.

.

You show me yours, I’ll show you mine…

.

Perhaps the most ill-considered public statement from NZ First leader, Winston Peters, was his recent (11 September) demand that Labour disclose it’s full tax plan as a pre-condition for coalition;

“You are not asking the questions. You can’t possibly mean to go into an election saying, ‘My tax policy will be decided by a committee, and I am very sincere about that’. One needs to know what we are talking about … that should be fatal to a party’s chances. And we need to know.”

The jaw-dropping, gob-smacking, forehead-slapping gall of Winston Peters! For him to demand clarity and full disclosure from others – when he himself has made a fetish of not disclosing to voters who he will coalesce with, post-election – takes the Hypocrisy-of-the-Year Award from National and plants it firmly on his own Italian suited jacket-lapel.

On top of which, none of Peters multi-billion dollar policies have yet to be costed.

So here’s the deal, Winston. You want to see Labour’s tax plans? We want to see your coalition intentions.

We’ll show you ours if you show us yours. After all, “One needs to know what we are talking about“.

As Jacinda said, “Let’s do this“.

.

Richard Prebble should keep vewy, vewy quiet

.

On the matter of Labour referring taxation reform to a Working Group post-election, former-ACT Party leader Richard Prebble was scathing in his condemnation that Jacinda Ardern would not disclose her intentions toward implementation of a possible Capital Gains Tax.

In his regular NZ Herald propaganda slot, he wrote on 7 September;

“…Jacinda thinks the answer to every problem is a new tax. Asking for a mandate for capital gains taxes without giving any details is outrageous. All new taxes start small and then grow. GST was never going to be more than 10 per cent.

Who believes it is fair that the Dotcom mansion will be an exempt “family home” but a family’s holiday caravan plot will be taxed? The details are important…”

A week later, he followed up with;

“In a “captain’s call” Jacinda changed the tax policy to say that a Labour victory was a mandate for Labour to introduce any new tax and at any rate that a nameless committee of “tax experts” recommended, just the family home is off limits.

Any tax? What about land tax? Yes. Tax on the family bach and boat? Yes. Water? Petrol? Nothing is off the table. Will the capital gains tax be 33 per cent? Maybe. The petrol tax 10 cents a litre? Probably. Water tax. Guess a figure. “Trust us” says Jacinda.

No party has ever asked for so much power.“

This, from the man who was a former Minister in the Lange Government which – in 1986 – introduced various neo-liberal “reforms” that the Labour Government had never campaigned on; had not included in their manifesto; and introduced the regressive Goods and Services Tax in 1986. The Goods and Services Tax was never disclosed to the public in 1984.

Prebble and his cronies deceived the New Zealand public in the 1984 election campaign. They withheld their true agenda. They lied to us.

For Prebble to now rear up on his hind legs, braying in indignation, pointing a stained finger at Jacinda Ardern, is hypocrisy beyond words.

As former producer of TV’s The Nation, Tim Watkin, wrote on Prebble’s sanctimonious clap-trap;

“To read and hear a member of the fourth Labour government like Richard Prebble howling about transparency is like an Australian cricketer railing against under-arm bowling. Labour’s manifesto in 1984 was as artful a collection of vagaries as has ever been put to the public and after winning a second term in 1987, Prebble and his fellow Rogernomes embarked on a series of reforms – arguably the most radical tax reform ever considered by a New Zealand government, including a flat tax – without campaigning on them.”

Richard Prebble should think carefully before raising his voice on this issue – lest his own track record is held up for New Zealanders to scrutinise.

Does he really want that particular scab picked?

.

Latest Colmar Brunton Poll…

.

The latest TV1/Colmar Brunton Poll (14 September) has Labour and the Greens climbing – a direct antithesis to the TV3/Reid Research Poll which had Labour and the Greens sliding (12 September).

