Yay!

The first generation of user pays, Gen X, are now going to have to wait longer to get their Super if National and ACT win the 2023 election!

It’s not enough that Gen Xers had to pay for their own education, it’s not enough that while they were paying that student debt off and Boomers were speculating them out of the housing market, now we are being told that those Boomers are pulling the Super ladder up behind them.

So Boomers speculate Xers out of the housing market, never fucking retire so that Xers can’t progress their careers and NOW they are taking their Super up with them?

Look you Boomers, I know you’ve had it good with your subsided life from cradle to grave, but sweet Jesus there is going to be such a backlash against you the very second Millennials + Gen Y + Gen Xers are a bigger voting black, and that’s predicted to be the 2023 election.

I know you boomers feel pleased as punch to get one past us by electing the Boomer King in Auckland as he privatises assets you won’t be alive to see the consequences of the sale of, but I’m telling you, raise our Super just because you want untaxed capital gains, there’s going to be a political backlash coming for you.

If you are a Gen Xer, you just got another reason not to vote National or ACT!

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

This Gen X Demographic needs to wise up & use the only power they can exercise & that’s at the Ballot box or else their screwed!

The retirement system is lousy because the unions refused to go on strike to save the Award System and universal membership.

The A.C.T.U. successfully lobbied for compulsory pension fund contributions by employers to be raised to 12% p.a., in addition to existing award wages.

Cullen was trying to tell everyone his retirement savings scheme would be just as good. Yet the accounts are still not compulsory, the unions are locked out of the system, and employers are only putting in 3%.

Will the local unions strike to save the state Old-Age Pension? Do they even care about raising employer super-contributions?

“he retirement system is lousy because the unions refused to go on strike to save the Award System and universal membership.” Which planet were you living on as the full frontal attacks on those “privileges” were waged by successive tory governments..?

The depth of ignorance required to make such a claim is breathtaking..

@Stefan: Nonsense. Jim Knox and Ken Douglas needed to start gearing up for a general strike in 1985 (under Labour!), to have any hope of defeating the Treasury Troika and the other Mont Pelerin ‘Chicago Boys’ inside both political parties.

I think this is an enormous red herring distraction when that was least needed. National want to increase the age of eligibility from 65 to 67 in 2037 ffs!. What are they thinking? Why announce that now during this tight election contest? National stood to gain virtually nothing but risk ruffling the feathers of those aged aged in their early 50’s. What it did do was allow a big distraction when there are already a list of very pressing issues impacting on NZ today…….and of course allow Labour to take the high ground and congratulate themselves for retaining the status quo and smile while giving their nauseating attempts at telling funny stories during their election year conference.

The message being broadcasted to NZ yesterday was Labour ….GOOD……National…..BAD.

National should have waited to have this discussion until in Government. Instead, they shot themselves in the foot…..again

I’m picking you’re a Labour voter. What with the advocating for complete policy dishonesty and everything.

This super age increase was once Labour policy of course until re election became their only motive.

Nats are just being honest about what they will do in office.

He pua pua and 3 waters say hi.

Keepcalmcarryon,

You picked wrong. Honesty and politics in the same sentence? I’m picking you believe in the tooth fairy. Did you miss the part of my post about Labour MP’s and their nauseating attempts at telling funny stories? Is that the usual way Labour voters speak about Labour MP’s? National need not worry about winning the 2037 election. It’s the 2023 version they need to win and I hope they do. Labour are a train wreck. My comment relates to tactics and what National stood to gain by putting superannuation in 2037 on the table at this time? It’s been a very predictable distraction from Hate speech, Health, Crime, Housing, He pua pua and 3 waters etc etc…..and it gifted the left wing loonies the chance to take the high ground.

You may well be right.

It does appear a pretty dumb move.

Maybe a trap for the gullible?

Understanding what Super is and how it dovetails with benefits may well provide the answer.

After 20 years I can’t believe we are still arguing over superannuation. There was no mass exodus of employers. Superannuation had absolutely nothing with rising house prices or ability to choose between a Remuera tractor (SUV) or a Tesla. The Great super debate has been settled. National superannuation daydreams have thoroughly defeated.

