To day we have learned that ANZ has made massive profits for its overseas owners.

ANZ New Zealand has posted a record net profit after tax of nearly $2 billion. That’s a 12 percent increase on last year’s profit. ANZ is the country’s biggest home and business lender as well as the biggest KiwiSaver provider. New Zealand’s Financial Markets Authority review of banking practices is expected shortly.

All this while we are still digesting the news that AMP has been sold off. AMP is another huge KiwiSaver provider that according to FMA figures has not done so well for its KiwiSaver members especially not those members that were allocated to AMP as a default provider. We are yet to see the implications and ramifications of the announcement this week.

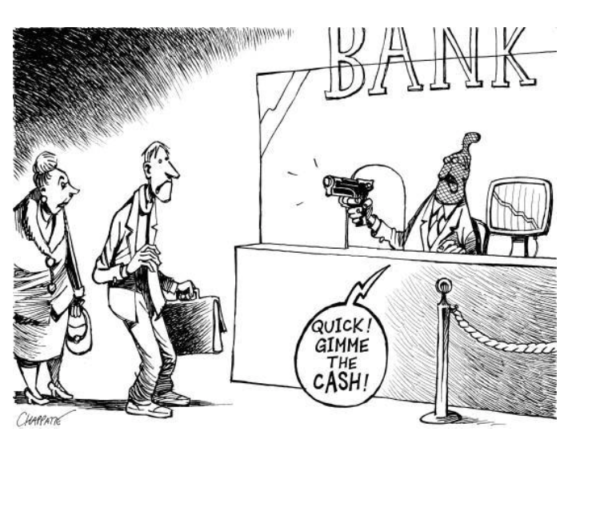

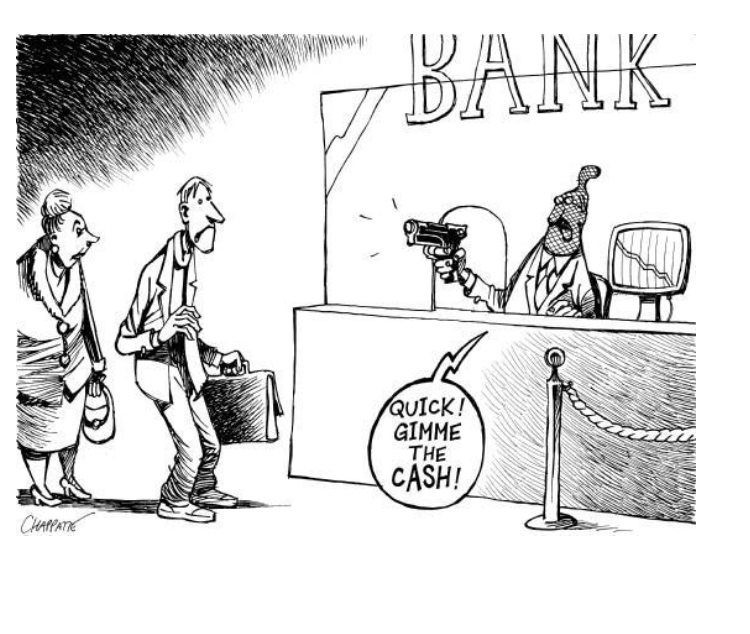

Both ANZ and AMP are default KiwiSaver providers. That means money flows to them automatically when a new member does not elect a provider. There is no evidence that the payback has been lower fees or action to help get members into more appropriate funds. Apathetic or unengaged members suffer high fees and low returns when they remain in a default fund with a default KiwiSaver provider. That suits the banks nicely. It’s a pretty easy way to make profits.

The radio NZ interview on the ANZ profits suggested that KiwiSavers might stand to benefit if the higher profits increased the share price. This it appears is because their KiwiSaver might have investments in ANZ shares, or they may themselves be shareholders. Neither of these arguments make sense. The default members very low return after high fees are extracted makes ANZ’s profits higher. If this enhances share prices why are returns so poor? Few, if any will be compensated as shareholders. Are they not just exploited with high fees while the banks conveniently invest in themselves?