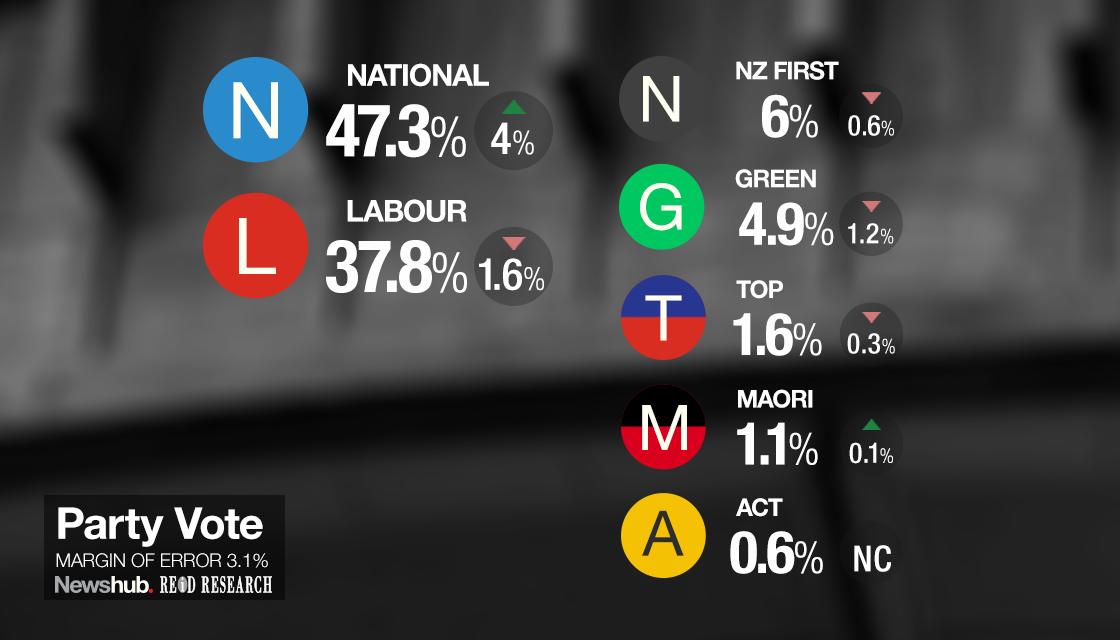

12 September: Reid Research-TV3

.

.

14 September: Colmar Brunton-TV1

.

.

Which raises two questions;

- Are polling polling companies operating in the same country? Or Parallel Universes?

- Is it about time that all public polling was banned once early voting begins?

The chasm in poll-results for National, Labour, and the Greens confirms critics of polls who dismiss results as wildly unpredictable. “Bugger the pollsters“, said Jim Bolger in 1993 – and with considerable justification.

Though Winston Peters and his supporters may be nervous at the fact that both polls have NZ First at 6% – perilously close to the 5% threshold. Any lower and Peters’ Northland electorate becomes a crucial deciding factor whether NZ First returns to Parliament.

Several commentators – notably from the Right – have been making mischief with the poll results, suggesting that a vote for the Green Party would be a wasted vote. Without the parachute of an electorate base, if the Greens fall below 5% in the Party Vote, their votes are discounted and Parliamentary seats re-allocated to Labour and National.

John Armstrong and Matthew Hooton are two such commentators making this fallacious point. Fallacious because even at Reid Research’s disastrous 4.9%, the polling ignores the Expat Factor. Expats – predominantly overseas young voters – are not polled, but still cast their Special Votes, and often for the Green Party.

In 2014, the Green vote went from 210,764 on election night to 257,359 once Special Votes were counted and factored in. The extra 47,000 votes was sufficient to send a fourteenth Green Party List candidate to Parliament;

.

.

It seems contradictory that there is a total black-out of polls on Election Day itself – when voting stations are open. But polling is allowed to proceed two weeks out from Election Day when voting stations are also open.

It may be time for this country to consider banning all polling whilst voting stations are open. If poll results are so open to wild fluctuations, and certain commentators make mischief from questionable data, then the possible risk of undue influence on voters cannot be discounted.

