NZ in recession as Corporations scream they aren’t causing Greedflation

Recession, no great escape: GDP data confirms economy took another hit in first quarter

The economy entered a recession in the first quarter falling 0.1 per cent, in line with market expectations.

Data from Stats NZ this morning showed how the economy shrank in the first three months of 2023.

And revised data showed GDP contracted by 0.7 per cent in the final quarter of 2022, worse than the 0.6 per cent recorded earlier.

Two successive quarters of economic contraction are widely considered a technical recession.

It’s offical, we are in recession, Wall Street freaks out as the Fed warns of steeper interest rates as the IMF warning us of economic calamity while food inflation is 12.1%.

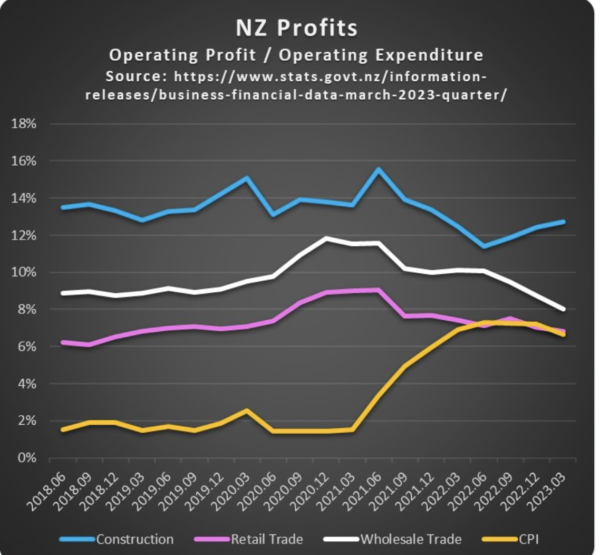

With all this happening, NZ business are quick to pretend their price gouging isn’t generating greedflation…

Inflated company profit margins not a major factor in driving up prices in New Zealand – report

Inflated company profit margins, so-called greedflation, have not been a significant factor in driving up consumer prices, according to a new report.

Business NZ – a industry advocacy group – commissioned the report from economic consultancy Sense Partners, which concluded that input costs such as materials have been the major drivers of inflation.

The report said 75 percent of inflation for non-financial businesses over the past three years had been inputs with the balance evenly split between wages and profits.

…really?

…I believe this claim by Corporations that their price gouging isn’t causing inflation is nothing more than PR spin.

First it leaves out the ‘Financial sector’ category of business because – ‘Financial firms require more complex analysis, as the volume of services consumed is not conceptually the same, which is outside the scope of this paper.’ (Under heading 1. Profit-driven inflation approach).

The second major omission is the report ignores the structure/makeup of the New Zealand business environment; it is dominated by franchises, the most obvious are Starbucks/MacDonalds/KFC etc

A third factor is the report uses averages of profit margins from 2017 to 2022 to show pre and post covid profit margins. Averages – there are hundreds of business in New Zealand, many are franchises (I just explained how profits are stripped out), that are lean and hard working. These small businesses have relatively low levels of profitability. There numbers will pull down the average for the few central owner companies who could well be undertaking greedflation but the lack of granularity in this report means we simply can’t see the greedflation on this level of data.

…the issue regarding Greedflation is that price makers who enjoy under regulated market conditions can force us to take any price.

We see this in the Supermarket Duopoly, the Banking Oligopoly and Construction monopolies!

As the brilliant Professor Wayne Hope points out…

Inflation today does not have monetary causes and monetarist solutions cannot work. Edward Miller, economic researcher for FIRST UNION, cites a US Federal Reserve study which debunks the Phillips Curve. Organised labour’s declining bargaining power weakens the relation between unemployment and inflation. Wage-push inflation growth is just not there, so why contract the economy? In New Zealand, between 1991 and 2023, union density declined from over 50 to 20% of the workforce. Clearly, today’s stunted, uneven wage growth is not going to trigger an inflationary surge. Emeritus economics professor Tim Hazeldine proposes a more plausible diagnosis:

It’s COVID inflation that was driven by a supply push from the pricing side of the market. The initial transportation logjams caused by lockdowns gave shippers—especially container shippers—the excuse to drastically hike their prices. In the confusion, many other sellers of many other products discovered that they suddenly had, as one analyst put it, ‘real pricing power’. And boy did they use it!

International research points in the same direction. For US economists Isabella Weber and Evan Wasner, evidence acknowledged by US and European central bankers indicates that “price setting by firms with market power drive inflation”. Giant corporations have the product portfolios, dominant market positions and revenue management systems to maintain margins and customers. With global reach, they are less dependent on any single national market and can shape prices. By contrast, small businesses cannot easily raise prices as costs go up and interest rate repayments increase. Creditworthiness and access to loans will therefore diminish.

