The hurricanes and floods have exposed a deep series of crisis in New Zealand society including a decades long:

- degrading of basic infrastructure from water, roads and railways.

- decline in health and education services including staff and infrastructure

- failure to implement any meaningful action to combat the climate emergency and reduce greenhouse gas emissions

- failure of the reliance on free-market ideological dogmas that depended on profit-driven companies instead of democratic collective decision-making to govern our lives.

- failure to prevent an explosion of homelessness and poverty amongst the most vulnerable in society

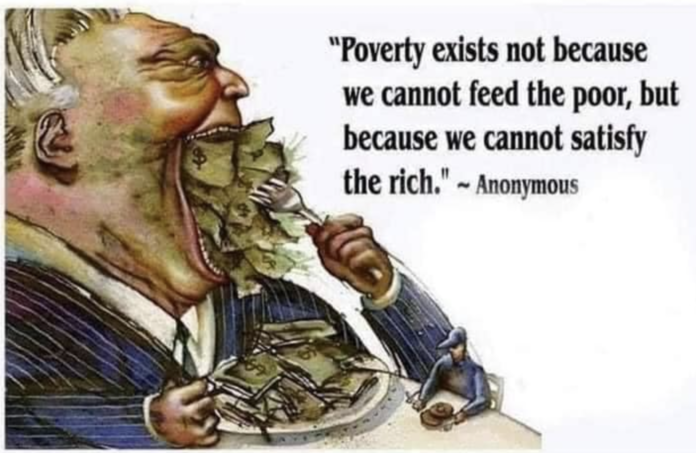

Most of these failures can be put down to the refusal to tax wealth at all. The tax system is based on taxing only declared wage and salary incomes or consumption taxes the are unequal in their impact. Working people are taxed heavily and the wealthy can easily evade taxes through capital gains, wealth accumulation and hiding their money in trusts or offshore accounts.

To save the capitalist system of production worldwide in the face of the Covid shutdowns the capitalist governments spent trillions of dollars in rescue operations across the globe. This included running huge budget deficits and simply having central banks print money.

This new wave of monetary expansion came on top of the expansion that followed the 2008 crash in an attempt to promote growth during what was the slowest expansion in the period since the end of World War two in 1945.

The end result has been the unleashing of levels of inflation worldwide not seen since the 1970s. The only way the central banks can now reign in this inflation is by a triggering a renewed economic slowdown by increasing interest rates.

However, the world now has more debt than ever before. And much of this debt is with what are effectively already bankrupt entities. “Three hundred trillion dollars. That is the record debt which global governments, households, financial corporates and nonfinancial corporates owed in June 2022, as estimated by the Institute of International Finance. The $300 trillion is equivalent to 349% of global gross domestic product, 26% higher than the pre-GFC figure of 278% (June 2007, see chart 1). The $300 trillion works out to $37,500 of debt for every person in the world, compared to a GDP per capita of just $12,000.”

The interest rate rises will inevitable cause a cascade of corporate and banking collapses or developing country defaults in the months and years ahead. The rapid collapse of three US banks last week with around $200 billion in assets each and the impending buyout of the giant Swiss-based Credit Suisse Group with $700b in assets despite an emergency $50 billion loan from the Swiss central bank. Credit Suisse rank among the 30 most important banks in the global financial system, and they have almost $1.7 trillion in assets. Their shares lost 98% of the value before being taken over today by the Swiss-based UBS bank their chief competitor for small change.

The deposits in the US banks were guaranteed by the US Fed invoking emergency rules to cover accounts in excess of the $250,000 covered by the banks insurance system. Otherwise hundreds of US banks would have been threatened very quickly. The US central bank is able to, for now, protect deposits but shareholders can still be wiped out losing tens of billions of dollars in the process so there is good reason to dump shareholdings as quickly as possible to try an minimise losses. The US has about 4000 banks so there is plenty of carnage still to come depending on whose the next objects of a collapse in confidence. At the moment, unlike 2008, the shareholders are not being bailed out so there is still a lot of money to lose.

New Zealand must navigate this new world reality. Access to funds abroad will be more difficult to get and more expensive. That means the record current account payments deficit will be harder to cover which will in turn compound the recessionary pressures that are already present and demonstrated by the 0.6% Gross Domestic Product decline in the December quarter.

