Winston, middle class economists and Kiwisaver – taking today what tomorrow never brings

Winston Peters is on the right track. We need to save our way out of our financial mess – Liam Dann

- The number of people contributing to KiwiSaver has fallen for the first time: a 1.3% decrease.

- Winston Peters has proposed making KiwiSaver compulsory, with increased contributions and tax cuts to offset costs.

- Critics argue the tax cuts could cost up to $28.3 billion annually, raising concerns about viability.

Blah blah blah.

Middle Class Capitalist says what?

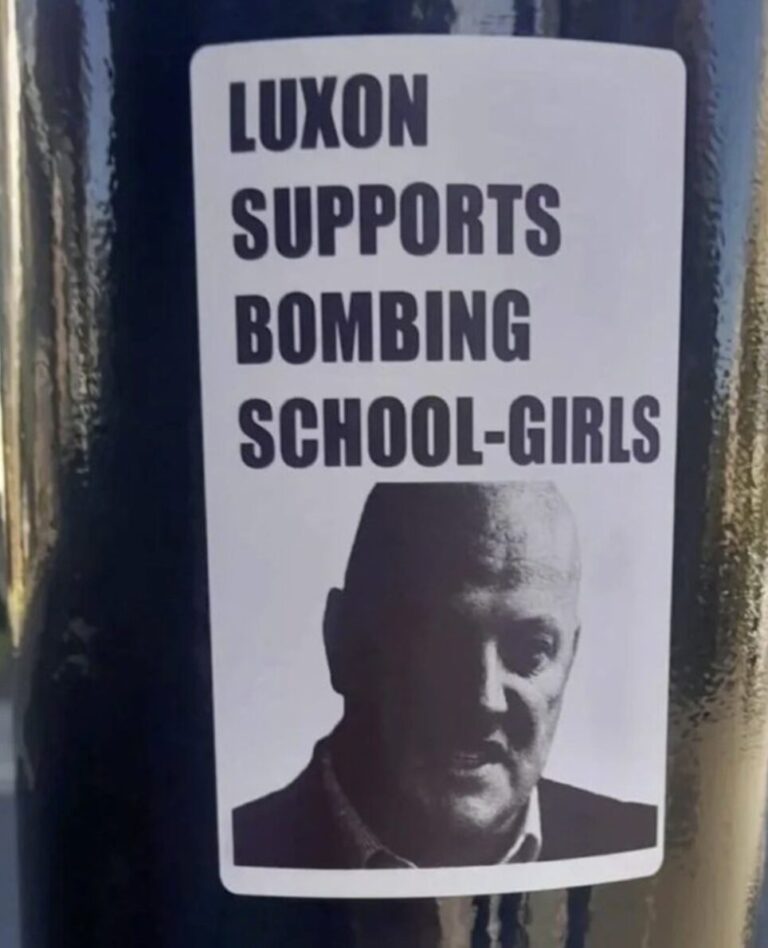

Matua Winston held possibly the saddest Fathers Day event ever last Weekend with his NZ First conference in NZs Landlocked Depression Capital, Palmerston North.

It was the usual blend of redneck lunacy, anti-vaccine Cheerleaders, Nuclear Power fantasies, and Stewart Nash’s $500 haircut.

After attacking the Sun for being Woke and demeaning every other Party for daring to exist, Winston was reviving dead ideas he’s been flogging for decades.

Winston’s been pushing for compulsory Super for Thirty years now and still hasn’t managed it!

If at once you don’t succeed, I get it.

But 30 years?

I don’t think people want to lose 10% of their wage in the middle of a cost of living crisis Winston.

People are more focused on the here and now than their retirement, not only is Winston out of touch with the realities of the economic down turn – his Government – has engineered, he’s also in another time dimension from the average voter.

How about less Back to the Future Matua Winston and a little more Kpop Demon Hunters?

The Political Right of Muldoon cheated NZ out of a proper super scheme, demanding people who are barely holding on start saving for a rainy day as they are drowning shows how out of touch the middle class economists and Winston have become.

When you can’t afford butter, how the Christ are you supposed to pay for your superannuation?

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

We are told repeatedly that our universal pension scheme, NZ Superannuation, is rapidly becoming unaffordable, and that we must all put our savings into KiwiSaver to look after our own retirement.

