Understanding economics. Part 3 – Economics to indoctrinate.

The Financial crash of 2008 and the climate crises is proof market theories of the economy and the ‘efficient’ allocation of scarce resources within a growth model is worse than rubbish it is actually seriously damaging our biosphere. But to build anew we need to understand how we got here or we could accidentally put the problems back in.

Many modern economists aren’t confident their subject accurately describes or understands the real world. They feel there is too great a focus on maths in economics which gives a false sense of predictability and confidence. This maths focus allows economics to be largely taught as a ‘science’. But a ‘science’ where there is no ethical or real practical ability to test a group, or create a control group to make experiments and validate through repetition.

Economics being thought of as a science arose from the popularity of science in the 18 century but more importantly it was co-opted into the moral political ideological binary from 1917 of communism bad and oppressive and capitalism good and free. And so into the cold war. Due to this absolute binary of thought economics subsequently has not been able to develop as a serious reflective subject. It is intellectually stunted.

The result was by pretending economics is a science conservatives did not have to question the role of the economy in the development of society. The economy just was in existence and lives in an eternal ‘present’ set of equations which are its natural order. You can’t question its foundational assumptions because that is not a data set that can be put into an equation or create a new equation to take account of some new data. It is all about formulas, measurements and aggregates, quantities, graphs.

The excessive data focus leads to a massive overstatement of the importance of private enterprise in the economy for generating wealth to the point that now almost all political parties treat the role of government as simply a facilitator of private enterprise to generate wealth. This has become a point of indoctrination that synchronises with the binary assumption about capitalism being ‘good’ so it must be ‘true’; then it can’t be right to question private enterprise wealth creation or you’re a communist.

Economic history was largely ignored as it was seen as irrelevant marxist cold war propaganda because it questioned the role and function of private enterprise. In fact it appears deliberately squeezed out from Economics by conservative departmental heads who instead linked in with the popular but completely useless commerce degrees. (Supposedly Bob Jones wouldn’t employ people with business degrees because they were boring and didn’t know anything. Urban legend?).

Economics has indoctrinated people with a simple story of wealth is good and these are the formulas and measures to gain it and preserve it. Don’t forget this market story stumbled badly in the 1930’s with communism booming and capitalism struggling. But when Keynes modified the role of the state, which then created the post WW2 boom, this allowed these market economic theories and assumptions to thrive in the background behind the state (protected in the binary of capitalism versus communism because the west wasn’t communist). So because people were making money they assumed it was because of capitalism and the economic theories that supported it. It allowed neo-liberalism in 1980 to come back and say the boom is basically because of us, but we could do the boom so much better if we got government off our backs.

Because of the climate crisis and the 2008 financial crash there is no longer any substance behind the neo-liberal theories of wealth creation. Wealth is simply not private enterprise economic growth; especially if the price is trashing the future biosphere and the growth only goes to a tiny group of people. So though Keynes gave massive insights to the west’s domestic economies and how to make wealth by creating an active social welfare state. His theories were not effectively applied in the international context of the developing world, and in the context of the political binary of communism versus capitalism, local people worldwide were exploited and neglected.

Therefore most people can now see this economic boom period was actually driven by authoritarian; rape, pillage, plundering of the natural environment and people, with the connivance of local elites in nation states who were militarily supported to hold authority. And all structurally supported and facilitated by our tax system and how our laws guide ownership of assets and economic activities.

It is these structures that need to change to put us back to a focus on the demand side of the economy. We need to change but National has no theory or policies on how to grow the economy except the ones that have lead us to the climate crisis. Their policy of farmers not going into the emissions trading scheme is working directly against dealing with the crisis. But emission trading doesn’t work anyway; farmers should be paying a (fart) tax. The mega expensive four lane highway from Whangarei to Tauranga and other pavements of poison is an old style of solution that has repeatedly failed all around the world.

