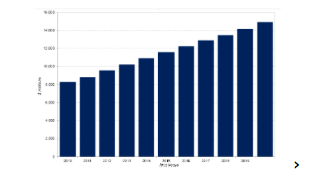

So the government is producing fiscal surpluses after years of deficits following the Christchurch earthquakes.

The surplus (OBEGAL) projected for 2016/17 is around $720m and then rises to a whopping $6,681m by 2020. Eventually, even after using some of the surplus to lend to students and capital infrastructure, there will be cash in hand to either repay debt or reduce taxes.

Oh good.

So this is going to justify tax cuts bribes in the 2017 election? If so who has sacrificed to produce these surpluses? Not the old.

NZ Super payments have increased not only because of demographic change but also because real rates of super have increased with wage growth. For example the single rate has gone from $256 to $385 net a week since 2005. An increase of 50%..

It is absolutely appropriate to link super to wages if older people are to keep up with living standards generally. In 2016 alone the rate increased just over $10 a week but is not heralded in the budget. Benefits got a zero increase. The super increase is new real spending that should be mentioned BUT doesn’t have to be. Why not? Because it is automatic.

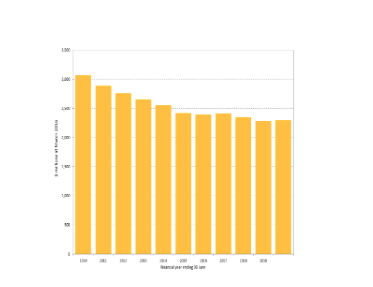

No such annual automatic increase for income support for the young. Working for Families in 2010 was $3.1 billion in 2016 dollars. To stand still this means the 2016 spend of $2.4 billion should actually be $700m higher. The government doesn’t have to fess up to cutting Working for Families because it happens automatically. This follows from a process it set in train in the 2011 budget. CPAG has complained endlessly about this. Who of the other commentators even noticed? A clever coup for Bill English.

Let us be very clear who will pay for those tax cuts. If WFF had been adjusted properly for inflation since 2010, National would be spending another $700m on it, in this year’s budget. If the exclusion of around 200,000 of the poorest children from the benefits of the In Work Tax Credit of at least an extra $72.50 a week (more for larger families), was fixed, National would have to spend another $600m. So it has saved $1.3 billion in this year alone out of the pockets of the worst off. This is how Bill English generates surpluses to justify John Key’s election year bribes of tax cuts to the rich.

If you are even slightly perturbed about this incredible imbalance: that along with housing the attack on Working for Families has a lot to do with the rapid increase in the working poor, please visit, comment, support, and share

Sorry Susan,

By 2020 we will be in another deep depression.

Don’t believe the Governments “Alice in Wonderland” predictions, they simply always just fake everything for their needs.

https://www.youtube.com/watch?v=ZprvOrynJF8#sthash.kr02g6I7.dpuf

We are headed for another Global financial crash more destructive than ever seen before, as we have changed our whole monetary system from real wealth to debt based “wealth, setting us up for a major disaster coming soon.

We are in the twilight zone before the total crash and one day we will see the banks unable to open and signal the end of the Breton woods “Alice in Wonderland” Enclosed world” they then created by decoupling the real wealth generated system, by tying the monetary value to the goods created for a new “currency trader” (John Key type)system, so now we have a system that solely relies of borrowed money to keep the “currency trader” financial FIAT money system going.

Struggling to pay Government/bank debts – there is always the promissory note one can fall back on:

https://govbanknotes.wordpress.com/2016/04/02/issuing-our-own-american-national-private-bonds-negotiable-instrument-money-orders/

Works for all those living in all western “cabal” controlled countries – just like us!

Sneaky and heartless

We know that the children of our country are our future,

this level of inequality is disatrous for NZ.

Great post. One of the wealthiest demographics is the elderly.

Sadly by the time many of the young are old, they will not have superannuation due to the greedy short term policies (often hidden or not mentioned in the MSM) that is robbing our country and it’s future of wealth.

But also to think about, why do we need working for families?

Because our wages are so low, you can not support a family on them for much of our population. That is a real and growing problem and instead of long term saving and policy to raise wages, we are borrowing up a storm to fund corporate welfare like Charter Schools and Saudi bribes and paying 7 million to SELL assets like state houses.

No wonder all the politicians need all their secret tax havens to stash their money in with all the benefits they are getting from their actions.

But we dont say NZ Super is because wages are so low and people couldn’t save for themselves. The young and the old need good programmes that are well supported. We will never be able to have a wage system that can do the heavy lifting for families of different sizes and ages.

Nor do other countries. Australia does so much better for the young than we do

The elderly vote ,children don’t ,it’s a election bribe ,pure and simple

so it is important to speak up for children!

I’m rubbing my hands with glee at the thought of a tax cut AND another National government.

Can life get any better??? 🙂

Ideally I’d like it to be a coalition with ACT, but that may just be wishful thinking.

Life is not better for most. If a tax cut bribe to the rich is offered, that National will have to borrow for, I guess National will will break more promises and hike up GST and other taxes again, just like they did last time.

So when those that have no money break into your house because you have more money than them, so as to buy cigarettes, you will be directly responsible for that theft because of your support for National policies.

$78 for a pack of durries

A pox on National and a pox on Labour. A pox on both your houses

Why drag Labour into National’s mess. its pox on you and everyone else the longer National clings to power.

“Why drag Labour into National’s mess” asks Words

There’s the ‘party of the working class’ jacking up this workers durries….

Tobacco Tax Bill Passes Under Urgency

The Customs and Excise (Tobacco Products—Budget Measures) Amendment Bill has passed through all its stages under urgency.

Ayes 109 (National 59, Labour 32, Greens 14, Maori Party 2, ACT 1, United Future 1)

Noes 12 (NZ First 12)

That’s why

The Greens voted in favour of it too, so all you are worried about is a tobacco tax? I will say it again, Why drag Labour into National’s mess. its pox on you and everyone else the longer National clings to power.

“Why drag Labour into National’s mess” asks the words

Coz there is labour ‘the supposed party of the working class’ tag-teaming up quick as Larry to gang-bang this working class man.

That’s why!!!

I am 71 years of age and my sole income is national super. After a lifetime of very low wages I was unable to save a cent for my retirement. However I am better off now than I have ever been in my life before thanks to NZ super. I live in a council flat with very affordable rent and have money to spend on all manner of things as well as being able to save for the first time in my life! I feel very guilty that I am so well catered to when compared with those a lot worse off than me. Something is very wrong somewhere. There should not be child poverty in this country ever.

Don’t feel guilty Pedro, you’ve paid your dues. Glad to hear someone is ok at least. And you are right of course, there should be no child poverty in this country, in fact, there should not be poverty for anyone, whether they be child, adult or elderly, at all.

Pedro

it is so good we are doing something right for people like yourself.

All of the features that make NZ Super successful are sadly lacking in the design of what families and those on benefits get. We need to learn from NZ Super

[…] The Daily Blog: The rules for the old too good for children? […]

Comments are closed.