Chris Trotter reaffirms his deeply cynical views of a Labour government pandering to its shallow voting base ruled by self- interest and ignorance. He infers that efforts by myself and activist groups like CPAG to highlight the plight of the poor and how to fix it may be worthy but are ultimately pointless.

Despite this I can’t stop myself writing about something truly enraging that just arrived via a CPAG OIA of more than 90 pages on the Working for Families (WFF) review. I hope my efforts are not completely fruitless.

What is fundamentally wrong with WFF goes to the heart of Labour’s framing of issues to appeal to its voting base. According to Chris Trotter this base comprises flighty, disaffected refugees from National; Labour party intellectuals who “inhabit the leafy suburbs” to whom more tax is an anathema; male working-class laborites who don’t want ’handouts to the poor’; and “kind Labour women” who want Labour to talk about poverty so long as they don’t actually do anything. This voting base is donkey deep in neoliberal thinking about the supremacy of paid work. That has not changed for two decades.

In Australia, tax credits for children are simply about children and their basic needs. But not here. Oh no, child tax credits have to be tied to getting those feckless sole mothers back into the paid workforce regardless of how many children in her care, how disabled or how young they were, whether she was herself sick or disabled, or whether full time paid work was even a remote possibility.

The long promised WFF review has been conducted under wraps, all discussion and meetings in secret and with no consultation, least of all with those affected. While we can now see from the OIAs the direction of bureaucratic thinking, between the annoying redactions that is, it does not impress with either its vision or basic logic.

The OIA shows that the original framing is being taken as the starting point for the current review.

The essential inconsistency in these two objectives is not discussed although it is acknowledged that the work incentive aspect has not worked out well. But neither has the poverty reduction goal.

Make no mistake, WFF has nothing to do with ‘low-income earners’ who do not have children. Of course, this group should be encouraged to retrain and get worthwhile employment. WFF is about children and is not for the young unemployed.

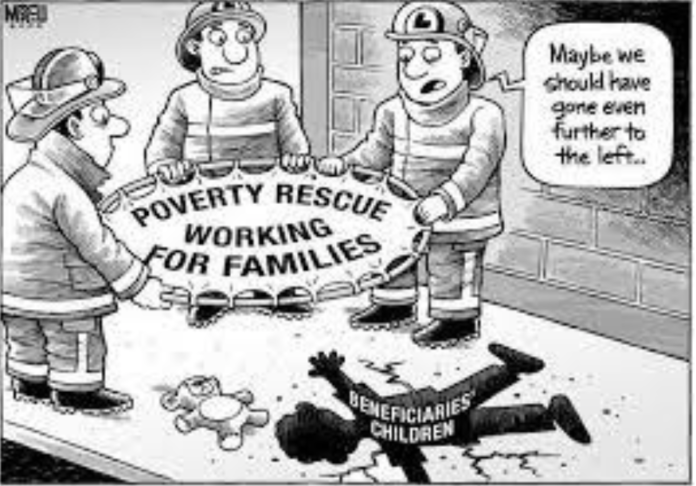

If a payment for children in poverty (ie the In Work Tax Credit IWTC worth $72.50/week or more for larger families) is designed to reduce child poverty, then, by definition, children in poverty who are denied the payment must remain in poverty (to give their parents an incentive).

Thus for 17 years the numbers of children under the lowest of the low poverty lines (about 170,000) has barely budged. Year after year the MSD has drawn attention to the fact that the WFF made no difference to the levels of child poverty in workless families. But ideologues can’t hear that. They believe, as expressed in Michael Cullen’s memoirs, that WFF was an unqualified success, “reducing child poverty by 30-70% [depending on the measure]” and that those (i.e. CPAG) who say otherwise “misrepresent “and engage in downright falsehoods.”

The confusion of objectives has led to a desperate muddle. The IWTC is not about rewarding an extra hour of paid work. Children of parents who work part-time while on a benefit are still deemed unworthy- their parents will have to find a paid job that lifts them out of the benefit system before they qualify for the IWTC. Ironically, if a sole parent got a part time job, the consequent vicious abatement of the core benefit has been a very real and punishing disincentive.

In 2004 David Craig and I wrote a blistering critique of Working for Families for CPAG called Cut Price Kids calling out this stupidity. Over the years the IWTC has had to be modified as its grotesque unfairness became clear to even the ideologues in Wellington captured by the third way mantra that paid work is the [only] way out of poverty.

In the first Christchurch earthquake, the government allowed parents who lost jobs to keep the IWTC for 16 weeks even when they weren’t working. In the last lockdown, the government removed the unjust rules for the IWTC that required 20 hours of paid work for a sole parent (30 for a couple) to get the IWTC. But government couldn’t let go completely of the paid work requirement, creating a further muddle. Today a parent still has to be off a benefit and provide evidence of some paid work or a wage subsidy to qualify.

