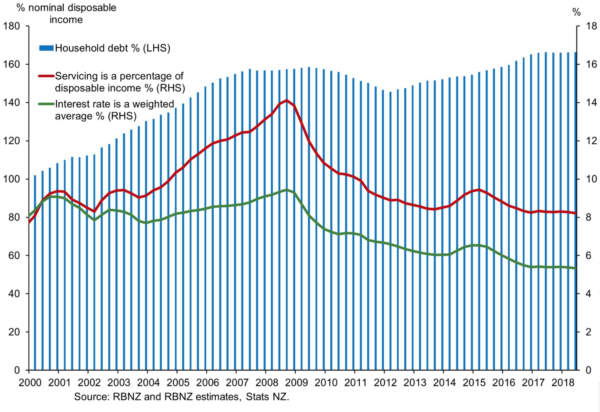

This is one of the graphs I worry about.

It comes from the Reserve Bank and if you look at the vertical blue stripes you will see that Household Debt in New Zealand is rising.It’s now about 170% of Nominal Disposable Income – so we are spending a lot more than we are earning.

This will not end well.

It’s a result of the classic neoliberal approach to running the economy and which the coalition is continuing to use.

Their aim is to drive down Public debt even though we have some of the lowest public debt in the OECD (See Berl Reference below) and not worry too much about rising Private debt.

As long as the government’s books look good that’s apparently all that matters.

If we took a more progressive approach to running our economy then at least 6 things would help ease the debt burden on low and middle income folk.

1.Remove GST from all food items and replace it with a luxury tax on things like expensive cars, yachts etc put a capital gains tax on house sales and instigate a financial transaction tax on all accounts except personal bank accounts.

2. . Reclaim the mortgage market from private banks by re-establishing the State Advance Loan system – a government guaranteed mortgage scheme that offered very low housing loans on new properties

3. Reduce the ability of Private Banks to create money through signing New Zealanders up to debt. Make a Government Trading Bank the ONLY bank that can create money.

4. If necessary – use the government’s ability to negotiate very cheap international loans which could be passed on to NZ Citizens to help them build homes.

5.Make money work for people not profiteers

Running the country’s economy as if it were household. is a mistake. You don’t have to hoard up billions of dollars for “a rainy day” when you own a bank and its already raining on a lot of Kiwis – (Food bank hand outs, for example, are up 25% on last year in Auckland)

6. A free education up to and including university and polytech

Sources:

https://www.rbnz.govt.nz/…/key-gra…/key-graph-household-debt

http://berl.co.nz/…/new-zealand-among-lowest-government-de…/

Bryan Bruce is one of NZs most respected documentary makers and public intellectuals who has tirelessly exposed NZs neoliberal economic settings as the main cause for social issues.

When I look at household debt and servicing I always have two questions. Does the debt represent/is balanced by a long term investment such as a house? And is the servicing cost on such an investment cheaper than rent/hiring?

one of the reasons we got here was record low interest rates

i agree its going to end badly new zealanders never took on the warnings of gfc and the party carried on.

i doubt many of the sleepy hobbits have ever seen that graph or even know what NZ true debt position really is. As usual when they do its to late damage done. those suggestions can ease the burden a bit but the howls of the indebted will turn to anger as there assets and homes are foreclosed on. the closest example is Ireland Steve keen has named nz as one of the zombie economy’s. if you don’t need it don’t buy it. if possible pay off debt

This is a surprise – someone who understands how the economy really works. I had believed there was no one in New Zealand who knew where money actually comes from.

Certainly no one in the mainstream media gets this stuff, but not many people in the alternative media understand it either.

As far as I can tell the only political party here who understands this is the Democratic Party for Social Credit who received 806 votes at the last election.

The coalition government should be extremely concerned that the tax system prejudices solo mothers, young people and beneficiaries.

It is a convention that poverty hits the unemployed the hardest. With hundreds of thousands of New Zealanders in and out of the workforce force earning bellow a living wage the coalition government must bring massive amounts of investment to bare, sufficient enough to house and employ large chunks of vulnerable people, as well as pay these people a decent wage.

