In recent months, the oil price slump has been well documented, written about, discussed, and by some has been seen as the foreshadowing of a major global economic crash.

The slump has partially come around due to previously high oil prices, which drove down the demand for oil. As well as this, the return to production for countries such as Libya, and a sudden boom in oil production has lead to the market being swamped in a tide of cheap oil. In the first few weeks of 2015, oil prices have regularly dipped below $50 USD per barrel, down from the height of $115 USD PB last year.

China is no longer buying the oil they used to. They are in downturn, and no longer need the oil they used to to get things done. America meanwhile, thanks to fracking, is now poised to become a major oil exporter, whereas before they were a major importer. Fracking has therefore helped fuel the crisis, and has launched a game of economic hardball from which only the very strongest will survive.

The effects of this slump on the economies of Russia (who were depending on high oil prices to keep themselves afloat through sanctions over the Ukraine crisis, and who’s economy is, not mincing words, the equivalent of a donkey that doesn’t know that it’s dead yet), Venezuela (who depends oil for 95% of its revenue), and Saudi Arabia (who have recently decided to withdraw most of their production and are depending on their $750 billion USD savings fund to keep themselves afloat until the prices improve), and to a lesser extent Canada (those bloody oil sands), Mexico, and Iran. All the existing markets, basically. But what of all the potential markets, who were opening up large block offers for oil companies recently? What of, for example, the country who many economists were calling the potential “Saudi Arabia of the South Pacific”? What of “Clean and green” New Zealand?

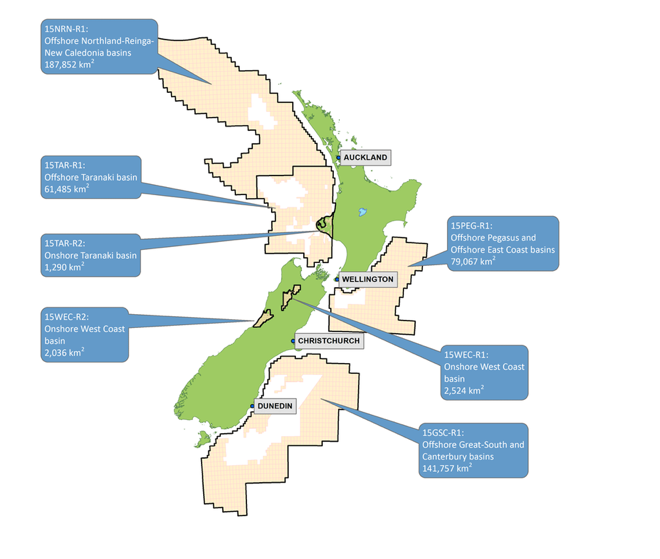

Block Offer 2015 consists of seven blocks altogether, three onshore and four offshore. These are:

15NRN-R1: Offshore Northland-Reinga-New Caledonia basins.

15TAR-R1: Offshore Taranaki basin.

15TAR-R2: Onshore Taranaki basin.

15PEG-R1: Offshore Pegasus and Offshore East Coast basins.

15WEC-R1: Onshore West Coast basin.

15WEC-R2: Onshore West Coast basin.

15GSC-R1: Offshore Great-South and Canterbury basins.

(You can view their exact locations on the graphic below, sourced from www.nzpam.govt.nz, New Zealand Petroleum and Minerals).

Altogether, the Block Offer consists of 476,00 square kilometers, the biggest block being 187,851.8 square kilometers (Offshore Northland-Reinga-New Caledonia basins), and the smallest being 1,290.1 square kilometers (Onshore Taranaki basin). But with the oil prices so low, and thus the profit margin having shrunk since the Block Offer was made, is there really any economic sense in selling off these huge chunks of land to overseas companies? If we must sell them, wouldn’t it make much more sense to wait until oil prices begin recovering, rather than going all for it now, when oil prices are at something like a six-year low? Because if we do sell them off now, it’s the same risk for less profit. Is that a sensible choice for a pro-market government to make? If anything, the release of a new “Saudi Arabia” into the market would worsen the crisis. The current figures show that the world is beginning to move beyond oil, into sustainable alternatives, which don’t threaten the future of our cities, countries and even our species.

If National insists that they’re a sensible, pro-market economy party, why are they investing in a resource that a) isn’t actually making very much money at the moment, b) will run out eventually, and c) threatens the future of our country? If their idea of a strong economy depends on Oil and Dairy, which have both suffered major tumbles in the last year, ado they really have the credentials to run a smooth, strong economy?

My name is Finn Jackson. I turned sixteen last year. I was born into a family of journalists who were very involved in politics. Since birth I have been surrounded by talk of Mayoralty Campaigns and election stratergies. This has influenced my entire life, and has prompted me recently to join the movement for change.

National don’t run the economy and the country. The top 1% of the citizens that own 52% of the nation’s assets do, through their finger puppets John Key and Bill English. These guys are not interested in anything but their own short term obsession of accumulating more wealth at the detriment of everything else.

The only viable solution is to elect a government with enough steel cojones to legislate to force these 1 percenters to pay their fair share of the TAX revenue – a comprehensive tax on all capital incomes – so that we can fund a basic universal income for ALL Kiwis, provide free education and medical services, affordable houses and transport services.

Where will the money come from? Up to 9.6 billion dollars a YEAR will come from the tax on capital income – as documented by the Serious Fraud Office.

Well put Tuan, I 100% agree. The youth of this country need to take a good look at the outcome of Neo Liberal Economics in the US and UK.

Plain and simple it does not end well for the working/middle class.

Is it time to stop believing the Bullshit and see whats happened to this country. ‘Youth’ do you want more of the same? or a new balanced fair way to run this great country for the good of all not just the top 10%………….. Stay tuned.

Tuan .

Your suggestions are a cross between being way too intelligent and showing way too much common sense and therefore will be relegated to the waste bin .

We should all know by now…….at the moment , greedy, self interested, morons rule!!

Welcome Finn.

Good clear concise presentation. Each one of these gets me nearer to getting the picture I believe we need to get, I look forward to more like this one.

Several contributors to this site have already arrived at the idea that our government certainly isn’t governing in the interests of the country nor of most people who live here. ‘Waiting until more profitable before selling big chunks of land’ I presume means more profitable for us locals, whereas selling now should mean ‘more profitable for our big wealthy buyer friends’. All you need to do is assume the government is acting on their behalf not ours, and hey presto! it all makes sense.

Well written and very worthy questions we should all be asking.

Look forward to hearing more from your generation.

In the late 20th and early 21st centuries the economic driver is oil. The amount of oil a country has (and/or uses) supposedly reflects its economic worth. In the years before Jesus Christ it was slaves, in medieval times it was serfs, in the early modern age it was empires. Do you get the pattern here? It is all about how the rich control the poor. That is the truth about economic drivers – it is how the rich manage the poor and how they can profit from them. It will be interesting to see what the next thing will be (after the oil runs out) assuming the planet is still habitable by then. My pick is that the next economic driver will be water.

Yes already an American state government wants to privatize water .

This is a scary thought.

Very well thought out and right. There is little else to say except to blather on about political rhetoric that neither adds to the discussion or outlines a solution.

However, I will add that the ‘youth’ should not be held solely accountable or responsible for mistakes made by prior generations. The majority of youth are under a voting age. One cannot expect change from the youth if the channels to make change are not readily apparent and encouraged.

Comments are closed.