Stuff reported on March 18 that “Ratings agency Standard & Poors has warned that New Zealand’s credit rating could be reduced if the current account deficit does not improve and government interest costs rise substantially to more than 10% of revenues.”

New Zealand also needs a massive multi-billion dollar recovery spend. That will worsen the current account deficit and increase deficit spending without tax increases. But the the New Zealand Reserve Bank governor Adrian Orr has told the government it can’t increase the already high deficit spending without unleashing further inflation which the bank is determined to reduce by raining interest rates and inducing a recession. The new money the government needs will have to come from new taxes or from cuts to existing planned spending. Given the already existing deficits in needed infrastructure, if the government wants wants to avoid decades of austerity in spending on health education and welfare it has no choice but to increase taxes. The only people currently not paying taxes are the wealthy.

The only alternative for a government that wants to protect jobs and living standards and spend what’s needed on the rebuild that New Zealand desperately needed is to bring in a multi-billion dollar tax take on the wealthy to pay for a Green New Deal to transform New Zealand. The goal is not to make capitalism work better using market mechanisms which seems to be the most that both the Greens and Labour are currently putting on offer. The goal should be to transform Aotearoa into a society that is no longer governed by the pursuit of profit. That transformation would include (courtesy of Elliot Crossan):

Emissions Reduction Now

All fossil fuel extraction in Aotearoa must be banned by 2030. Real action on agricultural emissions must be taken, with the dairy herd halved. False climate solutions such as fracking and biomass must be banned. Native forests and wetlands must be restored, and our oceans protected.

Green Jobs

The government must guarantee a just transition for all workers currently involved in polluting industries. New green jobs which rebuild our infrastructure and move Aotearoa towards a low emissions, climate resilient society must be created, with decent pay and conditions.

Public Ownership

Vital sectors such as public transport, energy and water must be taken into public ownership, with services being provided to all free at the point of use. Public transport must be radically expanded, with free, frequent and reliable services within and between cities.

Economic Justice

A living wage must be guaranteed for all workers, and a liveable minimum income guaranteed to those not in work. To further reduce emissions, we must move towards a reduced working week at the same level of pay. The housing crisis must be dealt with through rent controls and the rapid expansion of energy efficient state housing, built through a Ministry of Green Works. We must pay for these reforms through a wealth tax which affects only the richest 5% of New Zealanders.

Refugees Are Welcome Here

The effects of climate change do not respect arbitrary national boundaries and will create millions of refugees around the world. Aotearoa must immediately increase its annual refugee intake to at least 10,000. Climate refugees from the Pacific must be given safe passage and citizenship due to Aotearoa’s historical responsibility in the region. Internal refugees must be properly provided for by the state.

Peoples power from the bottom up

This programme can only be fought for and realised if we radically transform our communities and workplaces so that ordinary people are empowered to be agents of the transformation we require through peoples power being exercised directly from the lowest level of society to the highest.

Refugees are welvome, foreign people farmers and other white collar criminals are not.

Can we stop the fake wealthy wannabe refugees who already convicted for murder, coming?

Canada suitcase murder: Mother ‘shocked and angry’ that daughter’s killer is in NZ and fighting to stay as refugee

https://www.nzherald.co.nz/nz/canada-suitcase-murder-mother-shocked-and-angry-that-daughters-killer-is-in-nz-and-fighting-to-stay-as-refugee/4WV4EYP5DRFHDC2WFTGX4FH2BY/

Auckland mall terrorist forged medical documents, boasted about duping immigration officials

https://www.nzherald.co.nz/nz/auckland-mall-terrorist-forged-medical-documents-boasted-about-duping-immigration-officials/P4TXIN7YOI2OENGEKTWRCV2AD4/

Love how multiple sexual offenders finally get deported then invited to apply for a visitor visa to come back to NZ!

Man deported after indecent act in front of 13-year-old boy

https://www.stuff.co.nz/national/immigration/131494438/man-deported-after-indecent-act-in-front-of-13yearold-boy

Something sees wrong with NZ’s welcome of the criminal class – we can tax the so called wealthy more, but when NZ opens it’s arms to more and more international criminal class, victimising others here, then NZ is always going to drop more victims into poverty. From those bashed or abused and can’t work again, to those who suffer frauds and then lose everything they own. It’s now common just to go to your neighbour to burgle or shop to ram raid, and just help yourself! If they are caught then, the consequences are small creating a lifestyle for a growing amount of people who then get everything free, like welfare and accomodation to boot.