It’s against this background that immigration should be tightened across the board and benefits increased by 25% across the board to compensate the unemployed for seeking work and travel costs or effectively rolling out Mana in Mahi programmes nationally. Along with broad tax restructuring this should be expected to increase economic growth by 1 or 2 percent above the 4% growth today so that the economy is growing in the sixes and eights.

As it’s been stressed before the coalition government is about kindness and traveling down new tracks. One of the major conditions that a government can do to create the conditions for new growth is low inflation and a non-inflationary monetary policy and rises in the consumer price index should not exceed 5%.

It’s just 12 months since the coalition government has received a housing crises. While the global political scene remains confused it was not until after the government was sworn in that the full truth could be revealed to every one. It should be very apparent to all sections of the New Zealand community that the situation among our neighbouring countries are even more drastic than low wage beneficiaries face at home.

If New Zealanders are condemned to another wave of National Party vs the poor we will have another period of New Zealand in decline while the top 10% run away with the money. That consensus is sought around the Carbon zero act the crises may be over come only by the right policies of all New Zealand and Pacifica people coming together. The Carbon Zero Act should be agreed by all members of The South Pacific so that the whole region may recover. So now we must advance even further.

Bryan Bruce if you stand for election in 2020 or sooner you have my vote.

One good person in parliament achieves very little! Look at how the Greens struggled during the best time e.g. Jeanette & Rod at the helm.

Plus politicians generally follow public opinion they never lead. The huge contributions on numerous things have been grassroots organisations: GE, Nuclear Free, anti apartheid.

Those tossers in parliament would never have gone along with any of this except for the wave that swept the country in each case, they were forced to.

#bryanbruceformetoo. I enjoyed watching every one of Bryan’s documentaries on TV – I wish there were more.

Great stuff I agree with every point you have made.

I would like the big banks chucked out – I expect because we have signed up to free trade agreements with the Aussies we cannot now to do this – stupid.

Every single person who has a bank account in NZ should make sure that account is with Kiwi bank.

At the time of Kiwi banks inception the government knew that moving the ‘government’ accounts would make the bank the fantastic thing it ought to be would. Clark at the time said they wouldn’t move to Kiwi bank because they wouldn’t know how to do this specific work…. really, wouldn’t they quickly learn and wouldn’t those working in Westpac back then simply have moved to work in the new business.

I thought Clark undermined the whole thing and I am angry that these huge profits made for the banks by Kiwis continue to be moved off-shore from the big boys and that the previous government and the current one have not put any money into Kiwibank to ensure that it expands.

I also think that one of the conditions for Kiwibank should be to keep branches open in rural and poor areas where there clearly needs to be a bank.

Really the only way to lower private debt back to sustainable levels is to raise interest rates. That they won’t do now or ever, because it instantly exposes the Ponzi scheme of the economic “growth” (if you take debt out of it, it’s actually just been a constant recession) we have been seeing over the last decade. Indeed, I hold that interest rates in any of the OECD countries will never rise back to the historical average (which for NZ is around 7-8% BTW) since the economy would simply collapse due to the outstanding debt that can’t be rolled over at current prices. In a nutshell, we are ALL Japan now. It won’t end well, because low interest rates ultimately always create horrific market distortions (e.g. stock market and house prices), malinvestment and poor allocation of capital.

a 60min report out of Australia reports 55 thousand house hold at a mediate risk of foreclosure and up to 1 million in mortgage stress and that’s at current interest rates under the surface the nz story is probable the same .in Australia its those with interest only loans that are first off the cliff as banks are requiring interest and principle repayment when the loans roll over,so alot are finding there repayments jumping 50 percent. interesting 60 percent of westpacs loan book is interest only loans. alot of house holds have borrowed well beyond there incomes to service the debt at even record low interest rates.the banks are hiding the true default numbers.

https://youtu.be/smPR0s2W-Ck

Good ideas, all; how do you propose we remove the current lot of neo-liberal criminals and run the country for the benefit of its citizenry?