We are arguing about the wrong thing. Super is not near enough for many to live off.

The disparity between single and partners is something that needs to be fixed.

There are far too many people still earning serious salaries at the age of 67 to make the current policy economically progressive. With more people living healthier and longer we can do better by starting the universal entitlement later and create a better pool to fund benefits or public services from.

Or even to fund tax cuts to help the middle income strugglers.

Disclaimer: I do not care if this is done by the left or the right.

Super would have been enough but for the intervention of one Robert Muldoon. I know you weren’t in New Zealand at the time but have a look at what happens when those capitalist ideas are implemented. 500billion was lost with the stopping of super payments.

A gully-trap indeed; a cover over the facts of our economic system. National and Axe will never understand the reason for universal superannuation. Probably regular super payments are the money flow injection that keep this country of leaden brains floating.

TM. It’s called being honest about your intentions post election. Something labour is not.

Post?

New+view,

I agree with the subject matter. I disagree with the wisdom around the timing when there are so many pressing issues on the table already not being addressed.

Raising GST comes to mind and the flag referendum now who did this?

The funny stories were an embarrassment,a distraction strategy.

Have no policies but gosh we are funny.

Yep sums Nationals strategy up perfectly.

Means test Super.

Now there is a solution to a problem. Some need more help that others.

We have limited excess wealth. Let us share our excess wealth with “care”.

But that is not “fair”, I hear them say.

The same people that argue scarcity to achieve their objectives choose not to accept that concept when it comes to wealth.

Super is funded by the contributions made from taxes made during the working life, just like a private superannuation scheme, it comes to maturity at a time agreed -upon 65 years. It’s very welcome at this age, especially to those who have been in heavy or otherwise difficult work.

Except it’s not pre-funded .

Keep it at 65 tho .

Superfund!

Sort of pre-funded. Partially.

Remember, National stopped the funding when we were in financial trouble following the 2008 financial crisis and then resumed again when we’re in a better financial position.

Like a savings account. You save when you have excess wealth and use it to pay the bills once people reach Super age.

We should have this conversation. Either we borrow money now to pay out later or increase the age of eligibility and pay less up front or we much change Super to a benefit.

The fact is many who have not accumulated wealth get their Super topped up with benefits. In contrast to Super the winter benefit should not apply universally and only handed out to those in need.

Super is not charity. Top ups are.

New Zealand Super is strictly speaking not a benefit. NZers who are entitled to Super also receive benefits based on need on top of Super.

NZers younger than 65 are also entitled to benefits based on needs.

Where the benefit of choice, “jobseeker benefit”, matches the Super entitlement then lifting the age of Super entitlement merely discriminates against those who were fortunate enough to have build up excess wealth and health that allows them to work for longer and have more money to spend.

So lifting the Super entitlement age is effectively a wealth tax!!! By stealth?

Who is against taxing the wealthy more?? Surely not Labour supporters!!

Super is a benefit. Try getting it sent to you if you leave NZ – just like every other benefit.

But it is a non-means tested benefit, whereas all the (AFAIK) working age benefits are means-tested.

Lifting the Superannuation age is simply adjusting the criteria for receiving that particular benefit.

They take money off us, invest it in paying a universal entitlement and in investment instruments. Dividends are paid to those over 65. Those in need gets benefit top ups. So no, it is not strictly a benefit.

The wealthy pays 39% tax on Super and the poor gets benefits on top of. So it is a progressive tax on our own collective compulsory savings.

And that is why most NZers are so precious about the universality principle that underpins NZ Super. And we should be proud of it.

I’m inclined to agree Sinic.

Hell, what do you get for your tax.

A pothole and a world class education?

If we cannot afford “65 year old Super” we need to have the debate.

I support the current fairness model topped up based on need. But far too many 66 year olds are getting a benefit that they do not need.

Yes, let’s means test Super, so that the people who worked hard, paid lots of tax and saved get nothing when they retire.

If you wish to destroy a country, there’s nothing like creating a disincentive for working and saving.

I don’t have a problem with means testing. Ridiculous that millionaires get the living assistance and gild cards. But at the same time, everyone who’s on a benefit that shouldn’t be, needs to come off! The lifestyle bludging and piss-taking has to end.

