The crisis engulfing the globe seems to be on a trajectory towards levels of economic decline not seen since the Great Depression of the 1930s. At that time unemployment surged to levels of 20 or more percent in the capitalist world, including New Zealand.

That crisis involved a massive share market plunge, financial companies and banks collapsing, with production and trade contracting. Often the crisis was aggravated in different countries by governments accentuating the downturn through cutting spending to “balance the books”.

Capitalism has a business cycle of around every ten years. There also seem to be longer cycles and super crises every half-century or so that also may have an underlying cause. This results in a much deeper recession or depression as was seen in the 1890s, 1930s and 1980s.

Economic data from the end of last year was showing a downturn was already taking place. The current recession is actually well-overdue with the cycle being somewhat prolonged in part because it had been so weak compared to normal recoveries despite the severity of the 2008-9 downturn. Normally upswings match the downturns, but not this time.

Economic analysts Morgan Stanley estimates the US economy will contract 30 percent on an annualised basis between April and June this year, after contracting 2.4 percent January to March. An unemployment rate of over 12 percent is expected in the second quarter also – the highest since records began in 1948. Unemployment benefit claims surged to over 3 million a week last week.

France’s finance minister said the crisis was “comparable only to the great recession of 1929” and noted that French industry was operating at only 25 percent of its normal level. The German economic minister said that the crisis is testing “the functionality of the market economy” and that “whole markets are completely breaking down”. The Financial Times estimates China’s economy has declined by 30%.

So-called emerging markets are already in crisis. New loans have been cancelled. Loans are being called up. Some currencies are down 20% and since most debt is in US dollars this will soon make these countries insolvent and simply unable to pay. Interest rates will increase as a consequence, intensifying the recessionary impact. Argentina had already declared it couldn’t repay its debts in early February. Others will follow.

The rulebook of “responsible” capitalist economic policy is being thrown out the door to save capitalism from its own destructive forces.

Money is being printed by central banks to throw at the problem, including $30 billion in New Zealand. In theory this is actually unlawful for the European Central Bank to do as it is considered a precursor to inflation being unleashed. Central Banks are also guaranteeing loans from commercial banks to the private sector to try and ensure credit keeps flowing.

Government spending more than it gets in income, deficit spending, is now the rule. And the numbers are big, often about 10 percent of GDP equivalent.

Combined the USA, the ECB, Japan, Germany, France, Italy, Spain, UK, Canada and Australia have announced $2.2tn in central bank measures and $4.3tn in central government measures. This is the equivalent of 17 percent of the combined GDP of these countries, or 7.3 percent of world GDP. The Chinese central government has announced $587bn worth of measures, which is around 5 percent of its GDP.

What the government is actually doing is buying up as much distressed debt obligations from the private sector as they can to prevent a broader collapse.

So we have socialism for the rich. All the losses of the private sector, all their reckless speculation and debt creation will be put on the government’s books to be absorbed by the state.

This is spelt out by Mario Draghi, the former head of the European Central Bank in the March 26 Financial Times:

It is already clear that the answer must involve a significant increase in public debt. The loss of income incurred by the private sector — and any debt raised to fill the gap — must eventually be absorbed, wholly or in part, on to government balance sheets. Much higher public debt levels will become a permanent feature of our economies and will be accompanied by private debt cancellation.

While different European countries have varying financial and industrial structures, the only effective way to reach immediately into every crack of the economy is to fully mobilise their entire financial systems: bond markets, mostly for large corporates, banking systems and in some countries even the postal system for everybody else. And it has to be done immediately, avoiding bureaucratic delays. Banks in particular extend across the entire economy and can create money instantly by allowing overdrafts or opening credit facilities.

When giving money to the top 1% it must be done “immediately”, “avoiding bureaucratic delays”. With a few notable exceptions, including thankfully in New Zealand for now, workers, self-employed, unemployed, small business people are largely being left to their own devices.

But no government is insisting that the workers and the state get a hand in running these companies in a socially responsible way, protecting workers and the planet, after the crisis passes to ensure we don’t repeat the same old shit a decade from now.

Capitalism went through long depressions in the 1890s, 1930s, and a deep recession in the 1980s.

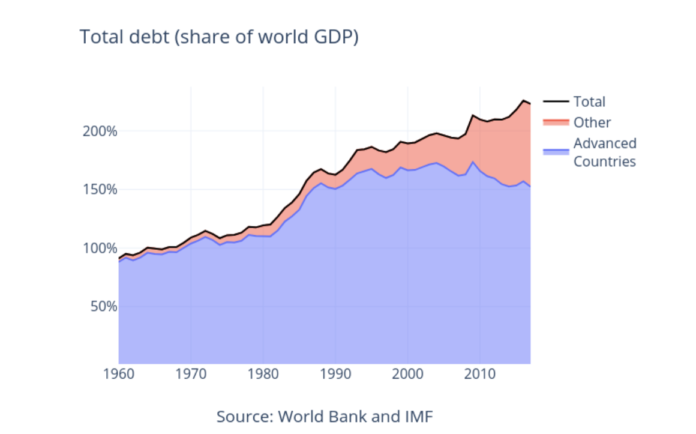

A new Great Depression seems to have been avoided since then by essentially allowing for a doubling of all forms of debt.

