I am genuinely astounded…

National Party Finance Spokesperson Paul Goldsmith wants to shake-up banking, by ripping a scab that hasn’t been touched for 30 years.

Goldsmith has called into question the independence of the Reserve Bank, responsible for setting interest rates and regulating banking.

He thinks the Government should have a say in how much risk banks are allowed to take, weighing up the cost to consumers of having a faster, looser and cheaper banking system with the need for stability.

The Bank has been independent for 30 years, with politicians of both main parties fearful of even questioning the bank’s right to manage it’s own affairs.

…this is pure and simple economic vandalism by a pack of right wing small Government ideologues. Put aside that this is the worst time to deregulate banks as we are about to go into recession, look at the previous example of National deregulating things.

Remember Pike River Mine where National deregulated Mining through inaction and it cost 29 lives and a crime scene National attempted to cover in concrete.

Remember the housing deregulation that led to leaky houses? How much did that cost? Why a mere $47 billion dollars!

National are trying to raise from the dead the Government = needless regulation myth, a myth that their very own Rules Reduction Taskforce looked at when National were last in power that concluded…

It was a surprise to us to find out that a number of the loopy rules are in fact just myths. They are misinterpretations and misunderstandings that have been repeated so often that they have taken on the status of facts. We heard many examples where people are not clear about what they need to do and why. Myths fill the gap when clear information is hard to find. We highlight these myths in this report along with the loopy rules that need to be changed or removed. We discovered that loopy rules are difficult to get rid of because they’re part of a wider system, because a focus on the customer is absent, or because of the interests of experts or the fears of their administrators. What’s clear is they thrive when rule makers fail to take responsibility for them.

…National are scrapping the policy barrel. Deregulation has been horrific to NZ and the damage National could cause our Banking Industry could be obscene.

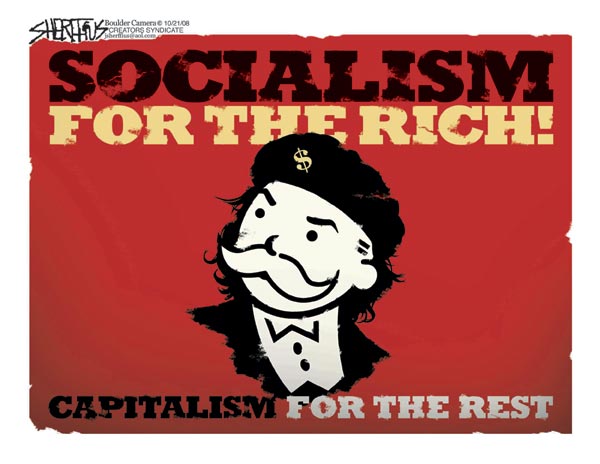

So far National are promising to beat up beneficiaries and allow the Bankers to run wild.

If National actually win on these policies, we deserve everything we get.

Martyn – Paul Goldsmith has no idea of ‘history’ and therefore has no credibility.

I am never surprised at what comes out of his mouth.

He always speaks rubbish in Q+A time in parliament, so when I hear him I just tune out.

He must use drugs or something when he tries to look intelligent but it always fails.

Another example of “hollow man” syndrome sadly.

nats really are the monster raving loony party who carries the risk when bankers blow up the bank depositors and the tax payer this is a really bad idea and another reason to keep the nats out of power there reckless greedy corrupt and stupid

the whole FIRE sector should be nationalised – – usury is illegal in the major religions for a reason. it causes wadespread poverty and destabilises nations when half of society is enslaved to the other half. the banks deliberately fuck with inflation, housing, stock markets, in their insatiable avarice to steal everything from hard working people. the profit motive (capitalism) brings out the worst in people, and the sooner it’s destroyed, the better

Comments are closed.