Why Marx was right when he said that wage rises do NOT cause inflation

The Reserve Bank is increasing the cash rate they charge banks by .75% to 4.25%. They say they must charge banks this rate for overnight loans because inflation is too high, employment is too high and we need a recession to bring both down.

In my view there is not scientific validity to the oft-repeated argument that we are threatened with a wage-price spiral. The recent rise in prices is way above the rise in wages and wages are obviously just catching up.

If the problem is as they claim that too much money is chasing too few good then they could easily fix that by an emergency wealth tax on everyone with over $5 million in assets. This could bring in billions of dollars from those who have too much money rather than taking it off those who have too little by making workers unemployed. They could impose excess profit taxes on banks and energy companies to bring in a few billion more if needed. Doesn’t that seem fairer than making workers unemployed, hungry and possibly homeless to reduce their spending?

The problem with supporters of capitalism is that they have no scientific way of understanding what is happening in society. The “monetarist” theory of value which most pro-capitalist economists adhere to is subjective because it is based on marginal utility, not objective like the classical economists who based their understanding on labour values. They monetarists also disagree among themselves on what money is therefore they have no understanding of how their subjective values get transformed into prices.

Their theories become simply a tool to wage an ideological class war against working people to allow them to exploit workers more effectively.

So the real aim of interest-rate hikes is not to stop a wage-price spiral but to raise unemployment and weaken the bargaining power of labour. British Prime Minister Margaret Thatcher was one of those who used the monetarist dogmas to wage a class struggle against the labour movement in the UK. Alan Budd, her chief economic advisor from 1979-1981virtually admitted the deception in 2010:

“There may have been people making the actual policy decisions… who never believed for a moment that this was the correct way to bring down inflation. They did, however, see that [monetarism] would be a very, very good way to raise unemployment, and raising unemployment was an extremely desirable way of reducing the strength of the working classes.”

Karl Marx actually explained why wages don’t cause general price increases in 1865 in a speech to a meeting hosted by the First International Working Men’s Association that was subsequently published as a pamphlet called Value, Price and Profit. His opponent in the debate was actually a trade union leader John Weston who thought fighting for wage rises would be a waste of time because prices would automatically follow.

Marx said: “a struggle for a rise of wages follows only in the track of previous changes (in prices), and is the necessary offspring of previous changes in the amount of production, the productive powers of labour, the value of labour, the value of money, the extent or the intensity of labour extracted, the fluctuations of market prices, dependent upon the fluctuations of demand and supply, and consistent with the different phases of the industrial cycle; in one word, as reactions of labour against the previous action of capital.” (emphasis added)

“By treating the struggle for a rise of wages independently of all these circumstances, by looking only upon the change of wages, and overlooking all other changes from which they emanate, you proceed from a false premise in order to arrive at false conclusions.” Broadly speaking, argued Marx, “A general rise in the rate of wages would result in a fall of the general rate of profit, but not affect the prices of commodities.”

To paraphrase Marx via Michael Roberts a little: First, “wage rises generally happen in the track of previous price rises” – it’s a catch-up response, not due to ‘excessive’ and unrealistic demands for higher wages by workers. Second, it is not wage rises that cause rising inflation. Many other things affect price changes, Marx argued: namely “the amount of production (growth rates), the productive powers of labour (productivity growth), the value of money (money supply growth), fluctuations of market prices which happens constantly anyway, and “different phases of the industrial cycle” (boom or slump).

The claim that there is a wage-price spiral and that wage rises cause price rises is an ideological smokescreen to protect profitability.

“Nothing is easier, or more emotionally satisfying, than blaming high prices on those who charge them, rather than on those who cause them.”

Thomas Sowell

Well, the employment rate is too high but should be allowed to come down under current circumstances and not by hiking interest rates.

It’s disturbing news bring that it is a month out from Christmas.

