Simple English: What’s wrong with New Zealand & how we fix it

There’s a simple puzzle at the heart of modern New Zealand.

We are educated.

We work hard.

We export food, energy, timber, talent.

We are not poor.

And yet:

Houses cost a fortune.

Infrastructure creaks.

Hospitals ration.

Councils are broke.

Young people leave.

Everything feels strangely “out of reach”.

It’s not a mystery of effort.

It’s a mystery of design.

Over the last thirty-five years, New Zealand hasn’t really been governed by Parliament alone.

It’s been governed by a set of fiscal and monetary rules that quietly decide what governments are allowed to build.

No one voted for these rules as a constitution.

But in practice, that’s what they became.

A hidden operating system.

If the ruler is bent, everything you measure looks wrong.

If the pipes point the wrong way, the water fills the wrong places.

That, more or less, is where we are.

The core thesis

Since govt started passing merchant banker friendly laws in the the 1980-90s, New Zealand has run under a fiscal–monetary settlement that:

• restricts sovereign credit creation

• treats Treasury and Reserve Bank doctrine as binding

• prioritises private and foreign creditors in capital allocation

• and frames public investment as “debt” rather than nation-building

The effect isn’t smaller government.

It’s reduced state capability.

We didn’t slim down.

We sold the toolbox and now rent back the hammer.

How the system actually works

(mechanics, not motives)

This isn’t about villains.

It’s incentives and architecture.

Systems do what they’re designed to do.

1. Measurement — the scales are off

Government decisions depend on measurement.

But our main instruments quietly misstate reality.

• CPI excludes land and construction costs

• HLPI shows materially higher costs for ordinary households

• Super is indexed to CPI, not wages

• productive investment is counted only as “debt”

• the state is treated like a household borrower

If you under-measure the cost of living, you underfund people.

If you treat investment like a credit-card bill, you stop building.

Measurement becomes policy.

In practice, it becomes constitutional.

False weights and measures don’t just describe the world.

They decide it.

2. Credit — the plumbing points the wrong way

The Official Cash Rate, set by the Reserve Bank of New Zealand, controls the price of money.

But private banks decide the quantity and direction.

So where does most lending go?

Houses.

Not factories.

Not infrastructure.

Not productivity.

Houses.

Which is how you get asset inflation without asset creation.

Money is water.

Right now our pipes fill property portfolios faster than hospitals.

During QE the state proved it can create liquidity instantly.

But most of that liquidity landed on bank and asset balance sheets.

So the constraint isn’t financial physics.

It’s design.

