‘How bad does it have to get?’ BNZ record profit prompts call for inquiry

Bank of New Zealand made an after-tax profit of $805 million in the six months to the end of March.

That represented a 13.5% rise in profit on the same period last year when BNZ made an after-tax profit of $709m.

The record profit has come at a time when households with mortgages are struggling with huge repayment increases at the same time as coping with high inflation.

ANOTHER OBSCENE PROFIT FOR BANKS?

Come on people!

The Australian Banks make more here than they do in Australia because they price gouge us and are pimps fuelling the property speculation!

Asking if Bank profits are ‘excessive’ misses the point – with 27 000 on emergency housing wait lists, 100 000 food parcels a month & underfunded health, education & welfare social infrastructure collapsing, Bank profits are obscene!

Windfall tax those rich pricks!

If you are going to turn a blind eye to the obscene profits made by foreign banks using the rigged casino of oligopoly can we all at least agree on one thing, that when the economy predictably ruptures next year and the corporate banks come to the Government with their giant golden begging bowl, encrusted with diamonds, emeralds and sapphires, carried into the room on the backs of homeless children, when the 4 big Foreign Banks come begging to be bailed out, we collectively tell them to go fuck themselves right?

Surely you simpering gimps sucking up to the banks by refusing to tax their obscene profits can collectively agree not to bail these greedy fucks out when the economy goes belly up right?

RIGHT?

Look at how the wealthy and rich are rushing to support the Right…

…Bernard Hickey has argued, “We could have gotten $200 billion in extra tax revenues if only there had been a fair tax system which meant that capital gains were taxed at the same rate as every other type of income.”

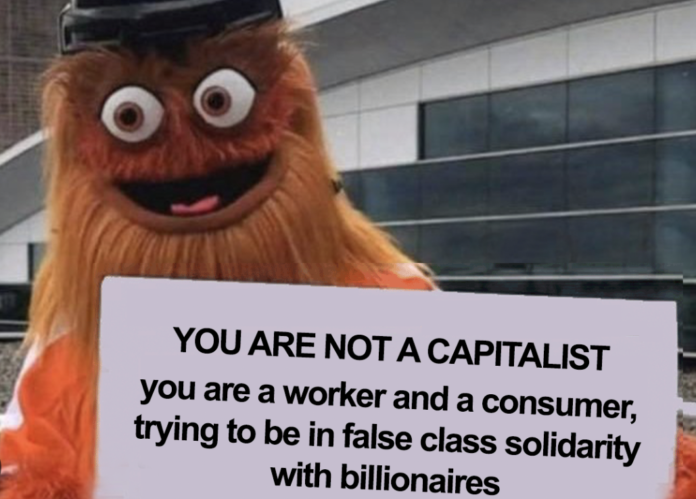

In a liberal progressive democracy, it doesn’t matter what role you play in the complex super structure of our society and economy.

It doesn’t matter of you are a garbage collector, a dr, a nurse, a drain layer, teacher or tradie – if you all stopped doing your jobs the system can’t work.

Everyone deserves to share the collective harvest of civil society with public services and policies focused on the public good enshrined in the intrinsic civil liberties each individual has.

Wealthy individuals who become mega rich thanks to the landscape generated by those values are required to pay more back into the system they have benefited from beyond the bare necessity of ruthless accountancy practices.

These rich pricks have designed the system for themselves, ‘you can’t tax unrealised capital gains’ the Right scream, like bullshit we can’t!

Council rates are based on valuation and you can borrow against that capital gain.

If it means the mega rich have to sell a mansion or two to pay the tax bill, so fucking be it!

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals, let’s start with them, then the Banks, then the Property Speculators, the Climate Change polluters and big industry.

Making these levels of extreme profit right before the looming recession of late stage capitalism is an outrage!

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Kiwis will find a way to screw themselves out of taxing wealth.

