Newshub-Reid Research poll: Kiwis support the Government introducing wealth tax

We asked in our latest Newshub Reid Research poll: Would you support the Government introducing a wealth tax? A clear majority, 53.1 percent, said yes, while just 34.7 percent opposed it.

Nationals 3 biggest donors (Hart, Mowbray and Bolton) have a combined net worth of 15 billion! The Bottom 50% of NZ has 23 billion.

The top 5% of NZers own roughly 50% of NZs wealth, while the bottom 50% of NZers own a miserable 5%!

Are those stats that live up to the egalitarian dream of NZ?

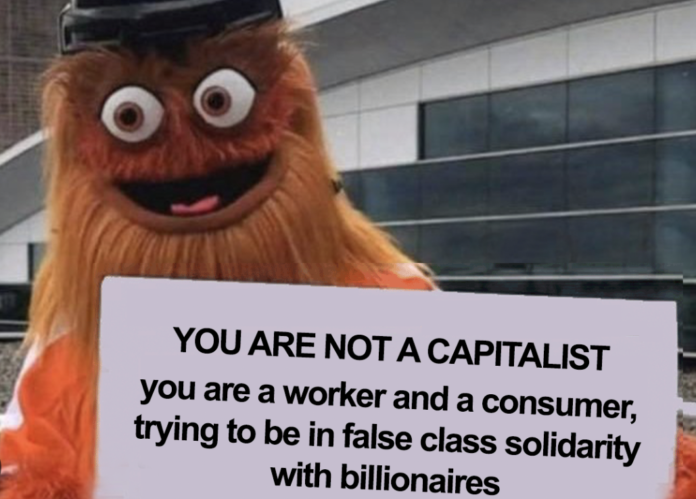

We need to remove the tax yoke from workers and put it on the rich pricks who have rigged NZ Capitalism in their favour.

The Financial Transaction Tax is that solution and would raise so much revenue we could lower GST!

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals with over $50million each, why not start start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry to pay their fair share before making workers pay more tax!

The Green Party wealth tax will hit too many home owner occupiers who are just hard working kiwis, a Financial Transaction Tax on the other hand hurts the speculators and hardest.

The Maori Party are talking about a Financial Transaction Tax this election, I look forward to their announcement on this.

If we want to rebuild our social infrastructure and physical infrastructure, we need more revenue and that revenue shouldn’t come from workers, it should come from the speculators.

We need to be kinder to individuals and crueller to corporations.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

The bigger question is how the teachers union and NZNO continue to be donors to the Labour Party when conditions for their workers has never been worse and the outcomes in their respective fields even more so.

The CTU continues to have this unhealthy relationship with Labour. They have always promoted Labour although back 2000 – 2006 the Greens Industrial legislation policy was way ahead of Labours!

I don’t think NZNO are donors to the Labour Party, but the overall absence of union leadership (apart from UNITE) challenging the neo-liberal straitjacket is disappointing to say the least. Because they don’t want to upset their Labour government mates. Silence from the weak CTU. When Luxon said that the Nats would pay back 20k of nurses student loan debt, the only thing that NZNO said in response was that it didn’t go far enough to fix the problem. They did not offer any ideas or make any actual demand in terms of what would be a good idea to begin to resolve the problem of the nursing shortage crisis like free all tertiary education. Until the union movement overthrows the old guard of current mediocre leaders, don’t expect any radical, creative and obvious demands like a financial transaction tax, just tax the rich, free tertiary education, free public transport, end all privatisation of publicly funded services etc.

Personally I never used to feel aggrieved about paying taxes. In fact I’ve always been quite happy about it. Proud even to support people in need, libraries, infrastructure etc

But when some pay none or reduced amounts due to their race or religion and other like the big tech companies (Apple paid $0 tax on sales of $4.2b -with a b – recently) then it can stick in the craw.

Then there is the obvious and massive waste due to ineptitude coupled with a strong sense that the government doesn’t respect the hard work that goes into generating this money from us the workers. And the lies about ‘no new taxes’ before adding new taxes didn’t help.

That’s what we’re pissed about.

Instead they just keep adding new taxes as it’s easier for the politicians to have us squabbling amongst ourselves rather than uniting against their dishonesty and ineptitude and marching with pitchforks.

Unions are like farts. You only like your own.

How do we do it then. This drum has been beaten to near death. How do we get the corridors of power to listen to us – on this very important initiative – let alone bend to our will?

Shouldn’t we be calling for rallies, protests, combined efforts of some kind against who and who and who! When are we going to turn words into actions?

I don’t think NZNO are donors to the Labour Party, but the overall absence of union leadership (apart from UNITE) challenging the neo-liberal straitjacket is disappointing to say the least. Because they don’t want to upset their Labour government mates. Silence from the weak CTU. When Luxon said that the Nats would pay back 20k of nurses student loan debt, the only thing that NZNO said in response was that it didn’t go far enough to fix the problem. They did not offer any ideas or make any actual demand in terms of what would be a good idea to begin to resolve the problem of the nursing shortage crisis like free all tertiary education. Until the union movement overthrows the old guard of current mediocre leaders, don’t expect any radical, creative and obvious demands like a financial transaction tax, just tax the rich, free tertiary education, free public transport, end all privatisation of publicly funded services etc.

Feed the poor, eat the rich…

I voted Labour to fix house prices and stop child poverty, they did the reverse, Nats will make it worse. We need to create a new type of democracy where self enrichment via selfish policies causes imprisonment or torture. These scumbags deserve no less.

One wonders how many of those surveyed were voters rather than children.

When robbing Peter to pay Paul, one can always be assured of the support of Paul.

People almost never make money through sales or selling something. Profit comes mostly in the form of refinancing. Ie shmuck 2 gets a greater loan than shmuck 1.

When one dude is hording all the resources everyone else might just kill him for food or just for fun. That’s fundamental why the left promotes progressive taxation.

I did some arithmatic on a transaction tax when the Alliance was pushing it. The main hypothetical source of revenue would have been from the sort of trading that made his fortune from. multitudes of transactions of huge volumes of financial assets in tiny amounts of time for mostly very small percentage profit. So even a transaction tax at a tiny percentage capture would kill most of those transactions. This would be a good thing in itself but it would not produce the anticipated revenue, it would gust stop or greatly reduce the number of transactions.

Transaction tax is not a bad idea but the numbers, and what transactions would be captured needs explanation.

Personally I have never seen any justification or equity in anything but income tax. Simple and universal capturing every stream of wealth accumulation. It just needs to be set at equitable levels and high enough to meet the stat’s expenditure. If someone makes their income largely from speculation then that is their income for tax purposes.

D J S

A financial transaction fee ought not be targeted on just the stock markets it should be aimed at the borrowing costs of high net worth individuals seeking an arbitrage with cheaper offshore lenders there by outstripping mom and pop investors ability to compete her in New Zealand but I don’t do the Maori Party or Labours tax policy so we will have to wait see what bright ideas they come up with to win the up coming election.

Thank God TMP are looking into removing GST off essential food items, TMP appear to be the only sensible party going, they could attract some pakeha votes, for the Party Vote.

What the heck is a financial transaction tax anyway?

FTT should be the only tax. On every transaction. With mechanism to prevent evasion. IRD could then focus on black and grey cash transactions.

Comments are closed.