What if COVID accidentally unleashes an inflation tsunami in 2021?

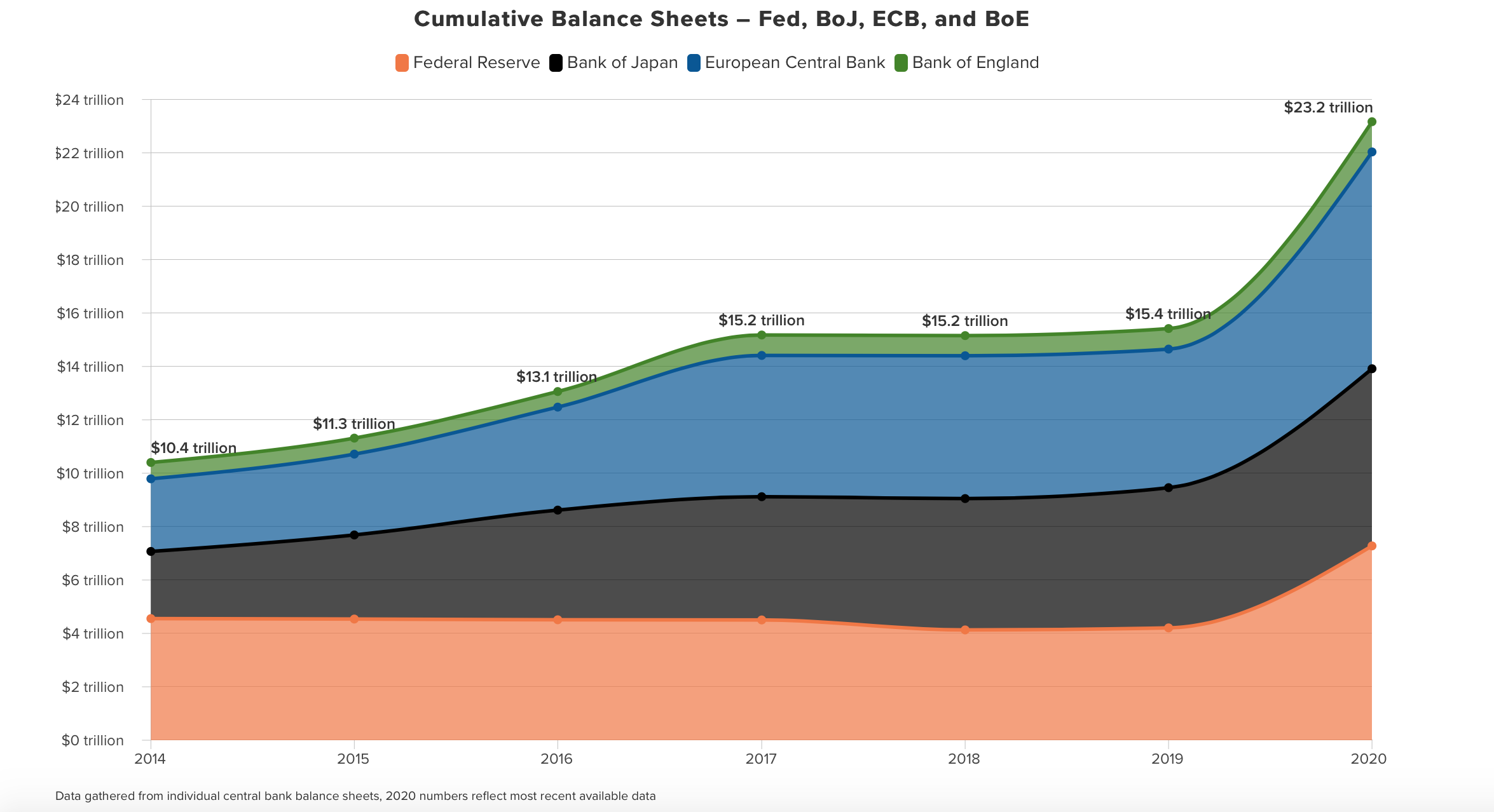

One of the great surprises in modern economics was that the avalanche of quantitative easing used to save the global economy from American Corporate bank greed in the 2008 financial meltdown didn’t create an explosion in hyper inflation in the day to day lives of ordinary people.

Because of the ease of global labour supply, wages didn’t increase, prices of goods stagnated, inflation disappeared but it did create the false conditions for the lowest interest rates in 5000 years, and saw all that quantitative easing balloon into speculative house and stock prices.

Covid has seen the main banks of the West sink trillions more into quantitive easing to deal with the economic whiplash the pandemic has created and in NZ we saw with the pumping of billions into the pockets of property speculators how our own house prices have skyrocketed.