How much tax does the BNZ pay on profits of $805m? Another commentator suggested about $300m going to the govt coffers. Not bad!

What is stopping government from nationalising the banks?

Another alternative will be to tax the wealthy and use that tax and invest it in KiwiBank and hand all government business to KiwiBank.

Where is the hold up?

Before everyone goes bat shit crazy – the story has no legs in my opinion without more crucial pieces of information.

I quote “Bank of New Zealand made an after-tax profit of $805 million”.

What was the pre tax profit? How much tax did they pay to NZ Govt?

How much have they given to the community?

How much risk do they under write in their client base?

I hate half story agendas looking at only one section of a financial pie.

I’m not evaluating a thing until I know all financial fundamental facts.

Looking or applying journalism to an agenda of one side of a coin is very annoying.

I’m saying the profits may be very high and NZ needs something in place to tax high profit income tax more.

However, many base their decisions like me on media info because we hardly have time to do research ourselves because we have day time jobs. So how about journalism drops the agenda tone and looks at the story of a the whole pie instead of the piece they just want to slice up.

Show us the whole money pie – not just a what I presume is a large piece because I hate assuming.

For this story to have legs I’d like to know the following:

1. Debt servicing amount wages, rent etc – GST contributed.

2. Debt under writing amount.

3. Tax paid on income profit.

4. Employment considerations – PAYE contributions to our tax system.

5. Community funding amounts.

6. Interest given to investors.

7. Is any of this profit part of client savings which is theirs like kiwisaver contributions or solely company profit?

Explain some things to us who don’t know about bank operations before picking what you want.

I know a business owner who made 500K in company income tax but this financial year 425K has to service debt from investment. It’s just paper sometimes without actual value that can be removed. It’s about individual perspective.

Am I out of line?

You are both.

Depending where you stand.

IMO we need to understand this better and make sure that we leverage off success to create better public outcomes.

Agreed

The banks make lots of profit because they mostly lend on housing, and house prices are high. In reality it’s the high price of housing that is the problem not bank profits. However, it would help if banks were owned by the state and o0perated as public utilities. It would also help if we limited their capacity for creating money out of nothing.

If they choose to domicile their profits to another tax jurisdiction, their parent company in Australia. Tax the profits at 45%.

If they choose to reinvest those profits within NZ indefinitely, maybe a 1% tax profit tax.

That sounds like a good idea.

Not sure one needs the complexity of adding the “1% tax profit tax”.

Domestic growth will probably generate more than enough economic activity to leverage off.

I find the remuneration excessive.

Profitable banks are desired,far beyond non profitable banks.

The margins are where the spotlight should be not the amount of profit.

Tax the rich!

Lol. L ain’t be doing that. Grantboy wants a job in the future

Just like John Key, no one was moaning about that.

John Key financially independent?

Top man Sir John self sufficient.

Covid Windfalls tax.

Santander profits up despite windfall tax on banks

https://www.digitaljournal.com/business/santander-profits-up-despite-windfall-tax-on-banks/article

Australia had a commission of enquiry and fined banks, NZ government, nothing to see here… lets tax the doctors as easier – Gov still don’t know why skilled people are leaving NZ!

Banks hit with $78m in royal commission penalties: ASIC

https://thenewdaily.com.au/finance/finance-news/banking/2021/04/16/bank-royal-commission-penalties/

Note – there is no point just reporting bank CEO salaries if they don’t include the bonuses.

Was that intended or unintended?

Either way, it reflects badly on those who caused this outcome.

We just followed what others were doing. There was a time when NZ was leading by example.

Early adopters often gain least and only end up rewarding the risk takers.

We should be inventors and only adopt proven technologies. Early adopting is fools gold!

Have you noticed over the past 30 years our govt has turned from looking after the people to just looking after business?

Politicians fill us with promises and then once elected those promises get ripped to bits in select committee and you end up with a paltry pile of writing that doesnt fix the problem they promised.