The period from the end of World war 2 in 1945 to 1975 was a period of very strong growth in capitalism because the world had been through the deep depression of the 1930s as well as experiencing the suppressed demand for consumer goods outside essentials during the war economy from 1939-1945.

Capitalist ideologues thought they had suppressed the business cycle by adopting policies associated with the theories of British economist John Maynard Keynes. This involved the government deficit spending to counter a recession. US President Richard Nixon famously declared “We are all Keynesians now” in 1971.

However, the costs of maintaining a world empire with wars in Korea and Vietnam meant that deficit spending became endemic and ultimately lead to a breaking of paper currencies being linked to a real value in gold and unleashing inflation of 15 to 20 percent across the capitalist world. A collapse of the US dollar was threatened. The only way to protect the dollar and crush inflation was to drive up the interest rates to whatever level was needed to “restore confidence” in the US dollar. US Federal Reserve chairman Paul Volker was given that job and pushed the official cash rate to 20% to achieve that. All other interest rates soon followed and a deep recession ensued.

Financialisation followed as industrial companies made more money from lending than making things. GE Money was more important than General Electric. Manufacturing fled to cheaper countries like China, which now produces 30% of world manufacturing. It took decades for interest rates to return to more normal levels. This helped account for the very moderate nature of the business cycles during the decades after the 1980s. Business investment and therefore growth is constrained by the higher interest rates in the advanced capitalist world and encouraged investment shifting to China and other places where labour was cheaper.

Cutthroat capitalist competition also produced massive industrial specialisation and just-in-time supply lines. These have been massively disrupted by the pandemic and the necessary health and economic responses which has exposed vulnerabilities for both sectors as a consequence that needs to be addressed if we are ever to recover.

The limits of Keynesianism was exposed in the 1970s and will be exposed again as we grapple with the current crisis.

Policies like quantitative easing were not particularly inflationary after 2008 except for asset price bubbles, because nearly all of the newly printed money was handed directly to the big banks and the rest of the 1% who control the various bond markets. In a financial crisis, the money was hoarded or used to settle debts rather than put into broader circulation. The money that is being created today will be used for the same purposes but is also being paid directly to working people who will use it as a means of circulation. As a general rule, the doubling of the supply of money as a means of circulation – i.e. paper dollars or their electronic equivalent – will double prices. That is a law of economic life the Keynes and his followers tried to ignore.

Price inflation will destabilise currencies, drive up interest rates, and threaten hyper-inflation like was threatened in the US in the 1970s and happened in Germany in the 1930s and Venezuela today.

The crisis that is coming needs a socialist solution for working people. The financial sector and all major monopolies need to be in public hands. We can then democratically and collectively decide what we need to produce and how we produce it in a way that cares for the workers, consumers, and the planet for generations to come.

That system has a name. It is called socialism. And rather than being outdated, it is a name and a system whose time has come.

‘Socialism’s time has come’

My..my they are all coming out of the woodwork!

Christine Rose, Chris Trotter, Mike Treen, Martyn Bradbury….who’s next?

Every marxist/trotskyite/far left individual are soiling themselves with excitement to implement their socialist Nirvana in NZ, got news for you…

NEVER.GOING.TO.HAPPEN!

“Christine Rose, Chris Trotter, Mike Treen, Martyn Bradbury….who’s next?”

I’m next.

Fuck off .

I’m not sure how to address anything I’m right says or any other neoliberal apolohpgists. They’re stuck in what ever back water bubble the anti-vaccers, 1080 and chemtrailers are in from last year onwards.

In 2008 I was sending of a couple of loads of logs per week to the export market. The company I sold to rang one day to say Stop! The ships can’t leave Tauranga. The world’s banking system is collapsing and no payments can be made for anything. A cargo has to be paid for before a ship can leave port and no payments could be made anywhere.

That’s when QE started. If it hadn’t the entire world would have remained paralysed. No currency could be recognised as worth anything so no business transactions could proceed. The QE fix was temporary in as much as it could not remedy the underlying problem of debt saturation, it could only expand that debt which has carried on expanding at an exponential rate.

So crunch time has come around again as was invertible , only this time it’s 2008 x 10.

But the only fix available to the powers that be is more of the same. It is iniquitous that that fix involves pouring more newly BORROWED money into the hand of those who already have far too much but the alternative is a complete meltdown of society. Money which is only a confidence trick at the best of times will be useless as no bank will be in a position to transfer it. It will have no recognisable value. So farmers won’t be paid for crops and transport companies won’t be paid for shipping food to supermarkets.

This is what will happen if governments don’t do what Robertson is doing now. The token of payments to unemployed workers etc. is to soften the outrage at the bailout of wealthy banks and business, but it is the banks that have to be held together to prevent collapse of everything.

