Labour & Green Budget Responsibility Rules are strangling us

The Finance Minister Grant Robertson released the 2019 Budget Policy Statement (BPS) on 13th December. This statement signals the Government’s intentions for the 2019 Budget and outlines its fiscal strategy. It is released alongside the Treasury’s Half Year Economic and Fiscal Update or HYEFU. This update sets out Treasury’s economic forecasts and its expectations of Government’s finances over the next four years. Both documents are an important part of the open and transparent Government we expect and enjoy.

In a follow up Radio NZ interview with Guyon Espiner, Mr Robertson rejected the accusation the proposed budget settings were a ‘fig leaf for neo-liberalism’. His rejection was based in large part on the claim that the 2019 Budget will be a ‘well-being budget’ – one concerned with the impact of Government activities on New Zealanders’ well-being. The argument here is that the previous Government’s budgets were only concerned with GDP growth and that many New Zealanders and especially our poorest children missed out.

It is doubtful that the previous Government’s budgets were only ever concerned with GDP growth but it is true that the poorest New Zealanders did not gain from the rising prosperity which recent economic growth brought. But it is by not clear how the 2019 well-being budget will change this given the budget settings offered in the BPS.

The BPS confirmed the Government’s five priorities for the 2019 Budget. These are:

- Creating opportunities for productive businesses, regions, iwi and others to transition to a sustainable and low-emissions economy

- Supporting a thriving nation in the digital age through innovation, social and economic opportunities

- Lifting Māori and Pacific incomes, skills and opportunities

- Reducing child poverty and improving child wellbeing, including addressing family violence

- Supporting mental wellbeing for all New Zealanders, with a special focus on under 24-year-olds.

These priorities are all well-meaning and worthy but it is not apparent how the 2019 budget will address them with the spending indicated in the BPS. The apparent priority of reducing child poverty best illustrates this uncertainty.

We could probably expect that child poverty will be reduced through increased spending on income support programmes such as Working for Families and working age benefits. It is the case that spending on income support programmes will increase from $24.0 billion in 2017/18 to $26.8 billion in 2018/19. Nearly one third of this increase or $836 million is just the annual increase in New Zealand Superannuation while a further $571 million is being spent on increased housing subsidies. Working for Families budgets grew by $865 million and $442 million is being spent on the new Winter Energy Payment. By 2022 Government is planning to spend $452 million on its Best Start programme which offers up to $60 per week for families with children under three years old.

These are generous amounts but are not particularly targeted. The additional Working for Families budget for example will be paid as increased entitlements to families who pass the work test and so will offer some relief to the working poor but not to beneficiaries. The bulk of the winter energy payments will go to Superannuants and the Best Start programme ends when a family’s income reaches $93,000.

Some of these increases need to be seen in the context of the previous Government’s clawbacks. Increased payments on the Accommodation Supplement were announced by the previous Government and adjusted the maximum payments after a ten year price freeze. Working for Families budgets have been reinstated to the same value they were in 2010 and before the National led Government gradually reduced entitlements and neglected to index payments to inflation.

The problem here is that we had high rates of child poverty in 2010 so why would lifting the value of Working for Families back 2010 levels necessarily reduce child poverty?

The 2019 BPS faithfully follows the Government’s self-imposed Budget Responsibility Rules. Mr Robertson’s fiscal conservatism is apparent both in his fixation on these rules and in the surpluses which are expected over the next five years. These surpluses rise from $1.7 billion in the current financial year to $8.3 billion by 2023.

There is plainly money available to do more but Mr Robertson’s justification for not doing so is that these surpluses are being banked for future generations. There is some irony in such a claim given the damage which persistent childhood poverty does for the life courses of those who suffer it. We appear happy to squander the futures of tens of thousands of New Zealand children to conservative budget rules in the belief that low levels of Government debt will benefit their generation in times to come.