Not content with dodging taxes and corporate welfare, now they’re coming for your Super.

Universal Basic Income for all from birth. Up to 18 held by government and invested. YP gets this ‘nest egg’ at 18 rather than the prospect of student loan for tertiary learning or for investing where they choose.

Other policy changes that fit with this – fulltime working week reduced to 4 days or 32 hours – Work & Income already define fulltime work as this.

Government Super at 60. No means testing.

Free Health and Dental.

Funded by progressive taxation along with CGT. Also funded by savings in administration for welfare – job losses at Work & Income.

The entire political class has failed to manage NZ Superannuation wisely or fairly.

Doesn’t matter if it was Clark and Ardern with Labour, or Bolger and Key with National. A plague on all of them!

Never understood Labour that the youth will lose 198K in their retirement?

Why do they always look at one side – politics I guess.

If you work for two more years you will have more for your retirement.

All parties would have been better advertising how important Kiwisaver is to youth or how about a tiny amount of student loan is topped up to commence kiwisaver for them as the start compounds amazingly with dollar cost averaging.

When someone announces such a policy why not look at positives around the area at some stage instead of on the fly scathing.

You miss the point that you are able to continue to work after you start getting super. So there is nothing to stop this, what are you on about?

Also – you are asking politicians to see ahead of the next election. We need to extend our parliamentary terms from 3 to either 4 or 5 years ASAP

Great point – but I guess can everyone continue work being the argument? I think below (if shown) in reference to life expectancy needs to be discussed.

It is the 2 fewer years to enjoy retirement & whatever the % is that will die between 65 & 67 years that are the issues with raising the retirement age.

Good we talk about this, I think more in terms of reality with life expectancy rising.

In 1938 the NZ public pension started and while I don’t know the retirement age then our life expectancy has changed from 1950 to 69.22, today 82.8, 2037 when they want to rise it is expected to be 84.75.

Seriously – something has got to give to be able to afford this in future?

How many Generation Xers are worried about a plan that won’t even take full effect till about 2044. In short you have to be 46 today before the age of 67 applies. Someone who is 55 today would get superannuation at age 66 under National’s plan.

In any event, do voters make their voting decision on what happens in 20 years time, or are their concerns rather more immediate than that?

It simply needs to be gradualised -so past the age of 62 you get a third of super, then at 65 two thirds and at 67 you get the full amount, raising the age for all is simply unfair for many and giving less out earlier helps (say) previous manual workers or those with poorer health transistion to gradually to partime status. However, the way costs are going up & the automation of work means we’ll have to look again at the UBI before gen X near retirement age.

Martyn you raised a valid point.

This will affect Gen X and others absolutely.

They need to remember this when they cast their vote this year.

But not all Boomers had it good. I agree some in that group did though.

I am from blue collar low working class. I sit exactly at the crossover zone between GenX and Boomer and I don’t remember handouts (although some older than me got cheap State Advance loans and support etc).I remember all Govts of the day messing and lying to voters plus extreme experiments with policies.

I remember high interest rate for mortgages, low wages, Rogernomics, Ruthanasia, Muldoon etc.

Younger voters must strongly critique our politicians and try to keep them accountable.

Perhaps that is one thing about social media and the like as it gets in politicians faces plus pushes for more transparency.

I agree Thinking-Man, something fishy going on here with the use of red herring distractions etc. You raise an excellent point.

Super is fundamentally not a benefit. (Fairness)

Those on Super who need helps get a top up benefit. (Care)

When the jobseeker benefit matches Super what is the difference between the beneficiary and those on Super? Nothing for those who need Super but a nice wealth boost for those who are already wealthy and/or continuing to earn salaries beyond the age of 65.

Hold on the French are up in arms about it going from 60 to 63 aren’t they. So the entitlement age should be coming down.

If what some argue around covid is true then we may well afford to drop the super entitlement age to 60 in future.

Super is supposed to go into low risk fixed assets like infrastructure, housing, stocks and shares and National just hate the idea of low borns having any political or economic capital at all.

And why would we do that, even if it was ‘affordable’?

Or we can spend the excess wealth on tax cuts.

They are French.