Getting rid of fixed hours of paid work took far too long and while it was essential in today’s fragmented and precarious labour market, the fundamental requirement that the parent does not access any kind of benefit remains. As we emerge tentatively from the latest lockdown the true extent of the damage to businesses and livelihoods will become clear. The families in most need who have had to go onto a benefit because they are now so poor will also lose this critical payment that is supposed to protect their children from child poverty.

Oh, and let’s not forget the pathetic attempt to make work pay with Minimum Family Tax Credit (MFTC). A family has to be both off the benefit and meeting fixed hours of work to have their incomes topped by the IRD with this oxymoron of a work incentive. The MFTC can be a very significant state payment worth more than a part welfare benefit, however as it is paid by the IRD is not called a benefit, therefore the family can have the IWTC too. As if it couldn’t get more bizarrely convoluted, this ‘work incentive’ MFTC has a 101.3% abatement- so the family makes itself worse off by working more.

There is much more to say about this promised WFF review that now seems to be on hold. But what needs to happen first is a redefinition of the purpose of this highly important redistributive programme for children. It should have a single objective – ie “to support income adequacy and reduce child poverty”.

The design of tax credits should be cognizant of effects on work incentives but not assume a primary role for the tax credits is to provide a work incentive. And WFF must be renamed so that is clear it is about support for our precious tamariki, not about paid work.

The review should be aware of the wide effect on work incentives for the working poor. Because of the muddled policy framing this is never done. If we care about making work pay, then why do low income parents struggling to get ahead in a hostile business world face such severe work disincentives? First, student loan repayments at 12% above the low threshold of $20,000. That plus tax, ACC, and KiwiSaver means an effective tax rate of 34.8%. Then, from a gross income of $42,700, the 25% abatement of WFF kicks in, lifting the effective tax rate to 58.8%, rising to 71.3 % above $48,000. Oh, and for those unfortunate enough to need an accommodation supplement (ie most sole parents)- you can add another 25% to those EMTRS.

Until the review committee rejects the idea that WFF tax credits for children should themselves operate as a work incentive we will continue to wallow around in this morass.

To close on a positive note, congratulations to Chris Trotter for his insightful assessment of the Cullen legacy including the failure of Working for Families for the poorest children:

“Who was he? This son of a London artisan who won a scholarship to the upper-class Christ’s College? This radical history lecturer … who was willing to sell Rogernomics to a confused and dismayed Labour Party? This Labour Finance Minister who left state housing underfunded and beneficiaries’ children unassisted by Working For Families?”

It was never ever set up for anything else then to prop up middleclass working families.

The end.

…and retained by National because its effectively a massive wage/salary subsidy for employers funded by all taxpayers.

The net result being to suppress everyone else’s income so as to benefit those who choose to have children they apparently can’t afford. A socialist dream ?

and retain under the current Labour doodahs.

And fwiw it was a massive wage / salary subsidy when Helen Clark and her Labour doodahs, many whom run government today installed it. It was never anything else.

If it were a wage subsidy, then how come the wages of those without children never went up?

At the time the problem was that the ECA destroyed unions and Labour’s effort in 2000 to make modest changes to this law got huge resistance – the WFF tax credits were a a diversionary effort to get a higher after tax wages, and it supplemented the MW increases that occurred in the following 3 years 2006-8.

because it takes a significant proportion of wage pressure off employers which impacts all employees

Na, while employers had access to migrant workers, and unions were weak, there was no wage pressure

I think you are both right RobbieWgtn and SPC.

WFF diverts workers from getting organised and winning their own wage increases from their employers in favour of transfers from other taxpayers. Low union density means those that do want to organise can start from a low base of experience and support.

And yes, objectively with a generally non fighting central labour organisation (NZCTU) and flood of migrant workers, actual pressure was low–unlike now with tourism dead, migrants and overseas students sidelined. There is upward pressure on wages.

Yep, that too, it all adds up

Therefore Sabine in the first review since 2004 we need to insist that its founding work-based principles are not just accepted and that it is redesigned for the uncertain world we now live in

ah, the hopeful brigade is out in force.

Labour will do nothing. 🙂 The review.

It’s called a tax cut targeted to lower income families with a parent in work.

You could call it the Mom stay at home tax cut. So very progressive.

Yes it is very progressive, more goes to lower income families, unlike tax cuts where those on higher incomes get more. And it does not discriminate been families with two lower incomes or one higher income and a person not working either.