This game of printing money to pump into property and stock market speculation to create a false illusion of wealth can continue playing as long as hyper inflation doesn’t overturn the apple cart.

But what happens if it does?

What happens if hyper inflation does suddenly explode out of nowhere?

To date all the inflationary pressures caused by this mass printing has led to driving up property prices and stock markets without touching the essentials and basics of life, but one of the impacts of Covid has been to shut down the global supply chains which is now creating scarcity of products that can’t get to market because they are bottlenecked at a Port.

This seems insanely dangerous because all those hyper inflation pressures will immediately jump to the very basics everyone uses.

Your Kiwisaver going up and your property value climbing is one thing, paying $15 for a loaf of bread and $20 for milk is completely another.

After every great pandemic throughout history, the peasant revolt in the 1300s, the London riots of the 1600s and the social unrest right after the Influenza pandemic of 1918, society always goes through intense social change brought on by the economic collapse lockdowns generate.

If the bottlenecks of supply chains are blocked unleashing a tsunami of hyper inflation on the goods everyone requires for life, Central Banks will have no choice but to lift inflation rates to desperately attempt to curtail that hyper inflation, which of course will mean the ocean of low interest debt that has been created to fuel hyper speculation will suddenly start feeling the true gravity of trillions in borrowing.

I’m no economist or financial guru, but it seems the basic laws of capitalism’s supply and demand will unleash a terrible tsunami of hyper inflation that the Global Reserve Banks will struggle to contain in any other way than to allow stock markets and house prices to shatter and crash by forcing interest rates back up.

Now if a vaccine can reach the 75% herd immunity threshold, those supply chains will reopen, but if we don’t gain that herd immunity, quarantine will continue to force those supply chains closed and the prices of scarce ordinary goods will start to dangerously inflate.

I fear all our Black Swans are coming home to roost in 2021.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media.

Prediction: Interest rates won’t go up – in fact they will continue to trend down. There also won’t be any hyper-inflation (with the exception of assets like stocks, houses, art, bitcoin etc – i.e. that benefit the wealthy). The highest bidder on treasury bonds ultimately determines the interest rate, which under MMT will always be the Central Banks since they are in control of the money supply. If you want a crystal ball of how the future looks, see Japan – they’ve been running this model for 30 years without any hyper-inflation. It does result in a poor allocation of capital though (it’s literally anti-capitalistic, since the money is mostly “printed” by the Government) and (so far) has served to massively increase inequality (despite most people here at the DDB continually asking for more government borrowing).

https://en.wikipedia.org/wiki/Modern_Monetary_Theory

What will happen to million dollar home loans when the interest rate is 10% or higher? And what will happen to $2 million houses – who will buy them when loans reduce in size due to high interest rates? Wages won’t increase because there are so many unemployed people willing to work for whatever they can get. So are house prices doomed? Since nothing that’s expected ever happens, I don’t think so.

‘Central banks will no choice but to lift inflation rates to desperately attempt to curtail that hyper inflation’

Do you mean central banks will have to raise INTEREST RATES to desperately attempt to curtail that hyper-inflation, Martyn?

We saw how well that worked in the mid-1980s, when Muldoon’s pegging of interest rates was undone [by ‘Labour’] and it unleashed 11%, 12%, 14%, 16%, 18%, 20%, 22% interest rates on mortgages and 3-monthly adjustments to wages and salaries.

The crash of ’87 sorted out a few things for a while, until the maniacs got back on their money-printing-come-speculation bandwagon again, as they did after the crashes of 2000 and 2008. So now we have the biggest bubble in history, by far.

By the way, what is called inflation is actually devaluation or money in the system. But calling it devaluation would not meet the [deceitful] requirements of the banks. And a $1, then $2, then $3 bar of chocolate now costs $5, while a loaf of bread is headed that way.

Interestingly, the yield on 10YT bonds has risen from about 0.7% to 1.1% over recent months.

“accidentally” – lol, good one Bomber

The old adage “what goes up must come down”

…has been proven wrong time and time again.

Asset prices seem to act as a sort of safety valve, keeping inflationary pressures off normal living costs. If NZ remains inflation free while the rest of the world suffers from it, we could see a lot of “hot money” heading into NZ, which could affect house and stock prices.

Asset prices seem to act as a sort of safety valve, keeping inflationary pressures off normal living costs. If NZ remains inflation free while the rest of the world suffers from it, we could see a lot of “hot money” heading into NZ, which could affect house and stock prices.

Hyperinflation? Hah!…. Money printer go brrrrrrrrrrrrrrrrrrrrrrr