We get a selection of promises that are populist topics but after being elected a whole bunch of Acts get changed unrelated to those populist topics and loopholes are inserted to create workarounds for special interests.

We have a donations issue where those with all the money are paying substantial donations to political parties and these donors never seem to get touched with political actions.

Yet all those people down the bottom have been legislated to the hilt, so many things have criterias attached to exclude you, under funding and under investment.

And now look at where that has put this country.

We need to change our political system but there isnt a way to do it because its the people who have screwed us are those who change laws…..

How much is ‘excess’ when referring to profits, and will the left refund the banks when they make a loss in subsequent years?

Given the massive profits their banks are making, those CEOs obviously deserve those ridiculous salaries.

If you want to target these profits why not have the RBNZ insist on higher deposit rates from retail banks? Is encouraging a decent return on savings not another way of making people think twice about spending?Clearly there must be a reason they are not looking at that.

Do I sense a little envy? Cry a little for Labour’s wasted promise.

And there I was thinking Labour and the Greens were in government.

So if I vote them into government they will start taxing the wealthy as well as the poor?

Let’s do this.

The evidence is in, and the certainly aren’t doing any of that and Martyn still thinks they are Left wing.

One must keep the faith!

Dreaming the impossible dream…

Envy?? WTF?

This is about people being severely fucked off at being bled dry by these parasites, in perpetuum.

Simple, don’t take out loans or use banks.

That’s right. Just go to the Free House shop and pick one up for you and your loved ones to live in.

FFS.

Big pharma profits obscene? Apparently not. Crickets.

In New Zealand? No. What are you on about

Labour have a 100% track record in broken promises.

Bank profits up under Labour Government.

That’s not all bad,we need a healthy banking system.

It’s actually great news NZ and Aus banks are profitable for compliance reason s.

I choose stability over compliance.

But yes, that is the essential role of government, creating the compliance regime to ensure stability of the financial system.

That is probably why labour is so reluctant to change things up.

The RB should focus on compliance and leave economic management and mismanagement to businesses and the government. The composition of the RB board tells us that they are set up to manage economic conditions rather than ensuring the economic institutions work in favour of all NZers.

The whole left schtick is to foment envy, hatred, bile and anger against specific groups and to say to voters “there’s your enemy over there, vote for us and we’ll slay them for you and your lives will be better.”

you mean like bennie bashing andrew?

The thing I find hard about the “tax unrealised capital gains” argument is what do you do about people who own their own home, but have little income. I’m thinking about superannuitants who live off the pension. They’re often not rich, I know many in my family who have no other assets than their house. Their houses will have gone up in value too. Should they have to pay a CGT against unrealised gains? How on earth would they afford that? Would they have to borrow against the home to pay the tax? Surely that becomes a debt spiral that can only get worse.

If you exempt pensioners from such a CGT, lots of the wealthy are technically pensioners. If you exempt the family home, then there’s loopholes there too.

I get the argument, but how do you actually make it work in practice. That’s what I see as missing in all this. If you can tell me how to make it work so that it’s capturing the people who can and should contribute I’d be more inclined to support it. Without it, I see some unhealthy unintended consequences.

Green with envy.

Adrian Orr guaranteed record bank profits with his over extended and continued Funding for lending program. Fatty Arbuckle loved the idea so much that he gave Orr an extension to his contract. They all robbed the poor to give to the rich. Our only hope is to get more French immigrants so we can educate these parasites.

possibly peach but that’s not a reason why we don’t do the right thing from now

Up yet Martyn?

He’s busy, he does have a life outside of TDB.

” ANZ had waived $1.3m in fees for cyclone-affected customers as well as made $11m available in interest free loans. ”

” According to the latest quarterly bank review by KPMG, ANZ has assets of $193b

Hey Bomber you can’t say they care with such a generous package !