This convoluted, punitive money trap is described very well by Susan. Neo liberalism and monetarism are so embedded in the NZ State itself that automatically punishing beneficiaries is seen as natural by senior Ministry people as free in and outflow of capital or outsourcing. Theirs is a cruel ideology indeed.

The Second Tier “middle class COVID unemployment benefit” allowed a recipient’s spouse to be in paid employment–try that on a regular Jobseeker Allowance and see how far you get! So there is awareness among MSD and IRD of exactly what they are doing. They can change IF they deem it necessary, or on rare occasion as ordered to by the Caucus. But these unelected State Sector officials still have immense sway as their “advice” to Jacinda Ardern not to implement a larger benefit increase showed.

What is the answer? MSD/IRD will not implement SSJ’s perfectly reasonable suggestions for In Work Tax Credit reform without strong pressure. There will be no severing of the work incentive linkage to IWTC under this majority Labour Govt. It can only be a future political solution driven by community organisation and direct action. Beneficiary advocates, NGOs, and the boomer replacement generations should be driving a major effort for 2023 to…

• Retire WINZ/MSD, pay a basic income to all citizens via IRD, set up a new agency for special needs groups.

• Replace the State Sector Act, Reserve Bank Act, and all the other rotten monetarist legislation with 21st century standard law and practice aimed at serving the mass of the people rather than corporates

• Return public infrastructure to public ownership and control

…yes aiming high, but with Climate Disaster and pandemics the legacy of “Roger‘n’Ruth” is no longer acceptable.

Tiger Mountain thanks for bringing up that point about the COVID payment. They had to twist themselves in knots to work out what to do when one of the rules of the payment was that you could have no paid work (therefore no IWTC for the children). They can do the sensible and fair thing, they choose not to. You are right that concerted protest action is required to get the change that is needed. Sigh

We can only hope they allow independent access to income support between jobs. If adult children living at home can claim the dole, why not a non working partner?

For mine it should be the Pandemic level 2 * the dole for up to one year (to allow retraining or internship), then the standard dole rate.

One concern is that this will get caught up in the Unemployment Insurance conceptual development and so nothing will change.

Poorest children are Kiwi children, but they seem last in the queue in NZ policy, which is all about neoliberalism and growing the NZ population via immigration rather than natural growth. We now have the population from 2050 but the infrastructure from 1980.

Apparently there are 22,000 people on MIQ waiting lists, when they come in, where will they live, not everyone has 40 million for the penthouse in Pacifica, and it seems more and more clear that the so called neoliberal market led sollution of ‘new builds’ supply, have little to do with NZ incomes. Perhaps if they had used that money and created state houses in the same levels of their low/no wage immigration, instead of privatising the land with Kiwibuild (and apparently now buying up old motels at great cost for emergency housing), the kids would be better off.

Only the cynical could think that a ‘warm, dry’ motel room in a slum filled with high needs people is a better alternative to a state house, with a nice garden that our kids in poverty used to grow up in.

Thank you Susan, for confirming what anyone who has ever had to ask for assistance from winz knows.

If you are young and on the ‘jobseeker’s allowance’, there are endless conditions and compliances including attending ‘jobseeker training’ or something like that for jobs that really don’t exist. A lot of money & publicity is poured into job schemes built on sand and while the CEOs get fat the rangatahi get disillusioned. Apprenticeships are like hen’s teeth and the mentoring of a ‘work ethic’ lost in the ether, yet we have a dearth of education facilities which actually train for real life skills and trades. A shortage of mechanics, technicians, research scientists, doctors, nurses, maybe has something to do with the student loan scenario which forces young graduates to seek work overseas in order to repay their huge loans.

Re-nationalising our core infrastructure and rebuilding our small & medium sized industries for which we produce way enough primary product might help turn the economy around for real people and thus their children. Tourism and carbon credits won’t put shoes on these children’s feet or food in their bellies (and no-one has any faith in the way charities are run these days)

The world will again be hungrily crying out for wool, hemp and natural fabrics so perhaps we could look at that.

I also think that the Minister for Child Poverty should be renamed Minister for Child Enrichment so as to spark a positive drift in the bureaucratic mindset-algorithm.

Thanks once again Susan.

Shame this is not in the main stream media.

I looked at Cullen’s bio, there is a man who did not do a great deal for our society despite the privileged positions he found himself in. Not a legacy to be proud of.

You will get no argument from me, Susan, that Cullen’s WFF is a vicious instrument of class rule. I shall never forget hearing its author defend it, using exactly the same intemperate and abusive language to be found in his memoirs, at a Labour Party/Fabian Society meeting at the University of Auckland.