In June 2018 in an open letter to the Financial Markets Authority and Reserve Bank, the Independent Financial Advisors drew attention to the foregone returns and high fees in default funds, and suggested that default providers may have a conflict of interest:

Several of the default providers had a serious conflict of interest which possibly explains their failure to switch default members to more suitable funds. Were they acting in their own interests by dragging their feet with this requirement? Statistics suggests they were acting in their own interests. There was a sudden large spike in switching activity in the run-up to the review of default suppliers and their re-appointment in 2014, which tailed off immediately after re-appointment.

The potential conflict of interest is demonstrated by the portfolio composition comparison between default conservative funds and KiwiSaver balanced funds. On average, bank owned default conservative KiwiSaver funds in April/May 2018 had 22.4% more of their portfolios invested in bank products than they did in their own balanced funds. In 2018 the five bank default KiwiSaver providers on average had 34% of their default funds invested in bank products. Effectively charging default members for investing in their own and typically other Australian banks products.

The Australian’s Royal Commission is unearthing some startling practices by the likes of ASNZ and AMP. FMA’s Rob Everett says the latest review of bank conduct & culture in New Zealand shows plenty that could be done better but so far no evidence of systemic misconduct. Are we reassured?

We may be a cut above the Australians, but even if the problem not misconduct, are we convinced that the banks and big insurers always act in our best interest? It is clear that the FMA are not happy with results for KiwiSaver defaults will we have to wait for a default provider review in 2019?

Hi your headline for this story should say KiwiSaver not Kiwibank. Can you change. Thanks, Kara

Kara Tait? Who is Kara Tait? You’re very polite Kara.

Thanks for spotting that Kara

Ah…? I think you might mean ‘Kiwisaver’ as opposed to ‘Kiwibank’ in the heading?

But I could be wrong. When I listen to people speak the parallel-universe language of ‘money’ I feel as if I’m listening to a Rain Forest native talking theoretical physics to a whale.

The bottom line ( And that’s about as much money-talk as I know I can write ) is that the foreign banks must go. Out they go. Fuck right off.

Because? Well, who cares for the because’s. Foreclose on them. Out they go.

They’re useless, worthless, unnecessary, unwanted, not needed. They’re also powerful, manipulative, cunning as shit house rats ( no disrespect to actual shit house rats,) and they suck our vital funds out of our veins like any good vampire.

The thing they do best is to lie to us. They have us convinced that they are essential to the running of our supremely rich, 20K sq kilometre bigger than the UK but with only 4.3 million people, country.

As I’ve written many times, the banks are the very foundation of NZ’s dysfunctions.

They will argue otherwise, of course. They would snort and sneer and laugh then shuffle a stack of paper then head to The Pelican Club for a nice lunch of single woman parent trying to pay her power bill. Then, of an afternoons ‘work’ they’ll ratchet up the cost of living a few more dollars and watch, as a result, a new homeless person living on the street outside their main office, as is the case with the bnz on hereford street. It should be said, at this point, that the bnz has a their car park entrance across the footpath on Hereford St. A main pedestrian pathway to the heart of Ch Ch’s retail centre. Is that a big Fuck You Peasants with an extended middle finger to all you exhausted Christchurch people? When there’s a big black penis extender German car about to leave for the lunch time brothel engagements a large orange light flashes! Does it flash “ Get out of the way you beastly unwashed. ”

In all seriousness. The foreign owned banks are the enemy. They don’t have guns or tanks but they’re waging a cynical war on us NZ/AO’s to get our money, and by association, they steal our lives away as we must work ever harder for their profits.

Fantastic Post @ Susan St John.

+1 – They need to do that and much more.

Banks and financial institutions are choking the equality and social mobility out of NZ and will eventually make us 100% banana republic.

Everything the government does (or doesn’t do) seem to be helping banks. From Fletchers losses being partly due to massive bank loans to ANZ and refinancing issues, to the government and councils obsession with PPP’s which the UK has found to be mostly helping banks and financial institutions. https://image.guim.co.uk/sys-files/Society/documents/2004/11/24/PFI.pdf

There has been not been any talk or investigation of a financial services tax or Robin Hood taxes even though much of our exports are now profits due to banks in particular and money is flowing out of NZ without being taxed.

The service level of banks in NZ is poor, while fees high, in particular to business and rural land and this has created a more monopoly situation as many NZ banks don’t lend on business or rural land easily.