After all ………

” Watson acknowledged the size of the profit but said it had to be seen in the context of how big ANZ was and the position it and other banks played in the economy. ”

“The actual profitability of ANZ NZ, which measures our returns versus the amount of capital committed by shareholders, is middle-of-the-pack when compared to large companies listed on the New Zealand stock exchange.”

Well that’s reassuring for so many who are facing massive cash injections from the increase in interest rates on their mortgages which adds so much more in their next half point profit to be released in six months.

It is time these parasites pay tax in the country in which they extort so much of our peoples hard earned money.

I HAVE TO PAY TAX !!!

Why should they be exempt ?

” ANZ had waived $1.3m in fees for cyclone-affected customers as well as made $11m available in interest free loans. ”

” According to the latest quarterly bank review by KPMG, ANZ has assets of $193b

Hey Bomber you can’t say they don’t care with such a generous package !

After all ………

” Watson acknowledged the size of the profit but said it had to be seen in the context of how big ANZ was and the position it and other banks played in the economy. ”

“The actual profitability of ANZ NZ, which measures our returns versus the amount of capital committed by shareholders, is middle-of-the-pack when compared to large companies listed on the New Zealand stock exchange.”

Well that’s reassuring for so many who are facing massive cash injections from the increase in interest rates on their mortgages which adds so much more in their next half point profit to be released in six months.

It is time these parasites pay tax in the country in which they extort so much of our peoples hard earned money.

I HAVE TO PAY TAX !!!

Why should they be exempt ?

” ANZ had waived $1.3m in fees for cyclone-affected customers as well as made $11m available in interest free loans. ”

” According to the latest quarterly bank review by KPMG, ANZ has assets of $193b

Hey Bomber you can’t say they don’t care with such a generous package !

After all ………

” Watson acknowledged the size of the profit but said it had to be seen in the context of how big ANZ was and the position it and other banks played in the economy. ”

“The actual profitability of ANZ NZ, which measures our returns versus the amount of capital committed by shareholders, is middle-of-the-pack when compared to large companies listed on the New Zealand stock exchange.”

Well that’s reassuring for so many who are facing massive cash injections from the increase in interest rates on their mortgages which adds so much more in their next half point profit to be released in six months.

It is time these parasites pay tax in the country in which they extort so much of our peoples hard earned money.

I HAVE TO PAY TAX !!!

Why should they be exempt ?

https://www.rnz.co.nz/news/business/489321/anz-posts-a-billion-dollar-profit

” ANZ had waived $1.3m in fees for cyclone-affected customers as well as made $11m available in interest free loans. ”

” According to the latest quarterly bank review by KPMG, ANZ has assets of $193b

Hey Bomber you can’t say they don’t care with such a generous package !

After all ………

” Watson acknowledged the size of the profit but said it had to be seen in the context of how big ANZ was and the position it and other banks played in the economy. ”

“The actual profitability of ANZ NZ, which measures our returns versus the amount of capital committed by shareholders, is middle-of-the-pack when compared to large companies listed on the New Zealand stock exchange.”

Well that’s reassuring for so many who are facing massive cash injections from the increase in interest rates on their mortgages which adds so much more in their next half point profit to be released in six months.

It is time these parasites pay tax in the country in which they extort so much of our peoples hard earned money.

I HAVE TO PAY TAX !!!

Why should they be exempt ?

https://www.rnz.co.nz/news/business/489321/anz-posts-a-billion-dollar-profit

Don’t people have choice to use KiwiBank or TSB? Regardless, a healthy profit means the government won’t bail out a bank when it fails on socialist grounds. Liberal orthodox theory is that you don’t intervene in a private market.

Inflation is killing us. I just have this general idea that the whole idea of printing money is the problem. Someone once said that there have been hundreds of states that created fiat currencies (not gold or silver basically), and every currency was eventually printed (or multiplied) into oblivion.

It is hurting but it is also transferring wealth from those on fixed incomes to workers.

Comments are closed.