I don’t think that collapse can be postponed forever , but I don’t quite see what will end it.They will just keep on printing more and more debt that we will collectively owe to the finance industry parasite . It has our jugular. It can’t and won’t be changed until that collapse has occurred .

Dig a guarden

D J S

“it is the banks that have to be held together to prevent collapse of everything.”

Agreed in the short term if we agree to live under the hegemony of international private bankers.

At some point we have to move away either by incremental change, bloody multinational revolution or a crash so deep that global trade and the financial cabal cannot foster enough support to fight change.

Hear, here!

Thanks for that Mike. I was under the impression that this last tranche of money had not been created as debt and that the govt had started creating the money by spending as is our right as a sovereign nation. So just more socialising the losses and privatising the profits. I’m Right says socialism will never come. Sometimes it seems like he/she is right but that is a logical impossibility given the fact of a finite planet. Some old dogs may need to learn new tricks or be taken for a one way trip to the vet. There is only one way out for the capitalists and it is the route that has historical precedence. That route is massive war to the point where most productive capacity is obliterated along with a large proportion of population. The problem here for them is that these days massive war will leave a world that wont be much fun to live in. But for many capitalists, and given the above statement by I’m Right, I would include him/her its my way or no way in much the same way as a childs tantrum when someone doesnt give them what they want

RBNZ to buy more government bonds, as well as corporate and asset-based securities to support liquidity in the corporate sector.

As I understand the process the reserve bank creates the money not the government. The RBNZ uses the money to purchase bonds issued by the government on our behalf . These bonds are little IOUs. This is the form that government borrows all it’s money. The bond will have a date on it at which the government commits to “redeem” it . (pay it off). So it might be new money but it is still created as a debt from the government (that’s us ultimately) to the reserve bank. That makes in new debt that is being created that will have to be paid eventually. Please if anyone knows better explain it clearly. Obfuscation won’t do.

D J S

Im unsure why it has to be that the RB needs repaying? Is it a private bank or do we own it? If the new money isnt inflationary, why is there an automatic time at which it must be repaid? The RB surely doesnt have the money already backed by private capital or does it? Does the RB really have to wait until enough private backing is secured before the Govt can spend the money? Its all electronic money anyhow but really the idea that the govt decides on a cash injection to save the economy and then waits for private backing is absurd. They make the call and then start spending so the backing by private money is just an unnecessary sell out?

I have no formal qualifications Spykeyboy but this is what I understand.Theoretically the NZ state owns the RB but there are conspiracy theories around that Rothchilds actually own all the western world’s reserve banks. Be that as it may it is lone ago established that the reserve bank and the government have seperate areas of authority. Everywhere . At many times in history countries have been ruled by royalty or dictator or elected government that have proven to be irresponsible and intellectually inadequate to manage the money supply or to understand how it works. I don’t think that has changed very much. But in any event stepping outside the international banking conventions dominated by the US fed is unlikely to be financially survivable. Or politically survivable, or nationally survivable or personably survivable. Bashar al Assad in Syria is one of three countries in the world that run a banking system where the state controls the issue of money and where it is spent and how and that is the reason that Syria is in the trouble it has been in for most of the last decade. Assad undoubtably does have the intellectual capacity to run his country’s banking and money supply and if he was allowed to trade normally with the rest of the world it would soon become clear to people everywhere that this is how their country must manage their finances too. The opposition to that happening is totally backed by the American military industrial complex. As Trump says the greatest military power ever to have existed.

So my understanding is that there is no reason that the RB needs repaying except the above. We would at least be cut off from the international payments system and be unable to trade with anyone like Venezuela or Iran. It’s OK for Russia , she is huge like China and doesn’t really need to trade with other countries at all but we do.

You can be pretty sure that Robertson has been told from outside this country, that it is time to start QE . Social security for the finance industry and multinationals. You may notice that the move includes “Open Market Operations” too. Which is to say they will be using some of this money to prop up the share market and try to prevent it from tanking.To just print money to buy shares with and to so called buy corporate bonds with which is just industry jargon for lending money to companies to prevent them from going under when they are insolvent so no commercial bank of investor would lend to them but it is deemed that they must be kept alive.

Cheers D J S

Thanks DJS. Yes that is my understanding too. I believe that Libya got the treatment due to an attempt to set up an independent pan Africa banking system too.

Agreed David. When we attempt to make a shift from filling the pockets of the banking cabal then we become a target for all manner of persuading measures including military intervention as necessary.

eg Norman Kirk setting up a citizen’s super scheme where a small percentage of a citizen wage was placed in an account in Govt coffers with a promise to add interest as time passed.

The MSM fought a battle with the idea but it went ahead.

Kirk got sick and died.

Rowling got hell from the MSM with Bob Jones and others attacking him from all quarters.

The next election the CIA designed and sponsored a dancing Cossacks TV add for National and money came into the country to run an overwhelming campaign against Labour.

National got in and eliminated the citizens super scheme.

There was no way the banksters and their comrades in crime, the insurance parasites were going to let a country become solvent and build up equity with citizens money they wanted

If Norman Kirk’s scheme had continued NZ would have been deep in surplus and the Govt a major player in financing, and all citizens better off. No management fees nor losses if finacial crises occurred. It was a Govt backed scheme unlike Kiwisaver in private hands..

