Time for the Political Left to look at Sovereign Credit to fund our infrastructure

Current government policies not suitable for long-term – Treasury outlook on fiscal future

The latest Treasury outlook on New Zealand’s fiscal future indicates current government polices are not suitable for the long-term and change is required.

Treasury’s 2025 Long-term Fiscal Statement, which looks 40 years out, has been warning for 20 years that population ageing will place increasing pressure on New Zealand’s long-term fiscal position.

The greatest mistake Labour did over Covid, was that they borrowed the money from private banking rather than do what Mickey Savage did, create Sovereign Credit!

In the 1930s–40s, the first Labour Government (Savage & Fraser) used the Reserve Bank to directly finance social housing, infrastructure, and employment schemes. This was sovereign credit creation — money issued into the economy for public purposes.

New Zealand used sovereign credit creation in the 1930s for housing and recovery. Since the late 20th century, reforms locked us into a bond-based system to satisfy global financial orthodoxy and inflation fears. The difference is simple: bonds create debt to outsiders, sovereign credit creates money internally.

Why borrow from private banks when we should be directly creating sovereign credit to build the vast infrastructure deficit and climate adaptation investment net we face.

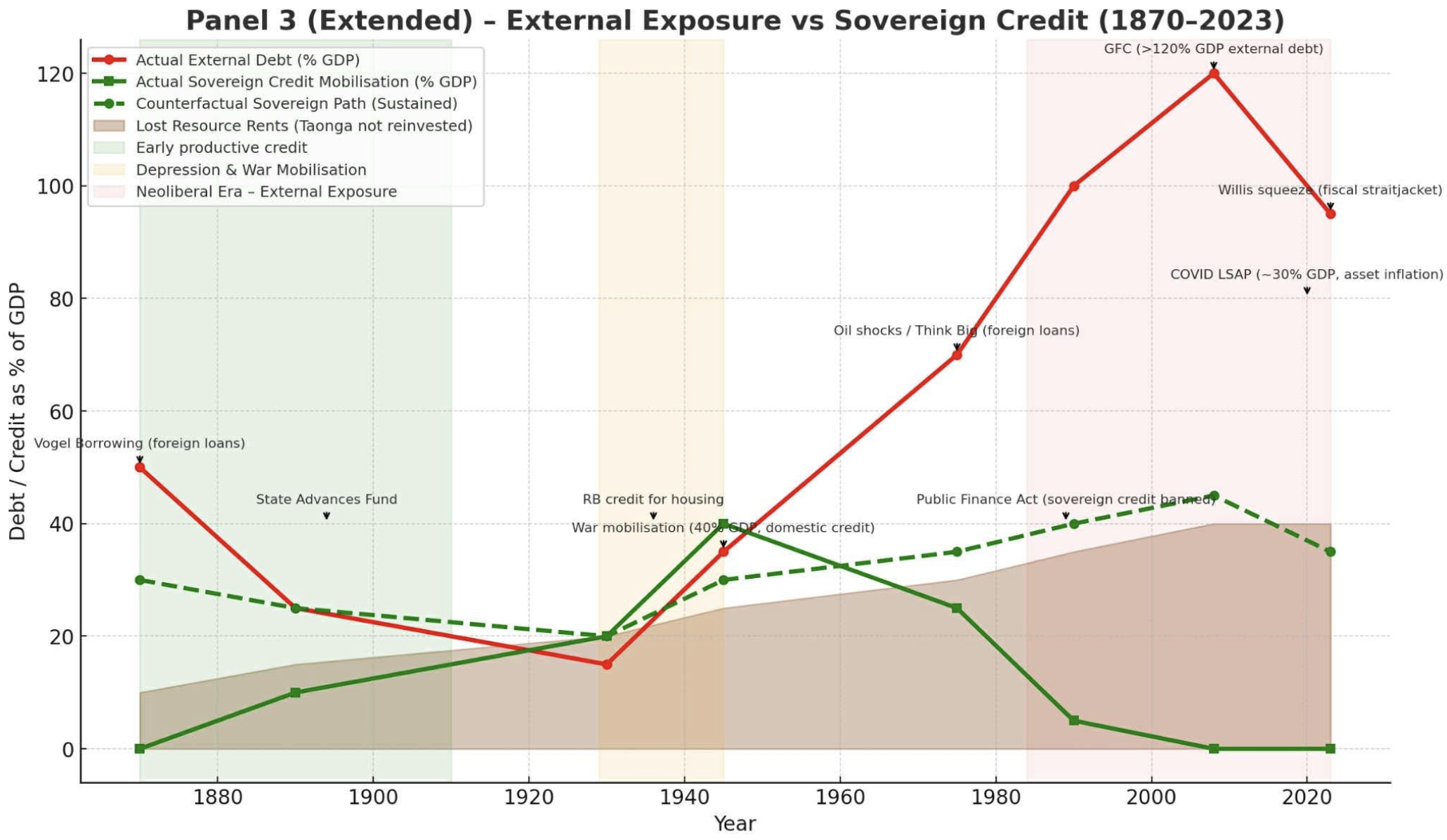

Consider the actual borrowed debt vs sovereign credit…

…so what would happen if NZ created sovereign credit now?

-

If the Reserve Bank or Treasury created credit for targeted, productive investment (say, green infrastructure, affordable housing, climate resilience):

-

The economy could benefit from extra capacity and jobs.

-

Inflationary pressure would be limited if the spending matched real productive needs.

-

International markets might notice but wouldn’t necessarily “punish” NZ — especially if debt-to-GDP stayed stable.

-

If NZ created sovereign credit now for targeted, productive investment, markets might grumble but wouldn’t punish us severely — especially if inflation stayed under control.