One difference I’d make to your programme Mike, is to delay refugee intake increase until we get the previous stuff sorted. Only then will we be in the best position to help.

Otherwise agree – this is generally the sort of blueprint to follow for creating a liveable future for our children.

The end of Capitalism. Didn’t expect it to happen so soon.

Yes. Refugee resettlement is humanitarian but comes with obligations for wrap around support, health, housing, language and literacy, and more. Towards meaningful employment that pays the bills and offers some discretionary spending. NZ would struggle with more refugees. In some of those areas it is struggling now.

No problem.

We tax the wealthiest 6.33% of our population.

Currently we tax the bottom 95%. It must surely be less work to tax the top 6.33%. Then we can all sit back and watch the cricket. Adam Smith and his buddy Karl Marx said so….. yeah, right.

It does not make a difference to the end result if government increase tax take but carry on wasteful spending .

That’s exactly what happens.Increase taxes left wing increases wasteful spending.

jonky, remember it? He lied to us while giving peter jackson $140 or so million of our money while peter jackson also lied to us as he was taking it. Are you suggesting pete and jonky are left wing?

Lets go way, way back bob. Remember the bnz? Tou want to talks tax payers money? Remember jimbo bolger having to renege on his promises to the elderly to instead plump up the bnz to on-sell to fay / richwhite? Remember that bob? Not a lot of needy getting their own tax money back there bob. Now fuck off bob would ya, there’s a good little desperado.

And the vanity flag project which when asked, Key said was his biggest regret. Not poverty, homelessness, crime, housing crisis, a fucking flag!

Right wing wasteful spending will always be worst than left wing social support spending little Bob desperado.

The statistics show otherwise.

Have you got the link to those stats or did your imaginary friend make then up?

Bert you obviously are not well versed and I forgive for that.

The current Labour Government have increased the tax take.

It’s not difficult look it up.

I can’t be expected to hold your hand.

and the nats spent taxes more wisely….examples please bob the last

Didn’t say that gagarin but I will say National more financially prudent.

and the national debt under them was?

it’s canard that the right are better managers well they clearly ain’t..

uk, france etc etc etc….

“Taxing wealth is an essential part of the only road forward in the crises we face”

Could you be more specific @ MT? Perhaps we start with our now nine multi billionaires and their little playthings, the four now *foreign owned banksters who steal our money in net profits at a rate of $180.00 a second. (* Australian owned to be specific. Australia is also our fiercest agrarian primary industry exports competitor. Does anyone else think that, that silly little fact, nothing really, warrants closer inspection? Probably not. Unlike the French, we love our abusers. )

RNZ

‘Banks make new record profits amid strong inflation, rising interest rates’

https://www.rnz.co.nz/news/business/485914/banks-make-new-record-profits-amid-strong-inflation-rising-interest-rates?utm_source=pocket_saves

I have said before I am happy with banks being strong and making a profit but when the profit comes solely from the decisions made by the government to control the economy then a windfall tax should be charged. This has happened in many countries so should not trigger any backlash from the banks.

Trevor, sure we need strong banks just not highway robbers. It is the increase profits during a finnancial crisis that seems obscene to me.

if banks like credit suisse are protected from failure by your tax money, should they not be subject to greater regulation….the management have proved numerous times that they are inco0mpetent and/or corrupt

Trevor, Trevor, Trevor… How are we ever going to take you seriously if you keep confusing the word ‘said’ with ‘written’. I hope you’re not having your tea and toast while standing naked in the middle of a busy intersection poor confused Trev. Poke it in a cone in it mate? You’ll be safe-as.

Of course you’ll be happy with the banks being strong and making a profit because they likely paid you to write that. Did they? Serious question. @ Trev. Dear ol Trev… Banks aye? $180.00 in nets a second out of our small economy then that goes off-shore. And you’re ok with that? Are you sure you are trev?

You’ve never worked or lived in the poorer parts of the town and the country have you trev.

