The simple reason why NZ Wages are pathetic and cost of living so cruel

Why NZ’s average wage is well below other OECD countries

Kiwis wages are well below other countries in the OECD – but why?

According to data from the OECD, New Zealand’s average wage was $97,554.16 in 2023.

This was behind countries such as Switzerland, Belgium, Austria, Denmark, Canada, France and Australia which all had average wages above $99,216.53.

NZ Council of Trade Unions economist Craig Renney said the average wage in New Zealand was also below the OECD average of $97,780.85

The OECD calculates the average wage for each country by dividing the national-accounts-based total wage bill by the number of employees in the economy.

“Those wages also don’t account for the higher cost of living in NZ which makes that problem more challenging,” Renney said.

There are simple reasons why our wages are so weak and the cost of living so cruel.

1 – We allowed the Right to destroy the Unions and that has weakened our ability to fight for better wages.

2 – We create monopolies and duopolies through their political links to ensure they milk us as consumers and exacerbate the cost of living pain, as Prof Robert MacCulloch notes…

Political appointments as patronage

MacCulloch’s core accusation is that New Zealand operates on a system of “soft corruption.” This week, he has explained what this means: “there is a high level of soft corruption going on in the country, and I’ve learned about corruption in New Zealand. It usually is not money under the table like it is in most countries and suitcases of cash. Corruption in New Zealand takes the form of you scratch my back, I scratch yours.”

…this cronyism is exploited by the powerful in NZ…

MacCulloch’s allegations about the influence of big banks

Probably the blog post that got MacCulloch into the most trouble was his recent argument that Finance Minister Nicola Willis forced out Reserve Bank Governor Orr on behalf of the big banks – see: Incriminating evidence now points to Finance Minister Willis forcing out Governor Orr to take over the Reserve Bank of NZ on behalf of the Big Banks. In this, he alleged that Willis, acting on the advice of lobbyists and corporate lawyers, pushed for looser capital requirements at the behest of big banks and circumvented the Bank’s statutory independence.

…and we see this with the Free Market think tanks pimping for corporate interests…

MacCulloch highlights the oversized influence of The New Zealand Initiative

MacCulloch’s ire frequently targets the New Zealand Initiative, a think tank he repeatedly labels as the “National Party’s Adviser / Think Tank” and a lobbying group for corporate monopolies.

…the cost of living is exacerbated by corporate interests as they price gouge us!