Good article, thanks. I thought this one was good too: https://i.stuff.co.nz/business/300748334/interest-rate-crunch-did-the-reserve-bank-drop-the-ball

And the one linked in that article was very revealing too: https://i.stuff.co.nz/business/opinion-analysis/300520400/whats-gone-wrong-at-the-reserve-bank

We are simply being lied too, by RBNZ who both don’t know what they are doing and don’t care how it affects us. The 5 out of 7 senior members or however many it was, who resigned without taking up other jobs, screams to me that not only are they paid far too much, but that they are irresponsible leaders. The fact that Grant Robertson extended Andrian Orrs contract by another 5 years tells me their is no one of any economic / moneary policy substance at the helm and likely no New Zealanders competent to take the role on and do a good job of it. I wonder if popcorn is still relatively cheap? It’s a WTF clusterf*ck block buster playing out right in front of us and no one is even bothering to cover it up. 5 stars.

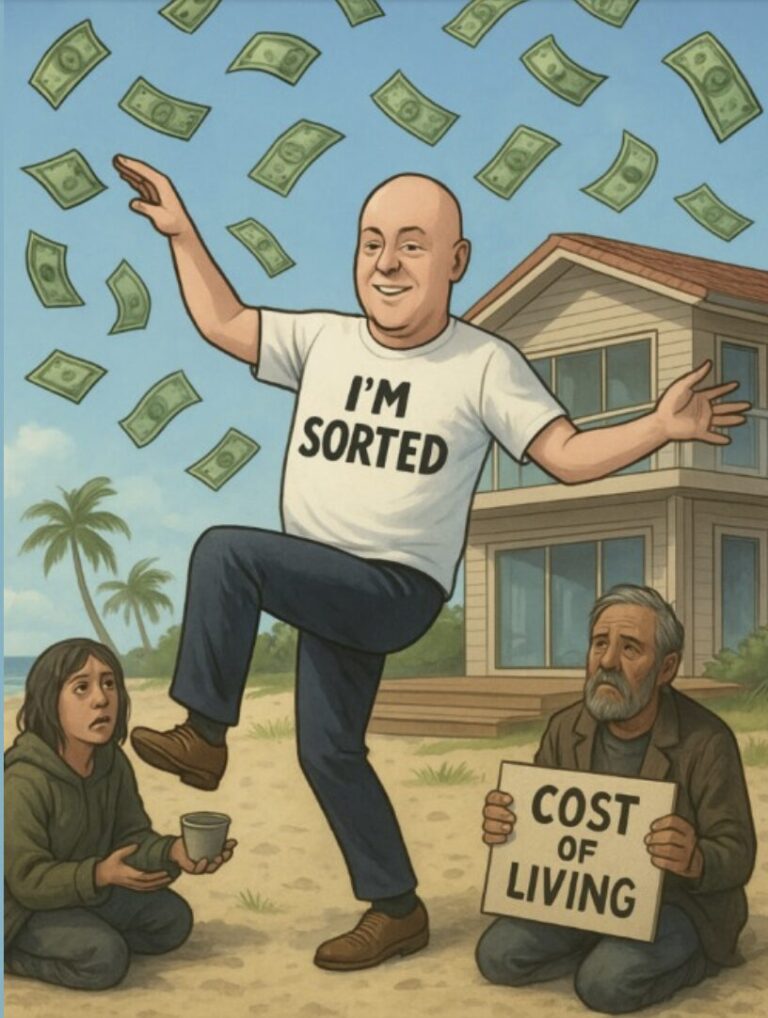

I wonder who higher interest rates and lower wages are going to hurt the most? HMMMMM – the middle class,

– not the rich without mortgages and not the profiteering business owners in the supermarkets/retail/utlilities/insurance/banking who are doing pretty well in NZ, thank you very much and another excuse for lowering/freezing the wages of those who work for supermarkets/retail/utlilities/insurance/banking during a cost of living crisis.

It makes little difference to the poor who are already in social housing and receiving food parcels. They have no mortgage and now have the free supermarkets to choose their koha food from. The government will whip out another energy payment.

it’s the workers and middle class that the ORC and low wages hit.

Honestly, it sucks, and the media in NZ sucks too for being ignorant, enabler idiots and the left sucks for allowing the stupidity of Labeen for years when they could have done something incredible – instead of helping them cling to neoliberal wokism and driving relentless poverty, crime, dysfunction and helplessness in NZ in the name of woke.

