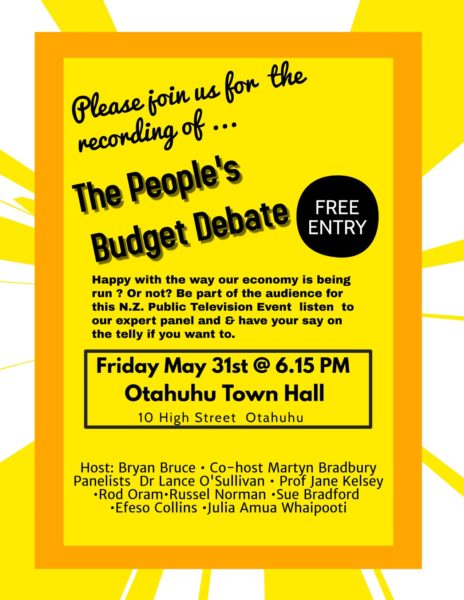

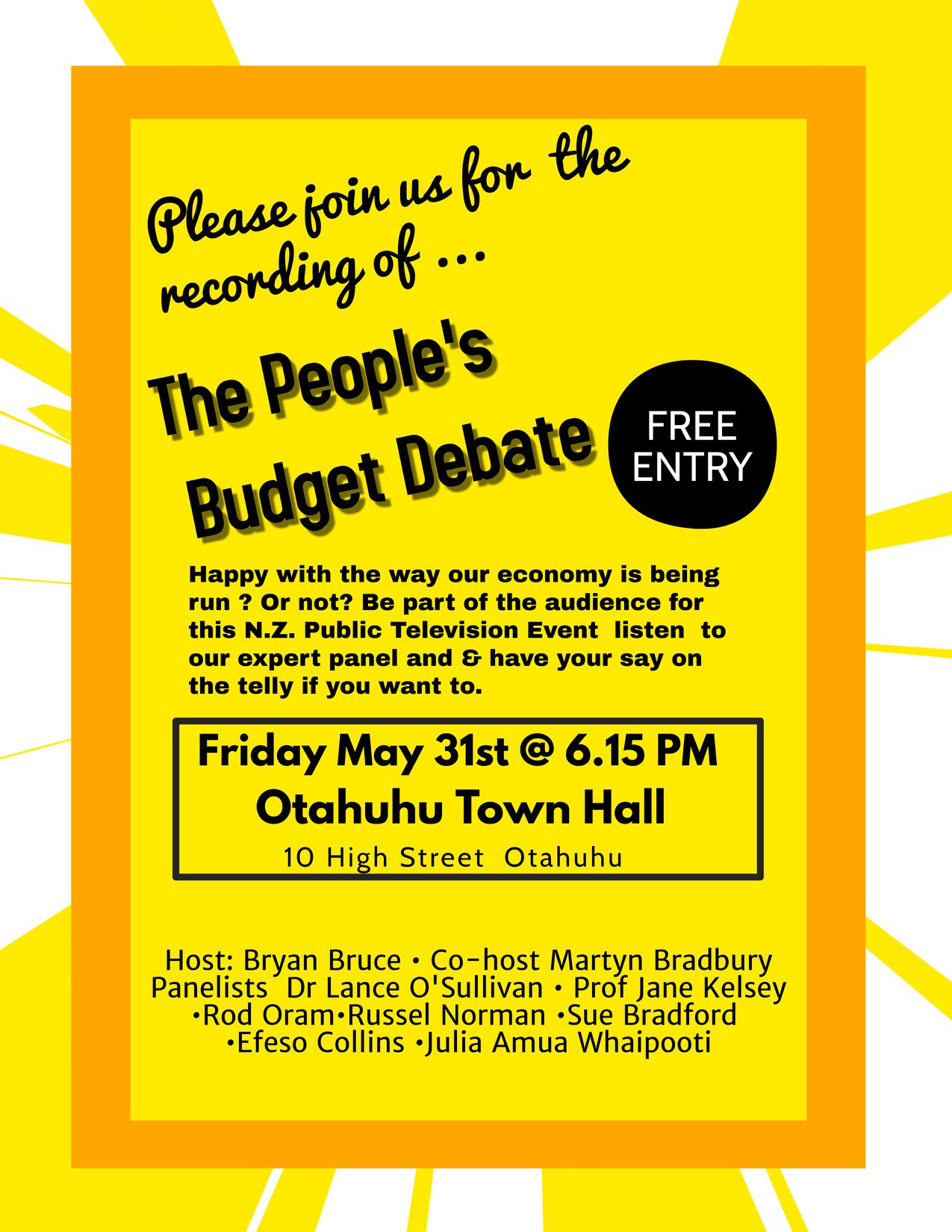

I am hosting New Zealand Public Television’s first Budget and Economy Event at the Otahuhu Town Hall Friday May 31st @ 6.15 pm

Please bring your friends and your opinions because we would love to record them.