The Finance Minister’s conservatism may however not be entirely misplaced. It is easy to work out how to spend forecast surpluses before they are earned and in doing so to overlook the fact that these forecasts are normally based on optimistic projections of economic growth and growth in tax revenues. Already the OECD is warning of a modest slowdown in global economic growth pointing in particular to rising trade tensions as a source of some concern. Without steady and consistent economic growth the Government’s accounts can quickly look fragile as we saw immediately after the GFC.

Banking surpluses and lowering Government debt as insurance against the next economic downturn makes some sense. The problem is that in doing so the trade-offs often impact on the poorest people whose needs get ignored. The Government’s well-being rhetoric obscures this trade-off in part because we struggle to reconcile the different values at stake. Budget rules which placate financial markets are never likely to be comparable with our understandings of such things as mental illness or the impacts of material deprivation on child development.

It is fine that the Government has five priorities which it believes will enhance our collective well-being but the real priority was set when Grant Robertson and James Shaw dreamed up the Budget Responsibility Rules.

Alan Johnson is a policy advisor to CPAG and Salvation Army

Despite all good fiscal intentions behind the “Budget Responsibility Rules”, at the end of the day, politically they are not much more than self-created handcuffs.

Clear socio-economic needs (poverty reduction) and ecological essentials (climate resilience) call for initiation and stimulus of adequate responses by the NZ government now, and in future.

If existing income and expenditure under the national budget cannot sufficiently address these two priorities, additional finance may have to be generated from other sources.

Focusing on these two priorities, too, an enormous potential for small business income or employment, coupled with effective climate adaptation, lies in a) climate proofing of public infrastructure and private assets, b) coastal and slope erosion control, c) forestry and fisheries conservation and value chain development.

> Further readings:

https://www.cbpp.org/topics/climate-change

http://www.governing.com/gov-institute/on-leadership/gov-fiscal-resiliency-natural-disaster.html

> And a special dedication to the inventors of the “Budget Responsibility Rules”:

https://www.youtube.com/watch?v=sE73giFnLBs

WATCH: Prime Minister Ardern discusses “Thousand chunks of chocolate” budget;

https://www.youtube.com/watch?v=xUEah4fgyxc

Five priorities from this government and not a single word about global warming.So thats not a priority then, even though we will probably die of it.

Labour are ideologous to austerity and neoliberal free market spending principles.

Its not like they didn’t advertise the fact.

And as long as people try and console themselves with mutterings about future financial apocalypses then..well, why would Labour change tact? You can’t have it both ways.

I wonder..would the UK have ever had the NHS if they worried about the next financial crash, especially at a time when UK national debt measured a 230% of GDP.

1. The current government in its HEYFU is forecast to spend less as a % of gdp than all the previous governments since the 90s. Even Conservative economists are very surprised at this government’s commitment to penny pinching.

https://croakingcassandra.com/2018/12/17/hyefu-bits-and-pieces/

2. Whether or not a government like NZ “saves” by taxing us more than it spends and pays down public debt now has no impact on whether it can spend and how much it can spend in the next recession. There is always a magic money tree when the capitalists need it – as the GFC plainly proved.

3. The Central Bank can always control the interest rates on the debt the NZ government issues if it wants to (see Japan). The Central Bank can directly fund government spending if it is mandated to. And if such financing doesn’t cause inflation during deflationary contexts – why would you not do it?

4. Excess surpluses by the government now is not necessary in these deflationary times. It is like a homeowner trying desperately to pay down the mortgage but not maintaining the house in the process. You’ve paid your debt off but the roof is so damaged that the property is a write-off.

The NZ populace ascribe way too much power to the “bond vigilantes”. And the latter like it that way. Heavy indoctrination keeps our progressive politicians from making substantial policy changes.

If the NZ government started to spend a bit more and tax a bit less my guess would be that the impact on interest rates and inflation would be small given 10 years of high labour underutilisation but the impact on growth and “well-being” could be substantial.

If they don’t loosen up a bit, some other kind of political force will replace them. See Europe.

