GUEST BLOG: Bryan Bruce – The Wind In What Wallows

Friday Satire 24/5/24

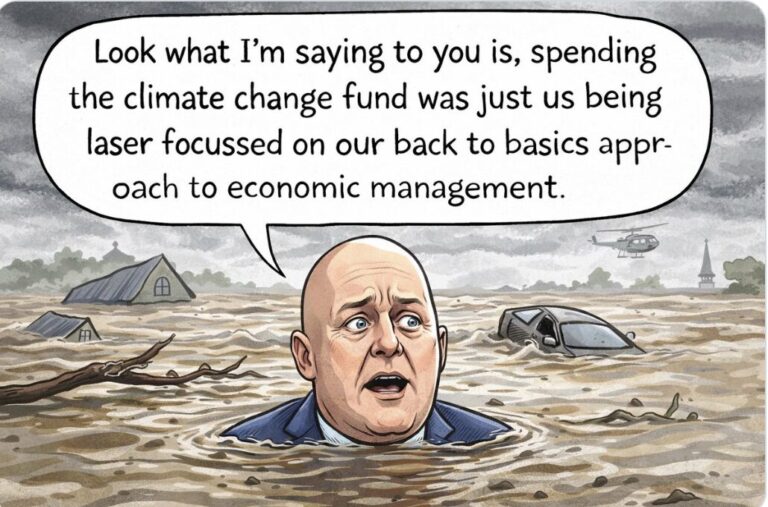

Mining is “back in business” under the new coalition Government, Resources Minister Shane Jones says.” TV One News 23rd May 2024

Toad sighed. He was looking out of the window of number 4 Beehive Row at the big shiny digger he had been given by Ratty, Mole and Badger last Christmas, but he hadn’t been allowed to use yet.

“It’s not fair!” he grumbled as he picked up the phone to call his best friend in the Cabinet.

There was a buzz and a click and then a pompous voice said.

“Mole speaking!”

“Is that you Boss?” asked Toad.

“Toady old chap. How’s tricks? Sorry if it’s a bit noisy my end but I’m at the races. How can I help?”

“Boss I just want to know when I can start playing with my new digger. It’s been six months now and I really, really, want to go digging for coal on the Westcoast and gold, gold gold!!! in the Coromandel!” Toad whined.

( At this point The Writer would like you to imagine the sound of horses galloping towards the finish line and a crowd cheering them home.)

“Sorry Toady, but as I explained, you’ll just have to wait ‘til we get the

the Resource Management Act changed…GO! GO! YOU BEAUTY!!!

…Oh sorry Toady …”Muldoon’s Boy” just came in at 30 to 1! …

Look mate don’t worry, Badger and Ratty are on to it! They’re pushing through the Fast-track legislation even as we speak! You’ll soon be in charge of Resources and be able to do whatever you want in the Wild Wood.”

“But…”

“Just be patient, there’s a good chap. Watch some of your porn videos or something to pass the time. Got to go now and pick up my winnings.. ‘bye!”

Click!

Toad felt peeved.

He looked out the window again at the big shiny digger and thought.

“What harm can it do if I just start it up?”

So he did.

And no sooner had he turned the shiny ignition key on the even shinier dashboard, than the gigantic machine roared and hissed into life.

“Poop! Poop!” shouted Toad (in that manic way he always does whenever he gets excited) and began pulling at levers and pushing buttons to see what they would do.

Suddenly the digger spun around on its axis and lurched towards the Beehive with its huge shovel snapping up and down like the jaws of some giant prehistoric creature gnashing its enormous teeth.

“Poop! Poop! Poop! Poop!!” yelled the delirious Toad as the security guards scattered before him, frantically waving and shouting for him to stop.

Just then Ratty, who had been working late on a yet another devious scheme to make rich people even richer, looked out his 11th floor window to see what all the fuss was about.

When he saw the chaos that was unfolding below him, he screamed out at the writer.

“Stop! Stop! I don’t like this Friday Satire at all! It’s terrible l! Stop imagining it at once!!”

But The Writer, who was an elderly gentleman, pretended he was deaf and allowed the Toad, puffed up with the power of his new digger, to demolish not just the Beehive but the whole of parliament buildings!