We are, I now realise, talking past one another, Susan. My argument is not with your ideas for a root-and-branch reform of the welfare system. I am with you 100 percent on that score. Where we differ is in our respective expectations of your primary audience – the NZ Labour Party. You continue to appeal to its political conscience. I continue to insist that it hasn’t got one.

Agree Chris. This is a compound problem. It probably only has a “new gen” solution as the older participants are entrenched, embedded and or captured. Rogernomes successfully installed their system from school boards to local authorities–outsourcing, Admin bloat, funder provider splits–they covered damn near everything–what they missed the Nats picked up.

The NZ neo liberal state is accepted by longstanding Parliamentary consensus as the default setting for operating this country. It will take a mass supported shift in thinking, organisation and action to change.

I agree with Chris 100%

This subject above and the callous write off of the medicines funding debate by specifically leaving the meds budgeting out of the pharmac review and continuing the screw you all minimum yearly increases tells you exactly where their political conscience lies andas You say Chris It has none.

It has the same conscience on this, as it later did on CGT. The same people who objected to tax credits to beneficiary families also objected to introduction of a CGT.

Thanks Chris

I remember that Fabian meeting and have found MC’s WFF position totally at odds not just with the facts but with his fiery opposition when National first introduced the Child tax Credit which was precursor to the IWTC in 1996.

On who is the audience… I don’t think we are so far apart. It is not just the NZ Labour Party it is government’s advisors. They have not given good advice to the PM (whose heart I believe is the right place), nor have they conveyed any urgency over WFF or welfare reform- nor have they consulted. If there is no political conscience the challenge is to appeal to the court of public opinion. And fortunately,this pandemic is helpfully in showing that no one is safe until the inequality issue is solved (ie can appeal to self interest). I remain tentatively optimistic.

The difference between what a well-run country with wellbeing as its final goal, and the ideas of Roger Douglas and Treasury, was alluded to in David Lange’s definitive reply to Douglas’ plan for introducing a flat tax and other connected changes, I am reading Harvey McQueen’s memorial called ‘The Ninth Floor’ where he served as education advisor in the Beehive and saw ‘the Boss’, David Lange done down by the neo-liberal star gazers in Caucus.

Our then PM, resigned 7 August 1989, after he wrote to his Minister of Finance, which I have quoted from the book. (I have to type this out as I’m not up with the scanner controls.)

Your radical strategy would negate our assets. We would no longer be united. Our determination would falter. Mine would. Our purpose would appall our own supporters. The research is just as clear about our weaknesses. We are thought to be uncaring. We cannot convince people we care for them simply by saying we do. If there is no basis in reality we will not be taken seriously.

I cannot dispute what you say about the damage being done by the continuing deficits and our growing public debt. If it is now doing us more harm than good to run a deficit we must ask ourselves why the deficit persists. It persists because we are reluctant to ask the taxpayers to pay for the mistakes of the past and to pay for what we do on their behalf. We can no longer afford reluctance. We have to face our responsibilities in government. If we spend it, taxpayers have to pay for it. We are accountable. Facing up to this responsibility does not mean we must overnight eliminate nearly all the public debt. The electorate does not expect miracles of us. We are expected to steer a steady course towards economic stability and our social goals…

User pays in social services: what is proposed would have altruism and benefaction do duty for entitlement. The thesis is that education or treatment in sickness should be available to those who can pay for it and to those who can prove their inability to pay for it. Those who are poor must seek for admittance to the entitlements of citizenship. They must depend not on the institutions of the state but the whim of government for their support. (My italics.) That is so much in opposition to all that you and I have stood for in politics that I do not even go into the impracticalities of it. It is wrong….

These pronouncements were not shared by others in the Labour Caucus, not Roger Douglas et al, and not by Michael Cullen. And they received knighthoods. But there was a song composed that echoed David Lange’s sentiments ‘The Impossible Dream’ used in the film about Cervantes’ Don Quixote. I like this verse.

To dream the impossible dream

To fight the unbeatable foe

To bear with unbearable sorrow

And to run where the brave dare not go.

Perhaps we can recover some of the plan that we would have followed if enough of the Fourth Labour government had remained true to their task.

https://en.wikipedia.org/wiki/1988_New_Zealand_Labour_Party_leadership_election

Wow!

Slightly tangential but look at the quality and love in those meals.

Coronavirus Covid-19 Delta lockdown: Couple provide 1000 home cooked meals to isolated elderly

https://www.tvnz.co.nz/one-news/new-zealand/non-profit-kaupapa-helping-struggling-wh-nau-in-far-north-despite-pandemic

This is the sort of thing that should be rewarded with government/community funding. Not the 2.75 million to ex mobsters or the 1 billion provincial money that doesn’t seem to have done much in the provinces to combat poverty.