This structure is a prime target for graduated moves to privatise our money system similar to the private US Feds.

The debt gets big enough then TINA is wielded to shoehorn in a float.

The RBNZ already has 3 external members on its board. johnkey wanted to increase that so the board membership was dominated by private sector participants.

A New approach on 1st April

https://www.forexlive.com/centralbank/!/here-are-all-the-new-rbnz-monetary-policy-committee-members-20190328

Well thats pretty interesting. So no chance of any different thoughts on how to put new money into the system. I understand that almost all new money is created by bank lending and that although it is illegal for any entity to create actual physical notes and coins other than the reserve bank the same is not true of digital currency which comprises some 97% of the money supply. The positive money crowd have drafted a bill which could be picked up by any govt that would extend this illegality to all forms of money digital and physical. The effect of it would be that banks would become a public service entity which could only lend against actual cash reserves and further that these cash reserves would not include normal business and household operating accounts which would be held at the RB. This would also mean that when a bank hits the wall only term investments would be at risk but the best part is that the RB would have total control of the expansion of the money supply and it would be done by allocating money that was to be spent into existence by the government as it saw fit and not created and syphoned of as mortgage debt by rapacious private banks. Can you already hear the screaming if this piece of legislation was ever picked up?

It’s arrogant of me but I think Positive Money have a fundamental flaw in their understanding of how they can fix / control the money supply. Because a head of the BOE once posted an article that explained that the “Money Multiplier” (look up on Wikipedia ) was irrelevant in modern banking ( as it applies to the UK anyway) , that it is a myth . But the BOE head did not say that , he said that it is no longer relevant. That is because the constraints to money creation by trading banks that the fractional reserve system once imposed on them are no longer applied. That is so here as well but I think the US has reimposed them.

If PM did what they advocate it would amount to re-establishing a fractional reserve system but without imposing or nominating the fraction of deposits that the banks must keep in reserve , this because they don’t believe in the “Money Multiplier”effect. But without imposing a nominated reserve ( Muslim banks work on 50%) the money supply would be multiplied up between banks and borrowers without limit , except the limits imposed by the banks themselves in assessing the viability of a potential borrower. In other words it would in effect change nothing from how it operates now.

D J S

Wiyh all due respect DJS I think it is the fractional reserve system that is a myth. Just look at all the squealing from the Aus banks when our RB is trying to impose cash holdings on them. I have never come across anywhere where these are imposed. If they were how is it that we have a situation now where 97% of all money is digital and 3% physical? Cash reserves can only be physical.

Also as stated above, far from positive money allowing unrestricted lending, the reverse is true. All lending will become 100% cash backed. The only lender without this restriction would be the reserve bank.

To understand this you have to understand that every time a bank loans money, the money is created out of thin air. No one has their account debited to pay for the loan. The total money supply is increased by exactly the amount of the loan. This is the definition of money creation and requires an amendment in parliament to make creating digital currency as illegal as creating physical currency.

On the topic of creating money out of thin air there was an interesting case in the USA here

http://www.thetruthaboutthelaw.com/banks-lend-money-they-create-out-of-thin-air/

And as for theformer UK RB governor, this is copied directly from a UK RB document titled “Money creation in the modern economy”

In the modern economy, most money takes the form of bank deposits. But how those bank deposits are created is often misunderstood: the principal way is through commercial banks making loans. Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.

The reality of how money is created today differs from the description found in some economics textbooks:

• Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits.

• In normal times, the central bank does not fix the amount of money in circulation, nor is central bank money ‘multiplied up’ into more loans and deposits.”

You can find that document here:

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

I should add as my partner points out , that the only way to prevent the multiplier from operating completely is to require the banks to hole a 100% reserve. Ie. not to allow banks to lend out depositor’s money at all. They would have to charge a fee for in effect doing the public’s accounting. Holding everyones savings and facilitating transactions for a fee. That would be positive money and might work quite well. It would still allow people to lend to each other.

D J S

David and SB.

The fractional reserve applies in NZ with banks needing to hold $1 for ever $9 they create.

97%+ of new money in NZ is created by banks who have a mandate to lend fiat money with a fractional reserve of 10%

The fractional reserve for those banks can be changed and a managed change to say 20%. 30%, 40% progressively would soften the change but of course create alarm and international consequences, that we would have to weather.

Less than 3% of new money is created by the RBNZ in releasing coins and notes.

At present there is some doubt that private banks comply with the fractional reserve of 10%. Whose is checking? Banking books cross borders.

State Reserves do not have to be in coins or notes but can be in Fiat money controlled by a properly nationalised central bank, probably a modified RBNZ.

But a separate Govt owned lending agency needs to be established again to take the place of our one time State Advances loans. The state need not have a fractional reserve as the entire country is the reserve.

Private debt must not be assumed by the state. If the Corporates create debt then that is theirs not New Zealand’s.

Inflation must be controlled by state oversight of all inflationary influences.

