A recent report on the property market in Stuff is headed: “World watching NZ housing market as Auckland labeled ‘canary in coal mine’” The report notes that:

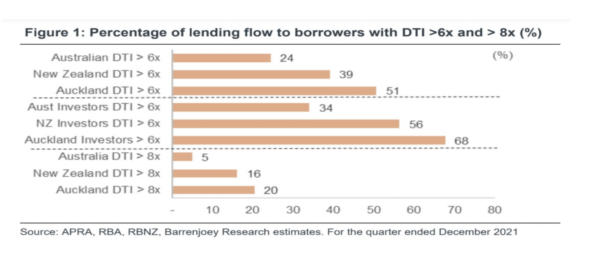

“The likes of Ireland and the UK have DTI caps between three and a half and four and a half times income. In New Zealand, customers with DTI of more than six account for 39% of recent borrowing, Barrenjoey found after analysing Reserve Bank data.

Auckland was higher, with 51% of recent borrowers taking out home loans at DTIs over six, and a fifth borrowed at DTIs over eight.

In the 1980s in NZ price to income was about 2. Other facts we need to be aware of

- Real house prices have gone up 300% since 2000 – an OECD record. The USA and OECD average is half that.

- Our household income to price ratio is also one of the worst.

- The value of NZ’s housing stock has gone from $250 billion to $1600 billion since 2000. It has gone from 2 times GDP to 4.8 times GDP in the same period. This compares to 1.7 in the US.

- The Sharemarket is only worth 0.6 of GDP compared to 2.2 in the US.

- Current household debt as a share of income has doubled in the same period from 80-160%.

- In addition, recent lending has been trending upwards to risky levels in terms of debt to income

This makes the likelihood of a major housing downturn as part of the coming New Zealand recession almost inevitable.

There Is simply no escape route from the capitalist point of view.

They must and will attack inflation. Budget cutbacks and interest rate rises are the principal tools they have at their disposal to achieve that goal.

For a period we will have “Stagflation” where we combine economic stagnation and continuing inflation. This is the worst of all possible worlds for working people.

Inflation is back worldwide and with it is the blame game. Central Banks and governments want to blame the Pandemic associated lockdowns and shortages or Ukraine War.

An impending worldwide recession in late 2019 was followed by the Pandemic in early 2020. This led Central Banks and governments worldwide to embark on a massive amount of money printing and government spending to prevent a broad economic collapse.

World production and and trade was then disrupted by economic closedowns that were imposed as public health measures to combat the impacts of the Pandemic.

The Central Banks then doubled down on money printing in response. This was led by the US Federal Reserve. “To understand the magnitude of the Fed’s money printing, we need to go back 22 months ago. At the start of 2020, there was $4.0192 trillion in circulation. On January 4, 2021, the number increased to $6.7 trillion dollars. Then the Fed went into overdrive. By October 2021, that number climbed to $20.0831 trillion dollars in circulation.” Since January 2020, the US has printed nearly 80% of all US dollars in existence.

All of the central banks have followed a similar policy. The New Zealand Central Bank Balance sheet went from an average of $20 billion in the 1990s to $30 billion in the mid-2000s to over $90 billion currently.

The monopolies that dominate global production and trade then seized whatever opportunities of genuine or manipulated shortages to impose price gouging wherever they could.

Most Central Banks (including New Zealand) ignored the growing inflation and tried to simply blame the temporary supply chain problems.

Rightwing pro-capitalist economic and political voices that would normally raise alarms at the risks to their economic system by such measures stayed silent as well as they sense their system had dodged the bullet of a broad economic collapse.

The money printing also induced an extraordinary explosion in the asset wealth of the 1% globally was also a factor in muting criticism as well I don’t doubt.

But today we have inflation averaging 7% over much of the globe including the central advanced capitalist countries in North America. Europe, and Australasia. In Japan, the inflation is lower for now but their currency has started depreciating significantly. These are numbers not seen for decades. Two important economies, Turkey and Argentina, have inflation rates of 50-60 percent.

There is an ultimate risk that the continuation of current policies if ignored, will unleash hyperinflation that will destroy the value of the US dollar and end its role as the world currency. From the point of view of the 1% that is something that must be prevented at all costs. This was threatened once before in the 1970s when US inflation hit 13% and required what was dubbed the “Volker Shock” in the name of the then US Federal Reserve Director Paul Volker who pushed the official cash rate up to 20% to restore confidence in the dollar. Government spending on welfare and education was also targeted for cuts. Aiming for a budget surplus became economic orthodoxy although this was only achieved temporarily in the US given the demands of its permanent wars of empire across the globe.

