Where does National really want to take retirement income policy?

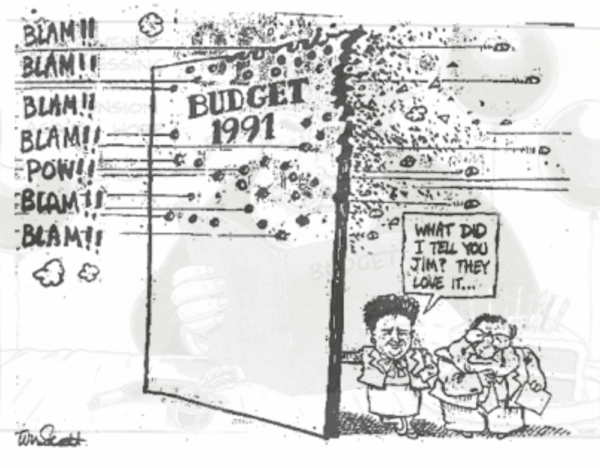

National’s retirement income policy ambitions are becoming clearer. In the early 1990s, as part of Ruth Richardson’s clever plan, the burden and risks of retirement were to be shifted to the private sector. She put in place legislation to change NZ Super into a welfare benefit- with a draconian income test while all the tax incentives for private saving under Roger Douglas had already been removed. For a brief time, NZ had cheapest, meanest, elder poverty creating, pension system in the OECD.

The shock and horror that followed meant National had to backdown, but recent policy announcements make me think they are heading in the same direction as in 1991. While meaningful incentives for KiwiSaver are all gone, Luxon promises to force private contributions higher to match Australia’s 12%.

Matthew Hooton says Luxon’s KiwiSaver move is good, now raise the Super age, and goes on to argue that KiwiSaver changes already announced in this year’s Budget justifies moving the age up by three months a year from April 2026. He can’t be serious surely: the people reaching 65 for the foreseeable future wont benefit from Luxon’s changes.

While National is unlikely to upset a large number of people by a rapid increase in the age, it does intend saving costs. Despite Luxon’s current pseudo-support of NZ super, extra funds in KiwiSaver will eventually be offset against the state pension just as in Australia. That’s their long game plan. Welcome to 1991.

Much of the commentary is paving the way for National. New Zealanders are particularly susceptible to being told Australia does things far better. Erik Frykberg Listener (29th November) portrayed the aborted Labour’s compulsory superannuation scheme as the biggest mistake that Muldoon ever made. Using the lens of self-interested fund managers, he suggests that if the scheme had continued, we would be rolling in a trillion plus dollars of retirement wealth. All of the real resource limitations in the NZ economy would be magicked away. And, if not the envy of the rest of world, at least the economy would be doing as well as Australia by now? Yeah right.

Sure, some people would do well personally, but conveniently ignored, more saving in one form can mean less saving in another. And even if there were extra saving there’s no guarantee that it would equate to better and increased real investment in New Zealand’s social and economic assets. Look no further than the NZ Super Fund where the large pot of paper assets, set to reach 35% of GDP by mid-century, largely represents investment in other countries’ share-markets.

Lacking in the story is what happens when you apply the lens of retirees who are not fortunate enough to benefit much, if at all, from the employment-related contributions as they don’t have a history of well-paid full-time jobs.

Before the introduction of NZ Super in 1976, there was growing elder poverty especially affecting women. Some of us remember the annual campaigns to provide food parcels to old age pensioners. At 60, women might receive a jointly means-tested old age pension providing a token of support for their years of domestic and childrearing duties or low paid work. Or they could wait for an equally inadequate, taxable universal super at age 65.

Under Labour’s 1974 compulsory scheme, the plight of the already retired and about to be retired were ignored. As the scheme would not mature for 40 years, elder poverty was set to grow to even more uncomfortable levels. Even when mature, many groups, women, Māori, Pacifica, self-employed, long-term sick and disabled would do poorly out of the scheme.

The Listener article refers to how wonderful the Australian compulsory scheme is and quotes average balances at age 65. But the average is strongly affected by people with very large super balances, so median is a better measure. The Association of Superannuation Funds Australian (ASFA) report for those aged 60 to 64, a male average superannuation balance of A$395,582 but a median of only A$219,773. For females the average was A$313,360 and the median A$163,218.

While 50% of women aged 60-64 who belong to the scheme have less than $163,218, 25% have less than A$49,200 in spite of Australian tax incentives and compulsion. The top 10%on the other hand have a median of around A$800,000 so there is a vastly unequal outcome.