(But don’t worry children, no one got hurt because this is just a story and there was no one in the building that afternoon except Ratty who, when he jumped out of his 11th Floor window, saved himself by using inflation to cushion his fall. )

Next day, when Badger returned from his cuddle up trip to China and saw all the damage Toad had done (especially the remains of his newly decorated office scattered all over the parliamentary lawn) he looked scornfully at the amphibian offender and shook his head.

“Toad…Toad…to think we trusted you to act responsibly with the powerful machinery we gave you. Whatever were you thinking?”

To which the Toad pleaded:

“It wasn’t me…The Writer made me do it!”

At which the Badger spun around, shook an angry fist at the writer (who had been watching all the mayhem unfold from the other side of the page) and yelled:

“What is the meaning of this outrage!!??”

To which the writer (and I have to say given the circumstances), very politely replied,

“Well Badger, your buddy Toad here has been threatening to dig up the home of my good friend Archey’s Frog on the Coromandel where he’s lived for the last 200 million years and I just wanted you to feel what that might be like.”

At which Badger huffed a huge huff and shouted:

“And YOU call that Public Interest Journalism!! I’m glad we cut off your funding! You hear me??… Glad!!”

“Really?” said the writer.

And with a quiet smile pressed “publish” on his laptop.

Bryan Bruce is one of New Zealand’s most important and respected documentary makers. His work is available on bryanbruce.substack.com

That was a very moving story. But having demolished the Beehive we won’t see Toad getting his moment of glory as he thrusts into the room where the weasels roam shouting ‘Death or glory!”.

But Toad might like to have another go – try the meeting below. I don’t trust these sticky-fingered gits not to interfere with our monetary system at the bottom end, to the detriment of ordinary people. So will M1 and M2 remain in their present forms? Banks may have to deal with reality money more than they like, but coins etc are a good way of getting distribution of some of the monetary assets through to all. And enabling small purchases with minimum recording.

https://www.scoop.co.nz/stories/PO2405/S00134/finance-and-expenditure-committee-meeting-on-cash-use-digital-cash-and-community-cash-trials.htm

Are M1 and M2 really money?

The Relationship between M1 and M2 Money. M1 and M2 money are the two mostly commonly used definitions of money. M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks + saving deposits. M2 = M1 + money market funds + certificates of deposit + other time deposits.

Measuring Money: Currency, M1, and M2 | Macroeconomics

lumenlearning.com https://courses.lumenlearning.com › chapter › measuring

Don’t forget about money supply measures M1 and M2

TwentyFour Asset Management

https://www.twentyfouram.com › insights › dont-forget…

25 Apr 2024 — M2 includes M1 plus small denomination time deposits and retail money market funds.

Why do economists make a distinction between M1 and M2?

Economists make a distinction between M1 and M2 because the elements of M1 include liquid assets only, while M2 includes M1 plus various kinds of near money, like savings accounts and money market mutual funds.

Why do economists make a distinction between M1 and M2? – Quizlet

quizlet.com https://quizlet.com › explanations › questions

Why would a person want assets with liquidity?

Liquid assets, however, can be easily and quickly sold for their full value and with little cost. Companies also must hold enough liquid assets to cover their short-term obligations like bills or payroll; otherwise, they could face a liquidity crisis, which could lead to bankruptcy.

Understanding Liquidity and How to Measure It – Investopedia

investopedia.com https://www.investopedia.com › terms › liquidity

Further: https://en.wikipedia.org/wiki/Money

Very, very good Bryan

So Pork is going to increase exports by a paltry 2 billion a year WOW .How is he going to get this coal across to Lytelton port when his buddy Brown is going to shut down rail .The last National government presided over the collapse of coal corp and its massive expansion of its cokeing coal mine .Has Pork ordered the 500 new wagons and 20 new Locos to pull them ,or are the mining companies going to supply their own as they do in Queensland .I would think the return to NZ inc will be very small when the net costs of this is taken into account .He could make the local council spend 10 billion to construct a massive off shore ship loading facillity as he would not be expecting his mining buddies to stump up for such things .