Once voting begins, polling should cease.

The only poll that should count after voting begins is Election Day.

.

Losing the plot, Winston-style

.

On Radio NZ’s Morning Report (14 September), NZ First Leader, Winston Peters lost the plot. His haranguing of Guyon Espiner did him no credit.

More incredible was Peters’ assertion that he has not made any “bottom lines” this election;

“I have never gone out talking about bottom lines.”

Peters’ blatant Trumpian-style lie flew in the face of his bottom-lines during this election campaign.

On a referendum on the Maori seats;

“My strategy is to tell everybody out there that you won’t be talking to NZ First unless you want a referendum on both those issues at the mid-term mark of this election.”

On re-entering Pike River mine;

“I’m making no bones about it, we’ll give these people a fair-go, and yes this is a bottom line, and it shouldn’t have to be.”

On a rail link to Northport;

“I can say for the people of Northland and Whangarei, this is going to happen. We’ve got the corridor; it’s been designated. The only thing it lacks is the commitment from central government and we are going to give this promise, as I did in the Northland by-election – we are 69 days away from winning Whangarei as well – and that’s one of the first things we’re going to be doing straight after the election.”

Peters has issued several other bottom lines, including changing the Reserve Bank Act, banning foreign purchase of land, setting up a foreign ownership register, reducing net migration to 10,000 per year, and not raising the age of eligibility for New Zealand Superannuation (from 65).

Peters also attacked Espiner for personally supporting the neo-liberal “revolution” in the 1980s. As Espiner pointed out, when Roger Douglas tore New Zealand’s social fabric apart, he was 13 years old at the time.

Plot lost.

.

Labour’s tax & spend – what ails the Nats?

.

National has launched a full-scale attack on Labour’s taxation policies and plans to set up a Tax Working Group to investigate the possibility of a Capital Gains Tax.

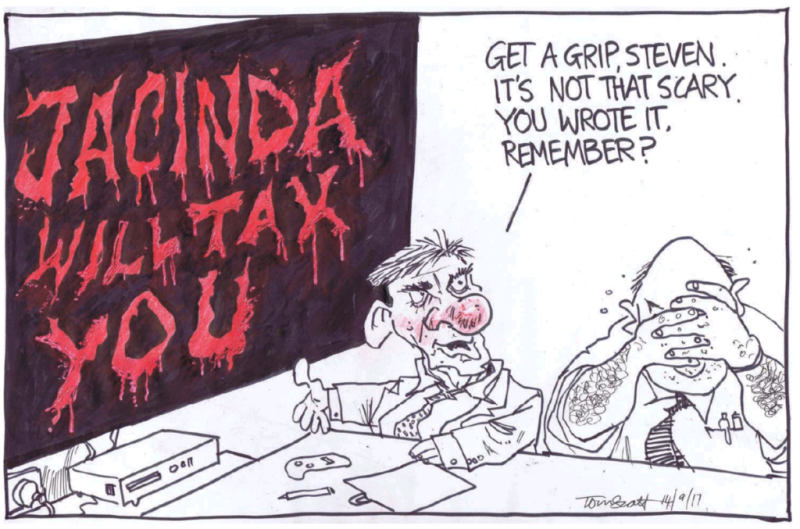

The Crosby-Textor line is childishly simple: the Right have identified a ‘chink’ in Jacinda Ardern’s teflon armour – kindly on loan from previous Dear Leader;

.

.

But there’s more to it than simply attacking Labour through a perceived weakness in their taxation policy.

Labour is attempting to shift New Zealand away from a low-taxation/minimalist government, and return the country to the fully-funded social services we all once enjoyed.

Remember free prescriptions? Yes indeed. Prior to 1986, prescribed medicine was free.

National’s growing concern is not that Labour will introduce new (or higher) taxes.

Their worry is that New Zealanders will like what their taxes can buy; free tertiary education. Lower medical costs. Cheaper housing. New, re-vitalised social services such as nurses in schools.

