest amongst us pay their fair share while the poorest gain more.

The Māori Party are lifting the tax yoke from the poor and the workers and placing it directly on the wealthiest and most powerful interests and by doing so they have given every Kiwi desperate for the transformative change that Jacinda promised in 2017 a reason to vote.

The scale of economic justice the Māori Party are presenting the New Zealand Electorate with goes well beyond Māori interests and becomes every Kiwi’s interests:

Te Pāti Māori’s tax policy

Tax rates

-

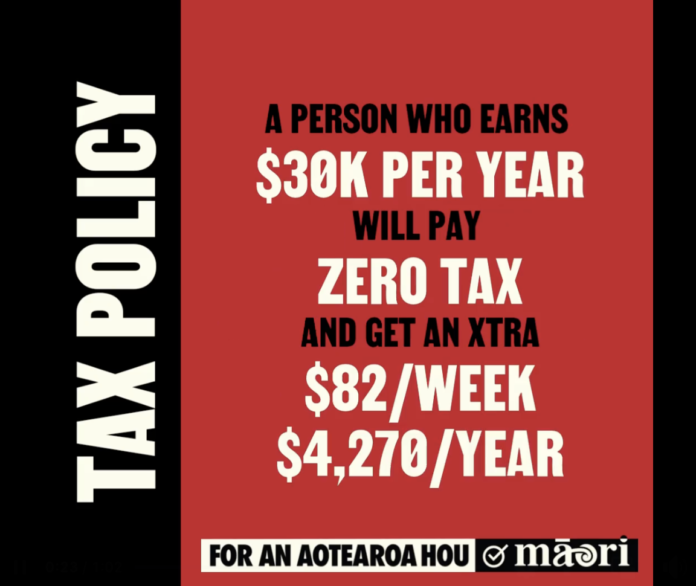

- $30,000 and under – 0% tax

- $30,001 – $60,000 – 15% tax

- $60,001 – $90,000 – 33% tax

- $90,001 – $180,000 – 39% tax

- $180,001 – $300,000 – 42% tax

- $300,001 and up – 48% tax

Currently the top tax rate – for earnings over $180,000 – is 39%.

The party would also:

-

- Remove GST from all kai and regulate the ability of supermarkets to hike prices

- Increase the company tax rate from 28% to 33%

And introduce:

-

- A net wealth tax

- A foreign companies tax

- A land banking tax

- A vacant house tax

Of course while standing for such economic justice, the Māori Party have also made themselves the enemy of the Billionaire class and Corporates who will fight tooth and nail to stop one cent of their vast wealths from being redistributed for the good of the people, so expect an intensity and scrutiny on the Māori Party designed to destroy them rather than critique.

The Māori Party Tax Policy would be the single greatest change in New Zealand politics since the Roger Douglas neoliberal revolution of the 1980s.

It is a mighty debate worth having and we should be grateful that the Māori Party have the courage to lead it!

First published on Waatea News.

TDB Recommends NewzEngine.com

If your on 60 ish k a year your tax will go up.

That’s a lot of rich pricks who didn’t realise they were rich pricks!

Spotted the innumerate man. Do you think that someone on $30,001 would have all of that money taxed at 15% for being paid a dollar more too?

If you’re on over 120kish a year your tax may go up slightly.

$60k is far too low; there was a time when an average family at the average income paid no tax (after Labour’s tax rebates and the universal child benefit). And there was also no G.S.T. — why won’t Tamahere abolish that, when even Kim Beazley promised to do so?

They’ve also maintained the tax cuts for the ultra rich. The old upper brackets don’t exist in their scheme — e.g. Where is the bracket for >$3 mn.? At one point that bracket was 77% under both the Tories and Labour, and for two decades it was 68%.

No, it won’t. The different rates only apply to the earnings within each band not to all income. So, for someone earning $60,000 they would pay nothing on their first $30,000 and 15% on the amount from $30,000 to $60,000 which means they pay a total of $4,500 in tax. Under the present tax rates someone on $60,000 pays $11,020 per year in tax. For $90,000 you would be paying $14,400 per year as opposed to $20,620 under present tax rates. So, it’s not until well over $100,000 per year that someone would actually be paying more tax under this proposal.

The current income tax on $60 000 is $11019.53, under the rates above it would be $4500. It seems that you forgot to allow for the tax-free band below $30000.

I see that Mohammed Khan has already explained your problem but I thought that providing the amounts would enable you to see the problem easier.