After the inflationary 1970s in New Zealand, we had our own version of the Volker Shock under the new Labour Government elected in 1984 and the official cash rate reached an all-time high in March of 1985 of 67.32%! Variable mortgage rates hit 20%.

Of course, capitalists who were in the business of lending money rather than producing goods were massively advantaged. That is the economic origin of financialisation and de-industrialisation in the advanced capitalist countries as literally, General Electric became GE Capital. The one percent don’t care how they make their money.

Accumulated wealth is stored in financial or non-financial assets. Historically this was broadly 50/50 in share but a gap has opened in favour of financial assets since 2008.

The 1% hate inflation with a passion as it reduces their financial asset values by that percentage or more. In the last analysis, they determine central bank and government policies on these matters and the war on inflation will be declared as absolutely essential for a nation’s economic survival.

For the right-wing politicians and monetarist economists, the fault lies with too much government spending and too much central bank money printing, and to a certain extent they are correct. Broad-based inflation is in the last analysis a monetary problem.

In the 1970s the principal means of creating money and fueling inflation was to run budget deficits. The governments routinely spent more than they took in taxes. The US also needed money to finance the war in Vietnam. The economic orthodoxy at that time became known as Keynesianism after the UK economist John Maynard Keynes. Keynes was an upper-class classical pro-capitalist free-market economist but accepted something must be wrong with the classical view when the theoretically impossible economic depression happened in the 1930s. He came to the view that a budget deficit is alright at times to stimulate demand and employment.

Prime Minister Robert Muldoon in New Zealand and US President Richard Nixon were public supporters of Keynesian policies in the 1980s despite their right-wing views on other matters. Keynes also had a cost-plus view of inflation so it was always in the last analysis the worker’s fault when prices started rising and his solutions involved wage controls to cut wages when that happened. Both Nixon and Muldoon followed this aspect of Keynes’s policies as well.

However, after the deep recession following the Volker Shock budget deficit financing was sharply curtailed – especially spending on working people – like welfare, health, and education. Infrastructure spending was also routinely starved.

Central Banks like New Zealand were made “independent’ with the exclusive goal of targeting inflation to keep it low.

A central bank can create money by simply printing it electronically. What that gets used for however is something that can be different in different periods. In the US they used the money to buy up bonds from distressed banks and industrial corporates to prevent them from going under.

In New Zealand, $28 billion was given virtually free to the banks to lend directly to whoever they wanted. They gave most of it to property speculators who drove up prices by 30% in one year. Another $100 billion was made available to the government to use to prop up businesses during the pandemic.

This allows the government to run big budget deficits without worrying about if the market can absorb the amount needed in the short term.

This is “unorthodox” by any measure but was considered necessary by governments and central banks across the capitalist world as the crisis hit.

World capitalism got out of the 2008 and 2020 crisis with massive money printing dubbed “quantitative easing”. Interest rates were driven to rock bottom as part of the process. Debt in all forms – personal, corporate, or state-owned – massively increased as well. A significant number of debtors of any type cannot survive even a modest increase in rates

The return to orthodoxy means the central bank must retire the bonds that it has created by buying them back and pushing up interest rates to do so.

But the budget deficits are also being targeted because they are also a way of creating spending artificially – a form of money creation but different from the central banks printing money directly.

This will inevitably induce a recession over the next year or so. This is true for the rest of the globe as well.

In fact, the poorer countries are being hit by a double whammy of war-induced shortages and prices rises for basic food, fertiliser, and other commodities. This will accentuate the downturn. There is also no chance of QE being deployed to tackle the deepening recession.

As Oxfam notes in a new analysis, during the pandemic’s second year (from March 2021 to March 2022), the IMF approved 23 loans to 22 countries in the Global South – all of which either encouraged or required austerity measures.

The International Monetary Fund has announced that the global economy is entering a major slowdown, downgrading the growth prospects of 143 countries. At the same time, inflation rates have reached historic levels. Around the world, hundreds of millions of people are falling into poverty, particularly in the Global South. Oxfam has sounded the alarm that we are ‘witnessing the most profound collapse of humanity into extreme poverty and suffering in memory’.

