Why Māori Party Financial Transaction Tax and Green Party Wealth Tax are real solutions

We need to remove the yoke of taxation from the 90% and reset it to the 10% richest.

We need to be far kinder to individuals and far crueller to corporations.

The Political project of the Right is to strangle the State of revenue to stop the redistribution in the first place.

Universal Left is the way to counter this with real subsidisation of peoples material well being with well funded public services.

The only Parties offering real reform on taxing the rich are The Greens Wealth Tax, The Māori Party’s Financial Transaction Tax and TOPs Land Tax.

Rev Brian Turner is spokesperson for EcuActio and his argument on new taxes to target the wealthy was published on The Daily Blog earlier ion the year:

The Sherriff of Nottingham rules the roost – where is Robin Hood?

Guest blog by Rev Brian Turner

EcuAction is a small interfaith group based in Christchurch which has worked with a range of people, both inside and outside Church communities, to develop this proposal to reform our tax system. Rev Brian Turner is the spokesperson for EcuAction.

Problem:

Aotearoa New Zealand’s tax system is heavily weighted against those on low and middle incomes.

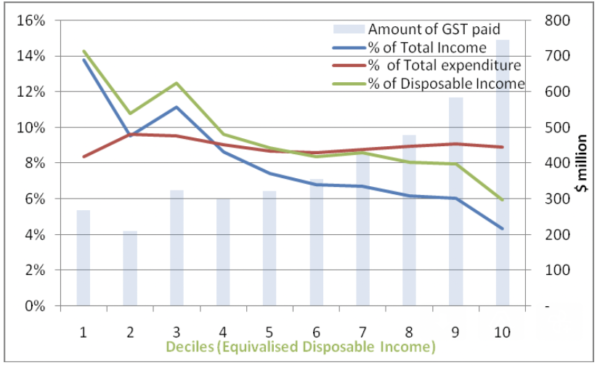

Wage and salary earners pay the highest rates of tax because they pay tax on every dollar they earn and every dollar they spend. And for those on the lowest incomes the tax rates are particularly savage. For example, the lowest 10% of income earners spend 14% of their income on GST while the top 10% spend less than 5% of their income on GST.

Figure 1: Amount of GST paid as a percentage of total income, total expenditure, and disposable income

We have a bizarre and immoral tax policy which says the more you increase your wealth, the lower the tax rates you pay. The Sherriff of Nottingham (rob from the poor to give to the rich!) would be proud of our country’s tax policies.

For example, in the 2014 tax year the HWI (High Wealth Individuals) unit of Inland Revenue found that 87 of the 212 New Zealanders with net wealth over $50 million were declaring incomes of less that $70,000 for income tax purposes. In other words, they are not even in the top income tax bracket!

This is unfair. It is wrong.

Wage and salary earners cannot avoid tax. It’s taken out of our pay before we get it and is deducted each time we buy something. But for the wealthy and super-wealthy, tax is almost voluntary as they find myriad ways to avoid or reduce their tax responsibilities.

The wealthiest 5% now own 37% of our wealth and their share is growing at the expense of the rest of us. Tax policy is a key reason for this growing inequality.

Aotearoa New Zealand cannot afford to carry those on high incomes. We can no longer allow a small number of people to become fabulously wealthy from not paying tax rates the rest of us cannot avoid. They are a liability to our tax system and to the health and wellbeing of the country. This must change.

We need a change to tax policy so everyone living in Aotearoa can live lives of dignity and self-respect. This tax solution takes us in that direction.

Solution:

Our solution is to remove GST, which has its biggest impact in low-income families, and replace it with three taxes which will impact those paying minimal amounts of tax at the moment.

Option A – fairer for everyone

Bring in

|

Option B – the Sheriff of Nottingham option (make the rich richer and the poor poorer)

This is what Labour and National are doing now!

|

Our Option A will put more money in the pockets of low and middle-income earners and shift taxation to those not paying their fair share.