Up until now, the Cult of Individualism had it’s allure. But it also has it’s nastier down-side.

If New Zealanders get a taste for a Scandinavian-style of taxation and social services, that would be the death-knell for neo-liberalism. When Jacinda Ardern recently agreed with Jim Bolger that neo-liberalism had failed – the Right noticed.

And when she said this;

“New Zealand has been served well by interventionist governments. That actually it’s about making sure that your market serves your people – it’s a poor master but a good servant.

Any expectation that we just simply allow that the market to dictate our outcomes for people is where I would want to make sure that we were more interventionist.”

For me the neoliberal agenda is what does it mean for people? What did it mean for people’s outcomes around employment, around poverty, around their ability to get a house? And on that front I stand by all our commitments to say that none of that should exist in a wealthy society. And there are mechanisms we can use that are beyond just our economic instruments and acts, to turn that around.”

– the Right became alarmed.

This election is not simply between the National-led block vs the Labour-led bloc – this is the battle for the future of our country; the soul of our people.

This moment is New Zealand’s cross-road.

.

WINZ and Metiria Turei – A story of Two Withheld Entitlements

.

Recent revelations that WINZ has withheld $200 million of lawful entitlements to some of the poorest, most desperate individuals and families in this neo-liberal Utopia (note sarc), has shocked some;

.

.

$200 million withheld from welfare recipients who could have used that cash to pay for doctor’s visits. Shoes for children. Even lunch meals – which so many National/ACT supporters continually berate the poor for not providing for their kids – as Donna Miles reported on 13 September;

.

.

Did the country rise up in a clamour of righteous anger? Was there a vocal outcry on social media? Were the Letters-to-the-editor columns filled were disgust and demands for a fair go for beneficiaries?

Like hell there was. If New Zealanders noticed, they showed little interest.

Yet, even the Minister for Social Welfare, Anne Tolley, had to concede that WINZ had fallen woefully short in helping those who need it most in our country;

“I agree at times it’s too bureaucratic and we’re doing our very best.”

$200 million in lawful entitlements withheld – and there is barely a whimper.

Contrast that with former Green Party co-leader, Metiria Turei, who did some “withholding” of her own;

.

.

A young solo-mum withholds information from social welfare in the mid-1990s, after then-Finance Minister Ruth Richard has cut welfare payments – and every conservative moralist; middle-class National/ACT supporter; media elite; and right-wing fruitcake, has a collective hysterical spasm of judgementalism that would put a Christian Fundamentalist to shame.

Perhaps if social welfare had not been cut in 1991…

Perhaps if WINZ had not withheld $200 million in rightful welfare entitlements…

Perhaps then Metiria Turei would not have had to withhold information, merely to survive…

Perhaps if half this country were not so drenched in…

.

.

Perhaps then, our sheep and pigs might finally learn to fly.

.

.

References

NZ Herald: Winston Peters to Labour – Front up on your tax plans

Fairfax media: Gareth Morgan positions himself as alternative to Winston Peters

NZ Herald: Richard Prebble – The Jacinda tidal wave can be stopped

NZ Herald: Richard Prebble – The Jacinda tidal wave has gone out

Radio NZ: Time to come clean on coalition compromises

TVNZ: Colmar Brunton poll – Labour maintains four point lead over National, could govern with Greens

Mediaworks: National could govern alone in latest Newshub poll

Colin James: Of polls, statistics and a Labour deficit

NZ Herald: John Armstrong – This election is a two-party dogfight now

NZ Herald: Remaining Green Party voters ‘mainly hippies and drug addicts’ – Matthew Hooton

Parliament: The 2014 New Zealand General Election – Final Results and Voting Statistics

Radio NZ: Morning Report – The Leader Interview – Winston Peters

Fairfax media: Winston Peters delivers bottom-line binding referendum on abolishing Maori seats

Fairfax media: Winston Peters says Pike River re-entry is bottom line to election deals

