.

.

“The point is if we’re going to have a tax programme [of tax cuts] – we’re not ruling that out in for 2017 or campaigning on it for a fourth term. But having probably a bigger one, to be blunt.” – John Key, 16 May 2016

“Philosophically we believe in lower taxes and smaller government, and government’s definitely getting smaller.”- John Key, 16 May 2016

.

Paula Bennett denies there is a housing crisis in New Zealand;

“I certainly wouldn’t call it a crisis. I think that we’ve always had people in need.” – Paula Bennett, 20 May 2016

.

Paula Bennett announces plan to offer $5,000 to homeless and state house tenants to leave Auckland and go live in provinces;

“I would say to those that are homeless that there is a chance that they could get a house in days if they were willing to look outside of Auckland.” – Paula Bennett, 25 May 2016

.

“Very quietly, a cut here and a decrease there, a failure to keep up with inflation in one place, and ignoring increasing population in another place, the Government is walking away from New Zealand’s longstanding social compact.

In his Budget speech, Bill English proudly says that government expenditure is down to less than 30 per cent of GDP, and that’s the way that it’s going to stay.

But how is this retreat from the economy achieved?

It happens by spending less on health and less on education, and not spending enough on housing for the least well off New Zealanders.”– Deborah Russell, 26 May 2016

.

“While it’s true the overall numbers of Housing NZ homes haven’t risen dramatically, the mix is changing and there are more in Auckland and less in places that we don’t need them.” – John Key, 27 May 2016

.

“Sadly, it seems once again that the Budget is a missed opportunity for children, while the military and Government spy agencies do extremely well. I don’t recall seeing any public opinion polls or evidence indicating the need for more investment in either of these areas, especially when there is such desperate need among families with children.

The Government has achieved its objective of appearing fiscally responsible and not much else. But through a lack of planning and an apparent lack of caring children are living in garages or cars, and do not have the nutrition or warm clothing that they need. Kiwi kids have a right to better lives than that.” – Vivien Maidaborn, New Zealand Executive Director, Unicef, 29 May 2016

.

“We would like to see some tax reductions, particularly for those middle income taxpayers who find themselves getting into higher tax brackets.” – Finance Minister Bill English, 27 May 2016

.

There is absolutely zero doubt in my mind that the 2016 Budget is geared 100% toward building up a surplus for tax cuts to be announced next year. Just in time for the 2017 Election. John Key and Bill English have strongly indicated as much with their “kite-flying” with hints of cuts-to-come.

Funding for various state services have either barely increased – or drastically cut. The result has been a $700 million surplus – which appears to have been achieved at the expense of cutting funding for social NGOs and state services for the most vulnerable people in our society.

Some of the winners and losers from this year’s Budget…

.

Winner

GCSB and SIS;

Funding for spy agencies (GCSB and SIS) will increase over the next four years by $178.7 million.

Loser

For 2015/16 Budget, allocated $471,932,000

For 2016/17 Budget, allocated $430,190,000

Budget: Cut $41,742,000

Who Pays?

Endangered species throughout New Zealand and future generations of New Zealanders.

.

Winner

For 2015/16 Budget, allocated $65,710,000

For 2016/17 Budget, allocated $77,442,000

Budget: Increase $11,732,000

Loser

For 2015/16 Budget, allocated $31,816,000

For 2016/17 Budget, allocated $31,816,000 (Based on zero change to NZ on Air funding; $128,726,000.)

Budget: frozen – nil increase since 2008/09.

