Headline: Inequality will be the issue for 2014.

By Mike Treen

(Reprinted from The Daily Blog)

Everyone from the Pope to Obama is bemoaning the effect that inequality is having on the world today. It is even being blamed for the depth of the economic recession and the weakness of the current recovery.

Obama recognised the fact that “the American people’s frustrations with Washington are at an all-time high. But we know that people’s frustrations run deeper than these most recent political battles. Their frustration is rooted in their own daily battles — to make ends meet, to pay for college, buy a home, save for retirement. It’s rooted in the nagging sense that no matter how hard they work, the deck is stacked against them. And it’s rooted in the fear that their kids won’t be better off than they were. They may not follow the constant back-and-forth in Washington or all the policy details, but they experience in a very personal way the relentless, decades-long trend that I want to spend some time talking about today. And that is a dangerous and growing inequality and lack of upward mobility that has jeopardized middle-class America’s basic bargain — that if you work hard, you have a chance to get ahead.”

Obama appeared to have no element of self-awareness when delivering that speech that the economic policies he opted for when coming to office may have contributed to that reality. A report in September revealed that 95 percent of America’s income gains over the past four years have gone to the nation’s most affluent 1 percent. A few weeks after his speech 1.3m jobless were cut from receiving benefits under a “compromise” the Democrats reached with Republicans to pass the budget.

Obama became US President in January 2009. The Christian Science Monitor reports that “since the official end of the Great Recession in mid-2009, 95 percent of all income gains have flowed up to America’s top 1 percent, who also now accrue 20 percent of the nation’s total pretax income, doubling their 10 percent share from the 1970s.”

Paul Bucheit reports on Alternet that “From the end of 2008 to the middle of 2013 total U.S. wealth increased from $47 trillion to $72 trillion. About $16 trillion of that is financial gain (stocks and other financial instruments).

“The richest 1% own about 38 percent of stocks, and half of non-stock financial assets. So they’ve gained at least $6.1 trillion (38 percent of $16 trillion). That’s over $5 million for each of 1.2 million households.

“The next richest 4%, based on similar calculations, gained about $5.1 trillion. That’s over a million dollars for each of their 4.8 million households.

“The least wealthy 90% in our country own only 11 percent of all stocks excluding pensions (which are fast disappearing). The frantic recent surge in the stock market has largely bypassed these families.”

As liberal economist Dean Baker noted, “Inequality did not just happen, it was deliberately engineered through a whole range of policies intended to redistribute income upwards.”

The Pope’s message was even more radical. Pope Francis released his Evangelii Gadium, or Joy of the Gospel, attacking capitalism as a form of tyranny and calling on church and political leaders to address the needs of the poor. He attacked an “idolatry of money” that would lead to a “new tyranny”.

“Such an economy kills. How can it be that it is not a news item when an elderly homeless person dies of exposure, but it is news when the stock market loses two points? This is a case of exclusion. Can we continue to stand by when food is thrown away while people are starving? This is a case of inequality. Today everything comes under the laws of competition and the survival of the fittest, where the powerful feed upon the powerless. As a consequence, masses of people find themselves excluded and marginalized: without work, without possibilities, without any means of escape.”

He directly attacked people who “continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world. This opinion, which has never been confirmed by the facts, expresses a crude and naive trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system. Meanwhile, the excluded are still waiting.

“As long as the problems of the poor are not radically resolved by rejecting the absolute autonomy of markets and financial speculation, and by attacking the structural causes of inequality, no solution will be found for the world’s problems or, for that matter, to any problems,” he wrote.

The main point was repeated by the Pope in a New Year’s Day Peace message. “It is a truly pressing duty to use the earth’s resources in such a way that all may be free from hunger,” Francis wrote in his message. “It is well known that present production is sufficient, and yet millions of persons continue to suffer and die from hunger, and this is a real scandal. We need, then, to find ways by which all may benefit from the fruits of the earth, not only to avoid the widening gap between those who have more and those who must be content with the crumbs, but above all because it is a question of justice, equality and respect for every human being.”

Even the Dalai Lama has joined in. In a speech December 7 in India he said “We have to think seriously how to reduce this gap between the rich and the poor.”

He went so far as to describe himself as a Marxist. “As far as socio-economic theory is concerned I am a Marxist. I am attracted to the principle of equal distribution. The poor and helpless need more care. While capitalism is only about minting money,” he said.

The process of wealth concentration has been going on for the last three decades but has accelerated since the world financial crisis. That crisis was at least in part a product of the grotesque excesses of the super rich and the speculative frenzy they indulged in in their relentless search for more and more ways to make a profit.