Summary of Option A

Removing GST would put $25 billion into the back pockets of New Zealanders. The income needed for the removal of GST would be made up by three taxes.

Financial Transactions tax (FTT) (raising at least $15bn per year)

A small percentage tax (0.1%) would be applied to all financial transactions through banks and financial institutions. For the average person this would amount to about $2 per week but would bring in around $15 billion for the government annually.

(More details in the Q and A below)

Wealth tax (raising approx. $10.9bn per year)

An annual tax on net wealth above $1 million

| Net Wealth | Marginal Wealth Tax rate pa |

| Up to $1m | 0% |

| $1m to $2m | 1% |

| $2m to $5m | 2% |

| $5 to $10m | 3% |

| Over $10m | 5% |

(More details in the Q and A below)

Capital Acquisitions Tax (approx. $2 billion per year)

This is tax on unearned income a person may receive from time to time – for example when receiving an inheritance. It would apply only to those receiving very large unearned incomes. We are proposing:

| Capital Acquired | Marginal CAT rate to apply |

| Up to $1 million | No tax |

| $1 to $5 million | 20% |

| $5 to $50 million | 40% |

| Over $50 million | 60% |

(More details in the Q and A below)

Questions and answers on Option A

GST (Goods and Services Tax)

What is GST?

GST is a tax we pay whenever we purchase goods (eg groceries) or use services (eg taxis) It was introduced by Labour in 1986 at 10% and was increased to 12.5% in 1989. In 2010 a National government increased it to its current rate of 15%.

How much tax does GST collect in Aotearoa each year?

Approximately $25 billion each year.

What’s wrong with GST?

GST is unfair. It is a regressive tax. People on low incomes pay a much higher proportion of their income on GST than people on higher incomes. This is because people on low incomes spend every dollar they earn but those on higher incomes are able to save some of their income so don’t pay GST on the saved money. Some countries, such as Australia, have exemptions for GST on such things as basic foods, medical and health care products. Aotearoa New Zealand has no exemptions.

The rich don’t pay much income tax but at least they will pay lots of GST on luxury things they buy?

Yes that’s true but it doesn’t change how unfair the tax is on low-income New Zealanders and the much lower percentages in tax paid by the wealthy and superwealthy.

FTT (Financial Transactions Tax)

What is an FTT (Financial Transactions Tax)?

It is a tiny percentage of tax on money transfers in or out of our banks and financial institutions. It would be collected by banks and financial institutions and passed on to the government.

What examples of FTT are there in the world today?

There are many examples of FTT in place around the world. The broad scope of FTTs are outlined here.

For example:

- Britain has an FTT (or Stamp Duty) on all shares traded

- The European Union has been discussing an FTT to apply to money moving between banks and financial institutions and trading in company shares and bonds and other financial transactions.

What kind of FTT is being proposed by EcuAction?

We are proposing a simple FTT of 0.1% to apply to all financial transactions. eg bills paid, shares traded and currency speculation would all be covered.

How much would I lose from my pay each week in an FTT?

A person earning $1000 a week would pay around $2.00 per week in FTT.

Why put a new tax on ordinary New Zealanders?

Because the FTT would replace GST. The person earning $1000 above would pay just $2 per week in FTT but would save around $100 per week by the removal of GST. They would have $98 more each week for themselves and their family.

So if the average person is paying only $2 per week in a FTT, how could that help collect the billions needed to replace GST?

Because the FTT would also target the hundreds of billions which pass through our banks every year from big business transactions and currency speculators. New Zealand has the 10th most traded currency in the world and accounts for 2% of the $3.2 trillion traded every day around the world. An FTT of 0.1% could bring in $64 million per day (approx. $20 billion per year) from currency trade alone. However, to avoid the tax, speculators would trade less in New Zealand dollars so the actual amount of tax collected from currency trade would be much lower.

Yes, but wouldn’t the banks and financial institutions just pass the cost onto their customers so households and things like Kiwisaver funds would pay the cost?