The effective tax rate for someone on 60K would in effect be 7.5%. Currently the tax on 60k is a lot higher.

We already pay record tax and have never had less to show for it – health, roads, law and order, anything.

Look at the obscene 3/5/10 waters salaries. Maori health authority employing 400 people to do ..er..what?

More tax?

No.

Less bloated public service/consultant circle jerks, no to co governance.

Problem solved.

“We already pay record tax”… Who is “we”…? If you refer to those on the minimum wage, then you might have a point, but otherwise, your statement is ridiculous, and inaccurate.. Having spent a lot of my life travelling the world playing my guitar, I can tell you that NZ’s tax rates aren’t at “record levels”. in fact, they are much lighter than just about everywhere I went, yet NZ is the most munted place I’ve ever had to spend time… Nothing surprising there.. I was here up to 2014, and was very pleased to get away when I did, as the attacks on the trades was in full swing, and from working on huge refinery, shipbuilding, and mining infrastructure as a boilermaker/welder in those countries, I can tell you that it isn’t the tax rates that matter to any but the poorest, but The level of insane greed and bigotry shown here makes NZ stand out as one of the least successful societies in the western world at present… The imbalances here are so blatant as to be impossible to miss, yet most of the tory “rump” have no idea that they exist..

There really isn’t any help that could fix you, is there….

“We” = New Zealand, team of 5 million.

Never been higher tax take , never been a bigger shit show of government waste.

Martyn – Again, Te Pati Maori tax thresholds are a bit low…$60k (Gross), especially if you live in the 5 main cities of NZ

Martyn – Again, Te Pati Maori tax thresholds are a bit low…$60k (Gross), especially if you live in the 5 main cities of NZ

Martyn – Again, Te Pati Maori tax thresholds are a bit low…$60k (Gross), especially if you live in the 5 main cities of NZ

I was amused to see the articles from yesterday where Robertson was being quizzed about whether he still thought a silly ‘fresh fruits and veges’ GST exemption would be a boondoggle, as he’d stated last year.

The best part about it is that he wasn’t even criticizing GST exemptions as such. But just the sort of ridiculous half-measure that Labour is now proposing, that will only benefit those who live on smoothie ingredients from New World Metro.

Just one question – is this just the 30K earner or everyone on the progressive tax system. Information that might help the TMP point.

Butch Caucasity and Debbie Double-Barrels prove themselves ready to lead us to the 3rd World.

“Moar tax!”

There is one thing that has always terrified beneficiaries of stolen and dubiously acquired land, and the NZ ruling class overall…unity of working class Maori & Pākehā!

Yes I think that is very true Tiger Mountain.

The Croatian man around the road, said he might be sent back to Croatia! Complete nonsense.

The adjusted income tax rates from the TPM would be of huge benefit to so many people on lower incomes and for two income families, especially where one of those incomes is from low wage or part time work. The other good thing is that it is not a greedy paye system. Even people on $120,000 will be marginally better off. It also avoids the ridiculous punitive measures of the 60-80% tax some would like to see on the very large salaries that a very few people earn. Well done.

Maybe the government wouldn’t actually need to tax people more, if they:

– stopped spending so much on consultants and PR

– stopped bloating the Wgtn bureaucracy

– got rid of the demographic ministries (I keep asking Martyn what essential services they provide, but the comments seem to get lost in the ether)

– axed the Wanangas (what do they actually do that’s useful?)

– stopped coming up with dumbass projects like 3/5 Waters

etc

You’re dreaming. The infrastructure is worse than it was in the 1940s. Plus terrible housing, no energy security, no advanced industry. There’s just too much to be rebuilt.

Promises are easy. But really this crew ain’t gonna deliver a single thing of that wishlist of yours, no more then the other crew build 100.000 houses.

I earn 80K a year and under the MP tax suggestion my income tax will go from 21.65% today to effectively 71.38% under those proposed rates. I’m not liking that idea overly much.

You would be better occupied by retaking math classes as it is about $143665 before the MP tax proposed catches up to the current tax rates.

I guess the other option is that you do a lot of cash jobs or other work that would disappear if the MP are in government?

It’s not maths you need to worry about, it’s how you have not thought through the consequences of the suggested tax rates.

An 2,300,000 asset that does not produce a income taxed at 2% = 46,000 per year

I get paid 80,000 and the tax on that would be 11,100 per year

So I’ll have to pay $57,100 per year in tax, which is 71.38% of my income.

Comments are closed.