Increasing the age is the sensible thing to do, as Labour thought as recently as 2014.

I will be directly impacted by this change, but because it is for the good of the country, I support it.

This is simply partisan nonsense from you.

The Australian government has moved it to 67 over a similar period . A cut in tax will put more money in the pocket of those due to retire so they could still retire at 65 or even earier if it is what they want to do. Fewer and fewer people are actually retiring at 65 now .If you enjoy your job it is better for your health especially mental health to keep in the work force.

Trevor Australia has a compulsory super fund

I have children ranging from teens to early twenties and to read the online forums they play in is to find that they and their peers hate Baby Boomers. I mean they really fucking loath them to a degree I don’t think even Boomers reached in their protests against their WWII parents (interestingly they seem to have a lot of respect for the parents of Boomers. the Great Depression/WWII survivors). “OK Boomer” is merely the politest tip of the iceberg. And this is not located just to NZ but covers their friends across the English-speaking world.

I’ve seen this coming since the late 1980’s. And it’s coming irrespective of whether you have a Labour-led, National-led, ACT-led or even Green-led government in the 2030’s/40’s. It’s the reason Cullen created the Superfund and Kiwisaver.

Sure, Millennials and Gen Z are pissed off, and so are we Gen-X’rs, but that doesn’t change the reality of the ratio of worker to retired people continuing to slide, as it has done for more than two decades now. That means higher taxes on workers for our pay-as-you-go super schemes. At some point that’s just going to break down as the Generations following Gen-X, Millennials, Gen-Z (XMZ) refuse the burden.

And if you think the pension burden will be bad, just think about the medical costs as XMZ hit 60+

Of course there may be a lot of inheritance going on as the Boomers die, but I’d bet that future governments will go after that too. The only real question will be whether the numbers of XMZ who stand to get that money directly from the Boomers will outnumber those who won’t?

Also this, Boomer-Os Killed The Summer Job Star:

In other words, if you were “holding” in 1987, when the oldest Boomers were forty and the youngest were twenty-five, you’re golden now. If you were just starting your career in 1987, you were racing against time. If you’re starting today, the deck has been stacked against you higher than you’ll ever clear.

Want to live the middle-class life of 1975? Better hope your IPO nets you ten million bucks. The wealthiest of the Baby Boomers deliberately created a world in which they’d pay less for the things they wanted (employees, labor, televisions) while being paid more for the things they owned (real estate, index funds, 1959 Les Pauls, 1985 Porsche 911s). It was a hell of a trick, wasn’t it?

National’s super policy sees New Zealand coming into line with the majority of the OECD.

The ranting and raving is purely political.

Oh Bob you are funny, normally you won’t admit we compare to the world and real world problems, now you want us to compare to the OECD.

Martyn – I understand what you are saying…so what is Labour doing to make Generation X feel better about retirement??

Vote Labour & be screwed now.

Vote National and be screwed later. ps. they (National) have a track record for wrecking superannuation.

Vote NACT and be screwed Now and Later, unless you are Rich.

“Vote Labour & be screwed now.”

or vote national and be screwed for a life time

Well it won’t take NatAct until 2037 to screw people either.

But at least we’ll still be a first world democracy then.

Another idiot who believes in the National party rhetoric. If you thought for yourself you’d be lonely. No comment would be an intelligent better option.

Really? I definitely don’t believe National and I certainly won’t be voting for them. National voted for Labour’s firearms legislation and their current courting of firearms owners is dubious at best, so National will not get my vote. ACT & the local Green candidate for me.

The left prohibit individual thought always have always will.

martyn the breaking down of society by age and endorsing prejudice is the same as doing that by race or gender…can I respectfully request you wind yer neck in?

and yes any young person who votes for no pension (in effect what it is) when they retire having no private scheme because they’ve spent a lifetime in shit gig jobs, is a fool no other word for it.

Vote National and be screwed later. ps. they (National) have a track record for wrecking superannuation.

Firstly super is the BIGGEST welfare spending there is in government.

Instead of trying to get it down, successive governments have given away free NZ pensions to incoming foreign pensioners.

