Two weeks ago I began this three-part series to help understand what is happening to the world economy today and why pro-capitalist economists are completely unable to explain it. Last week I looked at the conflicting Marxist explanations of the crisis that are common today and why they have departed from Karl Marx’s explanation in “Capital”. Today, I want to point people to some of the best explanations available today of what can be called “crisis theory”.

Critique of Crisis Theory blog

In the last decade, I have been working with a small group of Marxists in North America who are doing a blog focused on economics that I highly recommend. It is called A Critique of Crisis Theory. What I have been explaining here are essentially based on their ideas.

The blogs first 40 or so posts are being turned into the draft of a book which we hope to serialise soon. The author of the blog, Sam Williams, and his collaborators have been working on their economic ideas for some decades. The creation of the Internet has allowed these ideas to be shared with a much wider audience than was possible before.

More recently, Williams has been responding to new developments and discussing with others who have engaged or critiqued his ideas. I tried to critique his views on an aspect of economic theory I thought I had some familiarity with — productive and unproductive labour.

Classical economists like Adam Smith and David Ricardo along with Marx recognised that not all labour performed was productive of value and surplus value. We can see this easily when we look at the “labour” of a police officer, priest or soldier versus the labour of a miner or factory worker. I think we can identify who is a productive worker in that picture.

It gets a more complicated when we look at the labour of bank workers and retail workers whose labour may or may not be necessary for production to occur. It gets even more complicated when we look at workers in health and education who may be employed in a private business producing a profit for the capitalist. Anyway, that is the area I wanted to discuss.

Sam was patient in his responses and took the time to respond to my first questions in a very pedagogical way.

Then when I wrote back still disagreeing, he wrote an even longer and more thorough response that included a reference to Albert Einstein, who, he said, proved that matter and energy are different forms of the same thing, just as physical goods and “non-material” services can both be commodities embodying labour value. That sealed the issue for me, and I conceded that they had a far better understanding of this issue.

What I found by following the blog was that it appeared to answer many of the questions and doubts I had from my own reading of Marxist economic theory which has been an interest of mine though I am no “expert”, which I will come back to. From a young age I had been very interested in Marxist economic theory. Initially, I had been quite strongly influenced by a prominent Belgian Marxist economist by the name of Ernest Mandel. Much of what he wrote remains useful.

In some things he wrote in the 1970s, Mandel hints at the continuing importance of the role of gold as the money commodity. He also played an important role in analysing the “longwaves of capitalist development” of 40- or 50-years’ duration that appear to be a feature of capitalism, which I believe is correct.

The Critique blog author also believes long waves play an important role and provides an explanation for a long cycle based on long-term swings in gold production, which makes the argument for its importance even more powerful.

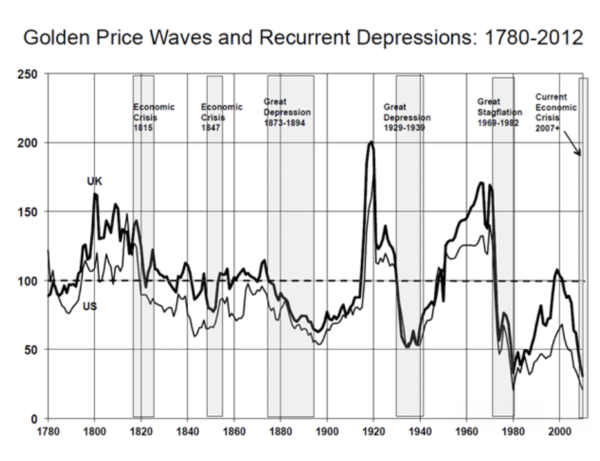

Another fine economist, Anwar Shaikh, who knows his Marx and supports an understanding of the history of capitalism involving long waves, has produced a graph that seems to support the Critique of Crisis theory on this point. He follows the long-term movement of wholesale prices in the US and the UK.

He shows in his graph that there is a movement in wholesale prices upwards during a period of the long wave that is dominated by strong upturns in the business cycles and trend downward in prices during a period of the long wave where business cycles are dominated by the downward phase of the cycle. The decline in wholesale prices is associated with a period of stagnation or long depression under capitalism. So, we have the 1873-1893 decline, the Great Depression of 1929-1939, the Great Stagflation of 1967-1982 and a similar decline, which he argues indicates a new Great Depression, beginning in 2008 which he describes in a lecture as a “very scary” conclusion for his students at that time.

To produce an accurate version of the graph, he needed to measure the prices in terms of gold because, in the period since the abolition of the gold standard, there has been a permanent inflation in paper money prices that hides the real movement of prices in gold terms. This fits very closely with the Critique of Crisis Theory blog’s view, even though Shaikh is broadly in the school that looks for the cause of crises in the tendency of the rate of profit to fall (TROPF).