This government of New Zealand has actually said it wants to go back to budget surpluses as soon as possible. This is economically illiterate. It is akin to a religious dogma rather than economic science. But it was a dogma adopted by the previous term of the Labour Government from 1999 to 2008.

This is not economically necessary in New Zealand which has one of the lowest debt to GDP ratios of any advanced capitalist country. A modest deficit is actually possible permanently so long as the economy is growing and the debt to GDP ratio can even trend down with one.

Government surpluses actually have the negative impact of withdrawing money from circulation and contracting rather than expanding economic growth.

Also, the deficit could be reduced from the current high levels by increasing taxation on wealth to supplement all the taxes workers pay but that seems unlikely in the foreseeable future.

Refusing to tax wealth at all includes nearly all forms of capital gains. This encourages a huge weight being given and taken by the property market in the New Zealand economy.

There are also two funds with over $100 billion between them that could be taken and used for an emergency like this.

These are the funds for future national superannuation and ACC payments that could be directed to be funding the massive infrastructure deficit the country has. These funds were created for ideological, not economic reasons.

The ACC fund was created to stop it from being a pay-as-you-go system to being an insurance system with its own fund to cover future claims because it was being prepared for privatisation.

The fund was created by overtaxing us in ACC payments. The privatisation was stopped by Labour in 1999 but the fund remained and the penny-pinching insurance model which aggressively denies entitlements also remained. The $40 billion could be taken and used for investments in infrastructure while ACCS was restored to being a pay-as-you-go system with a culture of entitlement, not denial.

The Superfund was also established by the 1999-2008 Labour government to allow an even bigger budget surplus to be maintained rather than be spent on things like public transport, water, or climate change. It now has $58 billion accumulated.

A fictitious panic was promoted that national super would become unaffordable in the future and we need a special fund to save for the future expenditure that will be needed. No government in the world thinks it is so incompetent that it cannot prepare for the future by spending appropriately now on infrastructure, health and education needs to make the economy more productive to be able to increase the tax take in the future. This is doubly the case when they could tax wealth and choose not to. The Finance Minister at the time, Michael Cullen, used the fund to keep money out of the hands of the other ministers who wanted to spend it on their needs.

The coming crisis will threaten the viability of New Zealand’s banking system given its almost total reliance on lending for property (including agriculture). It is probable the banks will need to be rescued from their own reckless expansion of debt in recent decades. In the US and Europe, many banks were nationalised after the 2008 crisis only to be handed back to the thieves who created the crisis in the first place.

This should not happen in New Zealand. Banking and insurance should be public services dedicated to meeting people’s needs, not profit-gouging thieves.

The only alternative is to nationalise the banks and insurance companies without compensation to the shareholders who have robbed us blind for decades. This will allow the state to take control of the debt mountain and at least partially write it off for homeowners and the many farmers who are also likely to be in a dire position once a global recession happens. It will also put the state in charge of all forms of money creation, including that of the banks in the form of credit creation which should be controlled to avoid inflationary surges like we saw in housing. The banks have also been central to the transformation of much of New Zealand agriculture into dairy production – a debt bomb-laden, soil degrading, and water-poisoning economic operation.

An alternative democratically developed economic plan for a Green New Deal to save the people and the planet then needs to be implemented.

The alternative economic plan must not be dependent on commodity production for profit and the relentless and endless degradation of the planet.

We must end all participation in the wars of empire we are currently engaged in to protect our own oligarchies in the so-called West that control, exploit and degrade human life and the planet in our part of the globe. Working people have no side in these wars.

What are the relative migrant percentages in Ireland and NZ? NZ is about double, or more, Ireland’s. The Labour and National Parties will simply re-open the floodgates, and floodgates they are, to prop up the housing Ponzi.

Where Robo got MMT wrong was he never read the last chapter of the book.

The ‘Taxation’ component.

When inflation starts to rise after pumping shit loads of cash into the economy.

You have to remove some of that excess capital from the system to control inflation.

That mechanism is called taxation.

If you remove the excess by using a Capital Gains Tax in that part of the economy where these excesses of Capital appear such as in the Housing sector!

You can control inflation and remove the excess capital which then becomes revenue into the Crown’s coffers which then can be used to pay down debt and be allocated to build some fucking houses! And other things.