Chinese pensions…

Guess what, in China you have to CONTRIBUTE minimum 15 years to get a pension and only get 1% of the indexed wage in China for your public pension.

http://www.oecd.org/els/public-pensions/PAG2017-country-profile-China.pdf

In India it sounds like no free public pension and minimum 10 Years of CONTRIBUTIONS of 12% and only 12% of the work force seemed covered for pensions anyway.

http://www.oecd.org/els/public-pensions/PAG2017-country-profile-India.pdf

In NZ you don’t have to contribute at all to a pension as an overseas person or be working, just be resident here for 10 years (used to be 5 years) to get 43 per cent of the NZ average wage and it is not means tested for overseas pensioners either.

Apparently their are 59,500+ Asian aged pensioners, (already more than the amount of Maori pensioners at 48,500+) – Foreign pensioners can even marry other pensioners and bring them into NZ after an online romance. https://www.rnz.co.nz/news/national/376220/10k-11-days-and-one-failed-deportation – this means that aged migrant numbers are expected to triple to 171,900+ in 15 years… against Maori aged pensioners who are 109,400 in 15 years…

Now the same people who are expected to pay much of the taxes (Gen X), didn’t get any free student years but expected to pay KiwiSaver while supporting those who have just arrived in the last decade and paid no/little tax for their pensions (shows the neoliberals – give to the rich, take from the hardworking professionals, while rising taxes for the hardworking professionals). Gen X also told there is probably going to be means tested pensions going forward, so you work hard, don’t get free education, don’t get free pension – why bother to upskill – gen y and z.

All the incentives are wrong in NZ to try and get a healthy, fair society of working and taxpaying people. It rewards those outside of NZ taxes and work.

Could hardly be worse if we were being run by an overseas entity which is paid for the task – like contracting out to mercenaries – or are we actually? And how is Health going to get on – it has been detached from the Public Service by the reforms. Devious gummint?

The decrease in the size of the workforce in 2022 was driven by a number of factors. The largest change related to machinery of government changes arising from the Health Reforms. The Ministry of Health had 769 fewer FTEs than last year, rather than around 140 FTEs more, due to functions moving to the new health entities that will be outside the Public Service on 1 July. Without these, machinery of government changes, the annual growth in the size of the Public Service workforce would have been around 0.3%, rather than a decrease of 1.2%. (FTEs – full-time-equivalents – (many are on ‘piece work’).

https://www.publicservice.govt.nz/research-and-data/workforce-data-public-sector-composition/workforce-data-workforce-size/

“why bother to upskill – gen y and z.”

Because at some stage the garbage heap will be full and it will be necessary to get rid of the trash. There’s a good chance there will be a lot less tolerance for freeloaders in the future.

Like all social programs, superannuation is only a necessity because it was introduced in the first place.

Around NZ and the world, people took care of themselves before these programs were introduced and yet people didn’t clutch their pearls.

There are a significant portion of the population who will grab any “free” stuff they can get then adjust their effort towards their own wellbeing accordingly, with the most obvious examples being people who have never worked, will never worked and are raising a little of children that will likewise never work.

Socialists call this “kind”, I call it cruel and quite frankly psychotic.

Vote National and be screwed later.

Had enough of this “generation __ victims” lazy journalism.

Every generation “gets screwed” in some way.

By letting them divide us in those artificial “generations” we are all screwed much more.

Divided we keep falling.

Not sure it’s wise increasing the age of superannuation. Considering how Covid-19 affected elderly people, it’s appropriate to retain the retirement age of 65. Plus there’s also other sicknesses prevalent in society which affect the elderly more so than younger demographics.

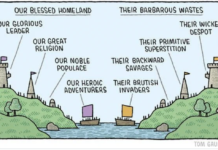

For people who don’t know what their letter code is –

The “silent generation” are those born from 1925 to 1945 – so called because they were raised during a period of war and economic depression. The “baby boomers” came next from 1945 to 1964, the result of an increase in births following the end of World War

II.16/01/2019

Millennials, Gen X, Gen Z, baby boomers: how generation …

image.png

The Conversation

https://theconversation.com › millenn

Green fields, farmer Brown. what cost you say,, your bottom paddock,, acre,, million their need say, afford a home. What noddy purchase,, baby jerry.

Comments are closed.