May I suggest a wording amendment to Bullet #4 of the Government’s five priorities.

Would it not make more sense to …Reduce parental poverty in order to improve the well-being of the child.

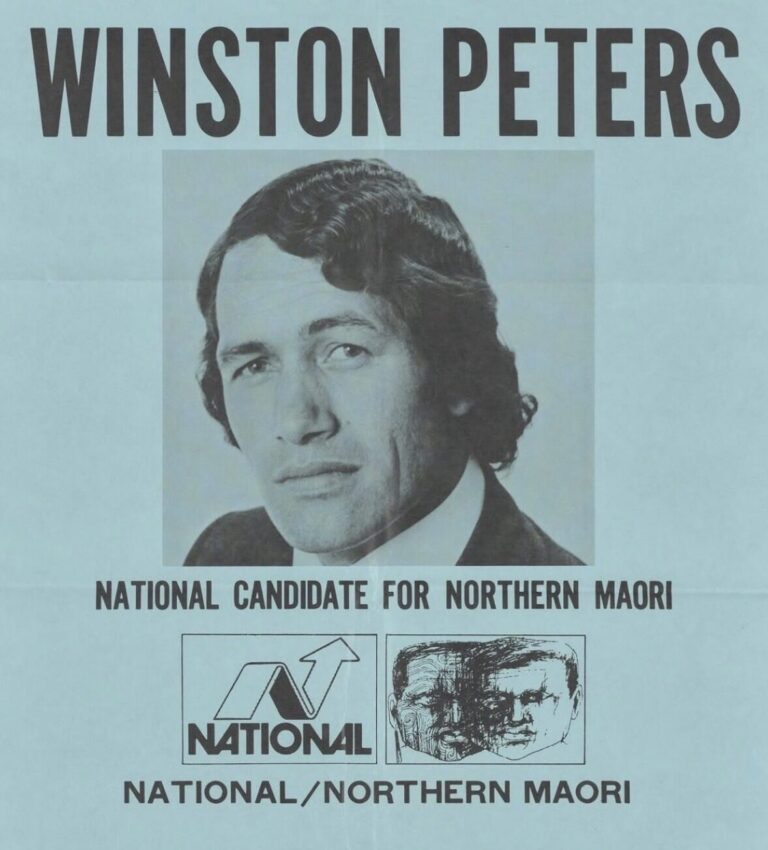

Well we have Tory parties from 1991 onwards putting the gears in neutral. Where we grind to a halt in nowhere land. The early years of the 1990’s was in nowhere land with a dependency on commodities that couldn’t pay for our imports. This is the golden age where vast numbers of New Zealand’s most vulnerable never got a look in. Where woman never got a look in with no equal rights or equal pay. Where migrants were factory fodder. Where brown people was excluded from the system, where we had these xenophobes running around for Britain and that awful cultural cringe of Don Brash that almost held us back for a generation.

Well we now have a caucus and government ministers deciding whether parliament will be a museum or apart of New Zealand’s heritage and cultural history. And we’ve got a government putting cultural icons in positions of change. When the kids come along the Tories of New Zealand can say no to the kids, get back down the time tunnel to the past.

When I went to school I learnt about self respect and self regard for New Zealand. Not some cultural cringe of a movement deciding not to worry about mental health, say don’t worry teen suicide, and saying don’t worry about youth unemployment. They’re not saying keep our communities free from domination by transnational gangsters. And even as the youth walk out on the Tories they are still looking for there doctorates and knighthoods instead of doing what must come with high honours.

Now that’s why Tory parties fighting every document, trying to tip there hats to every New Zealand kid trying to get a technical education and get all these monkeys off of their backs and kick out the same old sterile policies that produces doctorates and knighthoods with out any honour in them at all. Tory muppets can go back to there nostalgic 50’s with there bibles and there capes and the whole lot because they are not aggressively kiwi and they are not aggressively proud of our culture and we’ll have nothing to do with Tories or their sterile ideology.