There is a difference between QE and MMT.

And QE does not cause supply chain supply problems, nor disruption to global and local production, caused by lockdowns and worker shortages (isolation etc).

and no comment about the RMA and the dogs breakfast that Labour want to replace it with.

housing in NZ is fucked for many reasons not least of which is the restriction of land supply and the refusal of government and councils to build roads and associated infrastructure to support it

solution- compulsorily purchase all of the lifestyle blocks between old Albany village and Helensville. Build two or three big roads and carve that land up like labour did back in the day with Porirua, Upper Hutt, etc and then watch the cost of land collapse and housing prices along with it

Only problem is that this destroys all those existing mortgages and boom said government is voted out

We have no one to blame but ourselves

We have ‘kick the can down the road’ Govts to blame for sure.

Labour should be ashamed of themselves=housing ponzi and immigration the cornerstones of NZ GDP.

Wonderful analysis there Mike,apart from the bit about the Cullen Fund.

That fund allowed NZ to borrow at low interest rates and is an insurance for the future.

Norways Fund and the Canadian Pension fund are good examples of how valuable they are.

Not only that but significant capital growth has been realised on investment inputs – so much so that the decision of Bill English not to continue them was probably one of the worst decisions by a Finance Minister in our history.

Hi Blazer – That is only superficially true. Those other funds are the result of the savings from a natural bounty not from taxation. If it were possible to raise funds from taxation to find future government expenditures then why don’t governments do it for all future expenditures. These funds will also lose half their value with the next downturn and the ACC fund will need more ACC levies to recoup the losses.

Check this out by Susan st John

https://cdn.auckland.ac.nz/assets/business/about/our-research/research-institutes-and-centres/RPRC/PensionBriefing/PC%202021-2%20New-Zealand-SuperFund.pdf

The Guardian.

‘Bank of England ‘duty bound’ to trigger recession to curb inflation’

“https://www.theguardian.com/business/2022/may/01/bank-of-england-duty-bound-to-trigger-recession-to-curb-inflation”

And while most of us cringe in fear at the prospect of the price of a loaf of bread there are those few others driving Bentley’s to the Bank with boot loads of our money and the souls of our politicians.

So? Broadly writing. What are you going to do about ?

Whatdya gonna do?

Here’s what you can do. Nothing. You can’t do a thing about it. You’re powerless, entirely without direction, without organisation, without security, without cohesion, there are no real and proper unions, you’re segregated and compartmentalised by a cheap plastic commerce culture, the one you reach into your pockets to pay for the plasti pap they pimp to you and the deeper you dig while chasing the logical fallacies the deeper you get into all controlling debt.

They can please themselves because we can’t make a fist without forming a committee then follow directions with pictures, and it serves us right for what we’re about to receive and we’re about to be fucked without the kissing.

Bold, mad, crazy action is required but we’re too timid, shy and insecure to step up and say fuck this! We’re far too institutionalised and lost up the arse holes of foreign owned bankers to see out of their sphincters and beyond to what we’ve actually, literally got. A paradise of true wealth and true talent. A beautiful land safe and secure in a vast ocean and yet we let the sub human sociopathic narcissists sell you and me out to vicious predators who will, without a doubt be stalking us night and day, waiting for our vigilance to falter.

Here’s what we can do.

Expel the banks. All of them. Even the so called Kiwi owned banksters are corrupt and in stealth mode, stalking you where ever you go then they follow you home the slip inside before you can close the door.

Mandate voting. You live in a democracy then you have to vote. To not vote is to put the rest of us at risk and I say fuck that. I don’t want some lazy, dull minded moron put me and mine at risk just because they’re too arrogant and too stupid to get out of bed that one day every three years to vote. You do know, you non voter morons, that the plutocracy that has you by the throat hopes and prays that you just stay right there in bed. Never mind that silly old voting thing. What’s it ever done for you.

Remember? Money buys poor people stuff and things. Money also buys rich people the power they need over the poor.

Ban the Banks. We don’t need them.

Mandate voting. If we all vote, then sooner or later, good people will prevail.

Lastly and most importantly; request a Royal Commission of Inquiry into every crack and crevice of our politic and our economy spanning the last one hundred years by an independent board.

I promise you. You will be amazed at what they’ll find.

Aye Boys?

