Hey NZ.

How you doin?

Rough week eh.

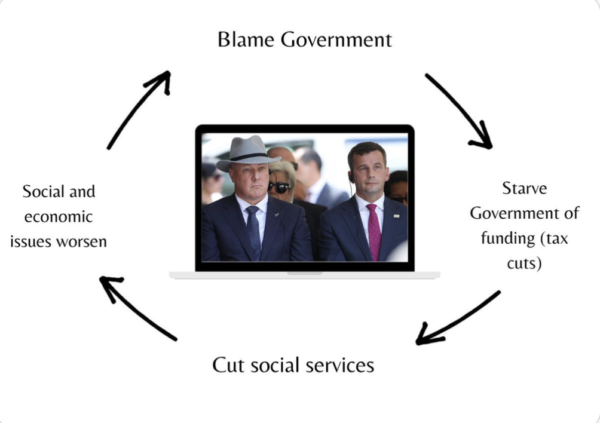

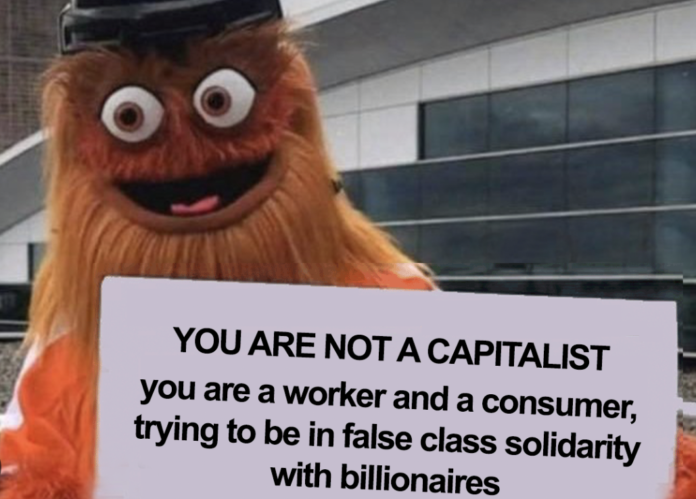

IRD Research shows the rich have been fucking us and because woke identity politics is all the rage now, the Left no longer have the political vocabulary to articulate the class warfare that is being waged upon us.

To get fucked over WHILE lacking the political vocabulary to articulate that because blah blah blah heteronormative-white-cis-male-patriarchy only ensures more identity division and not class solidarity.

NZ Capitalism is a rigged so the rich effectively pay 9% tax while the rest of us pay 20%.

Watching the remarkable push back from the lobbyists the rich have put out to talk down any tax justice against them has reminded us class is the fundamental fault line in NZ and identity politics are simply a distraction.

Look beyond the rich and their rigged capitalism, look at the Landlord debate right now!

Landlords have been given a captured desperate rental market to exploit because the State won’t build more state houses plus a direct state subsidy for rents and they want more???

Landlords want to evict you because the constant churn of desperate renters push up their rents!

We can’t tax their capital gains & we must give them the legal right to be arseholes?

There’s a class war in NZ but we don’t have the vocabulary to articulate it!

The deal between the State and private landlords is the State won’t build enough State houses if the Landlords step in a provide that rental service while getting huge subsidies via the accommodation allowance!

Meanwhile StateTenants have state houses build on flood plains!

Fuck this!

These rich pricks have designed the system for themselves, ‘you can’t tax unrealised capital gains’ the Right scream, like bullshit we can’t!

If it means the mega rich have to sell a mansion or two to pay the tax bill, so fucking be it!

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals, let’s start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry.

You should be angry, NZ Capitalism is a rigged trick for the rich and powerful. The real demarcation line of power in a western democracy is the 1% + their 9% enablers vs the 90% rest of us!

Unfortunately woke middle class identity politics is too busy cancelling people for misusing pronouns to offer a challenge up to neoliberal hegemony.

Put aside their alienating bullshit and a united front of citizens demanding the mega rich pay their fair share to the very society that built them their wealth is not socialism, it’s basic regulated capitalism!