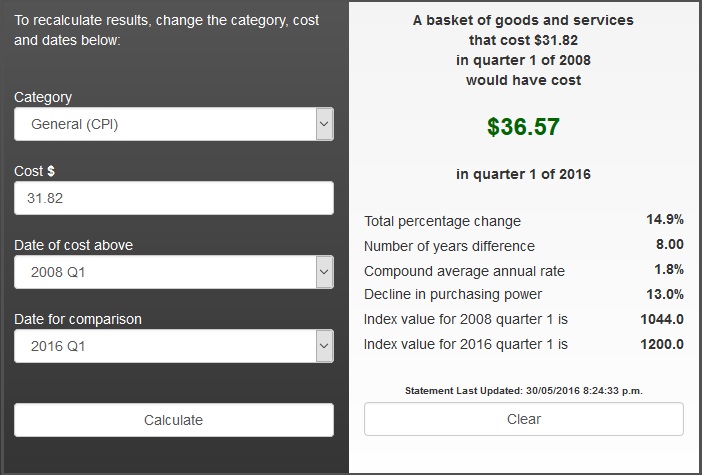

Note, based on the Reserve Bank Inflation Calculator, Radio NZ’s funding should be around $36,570,000 and it’s funding freeze by National constitutes a 14.9% under-funding;

.

.

Who Pays?

We all do.

.

Winner

Education – Charter Schools;

Funding for up to seven new charter schools will be provided in the 2016 Budget, the Government has announced. – NZ Herald

…$328.9m of capital funding and $20.2m of operating funding would go towards public private partnerships (PPPs) for seven new schools and three rebuilds. – Fairfax media

Loser

Public schools operation grants – frozen;

School operational funding has been frozen in this year’s Budget in favour of targeted funding for [under-achieving, at-risk] 150,000 kids.

[…]

… $43.2 million over four years will be provided to those schools with under-achieving students, and it’s expected the money will be used to raise achievement, there’s no accountability attached to the funding.

[…]

The targeted funding works out at about $1.79 per student, per school week – schools won’t even know which students are being targeted as the policy’s designed not to identify them. – Fairfax media

Early Childhood Education subsidy-funding – frozen;

Early childhood education providers got no increase to their government subsidies for the second consecutive year. – Radio NZ

Who Pays?

Our children.

.

Winner

NZ military –

The Defence Force receives new operating funding of $300.9 million over four years as part of Budget 2016 to support the work it does, Defence Minister Gerry Brownlee says. – Gerry Brownlee, Minister of Defence

Loser

Home Insulation Programme –

National has cut home insulation funding to its lowest ever level in Budget 2016…

[…]

Budget 2016 allocates just $12 million this year for the Warm Up New Zealand programme this year and $4.5 million for the Healthy Homes programme, compared to $23.9 million for Home Insulation last year. – Scoop media/Green Party

Who Pays?

- “low-income tenants, particularly those with high health needs.

- …young children (newborns to 5-year olds) who are living in cold, damp and unhealthy homes.” – Jonathan Coleman, Simon Bridges

.

There are three significant stand-outs for this Budget…

1 – This Surplus was achieved at the expense of the poor.

With school operational funding frozen; no increase for early childhood education funding; a dire crisis of homelessness; State houses being sold of by National; and a critical shortage of housing – it does not take much wit to understand that Bill English’s $700 million Budget surplus was achieved by under-spending in key social areas.

Worse still, National continues to doggedly pursue it’s policy to sell up to eight thousand state houses by 2017.

Compounding National’s mis-management of the country’s scandalous housing crisis is National’s unrelenting and inhumane demand for dividends from Housing NZ.

This far, National has extracted over half a billion dollars from Housing New Zealand by way of dividends.

Housing NZ dividends under National

HNZ Annual Report 2009-10 – $132 million (p86)

HNZ Annual Report 2010-11 – $71 million (p66)

HNZ Annual Report 2011-12 – $68 million (p57)

HNZ Annual Report 2012-13 – $77 million (p47)

HNZ Annual Report 2013-14 – $90 million – (p37)

HNZ Annual Report 2014-15 – $108 million – (p33)

HNZ Statement of Performance Expectations 2015/16 – $118 million – (p12)

Total: $664 million (over seven years)

The above figures do not include taxes paid by Housing NZ to the National government.

Imagine how many state house could have been built by Housing NZ in the last seven years.

Imagine that every low-income family that needed a warm, dry, home – could have had one by now.

Imagine that instead, National will be demanding another dividend this year from Housing NZ – and will be effectively giving it away by means of tax-cuts to affluent New Zealanders.