Thoughtful article Mike, lays out the history of inflation in an understandable way. How the capitalist class, and Finance Capital in particular, get bourgeois Parliaments and Senates etc. to legislate and act directly on their behalf. If working class people want to change that situation they must get politically active themselves, rather than merely voting for “lesser evil” partys.

Put them all, including the bureaucrats on the average wage.

Public Service returned to public services and to the Public.

Let’s referendum that!

“If working class people want to change that situation they must get politically active themselves, rather than merely voting for “lesser evil” partys.”

ep, and not just ‘wprking class’ either.

It’s taken me a while but I’ll no longer vote for the least worst option.

I’ll vote for the most competent and responsive electorate MP (sadly atm in my erectorate, it’s the great GR although things could change), and for the party whose policies most closely reflect my values – and unfortunately that’s not Labour at the moment.

Fuck all the spin and meerkating and false promises. We fought for proportional rep (MMP) so let’s use it as was intended rather than trying to be clever. I think they’ll probably have to get their learnings the hard way in that space, going forward – but the drums are beating and the natives are getting restless.

The hard part will be whether or not party spin merchants and meerkateers manage to capture those in charge – but then usually the bullshit artists stand out a mile. Quite a few of them seem to comment here at times

Notice how the greatest house price rate rises happened under Labour governments?

Thankyou Helen and Jacinda LOL

Must have something to do with incomes and low unemployment.

personally don’t give a flying fuck if the largest increase was under genghis khan ….

who/what/when is academically interesting but we have to fix what’s here in front of us right now.

Andrew thats Bullshit. Your hero Key let his property speculator and bank friends loose between 2012-2017 and prices grew 80% and was the start of the beginning of housing out of reach of NZers. Yes the speculators and banks had another go last year and prices increased 50%. But over 4 years from 2017 to 2022 including falling house values was only 50%. Your new tory hero luxon wants to invite the property speculators in with subsidised tax and tax cuts. Only labour can manage the property/house market.

Great summation Mike – needs to be made into an illustrated step-by-step video presentation. Distributed

virally or Posted on Youtube, it could lift the less financially/politically literate beyond their petty political prejudices, which politicians rely on to determine all elections, and help people to really understand how the system works and so make informed decisions. Maybe someone could develop a computer game to compliment it.

Geoff Bascand sank the titanic alright and Captain Smith Orr is going down with it fast. Robbo and Jacinda have missed the last life boat, they were too busy arguing about whether the paint on the grand staircase was inclusive enough. John Key was in the last boat on his own but decided to save himself. He even left his son Max behind, he is now in too deep even for his dad. Everyman for himself from this point on (and woman)… I don’t want to offend Bert. God speed fuckers!!!!

The government’s message for a decade has been around ‘first home buyers’ getting their first property instead in increasing wages in line with like minded countries like Australia to make sure NZ was not falling behind as a 1st world country.

As NZer’s on wages have been unable to afford housing they gave migrants NZ residency and citizenship so they could afford to buy here and prop up NZ construction by bringing in foreign money, not by working here on NZ wages .

Low income migrants and their families could toil for the woke and right wing elites on low wages that have become almost on par with benefits – thus creating a Ponzi, greater poverty and increasing problems with housing, health care, aged care, schooling and infrastructure.

The result is ever increasing lower skills in NZ and higher prices everywhere in construction, takeout, utilities and supermarkets (leading sponsors of low waged migrants), record small businesses like liquor shops and takeaways popping up as major sectors, and division as people are between a rock and a hard place.

NZ used to have a different immigration policy in 1980 which has been destroyed by the woke & right wing elites to create NZ as one of the highest immigration per capita countries in the world and make the Rogernoms more money.

govt should not be ‘helping’ first home buyers until we have sufficient state housing … full stop.

What also needs to happen is the immediate nationalisation of that Gold mine down in Thames & those commodities kept for the NZ Nation? There is going to be a return to a Gold Standard pegged to Currencies to provide Stability & trust which Western Countries, particularly America, has destroyed! The entire Western, Debt based Economy based on the USD Financial System is collapsing & being replaced by a Commodity based System with Russia & China, India & the Global south leading this momentous change into 2 different systems? The War in Ukraine has accelerated the end of the US dollar as the World’s Reserve Currency & a return to a sound monetary system backed by commodities like Oil, Gas & Food etc which is now under way. NZ needs to be on the right side of History, not the side which is going down like the Titanic!