The banks may pass extra costs on to their customers but these will not be noticeable for most New Zealanders most of the time. However, the removal of GST will be a huge boost to ordinary New Zealanders and the real economy. It will provide a strong economic stimulus as people have much more money to spend each week.

Wouldn’t our financial services just move to Hong Kong?

No. There would be no benefit in doing so because dealing with financial services would still require money to move in and out of our banks and financial institutions. However, there will be many attempts by big business and the super-wealthy to avoid the tax and the government will need to close loopholes so the tax cannot be avoided. Ordinary New Zealanders can’t avoid income tax – it is taken out of our pay by employers every week – so big businesses and the wealthy should not be able to avoid their taxes either.

Could the FTT harm the economy?

No. The rate is set so low that an FTT would have a very small effect on economic activity. The only area where it would dampen economic activity is in currency speculation which would be good for the economy in helping stabilize our currency.

What about when I buy a house – the FTT would be huge – how could I afford it?

If you bought a house for $1 million you would pay about $1000 in FTT – far smaller than estate agent fees. Meanwhile every week you have more money in your pocket to pay the mortgage back quicker because you won’t be paying GST on anything you buy.

What about my Kiwisaver fund? It buys shares so it would be hit by an FTT and I would miss out.

Yes, your Kiwisaver Fund would pay an FTT when it buys and sells shares but this would be a minimal amount compared to the “management fees” you already pay your fund managers. In any case low and middle income earners will have significantly more money each week (remember there will be no GST) to put more into Kiwisaver!

If it is such a good idea why hasn’t the government done it yet?

Because big businesses and the wealthy who donate to political party election campaigns don’t want an FTT. They will raise lots of phony objections and scaremongering against an FTT.

What do economists think about it?

There are mixed opinions but most economists who are concerned about making the tax system fairer are supportive of an FTT. Nobel prize winning economist Joseph Stiglitz supports an FTT. Even some high-profile billionaires like Warren Buffet and Microsoft’s Bill Gates support an FTT because they recognize current taxation in most of the world is unfair.

Wouldn’t people just avoid the tax by using bitcoin or something similar?

No. Good government regulations could ensure the tax is unavoidable.

Will big businesses fight an FTT?

They will complain loudly against it. In 2016/2017 when the European Union were on the verge of introducing an FTT, with both France and Germany keen, big business lobbies went on the attack with scaremongering, lies and half-truths to undermine it. Here are some of the things they did:

- Swamped the public and politicians with many baseless assertions about the disastrous effects of a FTT. They did this in a short period of time. What counted was “quantity, not quality” of the arguments.

- Pretended that the interests of the finance industry were the national interests of each country

- Pretended the interests of governments to finance their debts are in conflict with FTT proposals

- Pretended that a FTT would harm small investors saving for their retirement

- Ignored all arguments of FTT supporters which showed the value to economic stability from an FTT

- Declared the financial sector was willing to carry its fair share of the costs of the global financial crisis so an FTT would not be needed – but of course they didn’t!

Business lobbies and the wealthy will do the same thing in New Zealand to try and undermine this proposal for an FTT.

How much would an FTT bring in each year?

A conservative estimate is $20 billion per year. An FTT of 0.1% could bring in $64 million per day (approx. $20 billion per year) from currency trade alone. However, the tax would reduce currency trading in New Zealand dollars so the actual amount collected from currency trade would be less.

Wealth tax

What is a wealth tax?

A wealth tax is a small annual tax on a person’s net wealth. Net wealth means the value of a person’s assets (company shares, property etc) minus their liabilities (mortgages, loans)

How much would people pay?

Only the very wealthy would pay a wealth tax. Our proposal starts with people having net wealth of over $1 million as follows:

| Band | Marginal Wealth Tax rate pa |

| Up to $1m | 0% |

| $1m to $2m | 1% |

| $2m to $5m | 2% |

| $5 to $10m | 3% |

| Over $10m | 5% |

Shouldn’t everyone pay a wealth tax rather than just the wealthiest?

