Government putting more beneficiaries into greater debt, with loans totalling almost $2 billion

Figures released to 1 NEWS under the Official Information Act show almost 560,000 people now owe $1.9 billion to the Ministry of Social Development.

It’s 50,000 more people than in 2018, when $1.5 billion worth of interest-free loans were handed out for things like school uniforms, the dentist, electricity, and car repairs.

Each person owes almost $500 more than three years ago, with the average amount being $3420.

Social Development Minister Carmel Sepuloni told 1 NEWS that it’s much better than families going to get high interest loans “to cover some of these basics”.

This is crippling.

Beneficiaries barely have enough money to live on as it is, and for the unexpected costs in life, the State lends them money rather than recognise that the benefit simply isn’t enough.

What’s most egregious is that a chunk of this debt is over payment, that’s mistakes by WINZ, not the beneficiary.

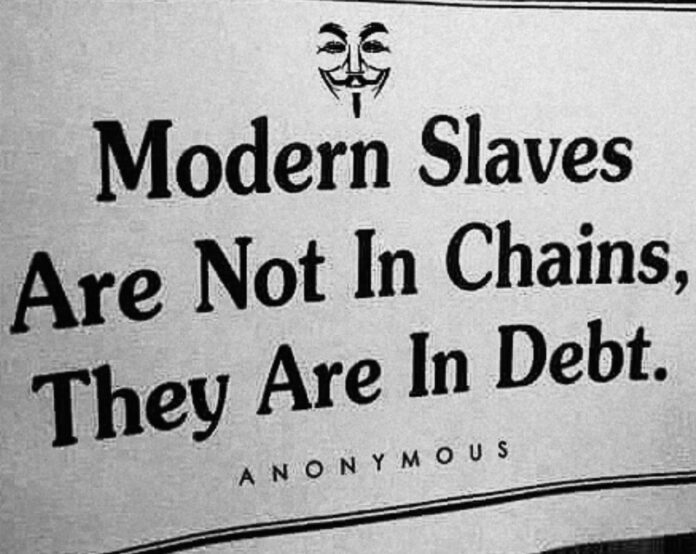

This is leading to debt slavery where Beneficiaries will die in debt to the State.

They are punished by an obtuse system within WINZ that does all it can to be toxic, and they are punished by low welfare that force them to borrow from the State.

The State claims that this is preferable to Beneficiaries borrowing the money off loan sharks, and while there is some truth to that, WINZ eyes that loan as an asset so they are gaming the system while bennefitting from it themselves.

This is no way to treat the poorest amongst us.

The debt must be written off.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Governments treat money owed to them as assets. To ask for debts to be forgiven would shake the money-lender system to its foundations.

Besides, there are CEOs, ‘captains of industry’, and senior council officers etc. struggling to find money to pay for yacht berths and yearly upgrades of vehicles and furniture etc. And there are perfectly serviceable buildings that need to be demolished and replaced because the comfort level is just not right. Therefore council rates need to be increased substantially.

Anyway, the dismal situation beneficiaries find themselves in is obviously their own fault. They could have lived in tents or cars on friend’s backyards, made clothing out of rags, and they too could have borrowed money to invest in the casino markets and made fortunes for themselves instead of wasting most of their money on rent and clothing.

Can’t afford dentistry? Why do they need teeth anyway? They can pulp food in a wooden bowl by bashing it with a rock.

It’s a debt-slavery, wage-slavery, mortgage-slavery system, unless you happen to be in the right ‘club’ Martyn. You know that.

I don’t even want to think about how caramel or Muldon 2.0 intends to restart the economy by making the porest New Zealanders pay for for it. The operational budget has to increase. These debts have to be wiped. Beneficiaries are just eating the recovery.

I wonder how many of the half million plus are single mums with children to raise? How many absent father’s leave their children and abdicate their fatherhood? Why does our society still condone that behaviour??

‘Why does our society still condone that behaviour??’

Probably because it has been going on for thousands of years.

Sinic I’m a male sole parent. How many absent mother’s leave their children and abdicate their motherhood?

Answer – Heaps these days, it has been going on for 9 years for me !!!!!!!!!!!!!!!!!!

Why does our society still condone that behaviour ?

Answer – Because in the rich country of NZ we have plenty to go round. Not that you would know it with all the right wing deceitful moaners spouting there bullshit lies.

But ACTS David Seymour said they should just go out and get jobs, there problem solved!

And why we should never have him near power again. Imagine if David’s mother never had him, that taxper money could have been better spent on a beneficiarie.

“Beneficiaries are becoming debt slaves”

Don’t slaves work?

Slaves are trapped and oppressed by an elite class system, like beneficiaries in NZ.

You can’t have a rich country without rich citizens.. saying that, your point has been heard. 🙂

You’ve been hanging out with to many unemployed economics professors.

A wealthy nation by its very definition wouldn’t have poverty. At least concede you can read a God damnd diction or at least made it past yr10/5th form.

These ones work at keeping wages depressed.

During the Covid lockdown I was representing Support Workers. Although their “for profit employers” had the DHB money rolled over on condition that the SWs were paid their average wage this didn’t happen. the DHBs cancelled home cares and many clients were too frightened to have the SWs in their house because they had (initially anyway) no PPE so the number of cares were cut down. Many SWs were on half their average wage for this period. Many of them still had to pay their SW debt of $50.00 per pay for recoverable loans out of their much reduced pay. Many of them were forced to go back on the sole parent benefit as a result. THis is simply outrageous.

Its so easy to get into debt, all you need to do is work a casual job on a weekend, incorrectly predict those hours before the 5pm deadline on Friday before the weekend or Thursday if its a public holiday on Monday or Wednesday if its Easter and WINZ will pay you more than what you were entitled to, they don’t give you a choice in the matter then write you up a debt for the overpayment then use source deductions, before you had a chance to object and take the money from future benefit payments, and most likely let you know after the first debt deduction payments been taken out.

We’re not all in this together.

Wait, what??

Comments are closed.