NBR: TV3 – The Nation – Peters promises rail to Northport

Newsroom: What a National-NZ First Govt might actually do

Fairfax media: Jacinda Ardern says neoliberalism has failed

Radio NZ: WINZ staff accused of withholding entitlements

Fairfax media: Turei rallies Palmerston North troops in fight against poverty

Other blogposts

Donna Miles: Child Poverty – Facebook Post Shows The Nats Don’t Care

Previous related blogposts

Election ’17 Countdown: The Promise of Nirvana to come

Observations on the 2017 Election campaign thus far… (tahi)

Observations on the 2017 Election campaign thus far… (rua)

Observations on the 2017 Election campaign thus far… (toru)

Observations on the 2017 Election campaign thus far… (wha)

Observations on the 2017 Election campaign thus far… (rima)

.

.

.

.

.

= fs =

Brilliant Frank

Great points!

So much info, so much insight. Well put, Frank.

The bit about special voting is particularly useful to counter misinformation on “wasted voting”. I’ll be using that info when convincing others to vote Green this year.

You also raise a good point why the Nats are so fearful of Labour’s tax plan. Once people realise what a wider tax base can buy us and our children, there’ll be no going back.

Richard Prebble. Hypocrite. I can’t be bothered writing any more on that odiouis little twerp.

Interesting insight on why the Nats are hysterical over Labour’s tax plans. If NZers did get a taste of Scandinavian style social democracy, that would be the end of neo-liberalism once and for all. This is something that cannot have escaped the attention of the Right.

Frank I think the Greenies have always been sitting around 7-8%. I also think certain people have been scaremongering. And I also believe the Greens can get more possibly around 10-12% because that is the margin of error difference and let remember they always do well in the special votes. Now I’m hoping we see hem on election night get 10-12%.

Now in on the Labs I think they have been sitting around 37-40% since Jacinda came in but I think they can get 44-47% I base this on the trends and my intuition. The youth vote has increased and this cohort I believe is in favour of Greens and Labs. I look forward to casting my vote on the day I really enjoy voting on the day and I have been politically active calling my whanau and making sure they get their young whanau out to vote for change. My whanau know who to vote for I don’t have to tell them it will be one of the above either way its a win win for us and a win for a much needed change.

I think the Greens will indeed get around 7 or 8%, Michelle. Once the ‘Specials’; are counted, the Party will be well clear of the 5% threshold.

Its perfectly clear.

A vote for Winston is a vote for the National government to continue.

In that interview Winston identified the ills of the neoliberal settlement and what he would do about them far more clearly and far more unequivocally than any other politician from any other party is doing.

Are we all interested in reversing the neoliberal regime ? Or are we more interested in promoting a favourite personality of a favourite party irrespective of their stated policies? It seems like the latter is the case.

The rubbishing of Prebble’s historic activities is deserved, rubbishing of Winston not so much, but the history of neither has any bearing on the veracity of the quoted statements made here. They were both quite correct in what they said about the taxation issue , and it didn’t need the Nats to attack it to make it a mistake.

It seems that it was originally intended that the working group would do it’s stuff this coming term and offer the resultant resolution to the

electorate at the next election. Wisely they have reverted to that plan and probably no great harm done by what seems to have been Jacinda’s indiscretion. Considering the enormous pressure commenters have put her under by anticipating transformational policies from labour now that she has been shoved into the leadership role , that she could not and cannot possibly deliver,some such indiscretion was almost inevitable. She is a very able and appealing individual but she is just a human like the rest of us, not some magical being incapable of error. It is conceivable that the unrealisable expectations that have been placed on her have done both she and the labour party’s prospects in this election considerable damage.

D J S

The Greens should announce they will push for George Rozvany to be part of the tax review ….. They need to quickly raise awareness and illuminate the simple truth.

Being that We do not need new or more taxes ….. just collection of what is due from the richest company s and people in the world. http://www.abc.net.au/news/2016-07-11/corporate-tax-minimisation-costs-governments-1-trillion/7587092

Harmful regulations created our tax segregation and revenue black hole…. Good regulations can fix it.