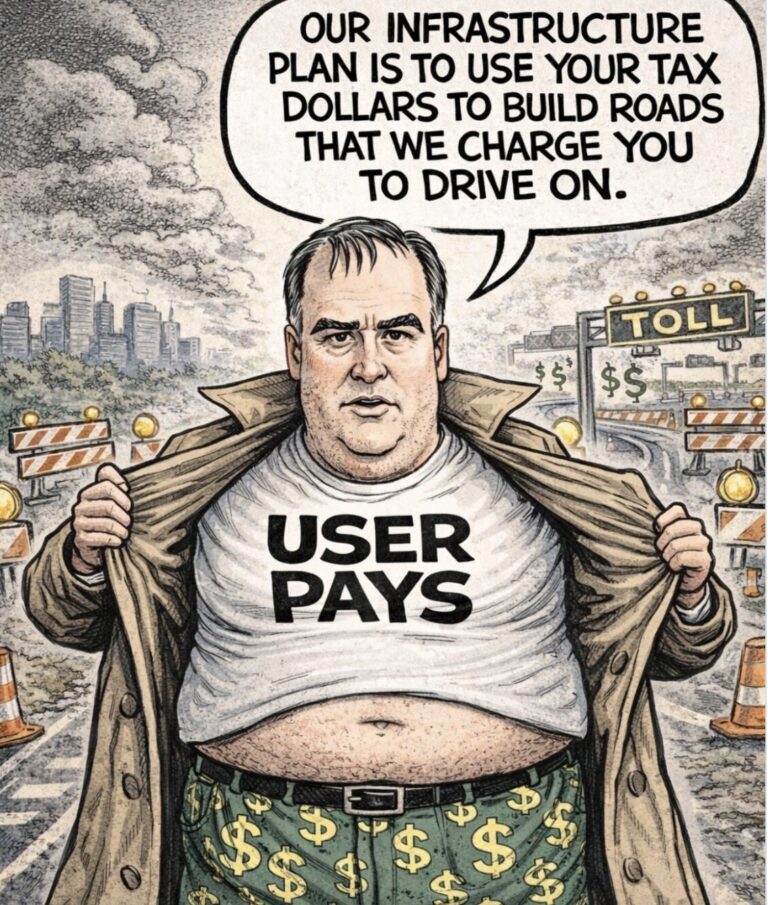

3. Assets: the commons became rent streams

• privatisation of public assets

• user-pays conversion of essentials

• weak royalty capture

• transfer pricing and profit repatriation

• offshore funding dependence

Over time, public wealth becomes private toll booths.

We didn’t lose the farm.

We just pay rent on it now.

4. Institutions: capability quietly hollowed out

• Treasury/RBNZ doctrine treated as untouchable

• New Public Management fragments delivery

• local government locked into debt vehicles

• watchdogs underfunded

• media concentrated

Before Parliament debates anything, the available choices are already narrowed.

Democracy still votes.

It just chooses from a thinner menu.

What shows up in real life

None of this is theoretical.

You can see it:

• housing unaffordability

• infrastructure deficits

• falling capital formation

• productivity stagnation

• foreign ownership of strategic assets

• rising household leverage

• intergenerational strain

This is what capability loss looks like.

Not laziness.

Not culture.

Capability.

The elephants (structural realities)

These are just observed facts:

• NZ is the most complete New Public Management experiment

• NPM struggles with complex public goods

• fiscal constraint + NPM → capture lock-in

• mortgage credit dominates bank lending

• CPI understates lived inflation

• Super indexation compounds extraction

• QE proved financial capacity exists

The outcomes follow incentives.

Systems behave exactly as built.

Proof that public investment works

Whenever the state directly mobilises capital for assets, delivery happens.

Historically:

• state housing

• rail and energy

• wartime mobilisation

Recently:

• Crown Infrastructure Partners co-invested fibre rollout

• Kāinga Ora rebuilt public housing capacity

No magic.

Just capital + mandate + execution.

When we build, we succeed.

When we outsource everything, we write reports and generate debts.

Why the system persists

Not conspiracy.

Career incentives.

• officials stay inside doctrine

• consultants work within mandates

• politicians fear ratings agencies

• incrementalism is safest

So every review tweaks procurement…

…but nobody checks the plumbing.

The architecture reproduces itself.

Design problem.

Not moral failure.

What fixes it

(restore mechanics, not ideology)

This isn’t radical.

It’s normal developmental practice used across the OECD.

Five concrete steps:

- Recognise fiscal–monetary doctrine as a de facto constitutional constraint

- Restore sovereign investment capacity via a public credit institution

- Fix measurement (CPI/HLPI/indexation) — honest weights and measures

- Capitalise resource rents into a permanent sovereign fund (National Dividend)

- Commission a full review of economic governance architecture

Plus:

• development bank / credit window

• sovereign investment fund

• resource rent capture

• beneficial ownership transparency

• funded watchdogs

• public-interest media

• national capability dashboards

Comparable to institutions like KfW or Norway’s sovereign fund.

This isn’t revolution.

It’s maintenance.

Transition

Year 1:

• measurement review

• development bank pilot

• windfall capitalisation

• capability dashboard

Term 1:

• scale infrastructure lending

• accelerate housing

• fix indexation

• capture resource rents

No shock therapy required.

Just change the rules that quietly steer outcomes.

In plain terms

We didn’t run out of money.

We ran out of permission.

We let accounting rules pretend the government is broke while banks create credit all day.

We called investment “debt” and speculation “growth”.

Then we wondered why nothing gets built.

History is clear:

When the state uses public credit to build assets, wealth compounds.

When private credit dominates, liabilities compound.

One builds bridges.

The other builds mortgages.

Conclusion

New Zealand’s constraint isn’t talent or effort.

It’s design.

Credit, measurement, and fiscal doctrine quietly limit what elected governments can do.

Fix the scales.