Where are the ”free supermarkets” that the poor can ”choose their koha food” from?

I’d really appreciate an explanation of this whole idea.

thanks

https://www.foodstuffs.co.nz/our-brands/social-supermarkets

“opened social supermarkets in Wellington, Kaitaia, Tokoroa, Whangārei and Otūmoetai, offering individuals and whanau experiencing food insecurity to shop in a supermarket-style environment with goods usually being free of charge or for a koha.”

Whanganui Koha Food Collective sets up ‘free food supermarket’

https://www.nzherald.co.nz/whanganui-chronicle/news/whanganui-koha-food-collective-sets-up-free-food-supermarket/JCEGJ7GB3NQ6WBE7JVONSZZC2Q/

Koha based supermarket opens in Otūmoetai

https://www.sunlive.co.nz/news/306069-koha-based-supermarket-opens-otmoetai.html

Foodstuffs North Island To Partner With Community Organisations To Open Social Supermarkets Right Across The Motu

https://community.scoop.co.nz/2022/11/foodstuffs-north-island-to-partner-with-community-organisations-to-open-social-supermarkets-right-across-the-motu/

WN… from an earlier post of mine: Here is a great initiative growing around the country – volunteer and donations based free food and meal initiative for hungry families who need a hand via high schools: Check it out: https://kurakai.co.nz/

Our government economists are ‘one trick ponies’ – they are obsessed with outdated economic theory that does not work but religiously follow it in NZ.

OZ and Singapore workers are paid more, their bank interest rates are lower and their rents are higher than NZ.

NZ is dysfunctional because everything is about ripping off the middle class and then our paid media pretends it is something else like landlords (when our rents are actually lower than other countries).

For example increasing OCR rates (when NZ already has incredibly high bank interest rates and our banks have the highest profits in the world – nothing done – government in fact makes it worse by constantly giving banks money and more avenues to rip off consumers).

Our supermarkets and energy companies make obscene profits but our government do nothing – compared to say landlords where they froze rents during Covid/removed interest from tax deductibility/created healthy homes. Problem was, that they failed to look at how NZ cost of living was compared to other countries, if they had done that they would have seen that NZ rents are actually lower, the issue is the high bank interest rates and low wages that stop Kiwis getting ahead and on the property ladder.

If you are a richer overseas person you can come to NZ, buy up property and pay overseas interest rates or buy in cash, that avoid NZ bank interest rates that Kiwi workers on low wages can’t do. Rogernoms encourage this so they can pretend that things are going great in NZ and their flawed rogernomic economic theory works.

Government policy over the past 30 years has stopped wage rises by lazy immigration – having foreign money come into NZ and buy up assets so that money is still flowing, while insuring that there is endless supply of low cost labour with NZ visas bringing in migrant family members off one salary of $42k – 1/3 of what is needed to live comfortably here. Importing in poverty to compete with NZ poverty and not worrying about the skill level or character of anybody arriving. Then they wonder why charities and social housing and our justice system is oversubscribed and getting worse and worse!

It’s open slather in NZ from engineers faking their qualifications, builders forging their own building consents and medical researchers faking medical degrees. Then the ram raids, drug abuse and money laundering crime which the government has turned a blind eye to and actually make worse by enabling the criminal class with easy assess to foreign criminal expertise and an inability to deport anybody. Other countries remove people faking it and lying – NZ enables it. https://www.helsinkitimes.fi/finland/finland-news/domestic/17335-finland-deported-unusually-many-foreigners-last-year-writes-yle.html

Daily we now have stories of the latest killings – many of them now random, such as the man that killed someones mother for no reason and had a history of knife crime https://www.nzherald.co.nz/nz/christchurch-sockburn-fatal-stabbing-murderer-of-christchurch-mum-of-four-had-committed-knife-rampage-a-decade-earlier/TL736RMECCXUJJ6GR6BIIRVIZM/, the dairy murderer (suspect does not look like a youth) https://www.nzherald.co.nz/nz/politics/sandringham-dairy-attack-government-has-blood-on-its-hands-after-killing/77CIR662KVEHXNS2X2GGINLZ7I/ government is on that one because they see the Indian community as a ‘vote’ bracket, mall and mosque terrorists.