2 – Many so-call “increases” are illusory.

When taken over a four year period many of English’s Budget “increases” are actually a cut in expenditure. Just two examples from many;

School funding for 150,000 under-achieving, at-risk school children, was budgeted at $43.2 million This sounds good. But that figure is spread not over the 2016/17 period – but over four years.

Same with the Warm Up New Zealand and Healthy Homes Initiative, touted by Ministers Coleman and Bridges as;

“…to insulate rental houses occupied by low-income tenants, particularly those with high health needs” and “to reduce preventable illnesses among young children (newborns to 5-year olds) who are living in cold, damp and unhealthy homes”

The media release touted;

.

.

But look further into the detail;

The investment includes:

-

$18 million of operating funding over two years to extend the Warm Up New Zealand programme to insulate rental houses occupied by low-income tenants, particularly those with high health needs.

-

$18 million over four years to expand the Healthy Homes Initiative to reduce preventable illnesses among young children (newborns to 5-year olds) who are living in cold, damp and unhealthy homes.

This is how English created his Budget “surplus” – with cleverly concealed cuts to social programmes that impact on the poorest; most powerless; most desperate people in our society.

And we wonder why entire families are living in garages, cars, and tents?

And we wonder how it came to be that children are dying from mould in damp houses?

.

.

3 – This is an Ideological Budget

Make no mistake – this was an ideological budget with “Neo-Liberal Approved” stamped in big, red letters all over it. It was cold-blooded and remorseless in it’s pursuit of specific objectives;

- reducing government spending on the poor, by freezing/cutting expenditure on social services

- increased government spending on security agencies (spy, defence, police), in case the 1981 up-rising is repeated

- satisfying demands from National’s business, conservative, and anti-welfare constituents

- to give Bill English a second surplus

- set the stage for tax cuts to be announced in next years’ budget

- and offer an electoral bribe to voters in time for the 2017 general election

As is almost always the case, those at the bottom of the socio-economic heap are the ones who pay for National’s ideologically-inspired budget. Sometimes they pay with their lives.

Expect more of the same next year.

.

.

Addendum

Spotted at a Z Service Station in the Hutt Valley; this Charity “voting” box, where customers vote for the charity of their choice. The charity gaining most tokens wins a $4,000 donation from Z. Of the four, Fostering Kids NZ is ‘miles’ ahead with tokens;

.

.

Note the level of support for Fostering Kids NZ;

.

.

It is refreshing to see indications that New Zealanders are still compassionate to children from vulnerable, less well-off families. There is still hope for our society, even if people like Key, English, Bennett, Tolley, et al have turned their heads to look the other way.

Acknowledgement: Many thanks to Deborah L for her sharp eye, spotting, photographing, and sending me the above images along with relevant info.

.

.

.

References

Fairfax media: Prime Minister John Key hints at $3billion tax cuts for next election

Fairfax media: John Key is beating the tax cuts drum for 2017 with bigger surpluses ahead

Radio NZ: No housing crisis in NZ – Paula Bennett

Interest.co.nz: Paula Bennett announces plan to offer $5,000 to homeless Aucklanders and state house tenants to leave Auckland

NZ Herald: Dr Deborah Russell – Budget 2016 – How do we look after all New Zealanders?