There’s no point making workers pay more to rebuild our resilience, tax the rich!

-Sugar Tax

-Inheritance Tax

-Wealth Tax

-Financial Transactions Tax

-New top tax rate on people earning over $300 000 per year.

-Capital Gains Tax

-Windfall profit taxes

-First $10 000 tax free

The Reserve Bank Governor is clearly telling us to raise taxes to pay for the rebuild, if Chippy’s Bread and Butter politics is to mean anything, he has to tax the rich to pay for the rebuild.

What’s the point of Bread and Butter politics of no one can afford to buy Bread or Butter?

Capitalism is rigged, Democracy is supposed to have the moral authority to challenge that.

We need to be kinder to individuals and crueller to corporations.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

I’ve always thought there are two ways a tax system gets for a government.

1. Taking more from a small pie which usually makes it smaller.

2. Taking more from a large pie but not too much to stop its growth.

This is how I’ve always seen the difference in Labour and National over the years.

However, over the recent years I feel Labour and National have become the same. Labour started taking from the small pie but have become resistant to the changes of CGT and others while still taking. National have stayed reasonably true to their lines but under new leadership have signally more to be done socially like Labour. But as they are not in Govt is this their real stance?

As for ACT I feel you get what you deserve but state assets are sold off to fill the gaps? Very heavily corporation which as we know are all profit driven. If NZ can’t separate a duopoly of a supermarket chain which is already set up as four – five identities then how on earth could they lean on Electricity companies for example when they are already 51% NZ govt owned who seem powerless or deliberately behind the scenes don’t give a.

The Greens just don’t understand the compounding nature of this so let’s leave them out as their pie is in the sky.

Just how I’ve seen it throughout and lately.

The super rich have always excelled under Labour, while at the same time Labour put regulation hobbles on productive enterprises, property owners (landlords and farmers) while throwing welfare crumbs to the rest of the community. Where we are today.

The Nats on the other hand have contained the super rich, freed up productive enterprise. While changing nothing that might improve the lot for the rest of the community.

Thats it. Full stop

No vision of a better NZ from either outfit!

Sigh…The IRD compared high wealth families income that included unrealised capital gains versus ordinary wealth kiwis that excluded unrealised capital gains.

We all know that this is a politically self serving comparison of apples and oranges designed to throw the envy tax dead rat on the table to distract voters from co governance/government.

The Sapere report was conclusive on one thing, the rich pay a higher percentage of income tax on their taxable income that anyone else does.

Bingo

And what about our schools and hospitals? Why do you hate them?

The bottom 30% effectively pay negative tax because of transfers (welfare etc) so the tax system is in fact highly progressive.

Spoken like an Act party representative.

Both true AND a compliment!

Thanks!

You must be lonely at night Andrew and no, No Comment, far from correct.

“Tax the Rich” should be a clarion cry. At the moment whoever adopts it is going to get a shitload of votes.

Hmm, if you wanted to turbocharge the National, Act election campaign this would be one way to do it.

Because The Daily Blog is no longer a fringe blog in the way the Socialist Unity Party was in pre internet days, the ideas set out in the blog will be used as a representation of a Labour, Green, Te Parti government’s agenda, at least in part.

The agenda set out out here would be the most radical in any OECD country. No OECD country has a combination of Financial Transactions Tax and Wealth Tax. Even Wealth Taxes have essentially been abandoned.

If you want run a campaign that would end up driving a significant numbers of New Zealanders to Australia, this would certainly be a way to do it. I can personally think of at least half a dozen reasonably successful people who would do that. Enough of their assets are sufficiently portable that they could do this. Unlike Americans, New Zealanders will actually vote with their feet.

So how will our hospitals and school be funded, Mapp? You lot have ripped the guts out of public services for the past 30 years. Dozens of hospitals have been closed because you wanted to cut taxes. If you are anti tax, you are anti humanity. Plain and simple.