No. Those with the greatest wealth have gained this through paying much smaller tax rates for many decades which is why they are now so wealthy. So a wealth tax would bring back some of the taxes lost in previous years.

What countries already have wealth tax?

| Current OECD Countries with a Net Wealth Tax | ||

| Country | Rate | Base |

| Colombia | 1 percent | Net wealth in excess of COP 5 billion (US $1.4 million). |

| France | Progressive from 0.5 percent to 1.5 percent | Net taxable wealth in real estate properties above €800,000 (US $968,000) |

| Norway | 0.7 percent at the municipality level and 0.15 percent at the national level | Fair market value of assets minus debt. Tax applies to value of wealth above NOK 1.5 million (US $180,000) for single/not married taxpayers and NOK 3 million (US $360,000) for married couples. |

| Spain | Progressive from 0.2 percent to 3.75 percent depending on the region | May differ depending on the region, but generally value of assets minus value of liabilities. Regions have autonomy in setting the exemption amount. Madrid provides a full exemption. |

| Switzerland | Varies depending on the Canton (local area where one lives) | Gross assets minus debts. |

| Source: PwC, “Worldwide Tax Summaries.” | ||

How much money would this tax bring in?

Around $10 billion per year as follows:

| Band | Total net wealth | Population | Marginal Wealth Tax rate pa | Total wealth tax from this band |

| Up to $1m | Most of us | 0% | 0% | |

| $1m to $2m | $262bn | 191,600 | 1% | $1.31bn (avg 0.5% of total) |

| $2m to $5m | $249bn | 84,300 | 2% | $3.74bn (avg 1.5% of total) |

| $5 to $10m | $158bn | 22,600 | 3% | $3.16bn (avg 2%of total) |

| Over $10m | $67bn | 4,900 | 5% | $2.68bn (avg 3% of total) |

| TOTAL | $10.9bn |

Capital Acquisitions Tax

What is a capital Acquisitions Tax?

It is a tax on unearned capital received as a gift or inheritance which is paid by the receiver. It would only be applied in cases of large wealth transfer.

How much would it be?

In cases of inheritance we are proposing to exempt the family home from this tax and the first $500,000 inherited by an individual. Beyond that tax would be levied on capital acquisition as follows:

| Capital Acquired | Marginal CAT rate to apply |

| Up to $1 million | No tax |

| $1 to $5 million | 20% |

| $5 to $50 million | 40% |

| Over $50 million | 60% |

Who would it be applied to?

The effect of the tax would apply to acquisitions from the wealthiest 5%.

Wouldn’t a person of great wealth simply break it up into smaller portions and give it as gifts before they die?

Some people who don’t want to pay a fair share of tax would want to try this but robust government regulations would ensure this tax was not able to be avoided. Wage and salary earners can’t avoid tax so the super-wealthy should not be able to avoid taxes either.

Why should this apply just to those with high wealth and not all of us?

In general people with high wealth have paid very small percentages of tax through their lives because their sources of income (such as capital gains on property or increased share values) have not been taxed like wages and salaries. This is a way wealth can be taxed for the benefit of the community.

What other countries have a Capital Acquisitions Tax?

New Zealand currently has no Capital Acquisitions Tax but many countries have a such a tax in one form or other. The following OECD countries tax capital acquisitions through inheritance as follows:

| Country | Top Rate |

| Japan | 55% |

| South Korea | 50% |

| France | 45% |

| United Kingdom | 40% |

| United States | 40% |

| Ecuador | 35% |

| Spain | 34% |

| Ireland | 33% |

| Belgium | 30% |

| Germany | 30% |

| Chile | 25% |

| Greece | 20% |

| Netherlands | 20% |

| Taiwan | 20% |

| Finland | 19% |

| Denmark | 15% |

| Iceland | 10% |

| Turkey | 10% |

| Vietnam | 10% |

| Brazil | 8% |

| Poland | 7% |

| Switzerland | 7% |

| Croatia | 5% |

| Italy | 4% |

Did we ever have a Capital Acquisitions Tax?