I would really appreciate it if you would share this post with your friends and family especially if they live in Auckland and please click on the Event link to tell us you are coming.

My intention is to try and run these television Town Hall events in cities and towns throughout our country because New Zealand Public Television and I believe that big issues – such as water rights and end of life legislation, need to be discussed in an open and televised forum.

We also think that people affected by government policy ought to be able to be able to tell the policy makers the upside and downside of what it is doing to their lives.

So the more support we get for this event and when it screens on NZPTV and The Daily Blog on the evening of Sunday June 2nd the better chance we will have getting the backing we need to run more Town Hall events like this one.

So if you like this idea please hit the like button on this post so we can show

NZ On Air and other potential sponsors that you want these Town Hall debates to happen.

By the way you can find New Zealand Public Television here www.nzptv.org.nz It’s free.

Kia kaha

Bryan Bruce is one of NZs most respected documentary makers and public intellectuals who has tirelessly exposed NZs neoliberal economic settings as the main cause for social issues.

It’s the job of the Governments bank, the reserve banks job to print money at 1-3 percent per year. Central government could easily borrow at 0-3 percent interest as long as it’s for war, productive purposes, energy policy or jobs.

Gosh where was this when we needed it when National were in power for 9 years?

The problem in NZ is that people’s incomes are very low and getting lower and demand is increasing.

So taxes have become less relevant to help people, because so many people’s living costs are close to or above their incomes. People now need to rely on their house to survive both in terms of a savings plan and somewhere for them and their families to actually live.

This has been caused by rogernomics to reduce NZ incomes and in recent years neoliberalism aka allowing many non tax residents or dual residents and hundreds of thousands of work permits that enable other nationals to use NZ social welfare, buy assets and resources here without contributing many taxes here, while creating a Ponzi of social needs that can never be stemmed.

Aka business bringing in a nursing assistant or tradie from overseas who then brings in 2 kids, have more kids while here and a spouse who all qualify for NZ support due to a 2 year working visa which then converts into permanent residency and citizenship.

Just adding in more taxes to the middle classes who are paying the majority of taxes in the first place aint going to help and giving so many benefits to new residents to NZ in the past decades, bringing in non waged or poorly waged for social support, while penalising residents born in NZ.

For example NZ government made NZ tertiary students pay massive interest rates up to 10% interest compounding daily from the 1990’s and that was never written off while using social spending to allow new residents in NZ to get 1 year of tertiary education for free and interest free loans if they stay in NZ.

NZ baby boomers payed 66% income taxes prior to the 1980’s while now government policy means you can come into NZ from overseas as a baby boomer and within 10 years get free super and immediate medical care even if you pay zero or minimum taxes here.

Australian Nationals like Tarrent are able to come to NZ and get free medical care, social welfare and vote, unlike NZ nationals in Australia.

In my view this has skewed incomes in NZ and our society in general, so that as a Kiwi, you are financially better off having 3 kids and being on a benefit and earning circa 1000 p/w (dependant on accomodation) in Auckland than being single on the minimum wage or even on the top tax rate of $70k when you work out how much it costs to work.

Aka circa $1000 p/w on a benefit with 3 kids in Auckland

vs $637 p/w on minimum wages (less $38.48 of student loans and then $21 Kiwisaver at 3%).. worse off

$1076 p/w net on $70k (less $116 of student loans p/w and $40 p/w Kiwisaver) … worse off

or earning the ‘whopping’ income of $120k means $1720 net on (less $231.32 p/w for student loans and $70 p/w for Kiwisaver) ….not much better off

Note $120k is now considered a ‘low’ income that qualifies you for Kiwibuild and get an ‘affordable’ house).

Add on 10% if you are working for average for travel costs to get to work… even on public transport in Auckland you are looking $50 p/w or $200+ p/w for a family…

If you then take the higher wages you start losing any benefits like accomodation allowance, working for families, and no community services cards so pay full price for doctors visits, no discounts on council rates, etc, more costs for travel.