Sound familiar? As Tim Hazledine would attest, supermarkets, power companies and banks are pricemakers who drive up inflation while the rest of us struggle. Most obviously, the four largest Australian banks in New Zealand collectively made over NZ$6 billion in 2022. They exploit, ruthlessly, the margins between the interest rates of wholesale money for them and the mortgage rates for captive homeowners.

…look, inflation lowered in our last quarter because of softening oil prices caused by Biden tapping the US strategic oil reserves. OPEC responded to Biden with cuts which take effect next month on top of the 25cent fuel subsidy relief coming off, on top of unprecedented 100 000 migrants on top of food supply problems impacted by the recent cyclone damage to our horticultural industry – Orr is driving the Economy off an inflationary cliff and daring Grant Robertson to take the wheel!

Orr is saying monetarism can only go so far and that the Government must use fiscal tools like raising tax to sort this out!

Price gouging corporations who have used their under regulated market dominance to milk obscene profits from NZ and are now pretending they aren’t causing Greedflation and that it’s all then workers fault for demanding more wages.

Month by month the economic house of cards gets more unstable and the rich who have benefited most keep tricking you into believing taxing them isn’t the solution, when it is.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Cuba street, worken mans club, leader of the Federation of Labour, coming out of the working mans club, with a large t bone steak, calling out to the passers bye, join the union, you can buy one of these every day.

Friday night,19 70!s Jim Knox, manners mall, coming out the workers club, that used to be their, with a raw t bone steak, waving it around, join the union, you can eat this every day.

https://www.scoop.co.nz/stories/HL2306/S00024/on-the-recession-engineered-by-the-reserve-bank.htm

This week, we got official confirmation that the Reserve Bank has finally achieved the recession it has worked so hard to engineer. The Bank has bludgeoned borrowers and households with interest rate hikes, and sought to ease wage pressure by creating recessionary conditions that are being predicted to throw thousands of New Zealanders out of work. Hold the champagne, right?

The Reserve Bank’s relentless jacking of interest rates has sent pain waves through large numbers of New Zealand households, with the worst yet to come. This pain was mis-directed in that many of the main causes of inflation (some of them located offshore) were left completely untouched by our central bank tugging and pulling at the interest rate lever.

Gordon Campbell;’s take on our measures to curb the CPI rate, only partly counting important causes, ie price of housing and rents. The economists reckon including them would spoil the purity of their figures. Bugger those. And a 1% rate is far too low, getting near stasis! What about 2% becoming the bottom and lifting the top to 4.5% remembering that it is an average, so could move from either of those figures temporarily. Then action would need to be taken but with a lighter hand, and with the minimum of interference from the state.

Consumer Price Index (CPI) (Annual % change)

Under the current Policy Targets Agreement (PTA) Mb>the Reserve Bank is required to keep annual increases in the CPI between 1 and 3 percent on average over the medium term, with a focus on keeping future average inflation near the 2 percent target midpoint.28/02/2022

Inflation – Reserve Bank of New Zealand – Te Pūtea Matua

I don’t understand why interest rates are rising and Supermarket food prices are soaring, with a Reserve Bank initiated Recession, the Banks and the Supermarket Owners are making super abnormal profits and the Lower Socio Economic Groups are left grovelling to try and make ends meet and trying to put food on the table, while they also pay exorbidant rentals to the Priviledged Landlord Property Owning Class.

Am I just thick or stupid as well ???

Can someone explain in Simple Terms why the Reserve Bank is raising Interest Rates like there is no tomorrow. I know First Home Buyers and the Lower Socio Economic Groups are not causing this Problem ???

I don’t understand why interest rates are rising and Supermarket food prices are soaring, with a Reserve Bank initiated Recession, the Banks and the Supermarket Owners are making super abnormal profits and the Lower Socio Economic Groups are left grovelling to try and make ends meet and trying to put food on the table, while they also pay exorbidant rentals to the Priviledged Landlord Property Owning Class.

Am I just thick or stupid as well ???

Bass line, capitalism, its profit, is the cancer of our humanity.

If stagflation continues, the real cause of the rising prices will be brought into even sharper relief. The unsold goods will begin piling up. Raising real prices would crush demand even further, but the falling purchasing power of the currency would ensure that a stable real price is still a rising nominal price.

Customers have a limited capacity to spend. This is the limit of pricing power, and the ceiling of the profit-maximizing monopoly price. But central bank devaluations of the currency — which have continued as real rates remain negative — can cause continuous rises of general price levels, without such limits.