The continuing meltdown on stock markets around the world didn’t slow down. China lost 3.6%, European markets slid hard and the Dow Jones just closed down 392 points.

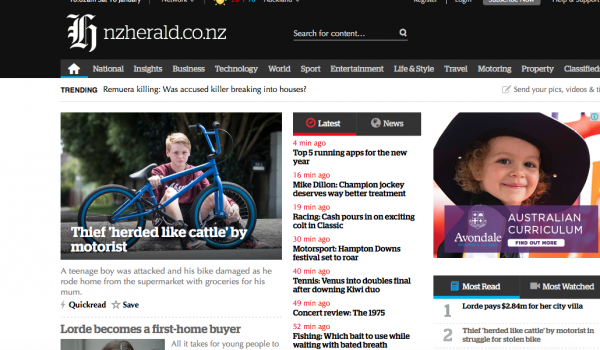

Meanwhile this is the shlock the Herald and Stuff are leading on their front pages right now…

..a Kid beaten up on his bike and Lorde buying a new house for a couple of million.

This is why NZers won’t see the economic collapse when it hits.

RIP kiwi saver

And there’s no Plan B to cover the ‘costs’ of the mini-boomers’ retirements.

In markets we trust….

Looks like the kittens have found the knitting bag and it’s all about to unravel.

So true Martyn our media wouldn’t know an important news story if they fell over one…

They know. But there are rules to be followed, and their prime agendas are to supply pabulum to the masses and defend BAU (business-as-usual). Hence, the masses are bombarded with an endless stream of trivia, distraction, feel-good narratives, misinformation and useless information- in a futile attempt to maintain business confidence just a little longer as the ship goes down.

News and commentary you won’t hear from the mainstream media:

1. The Baltic Dry Index (a measure of demand for shipping and a proxy for world trade) has hit a record low.

https://en.wikipedia.org/wiki/Baltic_Dry_Index

2. Oil sand bitumen falls below $10.

‘Think oil in the $20s is bad? In Canada they’d be happy to sell it for $10. Canadian oil sands producers are feeling pain as bitumen – the thick, sticky substance at the center of the heated debate over TransCanada’s Keystone XL pipeline – hit a low of $8.35 on Tuesday, down from as much as $80 less than two years ago. Producers are all losing money at current prices, First Energy Capital’s Martin King said Tuesday at a conference in Calgary. Which doesn’t mean they’ll stop.’

http://www.theautomaticearth.com/2016/01/re-covering-oil-and-war/

3. The Deflation Monster Has Arrived

‘Markets are going to crash, wealth will be transferred from the unwary to the well-connected, and life for most people will get harder as measured against the recent past.’

http://www.peakprosperity.com/blog/96307/deflation-monster-has-arrived

4. Atmospheric CO2 levels have surged and the highest ever single-day January result of 404.81ppm on 13th Jan was over 5ppm higher than a year before. The rate of annual increase has reached a new all-time high of over 3ppm per annum.

https://www.co2.earth/daily-co2

COP 21 was a sham and the so-called strategies to bring emissions under control amount to far too little, far too late.

5. Arctic Sea ice is at a record low, 2 standard deviations below the recent normal, as a consequence of burgeoning greenhouse gas levels.

http://nsidc.org/arcticseaicenews/

Once the remaining ice melts the rate of warming will increase dramatically, causing much greater climate chaos than already experienced.

There are dozens of other items of unmentionable news and commentary that clearly indicate the present system has no long-term future or medium-term future, and may not even have a short-term future.

Looks like the big crash the commentators are talking about is getting closer.

The market is very volatile. From what i have read US junk bond market is a good indicator when those rates tank as happened before the GFC then we could see a big correction.

The NZ50 has recently made new all time highs. The last high on 31st December.

So far it hasn’t turned down.

The AORD had its last all time high in March last year. FTSE in April last year, the DOW in May last year, and Nasdaq in July last year.

So New Zealand is the last to turn down.

Which means that here in NZ our mood is still fairly euphoric, as it tends to be at market highs. So we don’t recognise what will happen here when we eventually follow the rest of the world.

There are plenty of people in NZ who insist that somehow the mess in China won’t affect us, that Europe won’t affect us, and the collapse of the US markets won’t affect us either. Or that none of the markets are collapsing (and I bet they haven’t even looked at a chart of those markets).

And that there is no property market bubble in NZ. That our property prices have always gone up and always will – or they may flatten off for a bit. But a bubble and a crash? Heresy.

Pretty typical behaviour at market highs really. Very few recognise it. Its generally not until a crash is about halfway through that the reality of the crash is acknowledged.

If it weren’t so dire it would be hilarious.

Hence why I have changed my kiwisaver account at anz to cash assets instead of stocks and shares assets.

What happened to my carefully worded and rather long comment?

I’ve noticed that comments take a while to show up here on TDB these days.

And now not published?

That’s not exactly going to support participation and so readership.

I suspect that there will be plenty of action going on right now at the world’s money laundering and tax evasion havens as the filthy rich rush to get their billions stowed away before they disappear into a big hole.

Fancy a trip to the Cayman Islands? I hear Diego Garcia is a great place to visit at this time of the year.

Be careful of possible bail-in legislation by banks to sweep up savings of customers over a certain level into their emptying coffers (research bank action in Cyprus):

http://truepublica.org.uk/united-kingdom/grand-theft-auto-uk-eu-bank-depositor-bail-regime-implemented/

Comments are closed.