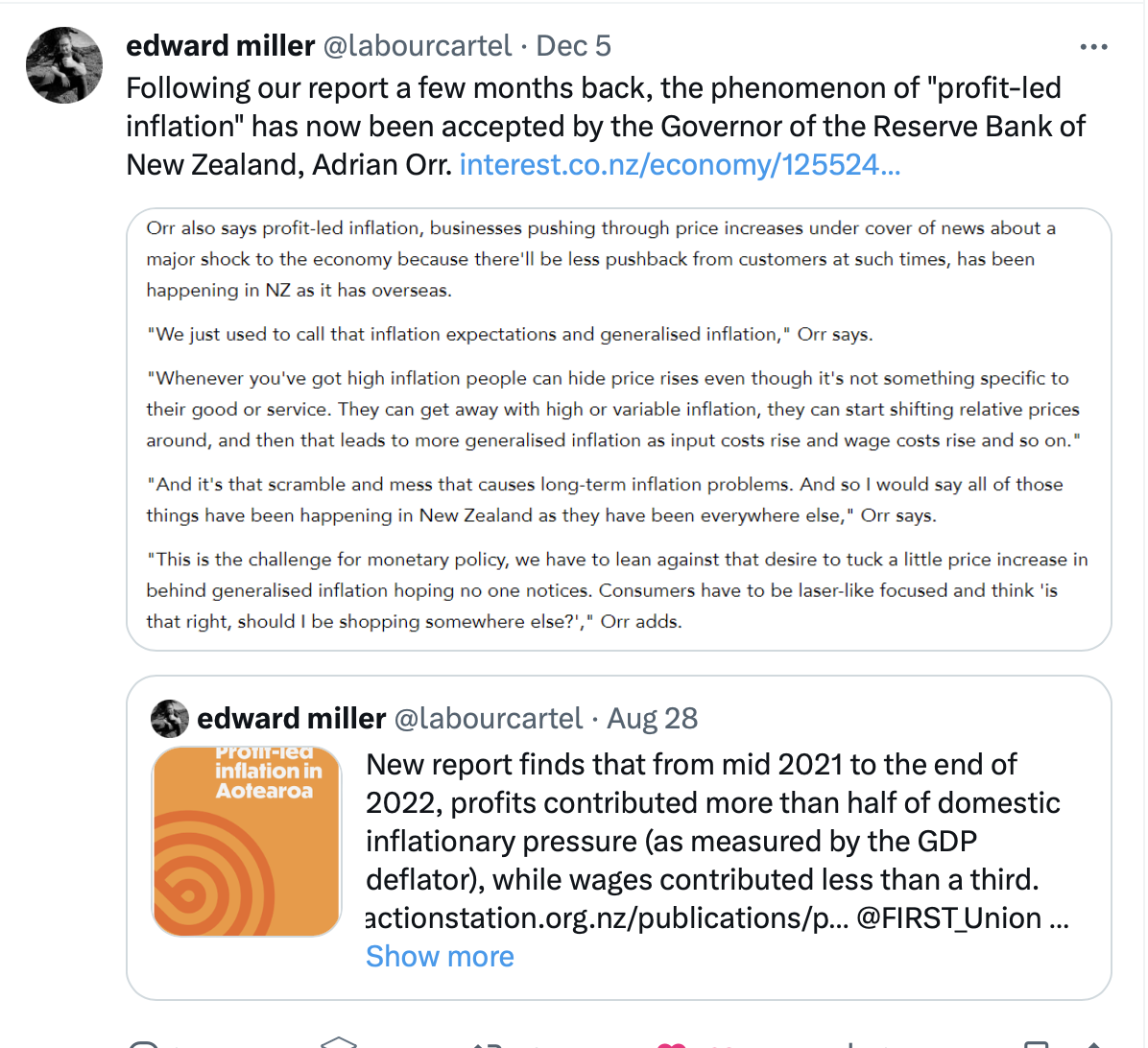

Too much of the inflation we are seeing is actually being driven by greedy corporate margins…

…Crikey over in Australia picks this argument up…

Profiteering is driving inflation, says former ACCC head. And here’s the hard evidence

Want evidence that inflation is caused by price-gouging corporations? Allan Fels has it in spades.

Profiteering has played a major role in inflation in Australia, Professor Allan Fels has argued in a report released today, in which the economist and former Australian Competition and Consumer Commission (ACCC) chair provides extensive evidence that Australian firms have exploited a lack of competition to push up prices over the past two years.

The report is the result of an inquiry commissioned by the Australian Council of Trade Unions and comes after an extended debate between progressive economists, the US Federal Reserve, the OECD, the IMF, the European Union and the European Central Bank (all of which have identified the significant role of profiteering in the post-pandemic inflation spike) and the Reserve Bank and conservative economists here (who insist profits have played no role in inflation and that it is the fault of wages growth and excess demand).

….it is the lack of proper regulation that allows these monopolies, duopolies and oligopolies to manipulate market dominance for their benefit.

New Zealand is already grossly under-regulated but look at the drive to dismantle what little we have for donors and Trans National Mining Interests…

Govt to free up foreign investment in ‘sensitive’ NZ land and assets

Ministerial scrutiny of whether overseas investments are in New Zealand’s national interest is to be significantly reduced in a move critics say risks eroding sovereignty but supporters believe will enrich New Zealand.

National and Act’s coalition agreement says the Government will amend the Overseas Investment Act 2005 to restrict ministerial decision-making to national security concerns only and make these decisions “much more timely”.

The act requires overseas investors to obtain consent from the Overseas Investment Office (OIO) before acquiring interests in significant business assets, sensitive land or fishing quota.

…and lo and behold, Dr Pork Shane Jones gained unprecedented fast track powers for many companies who donated to NZF!

The ATLAS Network is the international Hard Right Think Tank that have links to ACT, Taxpayers’ Union and The NZ Initiative. They are providing the blueprint for free market far right tactics attacking. the Left and are funded by the petroleum Industry. George Monbiot explains what ATLAS Network is…

A crash programme of massive cuts; demolishing public services; privatising public assets; centralising political power; sacking civil servants; sweeping away constraints on corporations and oligarchs; destroying regulations that protect workers, vulnerable people and the living world; supporting landlords against tenants; criminalising peaceful protest; restricting the right to strike. Anything ring a bell?

…demolishing public services, privatising public assets; centralising political power; sacking civil servants; sweeping away constraints on corporations and oligarchs; destroying regulations that protect workers, vulnerable people and the living world; supporting landlords against tenants; criminalising peaceful protest AND restricting the right to strike?

THIS IS ALL POLICY THE NEW HARD RIGHT RACIST CLIMATE DENYING GOVERNMENT HAVE ADOPTED!

The simple reason why NZ Wages are pathetic and cost of living so cruel is because that’s the injustice the system has been purposely built for.

We need to be far kinder to Individuals and far crueler to Corporations.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

Here is a piece from Gordon Campbell on Scoop which needs our thought and consideration. I think we absolutely need CGT and wealth tax looked on as a new expressway to better economic balance for all Kiwis. We are so keen on maintaining and improving roads and road transport, let’s apply that spirit to our actual human bodies and society, which are more important than the roads we carry on about.

https://www.scoop.co.nz/stories/HL2505/S00054/on-wealth-taxes-and-capital-flight.htm

On Wealth Taxes And Capital Flight Wednesday, 28 May 2025, 1:32 pm

Article: Gordon Campbell

A wealth tax is not on the cards. Yet in the run-up to next year’s election, even a CGT is going to be demonised as a plunge into radicalism. It is a sign of just how restrictive the politics of progressive taxation are in New Zealand, that a tax seen to be an utterly conventional tool in every other developed country in the world is still widely regarded here as being a surrender to the “tax and spend” forces of radical left wing extremism.