A state owned insurance company is also urgently needed with a mixed board being public servants and members elected by clients.

Corruption in the form of public servants and politicians answering to the dictates of offshore money and the like, needs a remedy. An agency with the powers of the SIS but solely investigating and reporting corruption to the police, SFO and the PM, would be a start.

johnkey for example and roger douglas both were our pinnacles of corrupt behaviour and should have been jailed.

!00% reserve would allow banks to lend out depositors money plus any other money owned or held by the banks individually.

They could charge interest at a rate above what they pay depositors so make money on the interest.

BUT THAT IS NOT ENOUGH FOR THEM.

Absolute greed has allowed corruption to force Governments to allow them to create money by eway of a law allowing this.

We need to repeal any such legislation and replace the present system of loans by making the Govt the sole agent who can create money that is not interest.

Dead on the money.

Pardon the pun.

Superb and timely Post @ Mike Treen.

Only fools would read this Post and not take it very, very seriously.

westpac. bnz. anz. asb.

Bye bye fuckers !

You can leave our money, assets and resources at the door as you leave.

Farmers? Can you please delve into who your traitors are? The ones who’ve sold you to slavery then get rid of them by any and all means and strike up new deals with a soon to be starving, shambling first world ‘economy’ and its populations?

Then? Weld yourselves to your down-stream service industry providers i.e. strength in numbers, so no fuck coming along can subjugate you, demonize you and entrap you in dubiously cheap foreign sourced debt again.

Or? We could simply export edible tourists after we lure them here with the promise of a good time.

Nummy num-nums.

Re @ Im right above and on a more serious note:

( I know. Eye roll, right? @ Im right is difficult to take seriously.)

Lets assume @ Im right is who he/she is. There are many reasons for an @Im right. Here’s one of them.

The @ Im right is a good example of a political confederate. They infiltrate a narrative and by comments and innuendo while running manipulative deflections in an attempt to derail a narrative vector their aim is to ensure that, that narrative dissipates and disperses like smoke.

We, can see him/her coming but to the casual observer who might allow their curiosity to draw them here he/she might make sense. ( I know. Imagine such a thing? )

That, is the danger of people like @ Im right. That, it could be argued, is their job.

Do you really think that all that you see and read here goes unnoticed?

That would be naive if so.

There are some very good and powerful energies sparkling away here and it’d be naive indeed to assume there were not cold eyes watching and reading what we write to express.

And those eyes will see that much of what we express is true and pure and that, in and of itself, will give the fuckers sleepless nights.

One would hope.

So. Sorry @ Im right. You were saying?

Yes? Spit it out?

You were saying that socialism will never work?

After neoliberal narcissists and sociopaths fucked our country? You still believe in what you write?

You do know that you’re commenting on TDB? Not The NZ Herald. Not Kiwiblog. Not RNZ? Not The Listener?

God, I nearly wrote Whaleoil but that’s dead and buried.

One down. Next?

Neo liberalism fucked this country…and here I thought we are in this current situation because some Chinese person ate an undercooked bat!

It’s OK, you can all play in your socialist sand pit, there are a handful of you on here (dozen or so) that post regularly and fill your nappies with sheer excitement that a revolution is comming…nope!

But if it keeps you all happy during the lockdown, go for it!

It’s cute to see….soooo cute

Except what you write on your tinfoil hate isn’t true. If you believe that allowing tens of thousands of kiwis to be taken by the corona virus then no one cares how righteous you are, you won’t be allowed on the team.

Shows how wrong you can be I spose

Imaright idiot seems to have trouble acknowledging a little knee high wave of a virus, has washed over the sand-castles which make the foundation of his neo lib right wing Trump world ,,,,,

He can not admit it is Governments using socialist methods ,,,,to stop total collapse caused by the present systems of finance and trade being knocked over ,,,

The usa right wing are calling this socialism ,, ” Americanisim ” ,,, throwing public money at everything ,,, but mainly in the wrong directions.

The virus is exposing what we euphemistically call weaknesses ,,, but in reality is stupidity ,,, a lack of planning and thinking at a social level. Greed is no good when it comes to public health… Who could have guessed.

Anyway this knee high wave has thrown our modern advanced civilizations into a certain state of chaos ,,, but also sent us a clear warning.

Because that Wall of Water,,, further out but heading our way ,,, is called climate change and sea level rise … Its a really BIG wave ,,,, and the effort to do nothing about it ,,,,is lead by the donald Trumps and right wingers of this world.

If we waste time trying to rebuild sand castles wrecked by the little wave ,,,,, then there is no question as to our fate when the big one rolls in.

A quick start in a new direction would be Burning Tax havens and deflating billionaires lifeboats ,,,, both done by bits of paper call legislation and regulation.

the first is good for the environment and the second will save lives.

Are we with the world ?? ,,, or with the world wreckers ?

https://www.theguardian.com/news/2018/feb/15/why-silicon-valley-billionaires-are-prepping-for-the-apocalypse-in-new-zealand

Close the borders tight. No toxic billionaires allows in.

