OCR rate cut is desperation not a turning point

The OCR Cut is not turning the corner, it’s a sign of panic and desperation!

Put aside the bullshit cheerleaders for capitalism who populate our media with optimistic fairy tales aimed at boosting the animal spirits of the free market and look at how bad the economy really is…

RBNZ says job-finding rate is worst in 30 years but businesses are hesitant to fire staff

…once our new ice queen Reserve bank Governor with glacier melt for blood takes over, watch how she starts pushing interest rates up. She has already stated how extreme she intends to be on this front with a laser like focus on inflation.

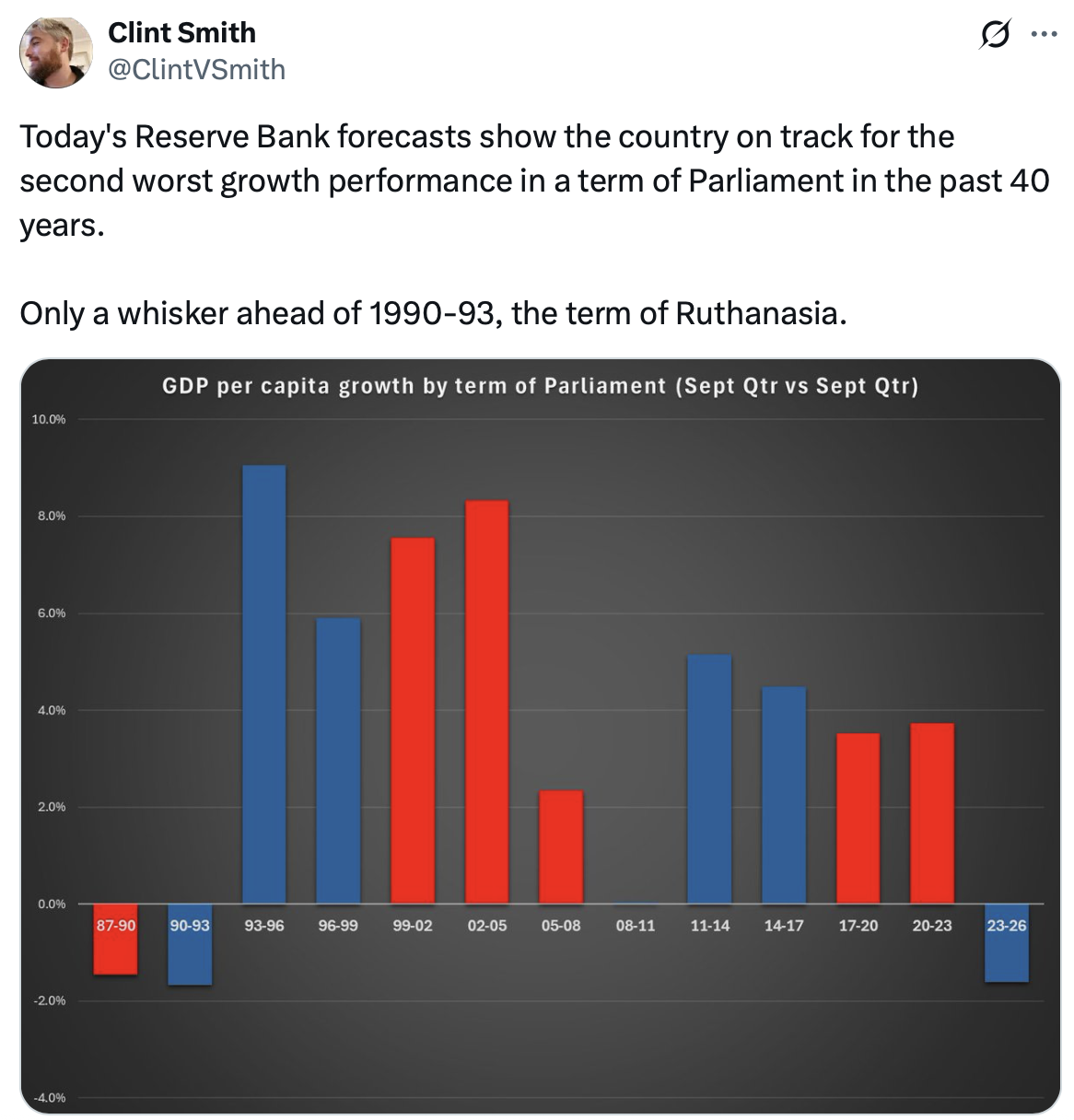

We have the worst economic growth since Ruth Richardson!