The largest Wall Street firms set aside $91 billion for year-end bonuses in 2013. In effect these gangster banksters are the biggest welfare recipients of all time. Because the central banks have been maintaining interest rates at very low levels for such a long period they are in effect subsidising bank profits to the tune of $83 billion a year.

While wages have been squeezed and austerity budgets imposed all across the globe the wealth of the world’s billionaires has doubled since 2009 according to a report by UBS and Wealth-X, a consultancy that tracks super-rich individuals.

As CNBC reported, “The global financial crisis was good for billionaires. The combined fortune of the world’s billionaires has more than doubled, to $6.5 trillion, from $3.1 trillion in 2009, according to Wealth-X and UBS Global Billionaire Census 2013. Their fortunes have grown by $226 billion in the past year alone. The group’s number also grew by 810 during the period, to 2,170.”

Billionaire.com commenting on the same report said that “Billionaires have lots of expensive toys but above all their favourite luxury assets are yachts. The total luxury holding of billionaires is US$126 billion, including yachts, aircraft, art, and jewellery, antiques, fashion and collectable cars (excluding real estate). On average, billionaires invest US$78 million in yachts.”

The financial news agency Blooberg produces their own Bloomberg Billionaires Index, a daily ranking of the world’s 300 richest individuals. They added $524 billion to their collective net worth in 2013 to stand at $3.7 trillion. Primarily this is the product of a stock market boom continuing with cheap money being made available from the central banks to speculate with.

The increase in incomes has also led to a huge increase in accumulated wealth. A 2006 report by the United Nations University found that “the richest 1% of adults alone owned 40% of global assets in the year 2000, and that the richest 10% of adults accounted for 85% of the world total. In contrast, the bottom half of the world adult population owned barely 1% of global wealth.”

An annual report by financial advisors Capgemini and RBC Wealth Management records the wealth of High Net Worth Individuals (HNWI) with $1 million or more in investible assets and Ultra-HNWI’s with $30 miilion or more in investible assets. The super-rich, representing just 0.13% of the world’s population own 25% of all financial assets (stocks, bonds and cash in banks).

A website called “Luxury Society” has a summary of the reports findings:

“The global HNWI population increased by 9.2% to reach 12.0 million individuals, after remaining flat in 2011. Aggregate investable wealth increased 10.0% to US$46.2 trillion, after declining slightly in 2011. HNWI wealth is forecasted to grow by 6.5% annually to US$55.8 trillion by 2015.

“Ultra-high net worth individuals – defined as those having investable assets of US$30 million or more, excluding primary residence, collectibles, consumables, and consumer durables – increased in number and wealth by 11.0% in 2012, compared to a population loss of 2.5%, and a wealth loss of 4.9% in 2011. Representing less than 1% of the global HNWI population, the world’s 111,000 ultra-HNWIs control more than one-third (35.2%) of HNWI wealth.” (The full report is available here for those with the stomach for it)

Credit Suisse also produce an annual wealth report and this year they had a great chart to go with it.

The chart shows that there are 3.2 billion adults in the world with less than $10,000 in net wealth. They collectively own total net wealth of $7.3 trillion or 3% of total world wealth. At the top we have a group of 32 million or 0.7% of the total with 41% of the world’s wealth – more than the bottom 91% of all adults.

Reuters reported that “Average global wealth has hit a peak of $51,600 per adult but this is spread very unevenly, with the richest 10 percent owning 86 percent of the wealth, analysts at the Credit Suisse Research Institute said. The top 1 percent alone own 46 percent of all global assets.”

Tax-receipt data collected by Messrs. Piketty and Saez show the top 1% captured 19.3% of U.S. income in 2012. The only year in the past century when their share was bigger was 1928, at 19.6%. The New York Times reported:

“The top 10 percent of earners took more than half of the country’s total income in 2012, the highest level recorded since the government began collecting the relevant data a century ago, according to an updated study by the prominent economists Emmanuel Saez and Thomas Piketty.

“The top 1 percent took more than one-fifth of the income earned by Americans, one of the highest levels on record since 1913, when the government instituted an income tax.”

Even the Congressional Budget Office has confirmed the trends for the USA.

The CBO finds that, between 1979 and 2007, income grew by:

- 275 percent for the top 1 percent of households,

- 65 percent for the next 19 percent,

- Just under 40 percent for the next 60 percent, and

- 18 percent for the bottom 20 percent.

- The share of after-tax household income for the top 1 percent of the population more than doubled, climbing to 17 percent in 2007 from nearly 8 percent in 1979.

- The top fifth of the population saw a 10-percentage-point increase in their share of after-tax income. Most of that growth went to the top 1 percent of the population.

- All other groups saw their shares decline by 2 to 3 percentage points.