Socialism = serious analysis, not your unfunny wanking I’m right/I’m wrong. I’m tired.

Looking after the cleaners, the supermarket workers, the rubbish truck people right now appears a better bet than say the billionaire hedge fund manager?”

The “essential workers”, neoliberal thinkers have at the bottom of the pile. Who’d have thought, all this time it was “trickle up”. Thank goodness for socialism. From our sandpit rose bricks and mortar.

Absolutely right bert except that its not a trickle but a torrent that goes up and its in built into the system that there will be hardship and fierce competition between those outside the financial elite.

When I get my mortgage and transfer it to the house seller all my scrabbling around for the weekly payments is 100% profit to the bank. There is no account at the bank where money is written off as I repay my mortgage. All that has happened is that money is drained from general day to day use and concentrated in financial institutions. Every day of paying mortgages makes the struggle harder and harder for the next generation of people buying houses as money gets harder and harder to find. We see this effect not in lower wages but in the eyewatering amount required to buy a house and the reduction in services that we once took for granted. Free education anybody? Heres a quote from an honest thief:

“The bankers own the earth. Take it away from them, but leave them the power to create money, and with the flick of the pen they will create enough deposits to buy it back again. However, take away from them the power to create money and all the great fortunes like mine will disappear and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of bankers and pay the cost of your own slavery, let them continue to create money.” — Josiah Stamp Former Director of the Bank of England

some Chinese person ate an undercooked bat!

imright is so wrong or easily taken in.

Neoliberalism is Trump keeping gun shops open as an essential business!

The people who most need to be convinced of this are those who keep voting for neo liberalism in the form of National and Labour. Most of us know this and can see how well more Socialist focused nations have fared in this compared to train wrecks like the brazenly capitalist US.

Spikeyboy . I’ll start again here for the sake of space.

I think that the Fractional Reserve system is no longer applied here and apparently not in the UK for quite a long time . Greenspan decided to leave it to the banks to decide how much deposit it was prudent to hold in the mid 90’s which effectively abandoned the fractional reserve in the US but I think they have returned to it now. but as no-one is seeking loans that the banks consider viable in sufficient numbers the reimposed reserves are not being approached anyway. I think that we are following the UK’s system now and as you say the fractional reserve and hence the concept of the money multiplier does not apply any more. That doe not make it a myth, it just means that it is not being applied now. If the FR was re introduced the MM would become relevant again.

It is true that if all money was cash. It could not be expanded beyond what is minted.This would prevent money creation by the banks just as requiring 100% reserves would. But no one is going to go back to a system where the banks have to hold warehouses full of paper notes and parcel them up in bundles to match each loan made any more than the customer wants to carry the van load down to the realestate agent to buy a house. And except for they charge a fee for holding that cash and for actioning every transaction, how will the banks generate the funds to pay their staff? In a fair and reasonable economy they do perform a service to the community. Of keeping account of people’s stored value , and of making judgements about who the nation’s money should be lent to and for what purpose. With their own survival being the constraint on bad judgement. Unfortunately QE eliminates that constraint.

I think that sovereign banking would be more pure if you like , but the fractional reserve system was perfectly satisfactory as the RB while operating in the interests of the nation could control the amount of money created by either altering the deposit to loan ratio , or adding / subtracting the amount of fiat money created by the reserve bank as the RB sees fit. Now the supply is controlled only by demand moderated by the interest rate.

The referred discussion on deposit creation if you think about it is purely semantic. If for accounting purposes the bank wants to put a newly advanced loan approval into an account and call it a deposit, seeing they are from then on going to treat the account exactly the same as if it was deposited by the customer it’s just a convenient way of keeping the record. Separating these “deposits” from what we would have thought of as deposits and calling the latter savings or something else doesn’t make any difference to the mechanism. And to be sure without the volume of “savings” any longer being a constraint on lending, now involving creation of an account now called a deposit, the two kinds of account are separated.

Cheers D J S

My recent discussion with David Tripe and information from the RBNZ, support the fractional reserve of 10% is still the basis for banks creating loans but there is no policing of it.

If the fractional reserve was 100% for loans then banks could still make money by paying interest on deposits and charging a higher interest rate for loaning out that money. No new money would be created by a loan but interest would create new money. The banks would still have to keep at least 10% of the deposits to meet withdrawals. That was the basis of banks before fiat money became the procedure used for loans.

When a bank lends a customer say $1000 , that money is spent on something . Say a fridge. The loan is taken up and passed to the supplier / vendor . The vendor then deposits that money in his bank account. Actually unless taken out in cash which as you point out earlier accounts for only a tiny proportion of transactions, the money never actually leaves the banking industry, it is transferred from the first person’s account at his bank to the vendor’s account directly .