Radio NZ: Checkpoint – PM puts onus on Auckland Council to create land supply

Fairfax media: Budget 2016 – A bare-minimum budget for children

Radio NZ: Tax cuts may be on cards – English

NZ Herald: Budget 2016 – $700m surplus this year

Radio NZ: Budget 2016 – SIS and GCSB get extra $178.7 million over four years

Budget 2016: Vote Conservation

Treasury: Budget 2016 – Vote Prime Minister & Cabinet

Budget 2016: Vote Arts, Culture and Heritage

NZ on Air: Radio NZ Funding Decisions 1993-2016

Reserve Bank: Inflation Calculator

Budget 2016: Vote Education

NZ Herald: New charter school funding announced

Fairfax media: Budget 2016 – School property and early childhood the big winners

Radio NZ: Budget promises funding for nine new schools

Treasury: Summary of Initiatives in Budget 2016

Budget 2016: Defence Force receives $301m new funding

Scoop media: Government cuts Warm-Up programme that saves lives

Beehive.co.nz: $36m for warmer, healthier homes

Radio NZ: Thousands of state houses up for sale

Fairfax media: Damp state house played part in toddler’s death

Interest.co.nz: Govt sees NZ$0.7 bln OBEGAL surplus in 2016/17

TV3 The Nation: Interview with Bill English

Additional

NZ Herald: Shamubeel Eaqub – House crisis puts Auckland’s future at risk

Other bloggers

The Daily Blog: Budget 2016 – What Bill English Didn’t Say In His Speech

The Daily Blog: The rules for the old too good for children?

The Standard: The Mother Budget

The Standard: Key’s powerful speech on the urgent housing crisis

The Standard: John Key used to be ambitious about dealing with poverty in New Zealand

The Standard: Budget 2016 – F for Fail

Previous related blogposts

Tax cuts and jobs – how are they working out so far, my fellow New Zealanders?

The Mendacities of Mr Key #3: tax cuts

Letter to the Editor – tax cuts bribes? Are we smarter than that?

National spins BS to undermine Labour’s Capital Gains Tax

John Key’s government – death by two cuts

A Message to Radio NZ – English continues fiscal irresponsibility with tax-cut hints

The consequences of tax-cuts – worker exploitation?

The slow starvation of Radio NZ – the final nail in the coffin of the Fourth Estate?

National’s blatant lies on Housing NZ dividends – The truth uncovered

.

.

.

.

.

= fs =

MIND BLOWING STUFF AGAIN FRANK,

YOU ARE A CONSOMATE INVESIGATIVE JOURNALIST NO DOUBT.

There is no doubt whatsoever that GCSB was the winner as key In’c wants to align their spy net wider to watch every opposition voice everywhere including all opposition MP’s leading up to the next election.

we all should be worried that the government is now showing itself as almost identical to the former NAZI intelligence agency, or the East German Stasi, https://en.wikipedia.org/wiki/Stasi or USSR KGB regime of public spy intelligence.

This regime definitely must be engaging themselves in covert illegal operations themselves, criminal enterprises and all, and desperately now the Panama papers have blown their cover want to keep this ability to hide all activities they are engaged in secret from us all.

Why else would they spend an obscene amount of money on a single agency when they have spent many millions already?

They are collaborating with the NSA and US Government already seen by the frequent visit from a retiring chief advisor to the US homeland security agency so perhaps key wants to bag a high placed retiring member of the US intelligence here too?

What a toxic web these lot are weaving now as an unholy alliance for sure.

Back to the 1950’s Mc Carthy era eh Frank? (Before this grubby PM was born?)

My God Cleangreen…not only are you a keyboard anarchist you are also, not surprisingly, a conspiracy theory nutter, sheesh…you must be a Green Party supporter! shows how toxic this ‘alliance’ is going to be for Labour.

Imright, you are deluded on so many fronts.

And deflecting from the issues raised by Frank. Frank has raised the prospect that this is a bogus budget pandering to neo-liberals, beneficiary-bashers, and selfish middle class baby boomers, and you’re rabbiting on about the Greens???

Stick to the topic. If you can’t, bugger off.

And your lot are screwed. Seriously.

Better cancel that membership card bud as National will be worth less than dog tucker after 2017.

More excellent work, Frank.

But you are preaching to the converted. It is time to start to call on National voters with a conscience to raise their eyes for a moment above the parapet of comfort and security and realise that everyone has responsibilities here.

I was very surprised by this quotation:

Philosophically we believe in lower taxes and smaller government, and government’s definitely getting smaller.”

Key is usually more guarded. Overconfidence might not work for him. I would love to know in what areas he believes the government has got smaller without causing harm. This smaller government thing, these days, is just an American Republican dog-whistle code for “stuff the Democrats”. It is entirely inappropriate, in a country like New Zealand, whose size often means that the only economy of scale is the national economy, for a shrinking government to be any kind of goal. This information should be passed on to any self-respecting journalist with the opportunity to interview the Prime Minister.

