Surprise, surprise – the NZ Tax system is rigged for the rich

Surprise, surprise – the NZ Tax system is rigged for the rich…

Richest Kiwis effectively pay lower tax rate than ordinary NZers – report

New Zealand’s richest families pay a lower effective rate of tax – over their whole income – than middle-income earners, two new government reports have found.

Today Inland Revenue (IRD) and Treasury released simultaneous reports looking at how much tax high wealth individuals pay across all income sources, and another on what the general population pays.

The IRD report gathered information on 311 of the country’s wealthiest families – many of them with a net worth of more than $50m.

The mean estimated net worth of the families surveyed was $276 million in 2021.

Treasury found the general population pays an effective 20.2% tax rate across all income sources. The IRD found high wealth individuals, by comparison, pay about 9.4%. The figures include paying GST.

The IRD’s report said the wealthiest people in New Zealand tended to earn more of their income through investments rather than salaries or wages.

It showed between April 2015 and March 2021, the surveyed families earned 51% of their income from business entities, 19% from property and 13% from investment portfolios.

Personal taxable income accounted for about 17% of their income.

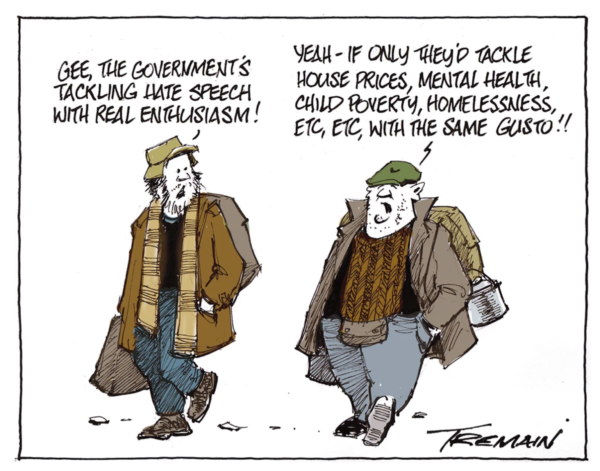

…you know the system is rigged, I know the system is rigged, they know the system is rigged.

What frightens the 1%+ their 9% enablers is that the second the 90% rest of us stop cancelling each other for misusing pronouns, the moment the 90% rest of us dump the identity politics divisions, we can vote to change that tax system and force them to pay more in tax to rebuild the shared infrastructure and this time around we use the egalitarian pillars of NZ, well funded universal public services, to redistribute that wealth.

We need a radical means to place the yoke of taxation onto those who are causing the most economic damage and greed – the Banks, the Corporates and Speculators!

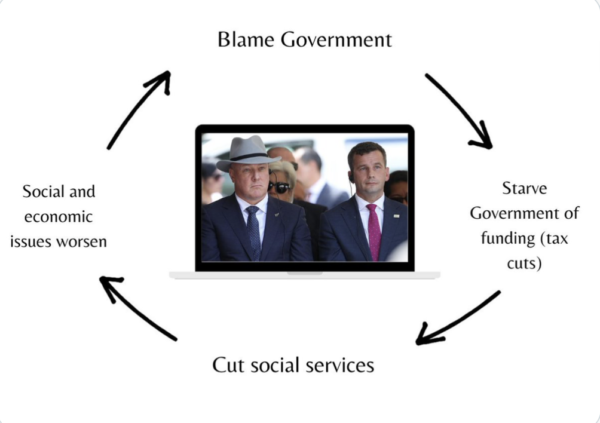

This is why the Tax debate every fucking election is such a shallow and hollow joke. Labour says blah blah blah and National scream tax cut. They are both fighting over an ever diminishing pie!

It’s the Great NZ Tax Cut Scam that never actually fixes the problem!

The true political division in a Capitalist Democracy is not the colour of your skin or gender identity or genital tribalism, it’s between the 1% richest, their 9% enablers and the 90% rest of us!

Labour must think big on funding universal provision of services to survive the economic downturn and the new post-Covid reality in a climate warming world!

Let’s ensure taxation is targeted at the corporates and the wealthy while subsidising the costs of the poorest.

I present the 10 point Left wing Economic Justice Plan for Aotearoa New Zealand.