When this $1000 is deposited in the second bank account it is not traced to the original bank account . It is recognised as a new deposit of money and treated accordingly. If a 10% reserve is in effect the second bank (or the second bank account as it could well be the same bank) would then be entitled to lend $900 of that to someone else. And so it goes from bank to customer again and again reducing by 10% at every step until the amount remaining becomes vanishingly small and the original loan has become almost but not quite 10 x the original loan. This is the money multiplier . It is not a myth it is simple logic and arithmetic. When a fractional reserve system is being enforced. It used to be when I was a child (a long time ago) that that 10% reserve had to be actually deposited in the trading banks account at the reserve bank at 3 in the afternoon on every trading day. Then it was deemed sufficient to trust the bank to hold it. Then the decided to let the banks decide how much they wanted to keep in reserve.

But John Key during a time a few years back when this was all under discussion and how NZ banks operated cf the BOE after the story came out that the BOE did not run a FR. That the lending allowed by banks in NZ was tried to their asset base. If you look up a balance sheet for the ANZ the asset side is all about the loans the bank has made that are owed to it. So it would seem that the more a bank lends the more it is entitled to lend which is interesting, but that statement strongly suggests that our banking system now pays little head to a fractional reserve constraint and Spikeyboy above is correct in saying the is no effective constraint in place to the issuing of debt.

But consider the fact that virtually no money ever leaves the banking system anyway. It passes from one customer’s account to another but always stays in the banking system. Only ever passing from one bank to another ,so a loan advanced when taken up become instantaneously a deposit in another. If thera was only one bank this would be obvious but in effect they operate as if they were only one bank anyway. So at 3 pm when a bank is required to balance the deposits it has received that day with the loans it has made , if it were one bank it would be absolutely automatic. It is in fact only very slightly different in that it becomes a matter of adjustment between them for each to balance at the end of trade, so they lend the discrepancies to each other overnight at a tiny interest rate. A bank that has overstepped too much that day or that the other banks are ostracising for some reason has to borrow from the reserve bank at the days reserve bank rate , slightly more but still very small %. But in this system that reserve bank rate is the only constraint on money creation. The bank has to be able to find a borrower who will pay enough interest to cover the reserve bank rate and make a profit . And eventually have the loan repaid.

Cheers D J S

But the point about the newly created deposit being newly created money remains. Nobody has had this loan amount removed from their account. Everybody has the same access to their money after the deposit is created as before. The loan money is new money that didnt exist before the deposit was made. If it were existing money somebody would no longer have access to an amount equal to the loan. This does not happen. The BOE document is very clear about this.

Agreed

Yes but the overall picture must still be seen that society has a group within it that have a legal privilege of creating money for their own pocket.

Joe Blow asks a private bank for a loan for $100.

The bank dutifully complies with the regulations, check that it has $10 in its coffers so lends Joe $100.

Joe pays it back after working hard or selling natural resources so gives that bank $100.

Apart from any interest paid by Joe the bank now has $90 it did not have before the loan so is enriched by at least 900% of the $10 the loan was made against.

The initial $10 may well have been a deposit belonging to a third party.

Also it has charged interest on the $90 it did not have before the loan was made.

There is no other racket like this allowed.

We let private banks do this. You might ask why.

Alternatively if Joe borrowed from a state lending institution, money can or will be created but when it is paid back then the state will be richer. That money can be applied to infrastructure, social programs, environmental restoration, education, public health, defense or where ever the Govt sees the need. Society becomes richer in assets.

Private banks take the undisclosed newly created and harvested money much of which goes offshore with relatively little or no benefit to NZ society.

Some of the money gained by banks is shown as profit / income and a small percentage is demanded as tax.

The 5 billion declared by the main 4 private banks seems a very small amount compared with the mortgages and loans floated each year and the new money created by the banks. Then there is the matter of interest and fees charged by these extremely privileged banksters

.

How did we get the legislation that allows this fiasco. That is an interesting study of institutional corruption of society we inherited from London.

I note that the privately owned Federal Reserve in the US is not a part of the NZ money system.

Not quite John W. If we are in a fractional reserve regime the individual bank has to hold $100 to be allowed to lend Joe $90. Or $110 to lend him $100. They can only lend most of what they hold not multiples of it. It is the nature of how their customer’s deposits / savings came into existence that needs to be grasped. Because they were originally loans from another bank ( or by the same bank to another customer).

Also another concept to get your head around is that when Joe pays his loan back to the bank it does not go back into the money supply . It is extinguished/written off goes out of existence. The system recognises that the loan money is out there circulating forever more and inflation would go ballistic if the total supply was increased permanently whenever a loan is made. It makes bank money very different stuff from cash doesn’t it.

It must be recognised that the banks do perform a useful service. And they have to be staffed. The interest , or some other mechanism for recompense is reasonable at some level. It could be made up of fees payable per transaction but it is going to cost something whoever does it.

I have a little book called “Money, Whence it Came and Where it Went” by Galbraith. I like his description.

“The process by which banks create money is so simple that the mind is repelled”

Cheers D J S

Sorry DJS but I have to disagree with you here. John W has got it completely right. The deposit amount that I referred to above is the money loaned created as a deposit into the account of me the borrower. It is this money that is newly created as a debt. The lending bank gets to create the loan money and charge interest!?! John W is right to be horrified and correct when he says that if this money creation scam was made to only be legal for an NZ owned RB we would no longer be suffering from user pays anything. Everything would be affordable and full employment guaranteed

I also fail to see how money used to pay back the loan goes out of existence. What you are saying is akin to saying that if I paid It back each week in cash they would take it out the back and burn it. Cash or digital, this is real money and no one is going to be extinguishing it!