This is what would make me happy Trev. Asset strip then deport the banksters then turn their ugly buildings, which always seem to be dead square in the middle of the very towns they pillage, funny that, and turn them into Discos. https://youtu.be/fNFzfwLM72c See? More fun. No debt.

Then? Write off all mortgages. All of them.

Then… and this is the bit that gets me wriggly. A Royal Commission of Inquiry up the once-were Kiwi banks and their privateer Kiwi bankster buddies until their narrow little piggy eyes fucking weep and water. And then just keep going…. a little bit further…. Oh Look! A multi billionaire! Look at that? There he is! In their natural habitat… Well I’ll be…

A billion dollars is one thousand million of the dollars. Take a Kiwi million then multiply it by one thousand and that’s one billion. That’s a lot of money Trev. Now, imagine at least nine more of graeme hart’s billions? Personally, I can’t do it, my ears start wringing. I read ( FYI trev. I could’ve also ‘seen’ in this case) on rnz’s website, the whimpering little lap-mouse bog-rag that it is, that there are NINE multi billionaires slithering around on all our lovely money. They must look through their cut crystal lead lights and out over their tennis courts, swimming pools and movie stars ( https://youtu.be/OvE9zJgm8OY) to see the tear filled eyes of the schmucks who believed your strong, profiteering banksters when they took that mortgage out on the house that’s dropped in value by 30% and falling trev. And you know, they’ll just keep going down, down, down like a Led Zeppelin. https://youtu.be/8j7oT2I8Nz8

( AO/NZ’er’s. You really need to start thinking in a novel sort of way. There are only 5.2 million of us on a stunningly beautiful and almost unbelievably fertile land area 29,000 sq km larger than the UK and we have one of the largest fishing exclusion zones in the world thanks in part to The Chatham Islands. We have the fifteenth deepest in the world lake containing naturally pure and fresh water that being Lake Hauroko and that’s only of of hundreds of huge, naturally occurring fresh water reserves. We had, until the right wing neoliberals found hiding up Labour like the cunning parasites they still are, sold or destroyed our taxes paid for infrastructure in a greed fest frenzy they called privatisation that I call a criminal act of blatant piracy. We had a passenger rail train running from the far north to Invercargill. And now we have huge, scary trucks carrying logs and a shit little passenger air service that’s prohibitively expensive to try and use for all but the wealthy elite.

Kiwis? People? AO/NZ’er’s..? What you’re told isn’t reality. Look around? What do your eyes tell you?

While mindful of the stats above you will see poverty, homelessness, societal dysfunction and a police state apparatus closing in like a dreadful net which is only visible to the few of us who come here and write desperately to encourage a new way of thinking. We need to have a peaceful, harmonious revolution followed by a public royal commission of inquiry. What do you reckon Trev? Kick it in the guts Trev? https://youtu.be/2MeCLILELNc

At the risk of repeating myself. Aotearoa / New Zealanders. Please. Try and understand… You’re being fucked without the love and kissing by a small clique of gleefully greedy power freaks who will relish the idea that they’re causing you undue suffering.

There’s one more vitally important thing to remember to try to comprehend. It is we, the Us’s who steer our country to where it best suits US. NOT, I repeat NOT the now all bought and paid for politicians and their beast-master billionaires. It’s all of us. Why do you think the first thing the privateer shadow-neoliberals did was to de fang then de claw our unions? The dawn of neoliberalism in AO/NZ was a show put on by criminals doing criminal shit in the broad light of day. 39 years later, and our societies and communities are in fucking ruins.

You guys have got to wake the fuck up! Rural money and urban workers!? You have to unite. You must come together and not in that horny-porny kind of way neither. Objective? Stamp on the four foreign owned banks. Immediately. Then, invite a royal commission of inquiry to the barbi instead of jonky the sausage then broadcast the entire procedure live.

I lived in Bromley which is not a rich area . Now retired I work at the Chch city mission and cook for the street men . In my life I have been rich and poor I have been a benefiturie .I have worked in a variety of jobs both at the bottom as a labourer and at the top as a team leader including banking and self employed . I feel this has given me a good incite of life .

trevor bootstrap tales are all very entertaining but prove nothing

Trevor’s comment didn’t need your usual pathetic utterance gagarin, it was in response to Countryboy. I suggest you troll elsewhere.