The reality is, in NZ the government is focused on tearing incomes down to an unliveable level based on some fantasy world they live in, rather than raising the entire level of incomes in NZ.

They refuse to address unsustainable demand and are addicted to the political donations they are getting from some dubious sources.

If they looked at what worked prior to 1980 which was making our own nationals do work, not penalise them for studying and being ok with them to plan for retirement with a rental property, it seemed to work better for society than bringing in hundreds of thousands on low quality work permits and allowing relatives to get free residency and social welfare here, while telling NZ workers how lucky/untaxed/drugged out/lazy/hopeless they are.

Likewise having rental properties to be available for renting to address housing shortages rather than the new way of building ‘social housing’ like Compass where 40 ‘high needs’ people are crammed together sharing kitchens while the tax payers pay 3 million to overseas companies for ‘social’ housing. (Whose companies probably pay no taxes in NZ anyway due to reciprocal tax arrangements.)

No worries about social housing from the wokies and renter unite though, who often represent the ‘social housing’ and think as long as people are ‘warm and dry’ then battery farming of social housing is fabulous and tenancy rights don’t apply. https://www.rnz.co.nz/national/programmes/checkpoint/audio/2018695582/social-housing-complex-tenants-feel-bullied-by-operator

(Especially as the wokies are often working for social corporations and setting a narrative, while being on the committees like fake Meth levels). The social housing and government also don’t believe that state housing or social housing should have ‘healthy homes’ in the same time frames as NZ private landlords, so not sure they have the vunerable’s interest at heart with their narratives, that sadly don’t seem to work a bit like ‘trickle down’.

According to this site, average teachers salary is $65,724 (NZD)/yr with average bonus of $1,393 (NZD)/yr

https://salaryexpert.com/salary/job/teacher/new-zealand

Teacher’s who did their degrees in the 1990’s in NZ will be especially worse off because they did not get the 1 year tertiary free and interest free loans, and had massive interest rates, compounding daily for years that they are probably still paying off….

The government seems happy to pay for $5000 relocation bonuses for foreign teachers and free tertiary for recent migrant students, but it’s an iron fist when making sure that the millions they took from students of the 1990’s era, was not written off nor a complementary free year of tuition taken off either to make it fair…

They then wondered why people went off overseas to work… I wonder…. also if you are a Kiwi with a massive student loan from that era, who works overseas you do not get interest free loans…

NZ generous to the world, penny pinching and mean to it’s own nationals abused during Rogernomics.

New Zealand’s commission numbers that are payed to brokers globally, we are paying market rates now. The numbers are starting to get to medium sized nation state levels. I guess thats what happens when you grow to over $70 billion globally. A corporate structure brought in under John Key is just the wrong structure for us. it doesnt fit, wouldn’t be an issue if we were to double the size of trade to what we are now, so not an issue just surprising to be at this level of equivalency. Dont forget smaller nations get lower rates due to volume size.

We shouldn’t have any interest in making commission anyway. It flips us from interests aligned to conflict of interest with our client states. It is the antithesis of our philosophy & how kiwis do business. If we ever wanted to save costs we would buy brokerages and let clients trade for flat rates. The reason being we need global solutions. Robertson might have to bail out one or two institutions in the next recession, and they might be Australian Banks.

The government placing both a delay and then determining on a risible amount on increase in the other income that can be earnt while on a benefit is totally inconsistent with its child poverty reduction goal.

It should not do much better but actively assist people with children into part-time work opportunities.

Then there is the ability of younger teachers and nurses (those not owning property) to afford to work in Auckland. There should be interest free tertiary debt for them and a 10% debt write-off pa.

Then there is the issue of totally inadequate numbers of state houses (10,000 on the waiting list). The government should borrow to finance the building of increased numbers of state houses (no net increase in public debt as this is an income earning asset) – albeit some being part of the rent to own scheme.

And also extend KiwiBuild sales to those moving up from flats and apartments to small section affordable family homes and those trading down from the large section family homes – quicker turnover to improve housing supply as fast as.

It should not only do much better, but actively assist … sigh.

Sigh, it probably won’t do much better.

System Change.

Now.

——————

Himno de mi corazon – Hymn of my Heart

https://www.youtube.com/watch?v=ZGN7PVsrAUM

Playing for Change Band

Comments are closed.