Lord knows there are few impartial and able potential interviewers these days. The trouble, as with Trump in the US, is that anyone who actually pursues a truly taxing line of questioning, will likely not get another chance. Until Key is seen as dog tucker, self-preservation may be a serious consideration.

For the Left to succeed in making any of this stick is not how good the point, nor how bad the current governmental behaviour. It is the questions potential voters ask themselves. Can we trust the opposition to be both credible and competent? Do they understand my perspective? Are they speaking to me?

Only after they have an affirmative answer to those questions will they ask: will their policies improve the situation?

I can imagine Andrew Little turning from answering whatever question-of-the-day may be asked him, and asking the New Zealand people in general and National supporters in particular, directly: “Is this the kind of country you want to live in?”

That can be the beginning of the end for this government.

1000% NICK,

This regime is now tired and lacks any Bedside manner to show compassion as it was never in style with them so the public has just about caught up with their false persona and from now its’ all down hill.

There we have it folks,… ‘ supply side / starve the beast ‘ aka neo liberal economics at work = disproportionate tax burden placed on working class and middle class tax payers , and a top marginal bracket which means corporate’s and the extremely wealthy pay negligible tax for infrastructure and maintenance of social services.

Trickle down economics at its most glaringly obvious.

Don’t really like posting great big long posts as it is often a turn off to read , but perhaps as an educational tool of what ideology NZ is following that has got us where we are , it is important as background knowledge. And even though it is based on USA neo liberalism it pertains to NZ.

It helps to put Franks data into perspective of why this govt acts as it does…. so here goes….

………………………………………………………………………………………..

Labour need to spend this time before the election campaign educating the public on the mechanics of taxation….if the electorate still decide they will be “on the winning side” in a divisive regime then so be it.

a little light reading to set them on their way

It is often hard to pin down what antitax crusaders are trying to achieve. The reason is not, or not only, that they are disingenuous about their motives — though as we will see, disingenuity has become a hallmark of the movement in recent years. Rather, the fuzziness comes from the fact that today’s antitax movement moves back and forth between two doctrines. Both doctrines favor the same thing: big tax cuts for people with high incomes. But they favor it for different reasons.

One of those doctrines has become famous under the name ”supply-side economics.” It’s the view that the government can cut taxes without severe cuts in public spending. The other doctrine is often referred to as ”starving the beast,” a phrase coined by David Stockman, Ronald Reagan’s budget director. It’s the view that taxes should be cut precisely in order to force severe cuts in public spending. Supply-side economics is the friendly, attractive face of the tax-cut movement. But starve-the-beast is where the power lies.

The starting point of supply-side economics is an assertion that no economist would dispute: taxes reduce the incentive to work, save and invest. A businessman who knows that 70 cents of every extra dollar he makes will go to the I.R.S. is less willing to make the effort to earn that extra dollar than if he knows that the I.R.S. will take only 35 cents. So reducing tax rates will, other things being the same, spur the economy.

This much isn’t controversial. But the government must pay its bills. So the standard view of economists is that if you want to reduce the burden of taxes, you must explain what government programs you want to cut as part of the deal. There’s no free lunch.

What the supply-siders argued, however, was that there was a free lunch. Cutting marginal rates, they insisted, would lead to such a large increase in gross domestic product that it wouldn’t be necessary to come up with offsetting spending cuts. What supply-side economists say, in other words, is, ”Don’t worry, be happy and cut taxes.” And when they say cut taxes, they mean taxes on the affluent: reducing the top marginal rate means that the biggest tax cuts go to people in the highest tax brackets.

The other camp in the tax-cut crusade actually welcomes the revenue losses from tax cuts. Its most visible spokesman today is Grover Norquist, president of Americans for Tax Reform, who once told National Public Radio: ”I don’t want to abolish government. I simply want to reduce it to the size where I can drag it into the bathroom and drown it in the bathtub.” And the way to get it down to that size is to starve it of revenue. ”The goal is reducing the size and scope of government by draining its lifeblood,” Norquist told U.S. News & World Report.

