Adrian has kindly explained that he needs to burn New Zealand to save New Zealand…

Adrian Orr: Beating inflation will mean higher unemployment

“Of critical importance to overall financial stability will be the robustness of the labour market.”

Orr warned that the interest rate hikes needed to beat inflation would mean higher unemployment.

“Returning to low inflation will, in the near-term, constrain employment growth and lead to a rise in unemployment,” he said.

“The actual extent of this trade-off remains unclear, however, given the significant labour shortages globally and the very different means of employment being adopted post-Covid.”

“Importantly, it is highly unlikely that we are at maximum sustainable employment if inflation is still high and variable,” he said.

…cough.

What if he’s wrong?

I don’t mean about needing to destroy jobs and raise unemployment rates by rapidly lifting the OCR, oh he’s going to do that, he’s clearly telling the well heeled part of town that he intends to keep raising the OCR and that he is openly accepting the collateral damage of job loses, I mean what if he’s wrong about why inflation is going up and is giving the economy the wrong medicine?

The argument is that if the OCR rises, inflation will fall because jobs will be lost and those losing jobs stop spending, thus demand is allowed to ease which is supposed to lower prices.

So far, so Keynesian.

But what if this is a unique moment of crisis in Capitalism?

What if there is a price to pay for printing $25Trillion and artificially lowering the interest rate to the lowest rate in 5000 years?

What if that tsunami of inflation was distributed to the deepest, darkest most de-unionised supply chains in China and that Covid and geopolitical tensions have snapped free market just in time supply chains to just in case supply chains which sharply import inflation?

What happens if job losses explode AND inflation continues to climb?

What if the global supply chains that have kept the tsunami of hyper inflationary pressures away from the West have actually ruptured?

What if all the Keynesian macro economic advice is worthless because of the extreme global debt and sudden importing of inflation back to the West eradicates all that previous inflation suppression?

What if lowered demand still sees prices climb because there is a tectonic realignment in supply chains?

What if Orr’s medicine can’t cure the symptoms because he’s misreading the disease?

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media.

Then we have the Great Depression. I well remember my mother still continuing her waste not philosophy well after it passed. Better times later could not shake her rememberance of it….

you destroy jobs you destroy money circulating in the economy…..goodnight SMEs, hello international franchises…..something nat voters should have a quite think about.

Why? it is going to happen, is already happening under labour. The 3.2% is an average. There are pockets were the local economy has been already destroyed or is hanging on by sheer will of the owners. Maybe people should vote Labour just so that they could collect the harvest of the seeds they planted. Let the country eat misery. This is something that will happen and neither Labour nor National are able to do anything about it.

The Reserve Bank did research a while back to see how comfortable Kiwis were with increasing unemployment to control inflation via OCR increases. Many people were OK with it (presumably because they didn’t feel they’d lose their jobs). It is a bit hard to solve complex issues when you only have a simple model and one control lever.

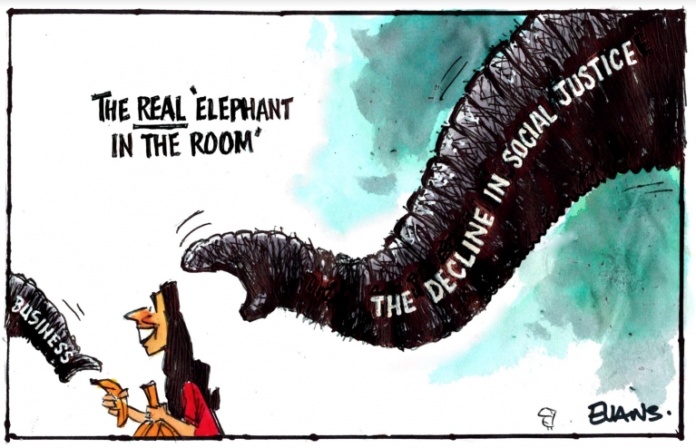

Corporate greed is the hidden (by mainstream economists and media) factor feeding inflation–they keep ratcheting prices up on basic consumer goods BECAUSE THEY CAN–geddit?

The average persons biggest cost is a roof over their head….rent,or mortgage(usually).

If this can be addressed the consequences of inflation will be negated.