Michael Roberts Blog on the “The Story of Inequality” reports on an very interesting speech by Sir Anthony Atkinson, a senior research fellow at Oxford University and one of the world’s experts on inequality. Roberts said that Atkinson had noted there had been an average rise in inequality of about 10% in OECD countries since the 1980s. But importantly “Atkinson then asked the question: why? What were the causes of the rise in household inequality of income in the advanced capitalist economies after the 1980s? The usual reason given by mainstream economics is that new technology and globalisation led to a rise in the demand for skilled workers over unskilled and so drove up their earnings relatively. This is the argument presented by Greg Mankiw recently in his defence of the top 1% of earners.

“Atkinson dismissed this neoclassical apologia. The biggest rises in inequality took place before globalisation and the dot.com revolution got underway in the 1990s. Atkinson pinned down the causes to two. The first was the sharp fall in direct income tax for the top earners under neoliberal government policies from the 1980s onwards and the sharp rise in capital income (i.e. income generated from the ownership of capital rather than from the sale of labour power). The rising profit share in capitalist sector production that most OECD economies have generated since the 1980s was translated into higher dividends, interest and rent for the top 1-5% who generally own the means of production. In 2011, capital income constituted 60% of the top 10% earners’ income compared to just 32% in the 1980s.”

Nobel Prize winning economist Paul Krugman points out that since 1973 in the USA Gross Domestic Product (GDP) per household has increased 46 percent in real terms, but median income per household has only increased 15 percent. Where did the other 31 percent go? It went to the wealthy.

Corporate profits are also setting new records. In the third quarter of 2013, profits after taxes accounted for more than 11 percent of US gross domestic product, the sum of all goods and services. That’s the highest such percentage of GDP ever recorded. For workers, income from wages and salaries has shrunk from more than 50 percent of the GDP pie in 1970 to 42.6 percent in 2012 – the smallest piece ever measured. At the same time fewer Americans are working than at any time in the past three decades.

One estimate I saw reckoned that if labour income share had remained the same in the USA wages would on average be 25% higher or $13,000 a year.

As Warren Buffett, the second richest man in America, famously said, “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

This story has a very familiar ring to us in New Zealand as well. Something I will be looking at a more closely in my next blog.

Even the World Bank and International Monetary Fund (IMF) and Organisation for Economic Development (OECD) have got in on the act. It is extraordinary to have these institutions express their concerns at growing inequality when they have operated as the policemen for international capitalism – enforcing the neoliberal “Washington Consensus” – that has contributed so much to creating the inequality in the first place.

The IMF report called Income Inequality and Fiscal Policy confirmed widening inequality. The GINI coefficient (a measure of inequality of income between the top and bottom income earners) in the US had jumped from 30.5% in 1980 to 38.6% in 2010, the largest rise in the whole world with the exception of one country, China, where it has risen from a relatively low 28% to a very high 42% during ‘the move towards the market’ in China over the last 30 years.

New Zealand had one of the largest increases going from 27 in 1980 to 34 in 1995 before dropping back slightly to 33 in 2008 – the latest figure available. Only the UK (27 to 34.4) and the USA (30.1 to 36.3) had similar sharp increases over the 1980 to 1995 period. The most equal society in the advanced capitalist world is Norway (24%), which is also the richest. All the Scandinavian ratios are relatively low while Germany and France are in the middle (low 30%).

Branko Milanovic, Lead Economist from the World Bank’s Research Department, has updated his 2005 study Worlds Apart which found that the world was “20:80” – that is that 80% of the world’s then 6.6 billion people could be classed as poor and the situation was deteriorating. His new report confirms the situation has worsened. He concludes: “Take the whole income of the world and divide it into two halves: the richest 8% will take one-half and the other 92% of the population will take another half. So, it is a 92-8 world. In the US, the numbers are 78 and 22. Or using Germany, the numbers are 71 and 29.” (Global Income Inequality By The Numbers: In History And Now – an overview)

The OECD report is headed “Divided We Stand: Why Inequality Keeps Risings”. Its introductory paragraph states: “The gap between rich and poor has widened in most OECD countries over the past 30 years. This occurred when countries were going through a sustained period of economic growth, before the Great Recession. What will happen now that 200 million people are out of work worldwide and prospects of growth are weak? New OECD analysis says that the trend to greater inequality is not inevitable: governments can and should act.” (Full report available here).

The reason for all this sudden concern for the growth in inequality is political. The capitalist rulers are concerned that the inequality debate will focus attention on their monopolisation of wealth and power and we may seek ways to curtail it or, even better, end it for good.

The January 5 Christian Science Monitor headed a feature article on the issue: “Income inequality: Does wider gap between rich and poor threaten capitalism?” They quote Bill Gross, one of the largest bond managers in the US, saying that the inequality in the USA “can’t go on like this, either from the standpoint of the health of the capitalist system itself or the health of individuals and the family.”