Don’t forget NZ now voted 2nd worst place by migrants to work in – 1 million new people bought into NZ many of which were scams that we are now paying for in crime out of control worse than before, and still they can’t get people on their crap wages and conditions and bray for more plumbers, vets, doctors, engineers. We are attracting bad migrant workers that fail overseas, who can easily come into NZ, often doing terrible jobs here while being billed out at outrageous NZ prices!

The better workers whether migrant of Kiwi go off to OZ to beat NZ’s low wages and unprofessional approaches. There is more interest in NZ wokeplace of pronouns and ripping people off with outrageous charging, than being an expert worker working for a fair wage.

Have not even mentioned that many tradies in AK are now expecting cash payment and have illegal workers.

You’re missing the point I think.

The government doesn’t need more revenue, it’s already overflowing with money thanks to additional taxes and bracket creep. (In fact, it should have less revenue because it’s wasting so much of it.) Also, more revenue won’t reduce inflation because the government is part of the inflation problem.

Instead, the RB is trying to stifle the M3 money supply after it created the problem by printing money to paper over the cracks created by the lockdowns. It is trying to reduce the amount of debt in the system. Next year the average mortgagee will be paying tens of thousands of dollars in additional interest. In order to keep their houses, they must either extend their mortgages or cut inessential spending. It will be a mixture of the two but expect the high street to suffer. Retail will be a dead zone. Welcome to the 2023 recession!

Wage rises are not the sole cause of inflation, they contribute with the other points you mention and one could argue to the contributing ratio’s.

Problem quoting Marx is that he wrote his thesis and lived in a time much different then today’s global market place.

A market place where capital is mobile, where labour is mobile, where technology has shrunk the global market, where global transport can distribute goods faster.

For example in Marx time a local brick works faced no outside competition, its market was fixed and labour cost could equate to labour input. The value of the brick was measurable in the cost of labour.

Now that brick works faces international competition from around the globe due to massive increase in global transport availability.

The brick works faces capital mobility in that the owners can relocate to a more “favourable” location. It is not tied to a location solely due to transport constrictions. Some countries offer incentives such as tax breaks, easier new brick work factory construction, cheaper raw materials, cheaper labour, easy access to port facilities, etc.

The Marx local brick works faces international competition for their labour. No longer is labour tied to a locale due to travel constriction as Marx would have faced. They are free to travel and resettle to another brick works keen on their labour and knowledge. They can be recruited via the internet, no need to travel first in the hope of a better position.

Technology transfer in Marx time was pen and paper plus a slow delivery service. In today’s global market place this technology transfer is instant. Freeing labour and capital to be located anywhere.

For example one can send a solid model drawing file to a machine shop in Vietnam and have DHL deliver the finished part within two weeks. Manufacturers are no longer tied to local machine shops or a need to have their own machine shops. In Marx time the only place to get machining done was local.

Same with creating a web site. No need for local web developer, Ukrainian (yes they are still working) web developers are just as accessible as a local web developer.

Same with software development. Get pieces of code written (Russia used to be good but not with sanctions) anywhere by someone who has an internet connection and a computer.

Problem for New Zealand labour is that they compete globally and with the way below par education system, are often unable to compete.

Try getting a competent local 5 axis machine operator. Easily earn $60 per hour after just a few years training. But we don’t educate or train them in New Zealand. Downwards spiral, Machining being done less and less locally thus no local operators are educated and trained.

Education and training is the key to higher wages in the global market place. Capital will flow to where the best conditions and skilled labour are.

But New Zealand is wedded to the Marx inspired (and no longer relevant) labour costing model.

Time for a new labour value and payment model based on the global market place.

I am sure there is a reason but rather than a windfall tax on excessive bank profits ( which I am sure will happen in the next year as well) why not have some real action on deposit rates and make interest income below a certain amount tax free. If you want to take money out of circulation why not use a bit more carrot than stick!

I like your idea Wheel