We could back this Sovereign Credit using ACC and KiwiSaver:

-

ACC Fund: ~$50 billion+ investment portfolio to meet future injury compensation liabilities.

-

KiwiSaver funds: ~$100 billion+ in private retirement savings, invested across shares, bonds, property, etc.

How backing sovereign credit with them could work:

-

Collateralisation model

-

The government issues new sovereign credit (say $10 billion for housing or climate infrastructure).

-

To reassure markets, it pledges that this credit is “backed” by the assets of ACC or KiwiSaver (effectively saying: if inflation gets out of hand, or repayment is needed, we can draw on these assets).

-

-

Investment direction model

-

Instead of using them as collateral, the government could require ACC or KiwiSaver funds to buy sovereign credit instruments (like 0% or low-interest bonds).

-

This would channel domestic savings into public projects instead of relying on offshore investors.

-

-

Hybrid public wealth fund model

-

NZ could merge sovereign credit issuance with a sovereign wealth approach — creating credit but investing it in productive, revenue-generating infrastructure, and having ACC/KiwiSaver co-invest.

-

That way, the projects themselves generate returns to repay the credit, limiting inflation risks.

-

None of what I am suggesting is new, Mickey Savage used it to build NZ and Postive Money has been making these points for a long time:

Positive Money NZ is the New Zealand branch of the international Positive Money movement (originally UK-based). Their core aim is to change who creates money in the economy.

At present:

-

About 97% of money in NZ is created by commercial banks when they issue loans (especially mortgages).

-

Only ~3% is physical cash issued by the Reserve Bank.

Positive Money argues this system:

-

Drives house price inflation (since most new money goes into property lending).

-

Makes the economy unstable (credit booms and busts).

-

Privatises the benefits of money creation (banks profit, not the public).

Labour, Greens and te Parti Maori need radical solutions to the many problems we have, investigating Sovereign Credit to build our infrastructure and climate adaptation is one of those radical solutions.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

The economy is crying out for sovereign credit to build electricity infrastructure and drive the price of electricity down to a very low price compared to the rest of the world. Energy price is the major determinant of a modern economies ability to create wealth.

Running deficits to create real assets housing roads schools infrastructure new industrial capacity increases government equity whereas a deficit spend for increased govt salaries and benefits is just debt.

“We could back this Sovereign Credit using ACC and KiwiSaver:”

Also the credit could be backed by increasing the royalties on Waihi and south island gold mines and taking possession of physical gold to ‘harden’ the currency.

Also the credit could be backed with bitcoin. The next time the Aluminium Smelter comes cap in hand for a low electricity price just allocate them half of the Manapouri power and route the rest into a government owned bitcoin mine.

Sovereign credit can be used not only for state housing and electricity but for whole industry start ups requiring $billion investments. Could the government put $2billion into partially govt owned pharmaceutical companies? Or use sovereign credit for R&D startups in the coming fusion electric industry?

How many billions in the Cullen fund .We could use all 3 of these investment funds and get stuff done .35000 houses were already to be built so they could be up and running next week for a starter .Then there are all the schools and hospitals that were ready to be built or upgraded so no doubt the planing and stuff has been done so they would be going soon .Then all of those poor young people would have jobs to go to everyday .If we kept the border intake to a minimum we would have low unemployment and higher tax take and less spending on benefits .

Bravo Bomber – a system that has long been ridiculed by those with a vested interest in perpetuating our reliance on the evil pernicious Capitalist model.

This financing paid New Zealand’s cost for the Second World War.

New Zealand did not borrow to pay for the war. The Labour government used Reserve banking and credit creation to pay for the war(wartime demand for wool, meat, timber and other exports helped too).

There were price controls on land, basic food and heavy state control of the economy that bankers, land speculators, stock traders, investors, financiers and other parasites hated but New Zealand finished the war debt free, with full employment and without the crippling inflation that many feared.

Britain did not and endured a long period of debt and slow recovery.

When covid struck I waited expectantly for Robertson to revive the method but the bankers won and we continue in debt.

RESTORE STATE SOCIALISM IN AOTEAROA! END CAPITALISM!

My mum voted Social Credit during the 70’s and 80’s. In 1981 they got 20% of the vote but under FPP only 2 MPs.

Ask Grant bloody Robertson why he didn’t use sovereign credit during Covid. He did receive advice on the advantage of doing so but the stupid little neoliberal incrementalist chose to make Australian banks rich instead.

Can’t see Chippy or his mates having the balls to fight the tentacles of the international banking system anyway

Grant Robertson basically did use the equivalent of sovereign wealth with the Reserve Bank quantitative easing. When the government paid tens of billions to businesses and their employees during covid, the Reserve Bank bought the debt the government was issuing. In short the government borrowed tens of billions (the deficit being way above usual limits) with the Reserve Bank being the automatic purchaser of the all the additional government debt.

But of course the consequence is that the government had a whole lot of new debt. The result being a huge increase in the government debt to GDP ratio.

Effectively, Martin is suggesting more of the same, with the money going mostly into infrastructure. But the consequence will be more government debt. The Treasury is already anxious about the increasing level of government debt, the interest of which now takes around 10% of tax revenue.

What matters, I think is how much money is circulating in the economy, and whether the amount circulating is sufficient to create inflationary pressures; so when the government borrows from the reserve bank, the bank can control the amount of circulation by either sitting on the debt and increasing the circulation, or decreasing the circulation by selling it.

Sounds great, but is this true,

“ Since the late 20th century, reforms locked us into a bond-based system to satisfy global financial orthodoxy and inflation fears.”

Or were we told this is what we will be doing with a threatening arm around our shoulder.

I suspect the mere mention of Sovereign Credit would result in a barrage of phone calls “are you with us or against us”.

But what was the role of John Alexander Lee in this financing of housing?

100% We’d still be a rich country if we’d done this all along!