– Advertisement –

Similar Posts

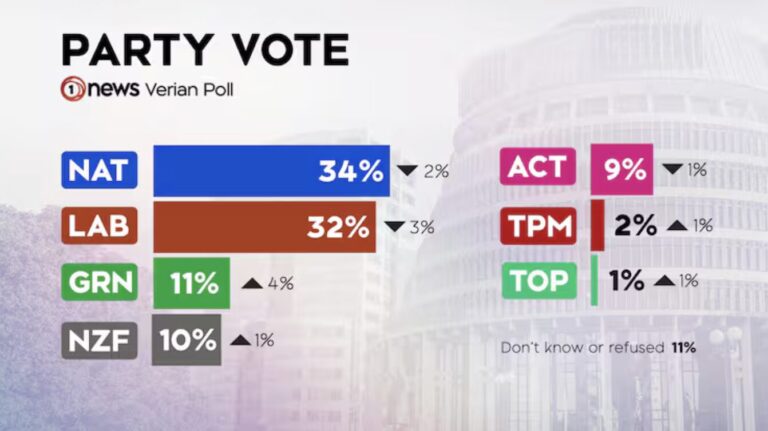

BREAKING: 1News Verian Poll – Right Wing Government Hold Power

The latest 1News Verian poll confirms what many on the Left feared: the Right bloc remains competitive and within striking…

Maybe if Eru hadn’t burnt all the Treaty Principles Referendum good will we wouldn’t be facing Winston’s attack on the Māori Electorates?

As Winston Peters targets the Māori electorates, fractured protest unity may weaken resistance. Is Aotearoa facing a majoritarian reset?

MEDIAWATCH – Damien Venuto surprised free market capitalism cheerleaders might be wrong

Are media cheerleaders ignoring cracks in New Zealand’s economy? Rising unemployment, weak retail and stalled infrastructure suggest deeper trouble.

The tragedy of bullied Kayden Stanaway, broken masculinity and why he shouldn’t have been sentenced so harshly

New Zealand’s justice system has handed down its sentence in the Grey Lynn feud shooting that left one young man…

Chippy shows Labour is listening on Indian Free Trade Agreement

Chris Hipkins outlines Labour’s conditions for supporting the India Free Trade Agreement, including migrant worker protections and transparency demands.

Do you really trust Shane Jones with Fast Track Powers to push a Gas facility that will only cost us while making climate change worse?

NZ First wants ministers to regain Fast Track powers as a $1B LNG terminal is rushed through. Is this energy policy — or corporate welfare?

Anomic frustration caused by the rapid spread of neo-liberal financial globalisation is starting to throw up all sorts of strange phenomena like political polarisation throughout the West, Trump, Sanders, Brexit, the Arab Spring and so on. Look for plenty more to follow, usually followed by buyer remorse, as whole swathes of Western society thrash round trying to find someone to blame for the collapse of their personal hopes and ambitions, (the underpinning basis for the post-war social contract). Maybe eventually the laws of grieving will kick in, but massive disruption, and perhaps some real damage will be done in the meanwhile. (Many already feel they have literally nothing to lose.)

Actually to blame is the industrialisation of the emerging powerhouses of China and east Asia, the concentration of lightly regulated financial hubs in the West and the puddle shallow, short-term-profit-obsessed, growth model of modern capitalist philosophy.

Anyone want to take those on? Good luck.

Cant argue with that NICK,

WE LIVE IN A SHALLOW TIME NOW.

WHEN LIFE IS CHEAP NOW.

WHERE WHEN I HAS RAISED IN THE 1940/50’S, LIFE WAS PRECIOUS.

These four issues CO2 emissions/global warming/ sea ice/land ice portals show how sick the planet is today with a rapid increase of CO2 and temperature with shrinking land & sea ice is doom for future generation’s with satellite methane gases leaks detection and acidification of our oceans dying fish stocks and loss of coral habitation.

Our criminal Corporations are killing our future habitation!

http://climate.nasa.gov/

Interesting analysis and discussion from RT

‘Brexit: Goal!’

https://www.rt.com/shows/crosstalk/348295-brexit-goal-uk-eu/

“Well it’s happened! Citizens of the UK have decided to call it quits. The decades-long debate whether to remain part of the Europe Union has been settled. Brexit is a reality. What’s next?”

CrossTalking with Xavier Moreau, John Laughland, and Alexander Mercouris.

‘Keiser Report on Brexit’

https://www.rt.com/shows/keiser-report/348318-episode-max-keiser-932/

“Max and Stacy are joined from New York City by Mitch Feierstein of PlanetPonzi.com to dissect the economic, monetary and financial consequences of the ‘shocking’ Brexit vote – Britain votes to leave the European Union.

The Keiser Report team look closer at the market sell off and ask if it’s part of a wider market weakness set in motion months ago, then examine the role of the media, much as in the rise of Donald Trump, in simply failing to understand the ‘disposable’ voters left behind by globalization. Mitch shows a chart proving that the biggest pound sterling sell-off was actually in 2008 and the currency has never really recovered since then. Finally, they look at the opportunities presented by panic selling.