The Wall Street Journal had an article November 10 headed “Worry Over Inequality Occupies Wall Street – Gulf Between Haves and Have-Nots May Hurt Economy.”

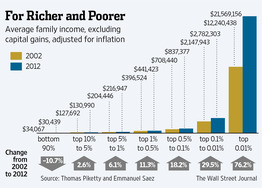

The chart that accompanied the article shows that the average income of the bottom 90% of families actually fell by 10% from 2002-2012 while all the top income groups grew. The top 0.01% saw their incomes grow 76.2 percent to an average of over $21 million in the same period. And those figures are adjusted for inflation and exclude capital gains.

Journalist Justin Lahart commented: “Even if they have found the widening gulf between America’s haves and have-nots troubling, inequality isn’t something fund managers have worried about professionally. That may be changing.

“Over the years, the only way inequality has really mattered to investors has been as a factor when considering stocks. If the rich are getting richer, companies that cater to them have better prospects…

“Lately, though, some big investors have worried increasing income and wealth gaps threaten the economy’s ability to expand. They also fret that public anger over it, which Democrat Bill de Blasio tapped in his successful run for New York City mayor, is creating dangerous political tensions.”

Here we get to the real reason the issue of inequality has become in Obama’s words “the defining challenge of our time.”

Big Business fears the issue will be captured by left wing forces independent of them and the parties they control. By giving vent to some of the dissatisfaction through the Democratic Party they hope to keep it contained within acceptable boundaries. Opinion polls are showing a growing desire for a third party alternative in US politics.

In Lorain County, Ohio, 24 councillors were elected in November on a union-backed Independent Labor Party slate against the local Democratic Party machine. The last straw was when the Mayor scabbed on a strike. At this stage the union campaign is still aimed at putting pressure on the Democratic Party rather than forming a truely “independent” labour party. But the strong vote is a signal of what is possible if a revitalised labour movement broke from the shackles that have tied them to the Democratic Party for decades with nothing to show for their loyalty.

Kshama Sawant, an open socialist was also elected to the Seattle City Council with broad union and working class support. Her campaign themes targeted inequality and the need for the labour movement to break with the twin parties of big business in the USA. Her inauguration speech summarised these themes as follows:

Sawant at swearing in ceremony

“This city has made glittering fortunes for the super wealthy and for the major corporations that dominate Seattle’s landscape. At the same time, the lives of working people, the unemployed and the poor grow more difficult by the day. The cost of housing skyrockets, and education and healthcare become inaccessible.

“This is not unique to Seattle. Shamefully, in this, the richest country in human history, 50 million of our people – one in six – live in poverty. Around the world, billions do not have access to clean water and basic sanitation and children die every day from malnutrition.

“This is the reality of international capitalism. This is the product of the gigantic casino of speculation created by the highway robbers on Wall Street. In this system the market is God, and everything is sacrificed on the altar of profit. Capitalism has failed the 99%.

“Despite recent talk of economic growth, it has only been a recovery for the richest 1%, while the rest of us are falling ever farther behind.

“In our country, Democratic and Republican party politicians alike primarily serve the interests of big business. A completely dysfunctional Congress does manage to agree on one thing – regular increases in their already bloated salaries – yet at the same time allows the federal minimum wage to stagnate and fall farther and farther behind inflation. We have the obscene spectacle of the average corporate CEO getting $7000 an hour, while the lowest-paid workers are called presumptuous in their demand for just $15.

“To begin to change all of this, we need organised mass movements of workers and young people, relying on their own independent strength. That is how we won unions, civil rights and LGBTQ rights.”

A December 11 Bloomberg poll found that “64 percent of Americans no longer believe the country offers everyone an equal chance to succeed, compared with 33 percent who do…. And for those making $50,000 or less, 73 percent see the economy stacked against them.” Another recent poll found that 64% of Americans believe Federal government policies favour the well off. 57% thought the government should pursue policies to reduce that gap.

US lawmakers are following the opposite course. In addition to cutting income support for long-term unemployed, Budget cuts kicked into effect November 1 that lowered the nation’s average federal food stamp benefit to less than $1.40 per person per meal. Today there are a record 48million Americans dependent on food stamps, 22 million of whom are children.

We need a new social and political movement that tackles inequality. But such a movement has to understand that capitalism and inequality are two sides of the same coin. There can be no lasting attack on inequality without also attacking its source.

(Unite National Director Mike Treen has a blog hosted on the TheDailyBlog website. The site is sponsored by several unions and hosts some of New Zealand’s leading progressive commentators. Mike’s blog will be covering union news and general political comment but the views expressed are his own and not necessarily those of Unite Union.)

—