This is now the New Zealand dream? The promise of democracy never looked so broken.

Wealth of trouble: Average house price eclipses $800k and growing

The average house price in New Zealand has eclipsed $800,000, and a property expert says consistent government messages about the need to protect property wealth mean prices will continue to grow.

So if we all grow vegetable gardens, stop eating avocado on toast and drink only instant coffee, then in a mere 325 years you too can save up enough of a deposit to buy a house in New Zealand?

The promise of democracy never looked so broken.

Thank you NZ Politicians, most of whom all own property.

Cheers Jacinda, your kindness won’t pay our rent.

Thumbs up to the banks, the speculators and the scum landlords.

You win.

Again.

The rich get richer and the poor get Covid alongside rent rises.

1 in 5 children are in poverty, 22 000 on social housing wait lists and entire generations have been priced out of ever owning a home.

When you can no longer look into the face of your child and know they will get a better deal of it than you did, that promise of democracy is bankrupt.

In 2010, the 388 richest individuals owned more wealth than half of the entire human population on Earth

By 2015, this number was reduced to only 62 individuals

In 2018, it was 42

In 2019, it was down to only 26 individuals who own more wealth than 3.8 billion people.

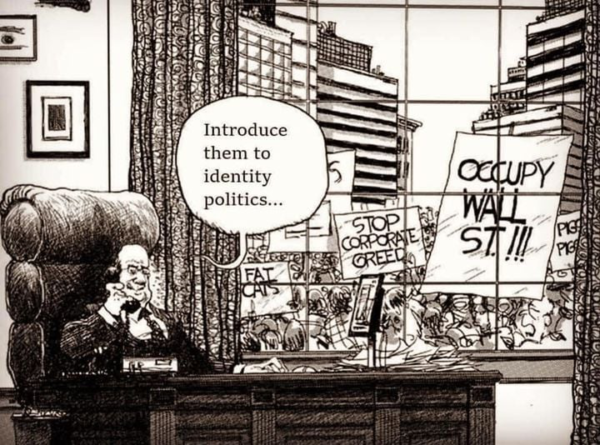

This isn’t a democracy, it’s fast becoming a feudal plutocracy on a burning planet.

Every aspect of our existence is monetarised for big data to sell us more stuff we can’t afford. We are alienated and anesthetized by a consumer culture that keeps us neurotic and disconnected. Our work, our existence, every move we make are all built to suck money to a minority class that sits above us while under neoliberalism, globalization, financialization, and automation, our existence as individuals has only become more disposable.

An election changes a Government.

A revolution changes the State.

We need a democratic revolution, not neokindess.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

The obvious solution is that once you have starved and saved and worked long, underpaid, insecure hours for decades to pay off your one bed converted garage 2 hours traffic jam from Auckland CBD is to then wealth tax that property when you finally retire a broken shell of a your former self to live off baked beans.

I just can’t understand why that Green policy is not more attractive. Certainly seems more attractive than a capital gains tax on the last 98 houses of a rich person’s 100 property portfolio – something that is clearly unworkable and bound to hit a huge fraction of the voting public. I’d much rather have a huge bureaucracy to value my assets and then gradually reposes them because I have no retirement income.

what you would do, to fix the problem in New Zealand, is transform the industry into a direct subsidiary of the banking system in association with the Government in partnership via public ministrys.

Renter’s rents, go into tier accounts as credit ( so rent becomes a building block to home ownership).

House values are also in tier accounts as credits.

Tiers are related to house/property level attributes/qualities.

If an citizen changes tier ( for example, wanting to live in upgraded different property ), the banks change your account ‘credits’ in relation to market conditions in that tier.

Houses are then bought and sold in the context of these tiers & credits.

A house is a home, they are not there for rent beyond growing one’s credits for one’s first home, the land lord economy is taken out of the industry beyond this. Home ownership then flourishes the market, innovations and expertise in both the supplies and demands in all the respective tiers at all levels becomes the rule and a growing participatory self regulating economy that solves it’s own problems better in partnership with it’s structure. The correct logical of this approach will build itself when given thought pursuant to it’s form and function of struture.

The industry actually going back to the market forces of the primary social purpose of houses, that is to provide homes, which will operate in the different tiers, as the benefits of the capitalistic shared ownership culture are able to blossom, is what needs to be believed in again within NZ for successful and sustainable outcomes.

A total revamp anotherwords.

If you want to see what the dregs of humanity like Gary Lin thinks about renters join this facebook group

https://www.facebook.com/groups/nzpropertychat/

It is shocking how much contempt the HAVE kiwis have for the HAVE-NOTS. Team of 5 million my arse!

Then to see Grant Robertson not care one bit about the current disaster makes me sick. We need to protest this theft of our futures right NOW. What is Judasinda Arden? Why is she destroying us?

No, I think transaction sizes will get larger and everything will settle. My estimate is it’s about half will be land and half will be the government. You can estimate it by counting gold and sovereign debt. If you look at the NZX it’s all unconfident because they don’t know how to pick stocks. So now half is saving by buying a property because they don’t know how to pick stocks.