1: Feed every kid in NZ a free nutritious and healthy breakfast and lunch at every school using local product and school gardens with parents paid to come in and help.

2: 50 000 State Homes for life built using the best environmental and social architecture standards using the public works act to seize land and immediately start building satellite towns using upgraded public transport hubs using a new ministry of Green Works to build them.

3: Free public transport plus vast infrastructure upgrade for climate crisis.

4: Doubling welfare payments and student allowances minus any bullshit claw backs from MSD plus Living Wage universally adopted as minimum working wage plus implementation of all WEAG recommendations.

5: GST off food and essentials like tampons, toilet paper, condoms, oral health.

6: Free Dental services for everyone through public health.

7: Debt cancellation – student loans, welfare overpayments, beneficiary debt, easier debt cancellation.

8: Renter Rights – (rent freezes, end accomodation payments, long term tenancy arrangements)

9: Buy out houses that can’t be saved, look at universal insurance for climate change events to cover those with no insurance, survival packs in every home, solar panels on every roof, vast increase in Civil Defence equipment, social licence of essential service resilience.

10: Properly funded public broadcasting with TVNZ advert free and merged with RNZ alongside properly funded journalism through NZ on Air with more money for the Arts and Science. If you can’t have good public journalism, the right wing media will destroy these other 9 advances.

Don’t tell me we can’t afford any of this because we can if the wealthy are taxed!

There are 14 Billionaires in NZ, and 3118 ultra-high net worth individuals, let’s start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry.

There’s no point making workers pay more to rebuild our resilience, tax the rich!

-Sugar Tax

-Inheritance Tax

-Wealth Tax

-Financial Transactions Tax

-New top tax rate on people earning over $300 000 per year.

-Capital Gains Tax

-Windfall profit taxes

-First $10 000 tax free

The Reserve Bank Governor is clearly telling us to raise taxes to pay for the rebuild, if Chippy’s Bread and Butter politics is to mean anything, he has to tax the rich to pay for the rebuild.

What’s the point of Bread and Butter politics of no one can afford to buy Bread or Butter?

Capitalism is rigged, Democracy is supposed to have the moral authority to challenge that.

We need to be kinder to individuals and crueller to corporations.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

No current NZ political party will do what actually needs to happen.

There are only 2 ways this can happen.

A new governing political party that does what actually needs to happen or

a revolution.

We’ve got 6 months, your time starts now.

Basically, if you don’t have a high paying job in NZ or own your own home u are now pretty much fucked. And if you get a second job your hit with high secondary taxes unless you don’t drink, smoke, have lattes, go out for dinner, buy new clothes, stay at home and bludge of your parents. And we have heard all the do goody stories of how some do well with nothing nevertheless we are all not the same.

NZ needs to look at imposing more ‘social good’ taxes – apparently the Labour and Greens are doing the opposite and rolling back environmental laws in NZ on plastic!

Italy’s plastic tax will enter into force on 1 January 2023

https://www.ey.com/en_gl/tax-alerts/italy-s-plastic-tax-will-enter-into-force-on-1-january-2023

https://kpmg.com/xx/en/home/insights/2022/11/plastic-taxes-a-european-perspective.html

Santander profits up despite windfall tax on banks

https://uk.news.yahoo.com/santander-profits-despite-windfall-tax-100657825.html?guccounter=1&guce_referrer=aHR0cHM6Ly9kdWNrZHVja2dvLmNvbS8&guce_referrer_sig=AQAAAHU5nm5w_twTNIQYiDwkSgrOuDgNIJ4krkG71GqPxfmX3lVk5Ys8GtR7bg0Ss8XXcE6HWHh8zqqS8vtgYTWFLEVIxP1VylBb8x015gnFcIG6mh8De7qki1rjuWxyHB3dFs-Mc6LEa7DYCHzp2XCQYm_U5mHt8BIMy1HRp8fYc0Xp

UK imposed a windfall profit on oil and gas post covid (although looks like they were already paying more than company tax already) and was looking into imposing a tax on companies that made record profits during Covid but paid pitiful tax like on-line shopping.

