The government confirms the wealthiest New Zealanders are legal tax bludgers

Well there you have it – in black and white. Revenue Minister David Parker has revealed what we all knew and what some of us have been saying for decades – that the wealthiest New Zealanders pay a much smaller share of their income in tax than those on the lowest incomes.

The Parker report has confirmed we have a Sherriff of Nottingham tax system where the poor subsidise the rich.

“Our citizens like tradies, nurses, school teachers, hospitality workers, hairdressers, cleaners, engineers and small business owners all pay a much higher effective tax rate than their wealthier fellow Kiwis.”

The project gathered information from 311 families, who generally have a net worth of more than $50 million, looking at the period from 1 April 2015 to 31 March 2021.

Once ownership of businesses, properties and other investments were taken into account, alongside wages and salaries, their median effective tax rate is 9.4 per cent, compared with 20.2 per cent for other “middle wealth New Zealanders”. Both figures include payments like benefits and superannuation, as well as GST paid.

Inland Revenue said a major difference was people on low to middle incomes tended to make most of their money through income that is taxed directly – that rate depended on the amount individuals earned.

It said personal taxable income was only a “small part of the economic income of the wealthiest New Zealand families”, with most coming from “increases in the value of businesses, property and financial portfolios they own or control”, and the picture changes when that was all taken into account, referred to as “economic income”.

That was the sum total of all of the different ways “people gain the ability to spend money… and also comes from the things you buy or own increasing in value, these things can be sold to gain the cash needed to buy goods and services” – otherwise known as capital gain.

The system was designed by the super wealthy for the super wealthy and facilitated into practice by the David Lange Labour government. The responsibility for this outrage rests with the likes of David Lange, Roger Douglas, Richard Prebble, David Caygill, Michael Bassett, Phil Goff, Geoffrey Palmer and Helen Clark who sat around the cabinet table in the 1980s while tax rates on the rich were slashed, death duties and sales taxes were abolished and GST (a tax on the poor) was implemented.

Shame on all of them.

URGENT tax reform is needed. Now. Tinkering won’t do it.

It’s time to act Labour! And let’s see these changes implemented as fast as Labour implemented tax changes to slam the lowest-income families in the 1980s.

Key promised to not raise GST and did so. Hidden agenda? National can never be trusted again. Meth houses, a lie, homeless man,during covid, a lie. They promised a brighter future, a lie. As a country we can not afford the cancer that is National.

What John misses is that the very wealthy dont sell assets to realise capital gain, they borrow against it as debt isnt taxable income and the entity that holds the debt pays it off.

Remove GST off everything.

The poor spend every cent they have so they pay much more gst than those who can stash it away.

Labour doesn’t work for the people anymore, shy of better mitigating the fall out of their rich-centirc policies better that National does. We have two main parties acting for the rich and nothing is going to change because the people that should be holding, certainly the Left side of this equation to account, still believe in their party.

The system is rotten and yet the people still believe in it anyway. Meanwhile, the non-believers are treated like garbage by the believers. No wonder the wealthiest among us are only getting richer. – most people either cannot, or refuse to see, the forest from the trees.

Laughable to see the apologists like Dave Seymour in interview providing wrap around services for the ultra rich and their obscene wealth without blinking an eyelid. Truly disgusting, even Ryan Bridge was providing cover with his thesis saying the average NZer would sympathize with the 1% because if the government goes after the wealthy with capital gains then the average NZer could be next. He goes further, “How can you tax imaginary income”, suggesting the wealth and assets of these elites is a mirage. Ok, if it’s imaginary then they won’t miss it if it’s taken away.

Parker emphasized the wealth of the top 300 richest families in NZ (average worth $280 million) lies in trusts and investments, with the top 1% of households holding 25% of New Zealand’s financial assets, and their wealth increasing from $1 billion in 2017 to $15 billion in 2021. We have to conclude then that the Labour government was responsible for managing this free for all, and god what a gold plated ram raid. These richest families own 7000 properties for a start. It’s obvious we need a public outpouring of fairness, kindness and empathy for these people because it must be nerve wracking trying to keep track of these property portfolios.

A third of New Zealand housing stock (600,000 dwellings) looks to be investment properties from the figures I could find, with individual investments

1-2 dwellings = 223,000 properties

3-5 dwellings = 264,000 properties

6-20 dwellings = 96,000 properties

21-50 dwellings = 12,000 properties

>50 dwelings = 10,000 properties

How we have 10,000 people owning more than 50 houses each while 30,000 are on the social housing wait list beggars belief. Looks like the answer could be to restrict investment ownership to less than 3 properties and require those owning more than two to start selling up. Also require someone to be a resident of New Zealand for ten years before they can purchase a house. If you don’t like it, mop up your cry baby tears with your hundred dollar bills.

It is 200 entities that own 50 or more properties. Many will be not for profits, some will be corporate, a very few will be individuals.

Oh but if you don’t have landlords the poor won’t have anywhere to rent….

Simple, you own more than 2 properties and you get CGT charged on it when you sell.

I would go as far as calling the rich bludgers instead I would call them greedy and selfish and that is not all of them just some, this is part and parcel of neoliberalism.