NZ Bank interest rates are much higher than overseas, which benefit foreign investors more as they can borrow at cheaper rates overseas or they have cash to just buy up.

And Kiwisaver apparently has 20% of savers profit’s going in fees to the provider on average.

@ SAVENZ.

Yes. You’re correct.

I forgot to suggest that the Big Four Banksters be foreclosed upon by our Government then asset stripped. Their fortunes having been appropriated, by them at our expense, be returned to us and michael fay be investigated by the serious fraud office, the IRD, the banking ombudsperson, the Home Office, the GCSB and then carry out a Royal Commission of Inquiry into just how michael fay got his sticky little fingers on the bnz in the first place. For those of you who don’t know who michael fay is? He’s closing in on being another Kiwi-as billionaire who owns Mercury Island in Mercury Bay. He flies there in his private helicopter from his down town Auckland building. If you’re down town giving food and fags to the homeless, you might be lucky to see his chopper fly overhead.

He’s also got a farm for sale at around $16 mil if sheep dagging’s your thing?

Don’t know what ‘dagging’ is? It’s when a sheep covers itself in shit which has to be cut off. Spring’s a messy time for sheep. No matter how hard I tried, I couldn’t get a sheep to wipe its bum. Dagging’s nasty, back breaking work. But hey? Remember? Wool built The Christchurch Club with a quaint little building called the Occidental right next door for the girls of the Land Barons to swap knitting patterns while The Real Men discussed politics etc.

And, I hear you ask? Why dag? Why, for the flies, of course. Once enough shit builds nice poo balls, the blow flies fly in and lay eggs of love in the poo. From there, maggots hatch out and start eating the sheep alive. Think, death by a thousand cuts. And if the sheep is really lucky, maggots will go in her bum parts. They’ll crawl in there and feed happily until the sheep dies a death so horrible that I get tears of distress as I think about the ones I’ve found down in gullies or under trees and too late for some of them.

Farmer! A little trick I learned. Get a drenching gun and a very weak solution of Jays Fluid. Insert it gently into the animal’s front and back bottom if you suspect an infestation of maggots. Then rest the animal with plenty of water… Job done.

So. Crutching, or dagging, must be a favourite pastime for SIR michael fay on his $16 mil farm in the Waikato. He [fay] and richwhite’s company bought the bnz AFTER bolger bailed it [bnz]out with YOUR $300 million back in the 90’s. I’m so happy they [ bnz] recovered to become a world leading bank making billion dollar profits. I’m so… Y’know? Filled with the double-penetrating bankster maggots of the Yay-joy’s !

Have you ever been out to Mercury Island CB? You should! The edifice Michael has built where the sheep yards once were looks like a gun emplacement. All concrete and rock. I think it is a nuclear air raid shelter. It mitt interest people to know that the foreground just in from the Jetty is a public landing zone , designated as such because it was a traditional haul to place for traveling canoes in the good old pre colony days. I don’t think Mr Fay wants people to know that.

D J S

Shouldn’t that header read “KiwiSaver”, not KiwiBank”?

yes yes yes. My mistake- too much hurry- thanks Martyn for correcting it.

Yes they can piss off the lot of them. It is so stupid that if you are a person with options (i.e. sufficient dosh to have options) that you would ever bank with one of the big boys.

I understand that one of the problems is that Kiwibank hasn’t the capital it needs because the government haven’t them anymore. Get on with it government!@#@!

I can’t believe that the government itself chooses to bank with one of the bggiers instead of our own Kiwibank which would make it MUCH MOTE VIABLE.

2 billion that could have stayed in the land of milk and honey.

EVERY SINGLE PERSON IN AOTEAROA SHOULD HAVE A KIWIBANK account.

No one must be in a default KiwiSaver fund, and I don’t think anyone is compelled to bank with an Australian-owned bank. Nothing to stop everyone switching their bank account to KiwiBank or TSB, and their KiwiSaver to one of the several New Zealand-based funds that produce good returns.

John

The problem is inertia. The idea of autoenrollment is to get people to do what they otherwise would put off. A requirement for those who are default providers is to ensure that all members are educated and helped make appropriate decisions. It is hard to see they are justifying their default status. Low income people are making a sacrifice to be in KiwiSaver but may not have the financial literacy to make appropriate decisions without help

Comments are closed.