At last- A person talking on TDB about economics, who actually knows what he is talking about. This must be the first time on this blogsite that I have found myself able to agree with every single word.

I hope Ms Adhern sticks it on her fridge.

If you could actually spell her name she might take some notice.

It is time that the RBNZ was used again to address the housing disaster and fund a Job Guarantee. Even the US are talking about this but not a peep in NZ. MMT is on the rise worldwide but ignored here

https://unframednz.wordpress.com/2018/11/06/a-radical-idea-for-low-income-housing-in-new-zealand/

Some of these proposals seem well-meaning but simplistic. Removing GST from all food, for instance, when many people are arguing for a hefty sugar tax to be imposed on the many foods and drinks that they argue are contributors to diabetes, obesity, heart disease, at huge cost to the public health system, and early death. I can see an argument for scrapping GST on fresh or frozen-without-additives fruit and vegetables, but beyond that difficulties present themselves: vegetarians might oppose making meat GST-exempt, for instance. A stronger case can be made for simply abolishing GST altogether, and looking elsewhere for the revenue.

As for the “elsewhere”, to put a luxury tax on “expensive cars and yachts” is simply the politics of envy; it would require a vast bureaucracy to determine which items are luxuries for the rich, and which ordinary goods for the rest of us, and the net revenue might be slight. Similarly, if a financial transactions tax were imposed, why exempt personal bank accounts? The rate of tax would probably be very small, 0.01% or 0.1%, and scarcely noticeable. Even at 1% the FTT on a house sale would be less than the estate agent’s fee! It might make more sense to abolish cash and require even the smallest transactions to pass through the proposed state bank, so that the FTT captures the black economy too!

Curiously absent from the proposals is any suggestion of taxing wealth, yet the accumulation of wealth, principally in absurdly overpriced property (second only to Hong Kong?), seems one of the main causes of inequality and poverty in New Zealand. Taxing it, or the “deemed income” from owning it, would provide revenue that would eliminate the need for GST and offer the possibility of zero-taxing the first $20,000 of earned income.

Free education at university and polytech sounds noble but has the potential to be ignoble: doctors, nurses, teachers, plumbers, electricians we need; but PhDs in the philosophy of cake-decorating, for the idle rich to amuse their days? I think not.

@ Bryan? Are you my long lost twin brother? I hope you are. I don’t have a brother, much less a long lost one, so can you be that person? That didn’t come out right did it?

There are two problems here.

#1 Is you make too much sense.

#2 Like Americans, no one here knows what to do with ‘sense’ so they just like on their abusers.

It took complex thinking and planning enabled by tax-paid-for university educations handed, with the best intentions to the criminally inclined who come up with a plan so cunning that we people are now well used to knowing they were conned that,despite that, they’ve invited the swindler banksters into their homes and hearths. It’s a bit like that weird psyche thing when people fall in love with their captors.

The reason, in this instance I guess, is because it feels amygdala-good ,dumbasses, to buy stuff and things your income can’t satisfy because it makes plants grow. At least that’s what the television tells them. ( Idiocracy. https://en.wikipedia.org/wiki/Idiocracy )

Back in the day, making too much sense got many a person strung up, so I’d watch it if I were you @ Bryan. There are many who have winnie peters love coursing through their trusting veins for example. And there are others still who believe it when they’re told it’s the powerless and impoverished who are to blame for our high finance jitters. Or The screaming night Terrors induced Debt-Shits, if you like.

We, us Kiwis, are heading into a period of ‘ adjustment’ for sure.

It could be severe! Or, it could be what-ever? It depends entirely on how seriously we allow it to be taken doesn’t it?