People look enviously across The Ditch, wring their hands, and say ‘If only we had a compulsory superannuation savings system like Australia’s. Then we’d all be rich. Let’s make KiwiSaver compulsory!’

NZ Superannuation provides a universal basic income in retirement. It will continue to do so as long as society is willing to be taxed enough to fund it. Yes, that tax could be going into private KiwiSaver savings instead, ensuring that the gulf between haves and have-nots throughout life becomes even more extreme in old age.

Or we can pay the tax, boost NZ Super to provide a more liveable bottom line for everyone who gets it … and those who have been able to save extra through life will enjoy spending their savings anyway.

It’s a moral choice: look after everybody, or look after me and bugger the poor.

The reason NZ Super is yearly becoming uncomfortably more expensive is because the surtax on recipients’ other income was abolished in 1998, so NZ Super goes in full to those who don’t need it, and costs the country a fortune.

Bring back some form of the surtax to restore NZ Super to being a universal basic income.

Okay, back to Australia. Is their compulsory universal superannuation savings scheme as good as we are so often told? Here’s Geoff Carmody, writing a decade ago in the Australian Financial Review (not a socialist newspaper). He looks enviously at New Zealand’s universal super, and reckons what we have is better, and fairer.

https://archive.ph/4FXUL

A response: ‘Geoff Carmody is right: scrap [Australia’s compulsory] super’

https://www.afr.com/policy/geoff-carmody-is-right–scrap-super-20160313-gnhrvy

https://archive.ph/GLHwf

Another: ‘Scrap [Australia’s compulsory] superannuation for a universal basic pension’

https://www.macrobusiness.com.au/2021/01/scrap-superannuation-for-a-universal-basic-pension/

And another: ‘Scrap [Australia’s compulsory] superannuation. It fails to meet the standards of a retirement income system. It is costly and inefficient, unnecessary, and incredibly unfair.

The age pension [equivalent to NZ Super] system is by far the most economically efficient retirement income system. Scrap superannuation. Expand the age pension. Boost the economy.’

https://treasury.gov.au/sites/default/files/2020-02/murray290120_0.pdf

And this:

2025may26: More criticism of the Aussie superannuation savings scheme that Kiwi find managers eye enviously

https://theconversation.com/actually-gen-z-stand-to-be-the-biggest-winners-from-the-new-3-million-super-tax-257450

Winston is badly out of touch with reality on this one

Given the scale of the infrastructure deficit (equating to around 10 billion dollars) there is no scope for widespread tax cuts that Winston is proposing

And given the share of companies recording a profit is less than 53% while business closures (in particularly liquidations) are at a 10-year high and increasing, many employers don’t have the scope to increase their contributions.

As for employees, unemployment is increasing (no surprise with all the business closures) and wage growth has largely failed to meet the cost of inflation. People are going backwards financially in a cost of living crisis. Thus, many of them don’t have the scope to increase their contributions either.

Not to mention, KiwiSaver hardship withdrawals are increasing

Voters are looking for solutions that will help take the pressure off the cost of living. So IMO, increasing KiwiSaver contributions without widespread tax cuts (which the country can’t afford) will go down like a cup of cold sick for most voters .

Wake up Winston

Winston’s plan give people tax cuts then compulsorly siphon that money back into the sharemarket via kiwisaver funds.

Effectively how is that any different from just increasing the govt contribution on the current scheme? Oh – it’s less redistribution.

The kicker in Winston’s proposed scheme – does the investment occur in NZ and what tax rate is applied to the companies that receive the investment?

If Winston’s scheme back in 1997 to ‘give’ all workers $60k in a fund account the initial entrants to such a scheme would have $700k in assets today.

If the Kirk scheme hadn’t been cancelled by National/Muldoon, NZ would have sovereign wealth similar to Norway and could have Scandinavian level social services.

That would be no good .The top 10% would be surrounded by 2 million sorted people whos money they could not get their hands on .

Norman Kirk was right over 50 years ago .Since then National have been led by two squat bald cunts that have fucked NZ economy big time .

Your foul remarks cancel your opinions gordon.

Cluck, cluck.

But Brooke says its ok to use the C word so whats your problem

Didn’t Singapore model their retirement or sovereign fund on the model NZ had in 1975?

Look at them now.

Yes we would be the Singapore of the pacific that NACT crave so much ,but they keep fucking it up so that will never happen