The crisis theory blog brings the very useful empirical work by Shaikh into long waves and crisis theory together in a blog as follows:

As a rule, after several industrial cycles dominated by the boom phases, the general price level rises above the value of commodities. This causes the rate of profit in the gold (money material) producing industries—mining and refining—to become less profitable than most other branches of industrial production. Capital therefore begins to flow out of gold production and refining.

As the production of money material declines, the quantity of money grows at an increasingly slow rate relative to real capital—productive and commodity capital. As a result, credit increasingly replaces money, eventually stretching the credit system to its limits.

Money becomes tight and interest rates rise. This situation, assuming capitalist production is retained, can only be resolved by a crash or a series of crises and associated depressions of greater than average intensity, duration, or both.

One result of a crisis or series of crises of greater than usual violence or duration is a lowering of the general price level—measured in terms of the use value of gold bullion—once again to below the value of commodities. This makes gold production and refining industries more profitable than most other industries.

Capital once again flows into gold mining and refining, causing the production of gold bullion to rise once again. The quantity of money then expands with low interest rates and “easy money”.

As the process of liquidating the previous overproduction goes on, especially of those commodities that serve as means of production, the accumulation of (real) capital stagnates. As a result, for a period of time, money capital is accumulated at a faster rate than real capital.

But once the accumulated overproduction—especially in the form of surplus productive capacity—is liquidated, a new “sudden expansion of the market” occurs leading to a series of industrial cycles dominated by the boom phases rather than the crisis or depression phases.

This “long cycle” is built into the commodity foundation of capitalist production and is the inevitable result of the commodity form itself once it is fully developed.

But this cycle is also affected by accidental events such as discoveries of rich new gold mines and technological improvements in gold mining or refining that can either weaken or reinforce it depending on circumstances, as well as by such “accidents” as wars and revolutions.

So, history is not an automatic repetition of cycles but a complex process involving both chance and necessity.

Williams and his collaborators are quite orthodox in demanding a return to Marx on the nature of capitalist crises as crises of the general overproduction of commodities. At the same time they incorporate major developments of the capitalist system in the 150 years since Marx and Engels wrote to explain what is happening today.

An important contribution

The Critique of Crisis Theory blog is making an important contribution to Marxist economic theory today. The blog is getting thousands of page views monthly and becoming influential in Marxist economic debates. It is getting the recognition and respect it deserves.

The world reality we face today is conforming to the central theses of the blog. The current unfolding crisis and the 2007-9 crisis are both clearly global crises of overproduction. There were simply too many houses, too many cars, and so on. Of course, “too many” from the point of view of being “too many” to be sold for a profit, not in terms of human need.

I think we all should pay respect to the founders of scientific socialism and give this issue of crisis theory the attention and importance it deserves. We cannot leave it to others, to “professionals” or self-selected “experts.”

I am not an “expert” on this stuff. It has been a continuing interest of mine because it is important that we understand what is happening and who we are, what our role is, what we expect will happen to this system, who the agent of social change is going to be, and what the prospects are for making change in the world today. Those are all issues that anyone who wants to find a way out of the permanent crises capitalism seems to have in store for us can begin to addr

Capitalism is based on ‘money’ and how it is allocated to control resources and labour.

As the U.S has the international reserve currency it has profited at the expense of the rest of the world…i.e it can ‘print more dollars regardless.

So the debt ceiling increases year on year.

After military expenditure became untenable, Nixon just removed the Gold Standard .

Controlling the IMF,World Bank,B.I.S , SWIFT and the petro dollar has enabled U.S hegemony and that is what is being challenged today.

Sanctions and confiscation of supposedly gilt edged U.S securities have accelerated the desire to shift away from the U.S military/financial complex.

Since the Fed is a privately controlled organisation it effectively runs the economy.The ‘few’ want to maintain that monopoly.

Unpayable interest bearing debt and the plethora of current financial derivatives must eventually end in…tears.

As Prof Michael Hudson notes, neither pure Capitalism or Socialism actually exist.Mixed economies are the order of the day.

Well Marxist Theory obviously needs to take account of the likes of Non Fungible Tokens–NFTs–and Crypto Currencies particularly with recent Bit Coin crashes. Finance Capital has long run pyramid type operations of one sort or another, and Crypto has its own hedge funds etc. So Mike, is gold really still that relevant apart from being a consistent comparison measure?

the only value a currency of any and all types has is what the punters belive it has…hence the constant ramping of gold silver and crypto.