What does ”reducing the size and scope of government” mean? Tax-cut proponents are usually vague about the details. But the Heritage Foundation, ideological headquarters for the movement, has made it pretty clear. Edwin Feulner, the foundation’s president, uses ”New Deal” and ”Great Society” as terms of abuse, implying that he and his organization want to do away with the institutions Franklin Roosevelt and Lyndon Johnson created. That means Social Security, Medicare, Medicaid — most of what gives citizens of the United States a safety net against economic misfortune.

The starve-the-beast doctrine is now firmly within the conservative mainstream. George W. Bush himself seemed to endorse the doctrine as the budget surplus evaporated: in August 2001 he called the disappearing surplus ”incredibly positive news” because it would put Congress in a ”fiscal straitjacket.”

Like supply-siders, starve-the-beasters favor tax cuts mainly for people with high incomes. That is partly because, like supply-siders, they emphasize the incentive effects of cutting the top marginal rate; they just don’t believe that those incentive effects are big enough that tax cuts pay for themselves. But they have another reason for cutting taxes mainly on the rich, which has become known as the ”lucky ducky” argument.

Here’s how the argument runs: to starve the beast, you must not only deny funds to the government; you must make voters hate the government. There’s a danger that working-class families might see government as their friend: because their incomes are low, they don’t pay much in taxes, while they benefit from public spending. So in starving the beast, you must take care not to cut taxes on these ”lucky duckies.” (Yes, that’s what The Wall Street Journal called them in a famous editorial.) In fact, if possible, you must raise taxes on working-class Americans in order, as The Journal said, to get their ”blood boiling with tax rage.”

So the tax-cut crusade has two faces. Smiling supply-siders say that tax cuts are all gain, no pain; scowling starve-the-beasters believe that inflicting pain is not just necessary but also desirable. Is the alliance between these two groups a marriage of convenience? Not exactly. It would be more accurate to say that the starve-the-beasters hired the supply-siders — indeed, created them — because they found their naive optimism useful.

A look at who the supply-siders are and how they came to prominence tells the story.

The supply-side movement likes to present itself as a school of economic thought like Keynesianism or monetarism — that is, as a set of scholarly ideas that made their way, as such ideas do, into political discussion. But the reality is quite different. Supply-side economics was a political doctrine from Day 1; it emerged in the pages of political magazines, not professional economics journals.

That is not to deny that many professional economists favor tax cuts. But they almost always turn out to be starve-the-beasters, not supply-siders. And they often secretly — or sometimes not so secretly — hold supply-siders in contempt. N. Gregory Mankiw, now chairman of George W. Bush’s Council of Economic Advisers, is definitely a friend to tax cuts; but in the first edition of his economic-principles textbook, he described Ronald Reagan’s supply-side advisers as ”charlatans and cranks.”

It is not that the professionals refuse to consider supply-side ideas; rather, they have looked at them and found them wanting. A conspicuous example came earlier this year when the Congressional Budget Office tried to evaluate the growth effects of the Bush administration’s proposed tax cuts. The budget office’s new head, Douglas Holtz-Eakin, is a conservative economist who was handpicked for his job by the administration. But his conclusion was that unless the revenue losses from the proposed tax cuts were offset by spending cuts, the resulting deficits would be a drag on growth, quite likely to outweigh any supply-side effects.

But if the professionals regard the supply-siders with disdain, who employs these people? The answer is that since the 1970’s almost all of the prominent supply-siders have been aides to conservative politicians, writers at conservative publications like National Review, fellows at conservative policy centers like Heritage or economists at private companies with strong Republican connections. Loosely speaking, that is, supply-siders work for the vast right-wing conspiracy. What gives supply-side economics influence is its connection with a powerful network of institutions that want to shrink the government and see tax cuts as a way to achieve that goal. Supply-side economics is a feel-good cover story for a political movement with a much harder-nosed agenda.