If those who don’t have an account are included, the median would be much lower. ASFA stats show ‘Around 23 per cent of females aged 60-64 have no superannuation compared to 13 per cent of males’.

We should abstract from the politics of what Muldoon did and look at benefits of where we ended up. For the past 50 years we have enjoyed the poverty-reducing effect of a basic universal taxable pension set in relation to wages. For many women of my mother’s generation, it represented their first independent income since marriage. It has been a great equaliser, very efficient to operate and extremely popular. It has underpinned the voluntary work of older people that is critical not onl for young parents, but in the Arts sector and charities of all kinds. The steady spending of older people who have a reliable basic income helps stabilise the economy in times of recession.

Now we have Luxon reversing ‘Muldoon’s mistake’ and raising the total contribution KiwiSaver to 12% of earnings. Making us more like Australia a jointly means-tested superannuation is surely the next logical step after a successful re-election? Be careful what you wish for and remember while well-designed contributory schemes have their place, they deliver the most for high earners in secure well-paid work while leaving others further behind.

Susan St. John – Honorary Associate Professor, Pensions and Intergenerational Equity (PIE) hub, Economics policy Centre, University of Auckland.

your arguing against reality ( the failure of neo-lib economy’s EVERYWHERE ), that’s a undeniable fact.

So explain why I should waste time with a vicious sow like you being pig ignorant…..

It might make you Sad’a and Mad’a Ada ,,,, but I enjoy making fun of ugly angry things like you.

Be Awake and not a woke ,,,, give the sick some stick ,,, @ Ada shes Viagra proof :0

KiwiSaver is just a cut down version of the super scheme that New Zealanders voted to reject in 1997.

ada sounds like cactus kate ,,,,, both get more bitter and mean every time they look in a mirror.

You don’t have to look in the mirror so much ada, unlike other unfortunates who are sometimes forced to look at you ,,, and at the end of the day Ada’s you’ve only ended up with a face that matches your personality ……

Ada should buy herself the tee-shirt,,, “ugly on the inside too”,,, it would be a rare example of honesty from her.,,,,

Her other one could say ” Viagra proof” :0

You don’t have a counter-argument, do you B Awakesky?

You only have abuse and that’s why the Left can’t challenge neoliberalism.

Here’s the thing Ada, National want Super to be user pays, always have been. They want tax payers money to be used as a return on investment to their donors, always have.

Wow! Not sure this dairy owner will retire anytime soon. So much better under National. Now where is that corrupt National dairy association businessman who sided with National now? The silence is deafening. Come on Trevor things are so much better under National…insert Tui’s ad here…

https://www.stuff.co.nz/nz-news/360906445/14-year-old-arrested-after-staunch-christchurch-dairy-owner-stabbed-robbery

It is so obvious this is the groundwork for getting rid of NZSuper.

In addition we are being told how unaffordable NZSuper is as the population ages, and people have fewer children. It’s economic bullshit. So much handwringing over NZSuper, -nil handwringing over the cost of climate change.

This is theft from the younger generation. By the time my children retire there will be no NZSuper. This is more neoliberal con, carefully moulding our beliefs. This is their whole individual responsibility idea, to save for your own retirement. The trouble is , it entrenches inequality, as poverty in your working life, makes for poverty in your old age.

We are supposed to pay for our own retirement- how about BigOil pays for climate change?

+1,000,000,000

The lie that “we can’t afford this or that” is tiresome.

Near on $NZD30 Billion ……. yep, $30 Billion……flows out of New Zealand each year as profits for overseas parasites who’ve sunk their teeth into our economy.

BTW, the CoC are encouraging more of this and want to sell even more of our assets.

So there IS plenty of money about to fund all sorts of things, IF our economy was managed differently ie. owned by, and run for the benefit of, workers.

Pure and simple folks. Read Marx. Throw off those shackles and drop kick the parasites (and their apologists like Ada) to touch.

Those parasites and apologists like me are the ones who are the most capable and we can support ourselves throughout life. We have choices.

So do you really want to kick out the most capable New Zealanders?

TBH, you won’t get the chance because they are already fleeing the basket case that is NZ.

“Those parasites and apologists like me are the ones who are the most capable”…..

Just gonna let your overinflated egotistical self assessment hang there.

It says so much (but not what you think).

Go on, Jase, quit your job as whizz financial genius, or corporate lawyer, or surgeon, and step up to bravely lead NZ into a Marxist revolution.

Sacrifice for The People, Jase!

The sheeple need your leadership! The buses will still be driven as you hide out in the mountains.