“Campaigners have issued fresh calls for a windfall tax on companies that prospered during the pandemic, after research highlighted six firms that increased their profits by a total of £16bn.”

https://www.theguardian.com/politics/2021/sep/20/fresh-calls-for-windfall-tax-on-companies-that-prospered-during-covid

All these knob ends saying other countries with far more comprehensive tax regimes will look more attractive. Why? It’s the same with saying the citizens pathway will have people leaving for Australia! Hello! You guys sound like god bothering folk who say don’t talk about contraception otherwise people will have sex.it’s happening anyway.

It shouldn’t be about rich or poor it should be about taxing forms of income on a more equitable basis.

And to all these bullshitters that say it’s about wasteful government spending, bollocks! The bills we have coming won’t be paid for by getting of the Ministry for women.

Kraut “ …we’re totally fucked.” Now. Eugene O’Neill put it something like, “ There is no present or future, just the past happening over and over again, now.” The dopey politicians will conjure up another diversion with their media and police playmates, like convincing the plebs that a Brit called Posie is the equivalent of a nuclear weapon, and many will believe them while most just go about their daily business. Unfortunately the needed reset is dependant upon politicians, so a clear-out of the major political parties is imperative. It’s our children’s future.

Over the past 3 decades, the wealthy have had tax cuts, while everyone else have had service cuts. Scores of hospitals and schools and other public services were closed down just so rich pricks can have more capital gains. Getting really sick of people having go without so others can have more.

Problem with the Parker explanation of capital gains is that he wants to be like the TOP party and tax UNREALISED capital gains. Now that sounds rally exiting until you go out and look at how one goes about taxing those unrealised capital gains, for they are “on paper” gains.

To do that we will need a national valuation day where every asset is valued. After that we need a valuation day each year where the assets are valuated for unrealised capital gain to levy a tax against.

Only winner in this is Bob Jones where he can lease out more Wellington office space for the many many asset valuation “experts” needed to calculate on paper capital gains. More non tax paying (except for GST) state servants. Just what the country needs, more state expenditure on public servants, NOT.

Now a Capital Gains Tax on realised capital gains, by way of asset sales, is doable but we have yet to see Parkers figures on what that the annual asset sale $ volume is and how much tax that would bring in.

Can we also concentrate on the people in NZ who are not paying taxes (and often receiving various benefits) but seem to have wonderful lifestyles without a job. In France they are cutting down on the drug dealers and non payers of tax.

Too many people who came to NZ 30 years ago and never paid a single dollar of tax, while living opulent lifestyles with multiple properties and overseas travel, while receiving NZ benefits and it’s only getting worse with all the free money that NZ government loves to give out. When overseas property owners and overseas backpackers are getting cost of living payments freely handed out, something is wrong with NZ government thinking. https://www.nzherald.co.nz/nz/cost-of-living-payments-potentially-go-to-120000-ineligible-people-worth-14m/WG6H23HDT7Q5474BJ2GRMJZXE4/

In NZ governments seem to be most interested (both the so called left wing and so called right wing) in taking taxes from the easiest target – which is the NZ resident middle class while not doing much to get the non payers, overseas residents, big business and super rich from paying.

We also have low company tax. Some companies seem to be paying much lower than the super rich, aka global tech companies and big phama. Then there are the directors that somehow have 5 small

‘cleaning companies’ that are vehicles for money laundering and mopping up government small business pay outs like covid wage claims and so forth.

In Oz they check company taxes in crack downs, but in NZ, checking if their revered big business is paying their share of tax and making this transparent by government and media, is missing in action.

One-third of big businesses in Australia still don’t pay any tax five years into ATO crackdown

https://www.theguardian.com/australia-news/2021/dec/10/one-third-of-big-businesses-in-australia-still-dont-pay-any-tax-five-years-into-ato-crackdown

NZ don’t seem to want to crack down on banking frauds and big business non payments of tax that Australia cracks down on and fines. Another reason why OZ is considered a better country for honest people to go to.

Seems like a plan guaranteed to accelerate the move of a lot more New Zealanders to Australia. Just when that has become a lot mote attractive.

The only thing surprising about this, is that the government released this information.

Labour had to do something to distract voters from the co governance/government 3rd rail. That’s why the socialist envy tax dead rat is on the table.

Robbie down the rabbit hole. Focus on the issue rather than your bias of co governance that started under Key.

The NZ taxed system is rigged for the wealthy, without doubt, not sure it has anything to do with co governance muppet.