This isn’t just speculation. Irving Kristol, in his role as co-editor of The Public Interest, was arguably the single most important proponent of supply-side economics. But years later, he suggested that he himself wasn’t all that persuaded by the doctrine: ”I was not certain of its economic merits but quickly saw its political possibilities.” Writing in 1995, he explained that his real aim was to shrink the government and that tax cuts were a means to that end: ”The task, as I saw it, was to create a new majority, which evidently would mean a conservative majority, which came to mean, in turn, a Republican majority — so political effectiveness was the priority, not the accounting deficiencies of government.”

In effect, what Kristol said in 1995 was that he and his associates set out to deceive the American public. They sold tax cuts on the pretense that they would be painless, when they themselves believed that it would be necessary to slash public spending in order to make room for those cuts.

But one supposes that the response would be that the end justified the means — that the tax cuts did benefit all Americans because they led to faster economic growth. Did they?

http://www.pkarchive.org/economy/TaxCutCon.html

10000% WK.

Shit I almost ran out of noughts there!!

Of course it is, the Nats are cunning strategists, while Labour is asleep at the wheel, desperately trying to “forge” alliances that they should have done three years ago.

Is there an alternative government in waiting?

I see none, to be honest, I actually am very sad to say this, there is NO real alternative as yet, as Labour, the main “opposition” party has up to this date not got its act together, it is time, and the MoU with the Greens can only be a humble first step, indeed it is rather worthless, without any real convincing policy that they offer, that may complement such from the Greens.

Where is it?

See critical panel looking at this deeply tonight Mike in Auckland, it was a “Must see” on 5th Estate mate, awesome display.

“There is absolutely zero doubt in my mind that the 2016 Budget is geared 100% toward building up a surplus for tax cuts to be announced next year. Just in time for the 2017 Election”

Absolutely agree Frank (I know, unusual I agree with you but you nailed that correctly 🙂 )

Labour were sooo adept at the ‘lolly scramble’ in election year it became a disappointment when they didn’t, why would you, anyone, be surprised that National don’t do the same lolly scramble? (and lets see what Labour and the Greens, as they are now ‘officially’ attached, surprise surprise have in their budget, the Greens have always been let off their costings…not so this election I hope)

I think you have your “cause and effect” the wrong way around. National’s lolly scrambling began in earnest in 2008, when it promised tax cuts that were patently unaffordable, yet went ahead with them anyway. Those tax cuts benefitted a few; the most well off – the top ten percent.

Labour’s “lolly scrambles” tend to benefit the majority of New Zealanders. Chris Trotter wrote an excellent piece on this very aspect on 27 May;

So attempting to justify National’s “lolly scrambles” by deflecting to Labour is not only a cliche, it’s patently wrong. But I guess it suits your position because that is the sum-total of your argument.

Which is zip, zilch , zero…

Next please…

Frank:

You’ve clearly forgotten the crazy days of the Clark government with Working For Families and Free Student Loans.

Both blatant vote buying exercises which were vastly unaffordable.

You will be reminded next year during Nat election cycle my boy

Andrew, WFF was a tax-cut for families. Please feel free to explain why tax cuts for the rich are so good in your eyes, but tax cuts for struggling families is not??

As for free student loans, you are mis-representing the situation. The loans are not “free”. Repayment is deferred until you are earning. After which, you pay, through the nose, or face arrest at our borders, Stasi-style.

So once again, your criticisms turn out to be bullshit lies.

What’s the matter, can’t you deal in facts???

Nazional doesn’t know whats affordable????

Everything they have spent our money on and sold all our assets has come to zilch.

Nazional today announced they are spending $100 Million on a Golf course while people are starving, dying and living in cars as they sell off our state houses???????

We know now low in moral compass are you to cheer vas your boss plans to allow this sheer waste of our precious tax dollars when so much they have caused hardship and death upon our citizens!!!!

You are all criminals!

Thank you national and thank you labour ‘the party of the working class’ for jacking this working mans durries up to $78 a pack.