No. However, before they were abolished by National in 1992, we had Estate Duties and Gift Duties under which the family home and the first $450,000 from an estate was tax free with 40% of the remainder paid in tax.

How much revenue would this tax bring in?

Without more detailed information it’s difficult to assess the income from a Capital Acquisitions Tax. However, an estimate based on the total value of the estates for people dying each year can be made and the income from this tax would be approximately $2 billion per year.

(The wealthiest 5% have 37% of total household wealth and the tax would apply largely to this group. Approximately 1746 estates (5% of those dying each year) which would pass on capital acquisitions which would attract the bulk of this tax. The average wealth of this group is around $4 million so a total of around $6 billion inherited each year would be liable to the tax. This would bring in around $2 billion per year)

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media.

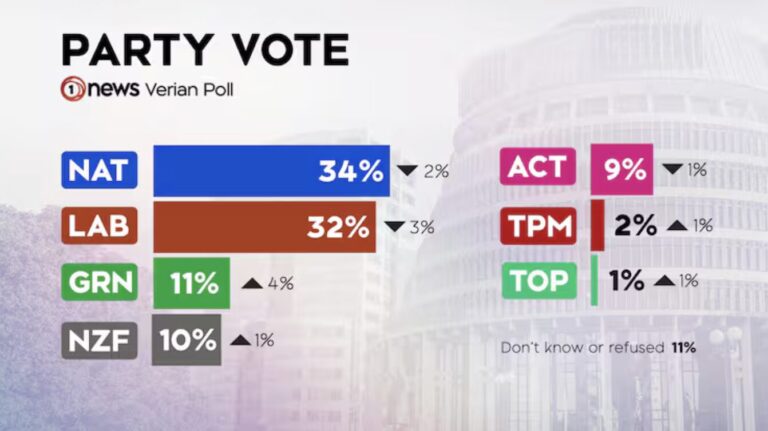

Voters are mostly stupid, ignorant and lazy – note how many people have read this article – 830 and compare that with how many have read and commented on the article about Posie Parker – over 2000 with 48 comments.

This is how center right economics, low taxation and incrementally starved public services become entrenched. Most voters are like frogs in a gradually heating pot of water, completely obsessed with issues that will have zero impact on their material lives while the capacity of the state to look after all of us is eroded all around them.

You are right on the button Peter. When you look at the state it is failing in all directions.

Law and order .Police stretched to the max and courts out of step with the general publics demand for justice.

Health .Nurses undervalued .Doctors were insulted by Little and are quitting in droves causing a break down in General Practice.

Education The fact that teachers and principles need to strike to get paid properly says it all.

Armed forces 20 percent understaffed with patrol boats not able to sail and army not able to help as much as they wanted during Cyclone Grabrielle.

Roads falling into disrepair.

Ferries terrible service

To be honest I will vote National but really not convent they will fix all the problems but hopefully they will not get worse.

Under National things will definitely get worse, we all know that as soon as they can, they WILL cut tax rates, further entrenching the problems you outlined. But hey! Lower taxes, am I right?

It does not matter how much you tax the rich if the government in power waste the income on poorly planed projects like cycling bridges and combining broadcasting outlets .

Greetings, comrades! Today, we’re going to talk about how Labour and the Greens can secure a victory in the upcoming 2023 general election. As you all know, New Zealand is in dire need of progressive policies that prioritize the needs of the many over the interests of the few. And one of the most important areas where we need to see radical change is in our taxation system.

Let’s face it: our current tax system is a mess. It’s regressive, it’s unfair, and it disproportionately benefits the wealthy. That’s why we need a new taxation system that ensures that the rich pay their fair share and that everyone else gets a fair deal.