Please listen to Ellen Brown in the interview linked below.

My apologies DJS. You are right. Repaying a loan destroys money in the same way as making a loan creates it. So that would make it appear that the main problems with this system are that the RB has lost control of the money supply and that as Ellen Brown says only the principal is created so that repaying with interest ends up destroying money quite quickly which necessitates an ever increasing debt creation cycle that keeps on feeding itself until it blows up. Surely these boom and bust cycles could be eliminated by spending money into existence from RB to govt. The only other alternatives are loans without interest or debt jubilees. I think Michael Hudson says that debts that cant be paid wont be paid. There needs to be some recognition of this from the banking sector and either some of the extreme profits put aside for this or go for the Chinese system that seems to be very successful. Almost all banking is govt owned and loans are made on whatever criteria maybe social factors of employment or sectors that are being pushed as nationally important but then when the loans go bad not necessarily foreclosing because its only the govt for which other social considerations are just as important. People seem obsessed with the theory of serious shark circling competition being the driving force of successful evolution when any serious study of nature shows time and again the benefits of mutual aid in supporting individuals and giving an edge to the survival of a seemingly weaker species against an apparently individually stronger aggressor. Demanding every pound of flesh is the downfall of the West

Old Trump is going up to 60% support as a wartime president from folk who haven’t been paying attention. In the 70s even Intermediate kids like me knew the basics of ‘mouse’ Rowling and ‘pig’ Muldoon.

The individuals haven’t been paying attention to the vital like we pre-teens.

Spikes boy and John W

Have a listen to this https://www.globalresearch.ca/universal-basic-income-covid-19-bailout/5708293

Cheers Spikeyboy

The bank might well take your cash outside and burn it too as to them it is only worth the paper it is written on. They don’t pay it’s face value to anyone. It must be accounted for somehow in their books but it only costs them the cost of minting it. The foldey is probably less than the coin.

If you visualise the banking system as a whole balancing the loans with the deposits as I described above, largely in the same move but balancing any discrepancy at the end of the day. With any over lending borrowed from the RB, it becomes evident that it is the RB advancing that short term credit , which it does with fiat money, that is actually increasing the overall money supply.

And yes you have it that when everyone (including government) rushes to pay off their debts it collapses the money supply like a mouthful of candy floss. Because it’s nearly all debt to begin with.

D J S

Just a thought though. In times like these where debt is still huge and limited ability to repay then all that debt is being treated as real money and the RBs of the world are complicit in this in accepting that debt and exchanging it for real money. Now if paying off debt destroys money does QE then destroy money rather than create it? Or do these collateralised debt instruments remain in existence. I was under the impression they are destroyed so how is it that this finacial wizardry is promoted as expansive when if it is a tricky way of paying off debt it should contract money supply?

i have been puzzling about QE money since it was introduced. It was described as Fiat money used to secure the financial system at first, but commentators constantly described the action as saddling the public with the tab.

As Don Brash on Morning Report back in 2009 said, having the RB go to the retail bond market and buy bonds with new money to increase the M1 money supply is something that happens regularly in the normal RB operations. It was just the degree that was unusual then , but also it was unusual (unprecedented in fact) that they also bought Bonds and stocks of major companies to rescue them then to. That part of it soon dropped out of MSM comment about QE.

Buying Govt bonds from the secondary market that the govt had already issued, for the purpose of borrowing for it’s normal business does not increase the public debt that ultimately we owe because it was already borrowed. It just changes who it is owed to. But if the Govt issues bonds specifically to facilitate the creation of that money then the QE saddles the public with the equivalent debt. So rather than alleviating the overall debt mountain it exacerbates it.It just becomes a transfer of debt from insolvent banks and companies to the public . Every improvement makes matters worse.

The trouble is that they have a tiger by the tail. If (when)the banks and overfinancialised companies are left to fail, esp the banks, the money system will fail completely. It’s much easier to identify what’s wrong with the system we have than to invent a new not that will fix them without creating other problems. I think a properly regulated FR system. with a prohibition on banks from engaging in any activity but receiving savings deposits and making loans to the public was workable.

D J S

Well in that case you would have to think that the independence of the Reserve Bank is part of the problem. Their primary responsibility will be to the financial system as it stands and runs. It is also very convenient for govts to be able to throw their hands in the air and exclaim that it’s not their call. Govts have the power to bend the RB as they see fit but all are frightened of the resulting squeals. but from what you are saying it appears that with a will the RB could take control of the amount of money created. this still leaves the problem of the need for continuous expansion of GDP. I don’t see how you fix that with debt based money creation exacerbated by interest payments. Surely this is the greatest benefit of the positive money approach. You no longer need infinite expansion or what equates for this in the real world, infinite expansion with discrete packets of massive destruction (wars, depressions, etc).

Comments are closed.