National’s budget slogan today

What marvellous news – tax cuts are coming…What splendid news!

Today Prime Minister John Key announced that future budgets would most likely include tax cuts.

And not before time. Low and middle income families are doing all the heavy lifting for the economy and need a break.

The two tax cuts the country desperately needs are:

- Abolishing GST – a vicious tax on low-income families (the poorest New Zealanders pay 14% of their income on GST while the richest pay less than 5%)

- Abolish income tax on the first $27,000 of income from wages or salaries

But we all know there is no free lunch – a pity someone didn’t tell that to the idle rich and the corporates – so these tax cuts need to be offset with tax on unproductive sectors of the economy which are not only distorting and damaging the country but are largely untaxed.

I’m talking about:

- A Financial Transactions Tax on currency speculators

- A robust capital gains tax where each person declares all their income irrespective of the source and pays tax the same as the rest of us

- An inheritance tax on estates valued over $500,000

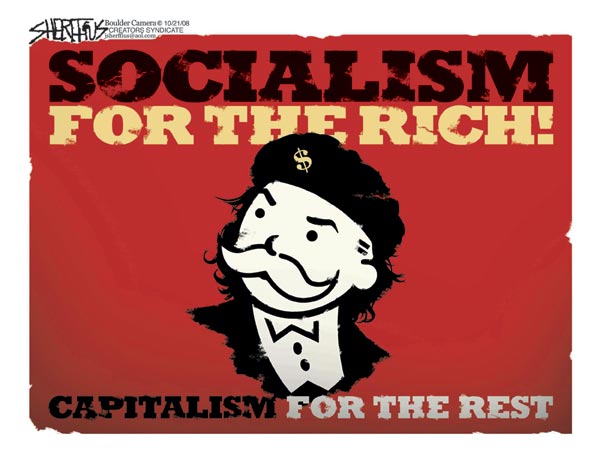

Over the past 30 years the tax burden has been shifted from the wealthy and the corporate sector to wage and salary earners through income tax cuts and GST increases.

That’s got to change.

In reality most of the richest 1% don’t pay any meaningful tax despite the 150 wealthiest New Zealanders getting an increase in wealth of $5 billion last year.

Sorry but enough is enough. Low-income families can no longer afford to carry the indolent rich and the tax-avoiding corporate sector.

So tax cuts are to be welcomed – starting with GST.

(Note: John Minto is Economic Justice Spokesperson for the Mana Movement)

Couldn’t agree more, John. Well said

Some of the other stealth taxes need a look too, user pays fees, council collection of traffic fines etc.

Key of course will do nothing of the kind.

Poorer New Zealanders are going to be obliged to develop the kind of black economy that prospered in the soviet union just to survive. The rich have their black economy already.

The rich have their bought economy already.

I wonder what services will be cut or assets sold, to make up for tax cuts. As usual, I think we know who will get the bulk of any tax cuts. It certainly won’t be the poor, that’s for sure!

The other ‘inescapable’ I would like dealt with is fuel taxes.

If the government was trying to persuade us to convert to a greener fuel, and the supply chain had been rolled out across the country, then the tax hikes on petrol and diesel might make sense. Might.

But we’ve had price hikes for years, apparently to build ‘ghost roads’ that have yet to get off the design boards, and electricity hikes because we have to replace ageing hydro stations – yet nothing has happened. Nor has there been any meaningful campaign by government to ensure that new electronics and household appliances are power-thrifty.

It’s all rip-off with nothing good as a reward for the years of frugality and want.

ME, ME, ME, ME, MINE, MINE AND BUGGER OFF, that is the “caring message” that people get taught under this government. “I want to OWN MY pay packet”, and “bugger off”, that is what people are encouraged to think.

More lives ruined, more living under bridges and in parks, more thrown off benefits, for not “meeting criteria”, more told to wait longer for health care, as the services are over burdened and under resourced.

I have seen it, hear it every day, and that is the damned reality in NZ Aoteaoroa, sadly too many in the increasingly brainwashed and also stressed out middle class are pressured into thinking the same, me, me, I want to desperately survive, and I have no time to think of those “not pulling their weights”.

Manipulation has many facets, but the horrible truth is, it often works, ask the ones that followed dictators and exploiters in the past of history. There are still enough survivors to tell us their stories.

But we will NEVER hear and see about them on the privately owned, commercially run TV, radio and other media we have now, as they rather sell dreams, excitement, fake stuff and lots of advertisement. Welcome to Aotearoa 2014, a sold out, sadly increasingly corrupted and manipulated country, where even many Tangata Whenua see only one solution, opt out and go to Australia, or whatever other “out” option, I dare not to mention the worst.

Time to revolt and stand up, people, I had enough, have you had enough? I am furious on “budget day night”!

[…] poverty just by growing the economy. You need more radical interventions, as Piketty suggests. Mana’s tax policy – shifting the tax burden from poor and middle-income earners to the unproductive, untaxed […]

I have to say I agree with you on this one, salary earners get taxed the most as they are the easiest to tax. Government is to lazy to implement a tax regime that would tax all income earners on their total income, far easier for them to tax a salaried worker.

Heard Key on Duncan Garner’s Drive programme talk about tax cuts after the election. He would not rule out a raise in GST to fund the tax cuts.

Jamie Whyte has floated a 17.5% flat tax rate. Instantly I had nightmare flashbacks to Roger Douglas, Richard Prebble in the 80’s. It reminded me of Key promising in 2008 NOT to raise GST.

The neoliberal bullshit revolution will be complete when GST matches the flat tax rate.

Tell me again who will be the winners and who will be the losers when GST goes up? Corporates? Rich? Those that can avoid GST?

The middle classes and poor, who will once again be shafted by National and ACT’s tax swindles and lies. Same old, same old croney Tory capitalism.

[…] John Minto has an interesting reaction to this. He says tax cuts are a great idea, and suggests shifting the tax burden back by abolishing GST […]

[…] support the Budget. TDB has provided many analysis of the Budget showing it up for the sad joke it […]

Comments are closed.