The IRD report into how rigged NZ capitalism is for the very rich highlights how under regulated NZ really is.

The obligation of the Government is to regulate Capitalism so that we the people benefit from the competitive dynamics of competition!

The right myth is that NZ is an over taxed, over regulated economy when it actually isn’t!

We are not an over taxed, over regulated economy!

Our top tax rate is the 39th highest in the world behind all the Scandinavian countries plus Germany, the United Kingdom, Ireland, France and South Africa!

Australia’s top tax rate is 47cents!

Our GST rate doesn’t even get us into the top 50 and our corporate tax rate is 40th while Government spending against GDP ranks 56th!

And we are voted easiest to do business by the World Bank!

Max Rashbrooke highlighted the horror of NZs under regulated market…

The bad news is that, to investigate 200,000-300,000 terrible rentals, the Ministry of Business, Innovation and Employment (MBIE) has employed a frontline inspectorate numbering … 37. Each inspector will have to check somewhere between 5000 and 8000 rentals.

…there is only 37 inspectors of rental properties for 300 000 terrible rentals?

Similar poorly funded regulation is apparent in the 82 labour inspectorates who are supposed to police hundreds of thousands of migrant worker exploitations!

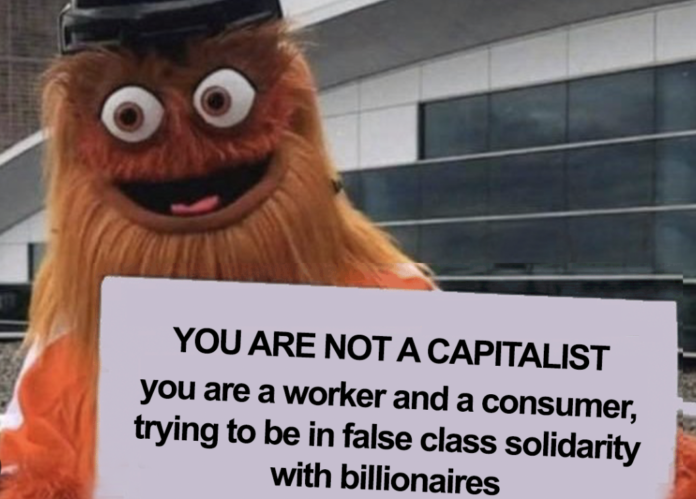

I’m not looking for socialism here folks, just basic garden variety regulated capitalism!

Time and time and time again in New Zealand we see an old boy matrix of vested interests who occupy market dominance and act like a monopoly, duopoly or oligopoly raking in vast wealth while leaving the local small and medium sized operators outside the cosy relationships!

Up and down NZ, small and medium enterprises are unable to compete because of the lack of basic regulation in the market!

We’ve seen it with the Drainage industry, the Supermarket duopoly, the medicinal cannabis oligopoly, the Gib Board monopoly – each time under regulated and poorly regulated capitalism continues to screw over us the consumers at a time of a cost of living crisis!

How are all the small and medium businesses in NZ supposed to advance if the economic landscape is dominated by anti-competitive practices?

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Labour has spent the last five years to figure this out. Now that they understand this they have adopted a policy reset under Hipkins.

What does this mean?

If it means Hipkins took the opportunity to push pause then voters know that what they voted for in 2017 and 2020 is still more or less in play as part of the longer term strategy.

So it then becomes important to start explaining how those policies, He PuaPua, 3 Waters, Climate response, low wage economy disruption, trade, housing, infrastructure, education, health ….. will affect our lives.

The outcomes created over the last five years are not much of an endorsement.

It is just not good enough to shout that the planet is burning and someone ….. anyone ….. to stop emitting CO2 and save our planet.

We cannot under any circumstances put the economy in the hands of this dreadful Labour Government again.The last 5 plus years of fiddling should be proof enough for anyone.

Does anyone believe Chippy can lead an economic recovery?

A green shoots tax levy should be introduced.

This can then be used to help fund the disaster recovery and creating assets that will make us less vulnerable to the risks associated with climate change.

The most efficient way to alleviate poverty and help those in need to recover through taxation would be to bring down the taxes in a way to assist those in need.

I am sure that everyone in NZ will appreciate paying less tax on the first $20,000 of earnings. The 90 wealthy buggers that signed the petition to pay more tax can be granted their wish and we can extend the curtesy to all those who earn more than $120,000 a year.

Surely the IRD has the stats that show the annual incomes of the 313 wealthy families.

More regulation,more tax,more state control.

Rubbish Bob. What regulations? All the bleating from dairy farmer representatives for example and what about? A ute tax? A few trees around a water way? What have they actually paid in terms of climate mitigation? Put climate aside and ask yourself what we will end paying for contamination of water, which they make a major contribution to.

If one looks at the significant effort from local authorities that goes into monitoring and managing the watercourses close to where they discharge to the sea one would think that our watercourses are generally healthy.

One can interpret the outcome in three ways.

1. That monitoring shows that the pollution that needs to be addressed is caused by run off from land close to the point of discharge into the sea.

2. That the authorities are stupid.

3. That the situation is not as disastrous as suggested.

You’re part of the problem Bob.

yup bob the first no more free rein for nz business to rape kiwis….terrifying prospect isn’t it?

Look how quick they can go after a beneficiary for benefit fraud while white collar crime continues unabated. May as well as call this ‘Legal tax evasion’ a subject politicians continue to turn a blind eye to.

One of the least corrupt countries in the world? Doubt it.