I’ve never heard so many simpering gimps defending the unholy profit rampage of the banks.

You corporate wealth worshipers should be ashamed of yourselves sucking up to the fucking Australian Banks!

Asking if Bank profits are ‘excessive’ misses the point – with 25 000 on emergency housing wait lists, 100 000 food parcels a month & underfunded health, education & welfare social infrastructure collapsing, Bank profits are fucking obscene!

Windfall tax those rich pricks!

Folks acting like banks are good…

…The banks are taking monopoly rental profits out of NZ economy! That $10b profit is $10b that should be staying in NZ! The 4 Aussie Banks are absentee landlords!

Why are you all so focused on building the Australian Economy?

Comrades, I have 6 words for you: Fuck. The. Banks. You. Stupid. Hobbits!

Look, if you are going to turn a blind eye to the obscene profits made by foreign banks using the rigged casino of oligopoly can we all at least agree on one thing, that when the economy predictably ruptures next year and the corporate banks come to the Government with their giant golden begging bowl, encrusted with diamonds, emeralds and sapphires, carried into the room on the backs of homeless children, when the 4 big Foreign Banks come begging to be bailed out, we collectively tell them to go fuck themselves right?

Surely you simpering gimps sucking up to the banks by refusing to tax their obscene profits can collectively agree not to bail these greedy fucks out when the economy goes belly up right?

RIGHT?

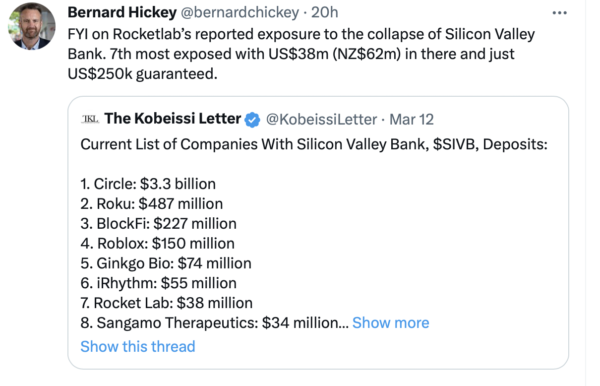

The current and sudden collapse of Silicon Bank has sparked a claim that there is no ‘contagion’ here and other Banks are fine.

Really?

The word contagion is constantly being denied but what if SIVB’s ‘contagion’ isn’t a shared addiction to clever financial instruments & is just old fashioned greed when interest rates are 0%?

What if the greed is the contagion this time?

Black Swans are in the uber heading home.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

I’m have said it before you may complain about a bank making a profit but if they fail you will have real,problems. The profit made by those Australian banks huge is about 12-14 percent on investment according to reports so not out of proportion. It rather my money was in a strong bank than a failed bank .

Agreed Trev. In my experience Aussie banks provide a great service at low cost.

The *real* problem is the financial illiteracy and lack of self-discipline of many New Zealanders who carry unnecessary credit card debt.

someone at westpac give andrew a free t-shirt

Aw Andrew. You’re amazing, you know that right? You’re so awesome and wonderful. All together with money an’ that. So experienced and knowing and everything. Gosh. Gee. I bet you save and are smart and are you shiny? I bet you shine? Mostly out your arse hole? Financial illiteracy is a real problem Andrew, I agree. $180.00 a second in net profits. Out she goes. What’s a person get on the dole? The pension? What’s left after $10 eggs ya fuckin egg. We’re balls deep in greedflation and you brain-fart out re financial illiteracy and a lack of self-discipline.

RNZ.

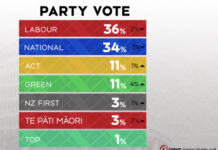

‘Green Party wants immediate action on bank profits.’