The Government has done such a terrible job with the economy, all they have left is whatever monetary easing they can squeeze out.

This is desperation, it isn’t an economic plan.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

The messaging around the OCR cut really does feel out of sync with what’s happening on the ground. When job-finding rates are at 30-year lows, a rate cut isn’t going to magically restore confidence—it just highlights how few tools are left in the box. The bigger issue seems to be that businesses don’t trust the recovery narrative anymore, and that’s a harder problem to fix than adjusting interest rates.

A lower NZ dollar is good for exports. Economics 101.?

The NZ dollar has lost 3% of it’s value in the last 12 months.

Good work Nicky and Flux-up.

The only way to repair that is to increase long term Crown revenue, not one off fire sales of whatever is left to sell (sweet fuck all).

Economics 101 seems to elude Nicky. She should probably stick to her Regency period fiction.

‘The Government has done such a terrible job with the economy …’

Hard to deny. But let’s be honest, what government could do better. Sure, a CoL can improve the social settings, that’s what they do best, but “the economy” is big structural stuff, and neither side appear to have much in the way of a way forward. Old paradigms are never easy to shift. I see the current feel good stories and upbeat sound bytes point to an entrepreneur-led recovery, niche business and smart operators on the international stage playing a key role in the global market. While that’s just peaches for Rocket Lab and the new kid on the block, Halter, let’s see if we’re up to it in any meaningful way, or just fall back on same old, the primary sector, dairy, logs, fish, apples and kiwi … and tourists. It’s what we do … along with selling houses to each other at inflated prices. At least farms, forests and orchards and airports offer local employment – even if in some cases the workers are imported.

… and to add, not to mention the plans of Business NZ to open the immigration floodgates and double the population by 2060. That surely will improve the economy! Not.

It’s been the acid test of austerity policies – they went downtown, and trashed the economy.

I only hope Labour are learning the lesson of this & Starmer & abandoning neoliberal fuckwittery for good.

Cutting interest rates stimulates the economy which is on the cusp of material improvement.

Why would savers invest in businesses either start up or established to see the business they put their cash into sold off to corporate vultures off shore.

If our Government had the balls to stop this corporate drain I may be interested in investing.

Examples, Silver Fern Farms, Alliance, Fonterra, Rocket Lab, Xero and numerous software and gaming startups. If you watched Jack Tame on Tuesday night you would have seen the man from Icehouse pushing his investors. I noted he didn’t say how many of the startups he’s been involved with are still functioning as NZ companies.

The man from Auckland ports bleating on about the huge increase in cars coming in as a sign of an improvement the day after Bishop cuts the duties because dealers can’t sell cars. Smoke and mirrors. The smoke from dirty cars.

Many wombles seem to consider reductions in Official Cash Rate as a reward for a well-managed economy.

It is instead a clear indication that our economy is in deep shit: a desperate attempt to increase consumer spending.

Our country is being run by ideological idiots.

Cutting interest rates a sure sign the economy is buggered .All good for the consumer perhaps but savers are nearly getting zero when inflation is 3% so are losing money daily .

Interest rates are a problem child of economics. From what I can recall, the interest cost must originate from an increase in the money supply, which is also a potential issue. Yes, it’s difficult for savers to survive on low interest rates; however, if they invested in productive enterprises that provided jobs along with productivity gains by producing things, society would be better off than by the focus on property lending, which results in distorted perceptions of value and the rise in inequality, which is a major cause of issues in society today. That’s a long way of saying that I agree with you regarding the economy being buggered, but it doesn’t worry me if savers get less interest.

It’s not good for consumers (I guess you are thinking they pay less for the money they borrow to survive) as they now rely on imported goods (NZ stuff is far too expensive) and lower interest rates are driving down the NZD leading to higher cost of imports.

The only people benefitting are property investors. That’s all this government are trying to do. Kick start the housing market and create wealth for their property investor benefactors.

Their plan will fail however, as although property investors benefit from lower interest rates and tax free capital gains, they are going to suffer from exponentially increasing rates and insurance as well as declining rents as immigrants learn to shun NZ for real economies.