Almost like a vast right wing conspiracy …..there has been a uniformity in the building of networks which has allowed enormous corrupt money flows …… with corresponding harms of homelessness and exploitation of ordinary citizens everywhere …

Its more than just corporate tax evasion …. they have also helped money laundering.

New Zealand …. “a contentious exemption of professional services firms – mostly lawyers, accountants and real estate agents – from being covered by anti-money laundering laws passed in 2009.” http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11706741

Austrailia …“Australia’s anti-money laundering law does not cover real estate agents, lawyers and accountants, despite promises when the law was enacted in 2006 that the legislation would be widened.” http://www.abc.net.au/news/2017-07-13/should-australias-anti-money-laundering-laws-be-extended/8703354

Canada ……. “An agency report suggested there is a close relationship between money laundering in real estate and the services provided by lawyers, such as placing wire transfers in legal trusts and creating investment vehicles that can shield true ownership of property.” http://vancouversun.com/storyline/ottawa-will-attempt-to-close-money-laundering-loophole

U.s.a Funny money’

In Miami, secretive buyers often purchase expensive homes using opaque legal entities such as offshore companies, trusts and limited liability corporations.

http://www.miamiherald.com/news/business/real-estate-news/article69248462.html#storylink=cpy

Britain …”Foreign investors are using illicit wealth to buy up property in luxury developments across London, out-pricing locals, according to a new anti-corruption report.”… “”This has resulted in an oversupply of prime property whilst Londoners are in desperate need of affordable homes,” https://www.dezeen.com/2017/04/25/overseas-investors-london-housing-market-crisis-faulty-towers-report-property-transparency-international-uk/

Its time to reverse the race to the bottom National have us on ……it’s a harmful world wide failure.

Winston claimed in that interview that cutting corporate taxes would lead to wage rises. This is classic neo-liberalism, and shown to be totally wrong by the experience of the last 30+ years. Winston doesn’t understand neo-liberalism (to be fair neither does Jacinda), he just knows its unpopular, and he will gain votes by railing against it, even while he advocates for its “trickle-down” policies.

When I was a child my father formed a little company under which he operated the accounts of his farm.

My grandfather who had business experience in England could not understand that a company in NZ paid no tax. But that is how it was. That was not a neoliberal era. To get into the hands of individuals, company revenue has to be distributed as wages , director’s fees or dividends, and taxed accordingly. So the less tax that is taken out of the company , the more revenue is available to pay out in wages which will in turn be taxed at the appropriate level.

As long as the company is domestic, not multinational, there is no need for any company tax at all. No one can spend company money on themselves without paying tax, it just allows the company to grow.

D J S

`DJS ….When you were a child your father must have been a tax dodging fairy tale spinner ….

Company taxes have been in existance in New Zealand for over 100 years ….

” Company taxes

The greatest impact of higher taxes was on companies. During the 1920s and 1930s New Zealand taxed companies directly at higher rates than many other countries” https://www.teara.govt.nz/en/taxes/page-3

Otherwise Your logic is as weak as your truth ….. dribble down Act economic theory

Some points taken.

I was working off a childhood memory, but it may have been a special concession to rural enterprises as referred briefly here.https://www.nbr.co.nz/comment/paul-goldsmith/how-taxes-stymied-pro-business-culture.

However though I stand by my argument that as long as it is a wholly NZ owned company so no dividends etc. go offshore, any money a company has to pay in company taxes reduces what it can pay in wages (or dividends of corse) thats a simple equation.

I assure you I am no advocate for neoliberal/ trickle-down/ Act type theory. But I am an advocate for trying to see clearly and objectively.

Cheers D J S

Well now that your a grown-up I would expect you to see the gaping hole in your logic …. and what is happening in the real world …..

That is that limited liability companies and trusts Are buying assets like houses and land …….

The company buys the house ….

If we had zero tax for local companies as you propose …. then a worker trying to buy a house with their taxed income …… would be at a distinct disadvantage against the company owner who could buy the house through their company …..