Too much neoliberal focus in NZ on criminals, ex-crims, and businesses, that seemingly are the only ones to get recognised for expansion.

The best initiatives come from the heart, with people joining the movement. This couple and their whanau are incredible and sounds like they have an incredible team including a chef. Because they seems so genuine they have attracted strong community help such as a website, and massive donations of goods from Auckland.

Beats Dome Valley landfill, recycle the goods!

This is how NZ communities should be working, not using ‘pseudo charities run along neoliberal lines with millions idle in bank accounts, extensive marketing by professionals and only a small percentage going to the people in need.

We already know working for families is for middle class families, its middle class welfare and the problem with many middle class peoples is they have tendency to put the boot into the poor receiving welfare, yet its alright for them. The entire benefit system needs to be revamped as most people will get of a benefit if the right system is in place by this I mean effective pathways to help them achieve independence. Benefit bashing doesn’t work and never will and we will always have some who will remain on a benefit of some type no mater what.

It’s for all families and MORE goes to those on lower incomes – if there is a parent in work.

One big change, made already, is to bump up the amount that can be earned from part-time work before impact on the benefit.

Labour Party political conscience,it hasn’t got one fabulous.

So true remember their election promises?

Children in poverty.

Homelessness.

House prices.

Mental health.

Kindness.

Governing for all New Zealanders.

Gosh their results show the extent of their political conscience,they haven’t got one.

The big issue of the review of WFF and AS, is whether increased support just goes out into the landlords pocket – will there be an effort at rent control?

no can not and will not be an effort at rent control. they had a full term and now are going into the second year of their first term, thus they had at least 4 years to do something, and they did nothing. How many more years of doing nothing are needed to remove some blinders from the eyes of the perpetual hopeful?

I will simply note the PM said that they were concerned that increased amounts in WFF or AS would just go to the pockets of landlords.

I guess any administration these days struggles with balancing adequate benefits with rates of pay at the margins . With all the complexity of taxation and family benefit , in the end it has to be a rational decision to work rather than to play at home on some device or other. For a long time that distinction has been moot in the area of minimum wage employment when everything is taken into account.

There are things we all need to consume to stay alive and someone has to do and make them. We can’t all live on welfare. And there is no law of nature that determines that there will be enough for everyone. The money is an arbitrary construct. It is a distraction to focus on it. It is what proper food and shelter is available that matters and more money doesn’t make more houses without materials and builders or more wholesome food. Someone has to grow it.

D J S

Point taken D J S but you fail to see the work that taking care of children entails and that this unacknowledged work done well is the key to a productive future workforce. The unpaid work a sole parent does is made visible when she is forced out to paid work and has to outsource childcare to the for profit sector. She is unlikely to have any energy left to cook ‘wholesome’ meals.

What can I say. It’s all been said. It seems to me that embedded in the heinous neoliberal policies is a mantra and dogma that if you don’t have a job you must be lazy and if you got pregnant with no father on the scene you must be promiscuous and/or trying to scam the system. Therefore you are undeserving and a loser. The system tars all these people with the same brush. I’ve heard this kind of talk from many of the middle class. Perhaps these attitudes will change when some of these people are in a position of holding out their hand.

The labour party took a massive right turn in the mid eighties and since then has made a few faux left moves which further entrenched neoliberalism. Here’s an idea. Since National seem to be hopelessly lost as their ground was largely stolen by labour, they could reinvent themselves as The People’s Party.

Hi Susan

I share Chris’s views as I have watched this play out over 30 years. I could wax eloquent over the what’s and the why’s but more importantly I thank you for your efforts on behalf of poor New Zealanders and their children. No matter how seemingly hopeless the situation, if not for advocates like yourself, nothing stands any chance of change. Thank you for your compassion, hard work and dedication.

Change is inevitable even if things get worse before they get better. One day NZers will realise that things must change not just for the good of the poor but for the good of NZ as a whole. Then things will happen.

Thanks Binky. The exposure of inequality in this pandemic may be the trigger for real change– we should be ever hopeful and insistent

The exposure of inequality should be regular on our TV news. There are so many stories to tell. Instead we have a cat or dog rescue or some other inane thing most nights.

I see the race is on for the ‘worst’ Dunedin flat. Two young guys in their flat pictured in the Press today. They told the reporter that the smell by the front door is sewage as the pipe is broken. These scum landlord sholud be taken to court, fined and made to fix it now without booting out their tenants.

Working for Families was a Clark inspired vote getter among the middle class.

Please keep up!

Comments are closed.