Thank you Bert .

what’s up bert no snappy rejoinder and ‘troll’ from you is fuckin rich…

gagarin I see Bert is picking on you now,he usually saves that for me.

Must say I enjoy Bert trolling me,it a wonderful source of entertainment, highly amusing in fact.

Folly as it is to argue with a fool.

Next you’ll be grooming me Bob. But given I’m over 60, I don’t fit your Dulwich school pedophile criteria background.

Bert so are all Catholics paedophiles?

Your generalisations are just silly.

he’s not picking on me you need to be effective for that all he has is wet noodles

“Standing in a bucket and pulling yourself up by the handles.”

Winston Churchill’s take on socialism,race to the bottom,everybody equally miserable.

Putting in real regulations and enforcement to protect NZer’s is a big problem that could be easily solved instead of yet another talkfest, expensive, new regulation group to ‘look into it’ for years.

Companies treat people like shit now, not just airlines, but supermarkets, banks and now tourism is increasingly run by people using it to get residency who don’t have a clue. Not helped by tech sites that seem to have many outrageously bad hotels as 4 stars… misleading the consumers further more. Tired of seeing specials that when a ‘combo’ are actually more expensive – everywhere now from supermarkets to eateries. They are preying on the large amount of people who can’t do simple maths, or don’t want to make a scene in public over a small but increasingly frequent scam.

NZ doesn’t have to change laws they need to start enforcing or creating normal laws to stop the endless run around of extremely bad service that is creating more profits for the offenders.

Loved seeing this – anybody who knows anybody flying at present have similar stories, in fact someone was saying if Luxton gets in as PM, how much worse can flying customer service get???

Man sent bailiffs to Luton Airport for Wizz Air refund

https://www.bbc.com/news/uk-england-beds-bucks-herts-64999557.amp

Dunedin couple wait months for Air NZ refund

https://www.odt.co.nz/news/dunedin/dunedin-couple-wait-months-air-nz-refund

NZ supermarkets – now food is more of a concern for renters than rent.

https://community.scoop.co.nz/2022/03/on-supermarket-rip-offs/

On Supermarket Rip-offs

“The cargo cult thinking behind the key recommendation of the Commerce Commission’s final report into the supermarket industry would have us believe that if land is made available, a white knight will come riding in over the horizon to create true competition, save us from predatory pricing and obviate the need for structural change in the industry. Dream on.

Keep the scale of the problem in mind. The two chains are running the most lucrative supermarket extortion racket pricing operation in the entire OECD. Foodstuffs and Woolworths are extracting $22 billion from New Zealanders in annual profits, well in excess of the rampant profit-taking by the Aussie banks. Last year in its draft report, the Commerce Commission lamented how harmful the current set-up was to consumers. It also outlined what was wrong with industry practice – ie, everything – and set out the range of possible actions that could be taken to address the problems.”

Banks make new record profits amid strong inflation, rising interest rates

https://www.rnz.co.nz/news/business/485914/banks-make-new-record-profits-amid-strong-inflation-rising-interest-rates

No wonder the construction industry is following suit with ripping people off here, why wouldn’t you when you see what profits the others get away with!!!

saveNZ that’s so silly.

Can you give an explanation why Bob, otherwise you are only trolling.

Thanks Gus.

That’s what I thought troll.

Thanks Gus.

You’re not going to be able to fix anything until you get politicians out of rich people’s pockets.

Govt tax take was $69 billion in 2017 and was $100 B in 2022. In addition they printed a further $60b during covid. It would appear we have very little to show for this spending if you look at health services homelessness, crime , state of our roads. Any one should be nervous about giving this govt 1 more cent just to see it squandered

Do some research Dave rather than stating what you believe. I’d suggest health and the cyclone plus roading took a lot of the allotted tax take.

We get you don’t like the government, similar to Bob, but making unfounded statements goes across as stupidity, just like Bob.

Thanks for your guidance Gus.

Labour was too busy giving hand outs to keep business afloat and a gold plated unemployment scheme worth twice the original unemployment benefit is where all the money went.

Meanwhile a review done by the welfare advisory group we’re still waiting on Labour to do something about.