Sooo grateful……Not

Stop yer whining…you too , could be paid $5000 for leaving Auckland then another $3000 to come back again to look for non existent work…

Stop being so ungrateful for Keys ‘ brighter future’ , mate…

All it takes is a trip down to WINZ and a quick short shrift and you too… can save on the rent by sleeping your family in the car…

Things couldn’t be better for the working man. Couldn’t be better at all.

Jamie, you need to think of poor SkyCity and Saudi Businessmen – they need our taxpayers dollars more than you do…. but wait there’s more, when you go into hospital they will deny you care because you smoke, and they now have to ration health care with the TPPA and government mandated increased population….

If only the tobacco industry had given more ‘donations’ to National or used Katherine Rich, they could have been sitting pretty in this budget like Alcohol and Sugar industry. (Helps when PM has vineyard in blind trust too, wink wink).

Quit ignoring/minimising labours part in all this….

Tobacco Tax Bill Passes Under Urgency

The Customs and Excise (Tobacco Products—Budget Measures) Amendment Bill has passed through all its stages under urgency.

Ayes 109 (National 59, Labour 32, Greens 14, Maori Party 2, ACT 1, United Future 1)

Noes 12 (NZ First 12)

This bill amends the Customs and Excise Act 1996 to make four cumulative 10% increases to the duties on all tobacco products.

____________________________________________________

$78 for a pack of durries, that bollocks is straight up robbery that is

Labour – party of the working class my ass

Ever heard of the English Barebones parliament of 1653 (Cromwell)?

Well, this budget is the “Barebones Budget of 2016”.

It is the Barebones Budget because it addresses social deprivation and homelessness as little as possible without actually ignoring it completely.

This budget is written for investors, speculators, polluters, corporates, monopolies, real estate agents and (last but not least) sleepy hobbits. All except the last category are what you would expect anyway so lets examine the last category – the sleepy hobbits.

How is this budget written for the sleepy hobbits – the undetermined masses who have little or no interest in who runs the government? It is a budget of anonymity, it wasn’t written by English it was written by a horde of faceless Treasury officials and foreign advisors.

If it was an LP it would be the equivalent of a Milli Vanilli LP, lip synching performers and session musicians.

That’s what the sleepy hobbits like – something bland, anonymous and quiet. They wouldn’t like to be woken from their slumber to discover how much National have screwed them over the last eight years, so National’s solution is to make sure they never wake up.

They sure won’t with this budget.

I’m leaning towards a salt and pepper budget myself

This may be simplistic but why do we have a government, I was taught that a government worked to give us a safe and civil society, made sure everybody was living well and employed and contributing. With this government pruning off each year from the services which is meant to provide, what is its purpose then for – when the government says it wants less government then shouldn’t it then have less MP’s in the house to service the work it’s supposed to do. Any good business when it is retrenching and down sizing prunes its staff accordingly. I may be a simple person but mathematics tells me that when a Government is bloated with staff, not working to its proper purpose then half of them should be told to take redundancy and get out. They seem to deliver less and less each year they are in – crazy stuff if you ask me – as I said why do we need them in – when the house is off over Christmas we have a civil service which ticks over nicely and nobody misses them, simplistic really.

Thanks again Frank. Good job – as usual.

My personal disgust is the lack of proper funding for the Arts.

To depend on the Lotto and not fund this very important cultural

gift and artistic expression, is just plain stupid. Kids in schools miss out as well.

Quality and professional artists and musicians take a back seat to performing arts when it comes to govt and private funding. Many of them are working in restaurants etc. to make ends meet when they should be helped out as much as possible.

[…] Budget 2016 – Who wins; who loses; who pays? […]

[…] blogpost was first published on The Daily Blog on 2 June […]

The above good analysis and break down provided by Frank should be homework for our rather useless, under-resourced MSM.

And Paul Henry – the BASTARD (that is what he calls “greenies”) – he should be ambushed and thrown out on the street, by angry viewers.

Why do such idiots like Tava from the Greens still grease up to him and visit him on his Breakfast Crap Show?

Henry, the mis-representer, government spin master, should be sacked, and first of all boycotted by all progressives.

Comments are closed.