Fix the plumbing.

Restore the toolbox.

Then wealth builds life again.

Which is how a normal country works.

Tadhg Stopford is a historian and teacher. Support change by purchasing your CBD hemp CBG at tigerdrops.co.nz

Three reasons pictured above, straight off!

Restore a 21st Century Ministry of Works, govt owned, govt run with a govt minister responsible.

“The Official Cash Rate, set by the Reserve Bank of New Zealand, controls the price of money.

But private banks decide the quantity and direction.

So where does most lending go?

Houses.

Not factories.

Not infrastructure.

Not productivity.

Houses.

Which is how you get asset inflation without asset creation.”

Countryboy was correct all along and this capitalist coalition promote the above.

What an absolute brilliant blog Tadhg. One of the best we have seen on TDB.

Interestingly everything you have said is opposite to ACT policies and the way Willis runs her finance portfolio.

“None of this is theoretical.

You can see it:

• housing unaffordability

• infrastructure deficits

• falling capital formation

• productivity stagnation

• foreign ownership of strategic assets

• rising household leverage

• intergenerational strain

This is what capability loss looks like.

Not laziness.

Not culture.

Capability.”

IT

We Work. They Own. How Rent Took Over the UK

We Work, They Own. How Rent Took Over the NZ

https://www.youtube.com/watch?v=BBC9eeDRw6Q

Rent in the UK ( NZ ) isn’t just expensive anymore.

It’s doing something else.

In this video, we break down how rent stopped tracking wages, why the housing market never corrected itself, and how a growing share of working people now spend months of their working lives each year just paying rent.

Using real data from HMRC, the ONS, and long-term housing trends, this video explains how the UK shifted into a system where owning property became more profitable than working — and how that change quietly reshaped the economy.

This isn’t a story about bad individuals.

It’s about incentives, policy choices, and a market that no longer functions like a normal one.

When a basic need disconnects from the ability to pay, the consequences spread far beyond housing — affecting spending, entrepreneurship, family formation, social mobility, and political stability.

This video explains how that happened, why it hasn’t fixed itself, and what those rising rents are really doing to Britain ( NZ )

Plus unaffordable house prices for our youth.

It’s awesome to read pieces like this that critically examine the root cause of what has gone wrong in this country instead of fighting over what sort of band aid to patch up the gaping wounds.

I think however you need to look at the tax system as well. Why has 1.2 trillion in capital gains on residential property alone over the last 20 years been left untaxed. Why can billionaires own a super yacht in an offshore (tax haven) company and then lease that boat back and deduct those payments against taxable NZ income. Why is there no tax on wealth; instead the focus is on labour which devalues labour and over values capital.

I like the way you look at the measurement of CPI as it is crucial to the design of this system. CPI does actually include construction costs, as new builds are included in the CPI. It does however exclude the cost of land, the cost of existing homes and the cost of servicing a mortgage. All of these items were removed by Bolger and Shipley in the 90s. And the question should be asked, why.

This lower than actual (research shows CPI as calculated now is half what it would be if calculated as in the 70s) CPI means more than reduced super payments. Most wage increases are tied to CPI. But the biggest factor is that a low CPI means interest rates can be kept low (by the supposedly independent RBNZ) even in the face of a property boom and so there is no means to reign in out of control housing costs through monetary policy.

This was by design, as it happened the world over, but is is immoral as the intent was always to value capital and demean the worker though reduced real wages and ever increasing rents. Workers are now bottom feeders, not productive units in a sustainable society.

The system is designed to make the wealthy ever richer and the workers ever poorer.

The end result of the current system will be the 1% hiding in their mansions while the 99% live in poverty with a million homeless .The 1% will soon starve to death as well because they live in stockades and supplies will soon run out and services will have failed long before that .All the wealth they have stolen over the years will buy them nothing because there will be nothing to buy .

You sound a bit like the fifth chapter of James “Look here, you rich people: Weep and groan with anguish because of all the terrible troubles ahead of you. 2 Your wealth is rotting away, and your fine clothes are moth-eaten rags. 3 Your gold and silver are corroded. The very wealth you were counting on will eat away your flesh like fire. This corroded treasure you have hoarded will testify against you on the day of judgment.” NLT