Well said Millsy

New Zealand is a bolthole for the rich. If they want long term security and luxury amenities moving forward then they’re going to have to pay.

Yes the Panama papers proved that Sam.

Just stay on the Whailoil blog then, see ya.

A third of New Zealand’s population are precarious renters, a third of homeowners own multiple properties and a third of these multiple homeowners are rabid speculators owning more than 5 houses. The human right of shelter doesn’t mean much at these rarified heights, it’s just a way to make money, and what a great run they have had ay? The government has known about this for decades, known about supply and demand, known about housing new migrants, known about the price of a shitty do-up in South Auckland being amongst the highest in the world. It might be time to start treating the property fanatics who have infested the country like the indigenous people, take away the lot and give them next to nothing in return.

When shacks in Otara are $600k plus we really do have a housing problem IMHO.

It does not matter how much tax this government takes in if it is wasted on pie in the sky ideas that only benefit the consultants that help draw up the plans and the government workers engaged to run it and then ultimately decide it was not a good idea and plan its abandonment . eg the cycle bridge .

That’s just a National talking point Trevor. The reality is cut out the waste ( as we should) and it won’t come close to being enough to fix all that needs fixing.

Things like CGT should be about taxing forms of income beyond salaries and wages to ease the burden on people working their arses off. Sure look at a wealth tax of financial transaction tax but taxes on capital should not be just about the Uber wealthy.

Very well said Wheel.

As a card carrying National voter you may be surprised that I can sympathize with those calling for a CGT as it seems unfair that one form of income is taxed while another is not. My proviso would be an allowance needs to be made for the eliminate of risk. Not all businesses are successful and so the tax system needs to except losses as a claim against future profits .

I understand what you are saying Trevor, problem is that offsetting losses on income becomes easy to rort. The U.S. is a really good example of this.

Bring on Capital Gains tax. The more Willis screams the better we know it will benefit the bottom 95% of kiwis.

https://www.nzherald.co.nz/nz/nationals-nicola-willis-claims-labour-cooking-up-a-secret-capital-gains-tax-plan-from-labour/ZEEZ7ZIDXJG3RDDMNFQZFXKWFQ/

Not sure how she managed to get such a big story in the NZ Herald seeing how Labour have a bought and paid for media.

And Nicola, this won’t get back the thousands and thousands of votes you leaked to ACT.

Yes Bert a CGT is well overdue. It’s actually just about common sense and given the tax report confirms what we all knew, it’s interesting that people label those on a benefit as bludgers.

Yes Bert who would have thought Nicola could get a story in the media. Fortunately Bob the first is able to list any failures of the current government because he spends every waking minute churning out OIA requests and doing hours of research. I mean it’s not like he reads any printed or televised media. That would tell him nothing.

Well said Wheel, accurate as always.

You can’t break a rigged system by wishing, or pressuring them into throwing a few more crumbs (please tax themselves a bit more) our way. We already have this – neoliberalism – anyway.

NZ capitalism is just capitalism, but we are a junior party within it. The people we choose to run their system, the political class, simply follow the dictates of the senior parties of capitalism…have you noticed how the world, certainly the Western world, do and say the same things!

We are not going to break this system with tax, that is laughable. We need to pressure their representatives, the political class, so that they fear us more than they covet them. Non-compliance (to their global-level, rich-friendly polices), civil disobedience, strikes are a few tools we have in our arsenal.

But before we can do this we have got to understand what the problem (or potential solution) is – the rigged political system.

Ada you are the voice of reason.Thank you.

You are shitting me. More likely Bob the first is a voice of reason and he’s an absolute moron!

You are right Mark in truth it should be called an envy tax .I am not sure if it still applies in the UK but it destroyed many esblished businesses in my area when I was there .

How are we supposed to pay for our health system then? Or we could just go American.

A good first step would be to define what “rich” is. After all, are we not all “rich” compared to someone in the slums of Mumbai. So “rich” relative to who? Where does “rich” and “poor” start/finish in New Zealand?

Comments are closed.