Everything is run down in this country due to a lack of taxation created by the previous govt.

big ups mark

If all wages are taxed then all capital should be taxed. And none of this exemption for family home rubbish. I paid $130,000 for my house 21 years ago and today got a latest valuation of $550,000. That’s good news for my 5 kids if I die soon but bad news all those people unable to buy a house who would have to pay $500 to $700 a week to rent a house like mine.

And some poor schmuck is gonna have to spend 550.000 at a min to buy your house. And you want to tax that poor schmuck cause you got lucky and your kids want ‘their’ money.

No I want to tax my capital gain and hopefully a CGT on ALL capital no exceptions will stabilize or depress house prices. This would mean the poor schmuck would have no capital gains tax to pay if prices were stable or a smaller mortgage if prices fell. I wish my house was still worth $130k then my kids would not have had to pay so much for theirs.

yes a capital gain is income how you choose to distribute those profits after tax is an issue between you and the kids bratty

In the event of a capital loss on an investment,be it property or otherwise,does that entitle one to a tax refund?

if it hasn’t been engineered by your tax lawyer bob the last…and only on this years bill so x percent of zero is zero..we shouldn’t have to cover YOUR business loses with rebates

If incomes had gone up 5 fold we wouldnt have a problem, this is a problem of two sides, we have investors jacking the housing market while we also have employers screwing their workers.

Excellent advice. The very first step tho is education. With a country of ignorami, we’ll never get the right ones voted in. Keep up the info TDB!

yea trev but govt incompetence is not an argument against the concept just the execution

I get your point .As someone who was self employed for a number of years it was amazing what you could claim for legally.

I’d support a wealth tax if it included the family home and holiday homes, same as any other asset.

Because that is where wealth has been built over the last 30+ years.

It’s Parkinson’s Law,no matter how much tax is collected it will be squandered by a Labour Government.

mere repitition is not an argument bob the last

Things that keep repeating,like the failure of this Labour Government,then it should be highlighted.

Repitition,is an excellent method of arguing, it drives the point home.

but it’s tedious and makes your posts bot like….are you a bot bob the last?

Yes I may well be given my points of view are consistent.

Drivel alert. What was National doing with all of the tax take when they were in power Bob? It’s not like there was no tax before 2017. They didn’t spend it on housing, underspent on infrastructure, health and education. Of course some of our tax in the last wee while is paying for projects like Transmission Gully because it was low balled on estimates anyway. While I don’t disagree there has been waste in the present day don’t tell me that is new. Remember things like flag designs and referendums? We had a kiwi with Superman’s ocular laser functionality FFS.

Ok Wheel I accept some that.

Wheel,

You are suggesting that if silly decisions were made in the past then it’s ok to make them now?

That’s not an argument it’s an excuse.

When you own your own business and don’t keep to strict fiscal rules you lose your business,no one votes you back in like they do Government’s.

Although denied Government is the largest business in our country and needs to be managed responsibly.My view is the people who make up the Labour Government are not capable.

Define ‘wealth’? One house, two houses? A house a business? a Kiwisaver and a house?

Is a first home buyer with a mortgage ‘wealthy’? Is the retired person who only owns their home ‘wealthy’?

Your neighbour has 2 pigs, you only have 1. Your neighbour is obviously a bourgeoisie capitalist running dog, so you kill him and take his wealth. You now have 3 pigs, the guy across the road only has 1 pig…

Very well summarised NC but I’m afraid most of what you say will fly by most readers here.

Good point. A freehold house and say over $1m in liquid assets. Not the 1%ers who should be paying a “fairer “share of tax – however that is defined – but rarely do. But often that is not in breach of taxation laws. Sometimes it is and the law is an ass. Accountants are pretty useful if you’re loaded. That leaves the 10%ers. How many? Mmm…not many folk have a spare million in change. But we now get into the earnings of some pretty important professionals, medical people for a start, engineers for second. FFS some chippies have salted away that much, only to get a crook back and RI for their trouble. These folk put in the mahi, earnt the big dollars and salt it away who knows where. Up to them. Arguably they’re on the top tax rate as it is and are paying a fair share. Who is silly enough to go after them for more. And is it fair? They’ll just bugger off and we’ll all being waiting (longer) for medical care and bridges. Nah, its the 1%ers and the corporate entities who are getting away with it. But they’re not the low lying fruit.