So, how do we achieve this? Well, first and foremost, we need to introduce a progressive income tax system. This means that those who earn more will pay more in taxes, while those who earn less will pay less. It’s a simple and fair system that ensures that everyone contributes to society according to their means.

But we can’t stop there. We also need to introduce a wealth tax, which would target the ultra-rich who have been getting away with paying minimal taxes for far too long. By taxing the wealthiest members of society, we can generate significant revenue that can be used to fund social programs and infrastructure projects that benefit everyone.

Additionally, we need to close the tax loopholes that allow corporations to avoid paying their fair share of taxes. By cracking down on tax evasion, we can ensure that everyone pays their fair share and that we have the resources we need to build a fairer and more equal society.

Of course, introducing a new taxation system won’t be easy. We’ll face opposition from the wealthy elite who benefit from the current system, and we’ll need to work hard to convince the public that our proposals are in their best interests. But with a strong, united Labour and Greens coalition, we can win the support of the people and secure a victory in the 2023 election.

So, let’s get to work. Let’s build a taxation system that works for everyone, not just the wealthy few. Together, we can create a brighter, fairer future for all New Zealanders.

Great comment and sums up what’s required perfectly. However, it is not the rich that will stop this happening but the majority of the electorate. The average voter who is not rich but who clings to what wealth they have and aspires to have more. Even the poorest voter will put themselves in the position of being rich and resent paying taxes on wealth they will never have. This is the great victory of capitalism and its complete capture of the cultural narrative around wealth. We can barely imagine and when we do, despise, an economic system that creates more equitable outcomes for everyone if it requires us to have less individually.

This is why our media is full of empathetic stories about people who can’t access basic services in the public health system but can only envisage accessing private health care as a solution.

Similar empathy is paraded for the victims of catastrophic natural disaster or misfortune but then questions and doubts the expensive solutions required with the countervailing confidence of a small minded accountant.

Nobody, and I mean nobody, will countenance higher taxation in any form. When National proposes lower taxes there is complete silence on the long term consequences of underfunding the services and infrastructure of future generations as each of us counts up the few hundred (or thousand for above average earners) dollars a year that will come our way.

On the other hand, mention raising taxes in any shape or form and catastrophic economic collapse, hellfire and doom will be screamed from every media outlet and by every talk radio commentator with breath in their body.

TL;DR

So the plan is to tax Granny so much she has to sell her home and then take a chunk of whatever’s left so her grandson little Johnny can’t buy a home – that’s a sure fire vote winner.

FTT makes sense though.

No you are wrong about Granny having to sell up – I understand there to be level of house ownership that is fine, perhaps 1 or 2 million.

We should definitely have FTT – it is nuts that we who have the 9th most traded currency in the world don’t have this, sure we will drop down but it is all a miniscule amount. Which of course adds up.

Oh man, it is so easy and cheap to be rich in this country!

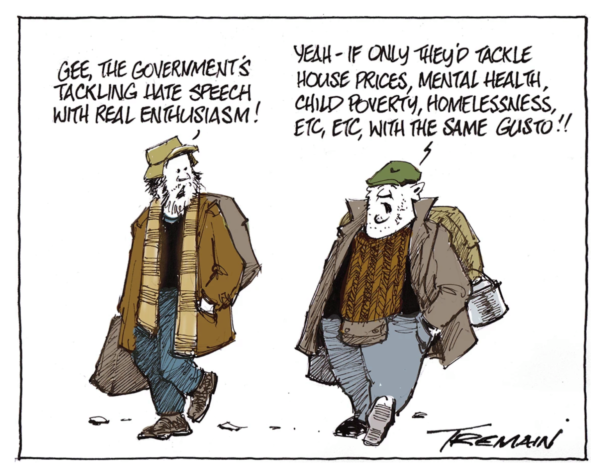

Good solid stuff! (Meanwhile, on the culture wars front …)