“Green Party revenue spokesperson Chlöe Swarbrick says the Australian banks are making roughly 20-percent more in New Zealand than they do in Australia,..”

https://www.rnz.co.nz/national/programmes/morningreport/audio/2018881050/green-party-wants-immediate-action-on-bank-profits

Thus fuck you andrew and trevor. If you are indeed AO/NZ’ers then you’re traitors, and liars by omission. What would your mothers think of you.

What are you basing the 12-14% on?

What is their real cost of…Capital!

So youm have done said nit beforn an’ that trev. Well done. Go you. Now don’t forget to wash your hands before you have your toast and cocoa before beddy byes.

yeah yeah yeah trev

Simple answer. Everyone join TSB. Government buys Kiwi Bank and dumps Westpac.

Apparently the Silicon Bank CEO was in the media a few months ago saying how banks need LESS regulation!!!! Hmmmm.

They did not had a risk control appointment for a year.

It is not inconceivable that interest rates would rise! Funny how SVB couldn’t work it out when they put too much into bonds that were worth less and less as interest rates rose!

The US government is bailing Silicon Valley Bank out, but they should then own the bank and then sell it off, and get the profits. NOT do the GFC where the taxpayers bailed out the banks and then the banks got profitable again, the managers made money and the taxpayers got nothing out of bailing them out.

In addition the managers and consultants and auditors who were in charge during the GFC got bonuses for their failure while the everyday person often lost their job, house and savings. This has contributed to less trust in government.

Financial crisis are happening more frequently with a poor risk control outlook combined with arrogance, with banks and consultants at the forefront of the financial failures. Governments fail to hold managers accountable and send out a message.

There needs to be much more regulations of banks and more scrutiny and regulation of their CEO’s, risks and financial positions.

And… On January 19, 2023, the United States hit its debt ceiling of $31.4 trillion.

The US banking sector is worth $23 trillion dollars as of Friday last week.

And high-interest rates are devaluating assets which in turn creates a cash-on-hand crisis if they can’t sell shit to plug the whole. How many more ‘banks’ have dodgy overvalued assets on their books?

High-interest rates have sucked all the value out of and made them poor investments and shit they can’t move?

Sorry but David Seymour needs to keep his off it. Pandering!? The man who plays on crime and race fears like a grandmaster of pandering comes out with that load of bollocks.

“That $10b profit is $10b that should be staying in NZ! The 4 Aussie Banks are absentee landlords!”

The Gang Of Four should be hit with a bank profit export tax.

Failing that they should be regulated in a way that say 75% of the profits they make off Kiwi mortgagors has to be reinvested in NZ businesses to grow and diversify the economy and then they can repatriate the profit from the business loans.

( Cough-cough…) Ah, who’s been begging for a hate storm on the banksters? Who’s been questioning why the fuck it is that we’re tethered to Australia via their greedy, parasitic scum banks when Australia is our main competitor for our primary industry agrarian goods’ winter bound northern hemisphere markets ? Where are the billionaires as I write? Not fucking in Tuatapere that’s for certain. ( No disrespect to Tuatapere people intended.) pervert ronny brierly was busted scurrying FROM Australia remember? Martyn Bradbury is entirely correct in every respect with regard to the banking cult. They, are the fucking enemy. Re seymour? What else can we expect the wee twerker to say what with roger douglas up, on and all over him? I’m praying to anyone and any thing that this might be the beginning of the end of the domination and poverty creation of the evil banks and their politician minions who deliberately exposed us to their bottomless, unbridled greed.

Now. Please. I’m actually begging here. Lets look up the last 80 years ( Longer actually.) to see where the real money’s gone. Aye Boys? ( That smell…? Is that fear coming from that super yacht..? )

We need to replace the whole political system in NZ.

Our politicians are useless.

With so many issues going on in this country all these worms do is attend to the needs of the well off. Im over it.

get set for taxpayers money bailing out ‘to big to fail’ banks AGAIN..maybe the bank CEOs should chip in, after all large salaries and bonuses are allegedly for success not taking the company to the brink.