The soldiers died for you and they get nothing and they have no choice with this corrupt right wing government…so no, we don’t all have choices, that is flawed ideology.

https://www.nzherald.co.nz/nz/politics/government-could-legislate-to-overturn-court-ruling-saving-billions-in-veterans-support-payments/premium/P6EPWP333JHZJMHMHCHNTBMQYA/

Now how much can we save if we choose to not have you in our lives Ada?

Your whataboutary is not the strong response you hope it is.

Theoretically it doesn’t matter whether employee or employer pays, the employee is likely to have lower wage rises as a result. KiwiSaver is a private savings scheme with next to no tax incentives, it is the gateway to again treating NZ Super as a welfare benefit aka Australia. I have argued elsewhere we need to recognize that there is already a high wealth and income divide among the retired- but tweaking NZ Super with a version of the surcharge would be the way to make it fairer and take the pressure off calls to raise the age aggressively.

Honestly, I loathe libertarianism. Whatever libertarians do always seems to turn to custard, because they are not very bright on the whole.(who can forget “what’s a leppo”) And when you do get a halfway competent one – things still turn to custard for those of us who haven’t got a lot of money.

Big difference to what Luxon is spouting and the AUS system .

First the 12% is paid by the employer not half and half as is Luxons proposal .

Second the 12% is not part of the employees weekly or hourly income it is 12% on top of that income .

Third the employee is then allowed to pay as much as they wish to top up their account .

Fourth Luxons smoke and mirrors is allowing the employer to use the increased amount as a wage increase so straight away the Luxon plan is a fail .

I was living in AUS when Keating bought in the super scheme .They started at 3% but employers baulked so he raised it 3% every year until they got on board .Clearly they were thick and it took 4 years for that to happen .

So the Luxon plan is a tax grab against the employee .Along with a real wage cut of 6% to pay the employers share .In reality the employee is paying the whole 12%.

Exactly.

Typical National party rout.

50 years on, life span has increased massively, the entitlement age is still 65 and no means testing.

Yeah, great scheme, why would you ever change it!

While I accept that change is necessary, the problem is that any change by this government will likely benefit those who already have sufficient means and penalise those who have not had regular, well-paid work throughout their working life. You will always find individual cases that seem undeserving of any universal scheme, so it’s unlikely that all people will be satisfied with any pension changes but with the people developing and in whatever government that makes changes mostly being in secure financial situations I do not see them having protections for low income people.

Why would any young person stay in NZ to have the privilege of working and paying ever higher taxes for the vast number of retirees?

Those young people are voting with their air tickets. Change will be taken out of the hands of the politicians by working age people refusing to remain and take part in an unaffordable scheme.

Air tickets to escape the crap Luxon govt

Decent well well-paid jobs, affordable housing and no cost-of-living pressure would encourage young people to stay. We do not have the luxury of digging billions out of the ground like Australia and what Shane Jones is proposing is not going to help the working people so we need skilled workers and lots of value-added exports to pay decent wages & get the economies of scale required to reduce living costs. People have been talking about this for decades but all we ever get is something to increase profits for a few at the top while the country goes backwards.

Lifespan might have increased, but there are still jobs where people’s bodies have more or less broken down at age 65 or even earlier. So why would we change it?

Yes Ada all those living longer with buggered joints and dementia should still be working

Not for concreters or most tradies Ada. Let’s not forget, as life span increased so did retirement from 60 to 65

However every politician upon retirement should receive no pension as they are already gifted a lifetime payout as part of a politicians package after working as a politician for a certain amount of years.

The reason you wouldn’t change it is that people’s working bodies are worn out at 65.

Two responses to the posters who say physical labour bodies break down before 65:

1) Have you never heard of people doing something different then the job they got straight out of school and did for 40 years? You write off all those physically worn-out people because you don’t believe they are capable of doing anything new.

2) A disability pension at the same rate as Super – for those too broken down to get any form of work.

whats your point

that the entitlement age for NZ Super can and should go up, for the great majority of people.

Fuck you’re an idiot

Non a realistic argument on your behalf Ada.

Who wants to be disabled and determining others life work choices is certainly not your decision to make.

To the contrary – others claim that the 65 year olds are too disabled to do any work, so why not recognise it is the reality.

And if others have to pay your income, they certainly get a say about your work/life choices. We already do that for working-age beneficiaries, remember?

I thought you made a reasoned statement a while ago Ada but that was random. We do need to find a way of running things that enables everyone to have a basic life, and in return do something that benefits society, so we don’t return to Industrial Age and before type poverty. That would be so gross after all our smart education.

Your argument in fact Ada indicates no need for a retirement end date, just keep changing jobs until you drop dead and then no longer a burden .

I like your thinking.

I knew your compassionate self would Ada( sarc).