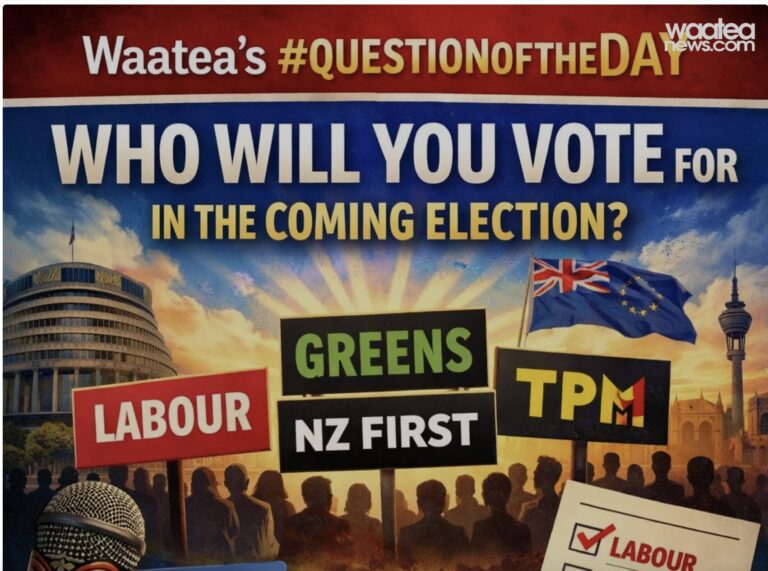

Labour and the Greens are aware of the climate crisis but neither have a vision for how our economy will work and function to deal with it. They seem trapped in using the existing failed market economic theories. I say this because they support private enterprise housing even though they don’t build affordable housing. And the market based emission trading scheme is not working to reduce greenhouse gas emissions.

We need to think if private enterprise fails or is good for the economy and how to control things like inflation. And ultimately what we have to do to control the economy in a truly sustainable manner.

P.s. I think there is some truth in following the advice of Martin Parker who worked in business schools overseas for 20 years and saw the stupidity and moral vacuum that they teach. He say’s, ‘I have come to believe that the best solution to these problems is to shut down business schools altogether’. ’ See his article in The Guardian ‘Why we should bulldoze the business school’.

To apply this to New Zealand. Our universities are very short of money so scrapping our useless business schools would save universities a lot of money – and people still want an education so they will do something else helpful like science or arts. The saved money could be applied to these helpful areas. And if business wants businesses graduates, then in the spirit of private enterprise they can user pay for them in full and set up their own indoctrination centres rather than getting government funding.

Yes we do need accountants, but with better tax laws, and laws that guide businesses structures, we won’t need any creative accountants and AI can take over what’s left. For economics it could be moved to the arts(?).

Thank you for this, Stephen. Really thought-provoking.

There are two things: (1) Oil – which made the economic miracle of seeming magic of endless and maniacal growth possible. Now we face a future in which most has been squandered and we are left with no comparable alternative (and most of the resulting wealth hoovered-up by the extremely rich and dangerously powerful).

(2) Something I first heard raised by Daniel Schmachtenberger – the nature of money itself and its part in the distorted mess we find ourselves in. Dunno if anyone is interested so I won’t try and summarise.

Again, thank you.

The trouble is that economics have always depended on their ‘ceteris paribus’ (keeping other things the same) to examine relationships in isolation. That is a reductionist approach that has taken the assumption that lowering the price of a good always results in more being purchased. (satiation does not exist) Then they combine many instances into an overall demand curve. Maths shows that this is invalid. The economy is a complex interaction of many agents. Isolating changes is not valid. The approach in the ‘Limits to Growth’ was rubbished and ignored by economists so they do not understand chaos and complex systems which tend to show new emergent properties that reductionism does not show. The failure of economists to see the GFC was because they ignored the nature of private debt and therefore could not see the whole picture. A case has been made to drop economics (classical, neo-liberal, and ‘Marxists’ etc) altogether and go to system dynamics and accounting. (Anti Economist League)