The problem with the increasingly hollow and expanding echo chamber of store-bought stupid is that one stops hearing anything new and so eventually manipulated fools will win because they’ll beat us with their experience and the bankster class hyper-rich will win because they’re writing the rules as I type.

Try this on for size. The fabulous Russell Brand talks with the equally fabulous Dr Cornel West.

Seriously, I promise, is worth your precious 17 minutes.

Creating the wealth of a country does not come from Government, particularly left wing Government.

Bob the snorefest.

Thanks MHK, I’m flattered by the attention you afford me.

Yes, you have attention deficit disorder, you need attention daily.

Yes I may well have MHK.

Marx, Engel, spent most of their time about violent control, Engel, not like Marx, yet Marx,without Engel, care largues, basic, money, would have straved. What a thought of knowing not about violence,barricades and diaNAS COME WITH US,HOW FUCKED yous, darrling trots.

ENGELS

Am gone at times,bomber,this election coming,these nats ,eh our leader got bug, egits, them sayin if not me her.Dont print that.

Socialism, what a breath grasp.

Easter,rebirth for the farm fence for the NATIONAL Party, of their New Zealand.

Easter,rebirth for the farm fence for the NATIONAL Party, of their New Zealand.

Easter,rebirth for the farm fence for the NATIONAL Party, of their New Zealand.

New Zealand has been an overseas employment agency for more than 3 decades, so being an overseas social welfare agency as well should be no problem…..The culture of caring for people overseas instead New Zealanders is very noble and very trendy lefty…..Taxing hard working people more , so that people who do not want to work can live a better lifestyle is certainly an option, but bringing more people here when we have had a steady pool of 400,000 people out of work for decades , because of being an overseas employment agency , might not be the best use of our limited resources……

We are governed by profiteers. The only way to transform this is through people power and the only way to get this ball rolling is through education and informing the people as to who or what is really governing them. The world we have today is not by accident, this is the world the profiteers designed.

You want transformation – understand the key obstacle in your way…

Capitalism,what a exploit,of a cancer of our humanity.

The statistics prove otherwise.

Wrong again Bob.

Sorry MHK but every statistical source say I’m correct.

I lived in Bromley which is not a rich area . Now retired I work at the Chch city mission and cook for the street men . In my life I have been rich and poor I have been a benefiturie .I have worked in a variety of jobs both at the bottom as a labourer and at the top as a team leader including banking and self employed . I feel this has given me a good incite of life .

Correct me if I’m wrong on this but I suspect no party has been elected to government since before the 80’s with a proposal to raise taxes for any reason what so ever.

It’s known as the “embarrassed millionaire” phenomena where even the most destitute voter can’t stand the thought of paying higher taxes in their aspired to future lifestyle.

yup peter but then they whine like bitches when infrastructure fails

Not this time. More money will not solve climate problems even though we will need to invest. More to the point borrow and invest. Somewhere in the region of 700 times GDP or seven trillion.

It’s a lie that anyone can be creative. Creativity is very rare. Look at the great classical music. It’s just 13 composers everyone else just replicates.

But it’s a mistake to think brilliant ideas or music can just be learnt or with in anyone’s grasps.

In business the guys with the best ideas get the most money, Elon, Bill Gates etc. The rest just replicate. The rest of businesses is just marketing they don’t invent anything.

It takes a population of 5 million to create a genius but the intellect has to be paired with finance or that person would have emerged by now. Do I think John Hart is an intellect? No! He marketed sandwiches he didn’t create anything! Just financialized the 18th century servant. He may not like me saying it but he’s just a servant.

But a good idea is how much heaviness can you lift. A good idea is a pulley, rope, wheel, leverage, borrowing.

To make those ideas better will require an advanced materials research centre. New fabrics. New building materials. Fuels, energy, transport, communication, whatever. So cheap and sustainable that anyone poor can afford them. So 100% recyclable and has to be the greatest example of vertical integration so zero wast in all of human history. At a fixed price of 7 trillion. Who cares if we are borrowing the money if it produces zero wast. That’s a huge start up cost for something that has to have no input costs or what ever.

We can build a space station that orbits the planet surely we could make a thing that is 100% recyclable. Truly 100% kiwi.

Won’t even need a new tax.