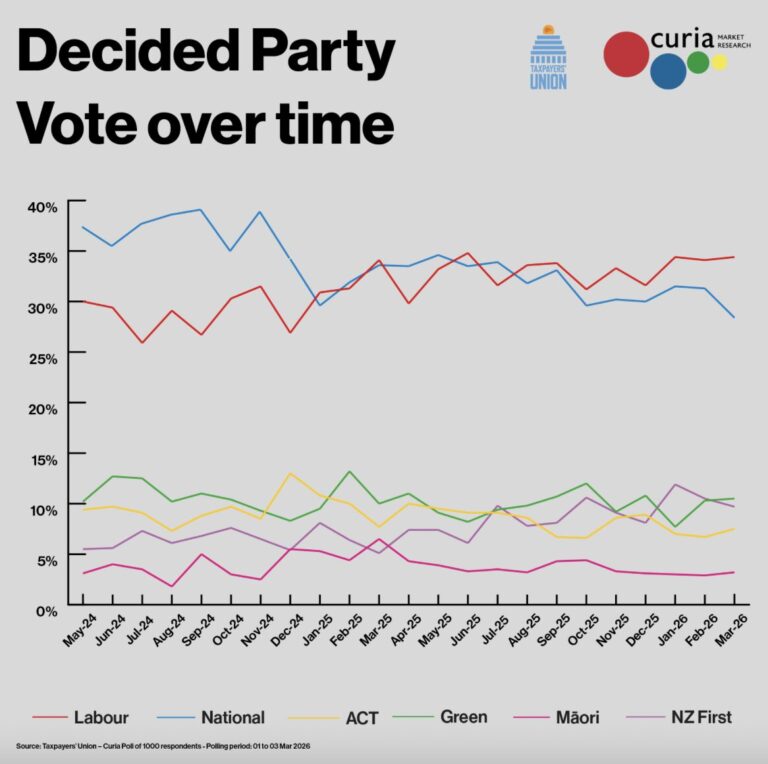

This explains why National and Act have received one million of donations for their 2023 election campaign and it says a lot about those who donated (greed). NZers need to wake up these parties appear to care mainly about the rich and don’t really care about the majority of NZers who are battling to get ahead and survive.

We need to adjust the tax thresholds to address inflation, make secondary earning more appealing so reduce the taxes on this income, address effective marginal taxes, look at means testing super with a period of time to allow people time to adjust to the policy, look at compulsory retirement (like Aus) with assistance for those unable to or who would struggle to do so. Introduce capital gains taxes. We should have planned for this, but we haven’t too many governments have ignored it at our peril.

“the top two tax brackets for those earning between $70,000 and $180,000 a year and those earning above $180,000 made up 21.2 percent of taxpayers and paid 68.5 percent of income tax”

Yes the rich are already over taxed. A fair tax would be we all pay the same tax amount.

Removing GST off essential food products is a NO BRAINER, and adding a SUGAR TAX on soft drinks and fizzies is likewise a NO BRAINER IMHO.

Yes, it is the tax system which should be addressed. I have always found a rate of GST of 12.5 percent to be infinitely more efficient and effective than anything higher than that, such as our current rate of 15 percent, so I feel that it should be lowered back to 12.5 percent from 15 percent with a view towards eventually putting it back to its original 10 percent.

Additionally, I feel that the rates of personal income taxation should be adjusted, at least temporarily, say an initial period of two to three years, to reflect the atrocities that the covid pandemic has inflicted on the working people.

I believe that those who are working full-time should pay tax after a petrol and maintenance allowance is taken into account for the vehicle they use to travel in. It is not good earning $700 per week, paying tax of $165 per week, and then having to pay $70 petrol and $40 other associated costs. Rather, the tax of $165 should be reduced to take into account the $110 in car expenses. Ideally, we would then be looking at a tax obligation of around $130 per week instead of $165. Employers are able to claim expenses and depreciation against the vehicles that are used in their businesses, regardless of frequency of use, so I do feel that a tax reduction is appropriate for full time workers who drive their own car to and from work, especially if you consider there can be quite a distance between their home and their workplace.

Removing GST off essential food products is a NO BRAINER, and adding a SUGAR TAX on soft drinks and fizzies is likewise a NO BRAINER IMHO.

There are countless people who appreciate the concept of GST being reduced over all rather than a simple restructuring to reduce fresh fruit and veggies and hike up the price of sugary drinks.

The reason for this is that GST is applied to almost everything. Rates. Petrol, cigarettes, alcohol, yes even these goods which also have excise tax applicable to them. Clothing. Furniture. Appliances. Vehicle registration.

The point is that if the very wealthy individuals and families were paying a more equal share of taxation then other forms of tax revenue could be reduced accordingly.

Also something was passed in NZ to destroy all the Tax Records in 1982, so nothing could be traced. I remember the Nazi’s used these tactics in WW2.

F*cking Suprise, Suprise these stupid c*nts in Wellington have only just realised that OMG, when someone like Michael Fay can become one of the richest people in New Zealand without doing an honest days work in his life it f*cking tells you something about how wrong this f*cking country is IMHO ????

Dick head. Fay employed thousands of kiwis until labour shafted him

Small minded small cock ignorance bro