Personally and somewhat grandiosely; If I was a gubbimint I’d be starting to hoard cash from agrarian exports and foreclosing on foreign banks. What’re the banks going do? Send in a warship? “Your imminent death and despair is brought to you by bnz/anz/asb/westpac. Nothing new in that so give up and we’ll only ruin your lives. “

The thing with power mad nutters is that they’re only as powerful as we allow them to be. I wouldn’t be too worried about the $-future of NZ/AO. After all. Big country. 4.7 million. Make’s foods, has fresh waters, plenty of fishes, etc.

What we NZ/AO’s should be worried about, all things considered, is being colonised.

The death of our planet’s fragile ecology moves on regardless. It’s in a death cycle because of our fascination with ourselves and our accursed ego’s and [it’s] gone over a tipping point. In other words, it’s too late. We’re fucked. The mad bastards who catered to our every perverse fantasy have lured us to a cliff edge and pushed us over. And because we’re on a beautiful piece of dirt, a paradise as Price Harry said, and miles away from pollution and over human-population we, by that very reasoning, are hugely vulnerable to a , for example, Chinese flotilla simply coming here, taking over then saying “ What’re ya gonno do about it then,hmmmm ? “

Is this then why this is so?

Drones. I know? Lets pack them with an air borne virus with a built in half-life of, say, a month and drop one on Mumbai to see how that works out?

And the drones won’t stop until they’ve achieved their objective while their humans go out for a beer and a barbecue.

https://www.theguardian.com/world/2018/nov/10/autonomous-drones-that-decide-who-they-kill-britain-funds-research

And one for the kiddies.

Tell them, if they don’t do their homework, Atlas will come and get them.

https://youtu.be/6vYA8L_r850

Here’s what we should do.

Pour resources into our agrarian primary industry immediately.

And by ‘resources’ I mean purge AO/NZ of foreign debt. We never needed foreign debt to begin with, so simply default with a hearty, raised middle finger.

The reason we have foreign debt, it should be pointed out, is because the grifters who’ve siphoned money away from our primary industry for generations used off-shore borrowing to hide their dirty deeds.

Rebuild rail into our primary industry hinterlands. We’re going to need to move people to and from the cities until there’s a decent cup of coffee in Balclutha.

Strengthen our ties to the Crown. And beware any fucker who Trump-ets on about us becoming a republic. That’s the surest way to being sold to the Chinese, or any other fucker, for that matter. The Zuc? King of Nu Zillind! Bezoslandia?

Create a free to air state funded radio and TV infrastructure just incase someone tanks the internet. Oh? You think that’s preposterous do you? Think again. I met a fellow in the early 1980’s who worked to develop this new thing ga ma jig called the ‘ world wide web’. His father worked for the US military which is why this particular African American got a top University education. He told me straight. The main reason for the WWWeb was to be able to threaten to take it away. It was, and is, a cryptic weapon. ( I know. Does sound iffy but I swear, that’s what he told me. Was he lying or exaggerating? I don’t know. All I’m saying is etc. )

A great Post @Bryan Bruce. Thank you.

Yep good ideas here. Simplicity & common sense is not to be sneezed at. All for some radical banking, economic, land & constitutional reforms.

While we’re at it; drastically reduce imports – boost local manufacturing & innovation – wind down our dependence on exports – stop foreign ownership & exploitation of our land & resources – nationalise & localise foreign owned land, infrastructure & businesses.

Only a radical, uncompromising national salvation government with real teeth & the long term interests of our nation at heart could achieve such aims.

Solidarity will only come when middle class welfare is not enough to replenish empty pockets, reduce the debt mountain & stop the rot.

Let not foreget a large part of the debt is speculation

The stupid hobite have used there homes as ATMs

The Piper will want paid ,it’s savers who are subsudisi g this recklessness and are exposed, and interest real interest rates at zero public policy favours the debtors

Re Point 3

I hope everyone has signed the petition here:

https://www.parliament.nz/en/pb/petitions/document/PET_78901/petition-of-stuart-bramhall-require-reserve-bank-of-new

Also pls check out PositiveMoney.org.nz

Comments are closed.