Actually to take your logic further ….. we should tax companies higher than personal income….. so that they pay more in wages …. which would in turn reduce their company profitability and taxes.

But New Zealand needs to fix its broken tax system … not gimmicks.

It shocks me that this isn’t already the case. I advocate banning poll for at least a couple of months before election day. That way the media has to report on policies, not polls, and people are more likely to vote for the party who policies most closely represents their view, rather than voting “strategically” for larger parties that don’t, but are sure to get in.

Frank this is an excellent piece, one of your best.

Seems to me the arch hypocrite Richard Prebble is a tad agitated about a capital gains tax being introduced. Perhaps he knows he will be up there front of the line, having to cough up on unearned income on his multiple properties!

HELP FRANK,

We have bigger issues now to deal with see this!!!!!

“The Government took away democracy from the people of Canterbury and in return gave us more big irrigation schemes, more cows, and more polluted rivers,”

We say the Government have proven themselves are corrupt and have subjerted our whole democracy.

MP Jian Wang is clearly a chinese spy operative that was sent to NZ to infltrate our Government as his family is actually operating “Wang Enterprises” a digital intellegence company operating a spy network in the USA also as a “digital intellegence contractor” and was found to be falsifying US elections since 2000.

MP Jian Wang is now holding several NZ Government portfolios that he has access to all our intellegence information now to destabilise our election process.

The police should arrest this spy who was operating formerly in China as a contract educator for chinese Government spies before he left china to infiltrate our government in our country.

National Government has allowed our country to be placed in jeopardy by this corrupt Government, and oppoostioon political parties & Greenpeace should now call for this chinese Government spy to be arrested now, as the election may be already hacked by this man and his association with his chinese government.

Here below are the facts and US federal court testimony given by a senior computer contractor Eugene (Clint) Curtis about the activity of Yang Enterprises election fraud.

https://www.youtube.com/watch?v=S7R1_ixtlyc

Clint Curtis was paid by Wang Enterprises to hack into the US elections process and change the result of the elections under administration by Wang Enterprises.

Also here are comments about Jian Wang.

DSpare30

13 September 2017 at 8:30 pm

This from Bradbury was interesting (usual condiment recommendations apply):

I met Jian Yang once in his role as the head of politics at Auckland University when I was applying for post graduate study and I was always surprised in my 20 minute interview with him that he knew more about who I was and my political activism than anyone else on campus. He asked me lots of questions that had bugger all to do with the study I wanted and far more focused on who I knew and what they were doing.

The allegation that he might be a Chinese spy doesn’t surprise me at all.

https://thedailyblog.co.nz/2017/09/13/so-nationals-blue-dragons-might-be-red-dragons-how-national-are-utterly-compromised-to-china/

Subject: My investigative work on Jian Yang. The Standard https://thestandard.org.nz/national-mp-jian-yang-was-investigated-by-sis-for-possible-ties-to-chinese-government/#comment-1384919

https://thestandard.org.nz/national-mp-jian-yang-was-investigated-by-sis-for-possible-ties-to-chinese-government/#comment-1384919

I woke up to realise now that this NZ MP Jian Yang may be family of Yang Enterprises in USA who are snarled up in a voting fraud hacking case and is he trying this here now?

See these clips and the testomony abour ‘Yang Enterprises.

Fishy stuff may be connected?

Eugene Curtis – Yang Enterprises election fraud.

https://www.youtube.com/watch?v=S7R1_ixtlyc

NZ MP Jian Yang – is he related to this family Yang Enterprises computer intelligence company carrying out voting fraud in USA?

https://www.youtube.com/watch?v=S7R1_ixtlyc

http://www.americanfreepress.net/html/florida_election_stolen.html

(2017/05/15 17:15) The Newest Breaking News … for global hacking waveWashington PostPutin Blames … of the young developer Jian-Yang’s octopus …

[…] blogpost was first published on The Daily Blog on 15 September […]

Comments are closed.