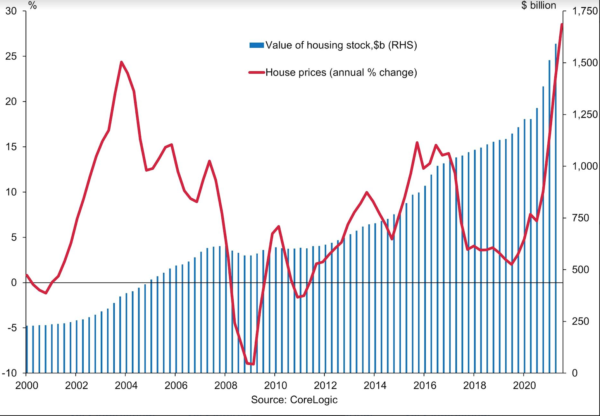

There is an inevitable “correction” coming with the inflationary storm being unleashed by late capitalism. This will lead to higher interest rates, and the weak links on the debt mountain will be toppled one by one.

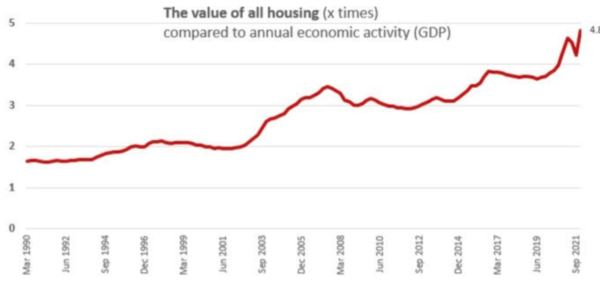

In Aotearoa this inevitably will include housing debt. At the moment housing values equal about 4.8 times our total economic activity as measured by Gross Domestic Product. This compares to 1.7 times in the US.

The sharemarket in Aotearoa by contrast is only worth 0.6 of our GDP compared to 2,2 times for the US.

Current household debt as a share of income has doubled over the last two decades from 80 to 160%. That means any increase in interest rates will have a dramatic impact on people’s ability to service those debts.

Some people will be forced to sell their homes. If that becomes a cascade then a deep price “correction” and broader economic crisis is inevitable.

People have panicked about these sorts of statistics before. We aren’t to forget, though, that a lot of the wealth belongs to our oldest generation and will be passed on as time goes on. This “trickle down” economic marvel has worked well for New Zealand at least twice previously, and in Australia at least once. While the theory did not work well, ultimately, in the US 1980’s Reaganomics era, it was due to the fact that the taxation system was geared towards the wealthy businessmen of the time. There’s still scores of people who can recall the Prosperity Teaching in Christianity, which funded the lavish lifestyles of televangelists; the prominent New York City hoteliers and industrialists, who got generous tax breaks; etc.

“There is an inevitable “correction” coming with the inflationary storm being unleashed by late capitalism.”

Money printing isnt capitalism. None of this would have happened… the large bubbles etc if there was no govt intervention since 2008. We should have let it pop back then.

“… the entire small business economy of New Zealand relies on its working capital from residential property that’s probably the favourite form of borrowing for small businesses because it’s really hard borrowing any other way.” In https://www.rnz.co.nz/news/business/459813/incredibly-prescriptive-lending-code-ruining-lives-mortgage-broker

So, does this mean that if the housing market tanks, it’s 1932 all over again for the small business sector as well?

Perhaps we will be able to buy at least one of our banks back for a NZ$1? Buy ’em up while the price is down – good financial market tactics. I’ll put in up to $100 if others will.

I was looking on a comedy website and came across this quote from Jacinda Ardern that was apparently spoken with a straight face at the recent Labour party’s caucus retreat in Oakura near New Plymouth.

““Labour has demonstrated our ability to manage challenges and change, and we will continue to demonstrate our ability to manage challenges and change when it comes to climate, housing, poverty and everything that we continue to face as a nation,”

Labour managed the challenges on housing? haha. I love Jacinda’s sense of humour.

Thw smart conperson knows that if you can’t make it, you can fake it. And Labour has kept on top of change, luike holding down the staeam vent on a pressure cooker.

Where in the country are you living? there’s housing development everywhere. From the upper well clad home in what will become a leafy suburb to the upper dressed down affordable in a virtual copy cat of coronation street style metropolis. The banks have the squeeze on people wanting to own their own home. $40g is a lot of capital for a potential home owner to save and prove a track record. The future of owning and or keep owning a home is dependent on persons employment, on going income. This is often not a grantee depending on the trade or profession a person is engaged in. Its possible for any person to become redundant, due to sickness, accident, or movement/change in business, but more so for people working as manual labourers.

Like the rest of the western world we have more then our fair share of low income workers, wage workers, Are those likely to be out of work once the contract is done. These are the people less likely to obtain bank loans towards home ownership.

Given that the banks are not Nz owned or controlled, tell us how does a Govt, dictate to these organizations, what and who they should loan money to? Also given that the Govt, is not as powerful in the great business scheme of things as people would give them credit or blame them for when it comes to who, what and how, the money is doled out get people into a home. The country is over flowing with new home builds people, take a look around.

As long as Councils artificially ration the supply of land for building, there will be a housing stock shortage. Even if the central government overruled them now, it would take many years to correct the imbalance in supply & demand.

Higher interest rates would dent the rise in house prices and maybe even push them down a few percent, but history shows that when times get tough and cash is a little short, people hang hard on to their properties and instead cut discretionary spending. Typically there is a drought in house sales and a recession as people batten down the hatches and get on top of their debt. Meanwhile inflation slowly nibbles away at the remaining debt until the situation is corrected.

You hope, Mike was mild in suggesting possible downsides to the high household debt. There is a possibility that debt defaults will spread from households to highly leveraged corporates, when disasters increase insurance companies will fold due to excessive claims, superannuation plans reduce in value etc.

Ask the people in Tonga how they feel about life continuing to go on as normal.

GDP is just bullshit, measuring the movement of digital money from one place to another, as speculative bubbles get blown by central banks.

Now it is all unravelling fast, with energy prices rising fast (expect the next fuel price rise later today or tomorrow) and food prices rising fast -oops, wheat up 23% year-on-year- and all the speculative bubbles are found to have nothing supporting them, other than yet more bullshit and devaluation of money in the system.

But you won’t get ANY politician to admit any of that because it is their job to lie to the masses about EVERYTHING.

The dominant economic-financial system has been propped up for decades via all sorts of chicanery, and now the writing is on the wall.

I see Brent crude is up another $2 overnight, and the 10Y US Treasury has surged to 1,84%. Meanwhile, actual inflation (devaluation of money in the system) approaches 15% annual rate in western nations.

But politicians will keep up the fake mantra about inflation it being 3% for as long as they can. Which will probably be another month or two. Just more lies.

The collapse of the neoliberal fraud system foisted on NZ decades ago by corrupt liars is going to be very ugly.

Awaiting the treason trials.