However realistic house prices and rents,do not allow super profits for the vested interests .

14 years of ramping property prices,share buy backs and bailouts ….have come home to roost.

Modern monetary…theory…indeed.

It will wipe thousands of people out, but who cares, as long as you get your cheap latte. Which is what this is all about.

Fortunately the Labour government has not had the time to completely destroy our farming sector so once again they would be there to save us from bankruptcy. Unfortunately if NZ voters vote this mob back into power it will be the death nell of the rural sector .

..and we get clean rivers and lakes for a chance. For 30 years, farmers in this country have coined it, while our rivers have become open sewers.

Im guessing you have grandchildren. Are you able to look them in the eye, and tell them how you think that farmer profits are more important than them being able to swim in nice clean water?

‘nice clean rivers’ don’t create any tax revenue that can be used to pay for hospitals, superannuation or other benefits. Dairying does generate tax revenue and jobs.

Some rivers are kept from being visibly polluted but that’s more for tourism reasons.

So you fully condone the pollution of lakes and waterways by greedy farmers?

Dont you want people have clean air and water?

Dont you want any envionmental legislation whatsoever>?

Sorry Trevor I think you are off the mark with that logic. How are Labour destroying farmers. The latest scheme which was prepared essentially by the primary sector is in the consultation phase and hasn’t even taken effect. Stop listening to those stupid old wankers from ground swell. Any primary producer with a clue about export markets knows damn well we won’t get away with doing nothing, and if anything it will increase their ability to market NZ primary produce.

So has he given up on MMT? Modern Monetary Theory? Because he didnt want to do the last bit where you raise taxes where inflation occurs in sectors like housing and nail it with a tax to suck out the excess liquidity?

Then paydown debt and spend on building affordable social houses and health and education?

You’ve accidentally just nailed why MMT could never work. Raise taxes that much? HA!

So it was an MMT strategy? What you say makes sense albeit not being exactly a vote catcher.

Sometimes it seems that sometimes doing half a job is worse than not starting it.

Who is “he” Tane? Adrian Orr is monetary policy not fiscal policy. Not that I disagree with the tax piece (unfortunately Ardern is gutless on that). I wonder if we had CGT regime in place, pre money printing, if the property prices would have gone quite so high? Probably but at least we would potentially have more tax revenue to utilise

The logical and predictable end game of covid cult.

Funny how kicking the can down the road and dribbling on about IwiMania doesn’t protect your legacy.

Oh right Frank, iwi mania is clearly responsible for global inflation!

That being said it does make one wonder what the point of saving the economy in the first place was ( if you are going to kill it now)

Personally I think the doom and gloom is not necessarily correct on the inflation outlook. As Damien Grant is pointing out, the numbers don’t support continuing escalation. Put the politics aside and look at the actual numbers. At least Damien does that.

Martyn is it really about just losing jobs to reduce consumption? Is not also about those with mortgages reining in spending because they will be spending all their ‘disposable income’ on interest?

I agree though that if the bulk of inflation is imported what f’ing good will raising interest rates really do. Is consumption of food really going through the roof? International airfares ( which have been given increased weight in the CPI) are really going through the roof because of massive demand? I get fuel costs but they have been high for quite some time.

I am starting to think there is a whole lot of gouging or predictive price rises going on amongst the political bullshit being spoken.

It is going to get worse. Throw in a few bad harvests due to droughts, floods, fires. Throw in a second planting season missed in Ukraine, a fertilizer shortage world wide, a few more floods, droughts, fires and and huge shipping costs and soon you have some shortages here and there, small permissible at first, and quite annoying in the end.

We will have high unemployment, we already have in places such as Rotorua – 11% a few month ago well above the national 3.2% on average – and yes, smaller businesses will close, and why should they not. Add in high rates, new costs for water, high energy costs, and people will end up losing their houses because they can’t afford their rates.

We are holding on to a house of cards.

The government and their affiliates have always got it wrong, well, at least for the past five decades.

The way to secure a strong and stable economy is to create jobs. Otherwise, yes, there is a high likelihood of a Great Depression.

The voodoo economics will continue until the right figures are finally squeezed out from the traditional blend of pointless misery and suffering.

This is all lining up nicely to create a catastrophic 2023.

Ideal for the election!

Comments are closed.