On the evidence, a wealth tax would be entirely justified on the grounds of fairness and equity. Only two years ago, IRD research showed that the income of the wealthiest New Zealanders is being taxed at less than half the average rate of ordinary wage and salary earners. Not surprisingly, the coalition government quickly shut down this IRD line of research.

If, in future, a meaningful attempt was ever made to correct that injustice by way of a wealth tax, one immediate concern is capital flight i.e. the tax will allegedly cause the wealthiest Kiwis to up stakes and move to tax havens elsewhere.

To some extent, that concern looks bizarrely misplaced. Right now, an estimated 191 New Zealanders are leaving this country every day, for what they regard as greener pastures elsewhere. This is happening without any meaningful response from the government presiding over this outflow of the best and the brightest, the hopeful and the desperate. Yet if a few billionaires left in high dudgeon after being asked to pay a little more tax for the general good? Perish the thought!

Moreover, how transferable would these riches actually be, given that much of the wealth in question is sunk in property empires or in neo-monopoly businesses firmly located here. Even more to the point, many of the possible socially desirable destinations operate a capital gains tax and have other revenue gathering taxes comparable to, or in excess of, what we have here. Not everyone – and their sack of gold – can get into Switzerland.

There was an interesting and insightful YT piece on NZ and its abysmal wages and working conditions, and its correspondingly high COL, put out about a week ago. It expanded on most of the points Martyn has covered and had additional ones. My comment there was Kiwis have got exactly what they voted for, and exactly what their failure to vote, resulted in. The voting tally at the last election said it all. 80% turnout, with the vast majority of non voters being disillusioned lefties. Before the political wheel turns, a certain amount of pain is required to teach the stupid the consequences of voting for the right and centre, and for failing to vote at all. Those consequences are being felt right now. But until they affect the remnants of the middle class, there will be no change. We on the left know that sheep are easily led and manipulated, and history shows us that until they suffer for their actions, they won’t change. Until the majority of Kiwis earning less than $180K pa realise that they are the poor, and vote accordingly, the current pain will continue unabated.

A big cause of grief is the floating, inflating, expanding yet constricting 15% GST on every bloody thing. And that may become literal if ‘they’ the PTB, start charging for blood after we are encouraged to sell it as a way of earning money by the desperate. It was done at the time of the ‘plague’ of HIV!

What is this productivity the right always talks about. Is is capital equipment efficiency?

Is it efficiency of land use/

Is is the efficiency of raw materials input?

Is it the efficiency of technology application?

Is it the efficiency of energy use?

Is it the efficiency of labour use?

Using the data available in my business, the efficieny of my labour use would calculate out as infinite!

Total NZ wages as percentage of GDP is 38%. Total Aus wages as percentage of GDP 64%.

Do NZ wages need a complete economy wide reset? Henry Ford reset wages in his factory so the workers could afford to buy the output.

At the end of the day it’s about productivity. We will not have higher wages without improving output as a ratio of inputs. There are a range of factors that contribute, poor education outcomes for a large portion of the work force, lack of business capital investment (in part driven by the tax incentives available) lack of government capital investment, monopolies have a role e.g supermarkets however the best approach to addressing this is encouraging competition. Higher regulation typically helps incumbent operators. The example of getting rid of Orr being in favour of the Banks is the wrong way around. The big Banks can deal with his increase regulation, bs11, high minimum capital reqs , aml etc all make it harder for new and small operators

Productivity can be measured in a number of ways. For example GDP per capital increased in NZ nearly 300% between 1995 and 2024 but wages? Nowhere near.

As you also point out, the monopolies in NZ (e.g. grocery sector) reduce productivity, yet are the target for large market players – even better a total monopoly such as Sky Television for sports television.

Another factor impacting your productivity in NZ must be a small domestic population that negatively impacts the market ‘forces’ of supply and demand by not being enough to result in economies of scale – our population is too small to activate these forces in any meaningful way.

Yet another modifier of productivity in NZ is the poorly designed fiscal policy of successive administrations over the last 50 years or more. A lack of CGT means there are perverse incentives to invest in housing over productive capital (which, of course, impacts on levels of business capital investment). The NZ housing stock was already massively overpriced before housing prices spiralled between 2015-2023 – this in combination with the regressive taxation system here make improving productivity virtually impossible.

So large companies – go to bigger populations don’t come here and try and pack us 1,000 to a box meant for 100. The result is too much friction and being rubbed up the wrong way causes outbreaks of fires.

While productivity is important how do you explain why almost all of any productivity gain ends up with owners instead of workers? You have faith in new and small operators in banking which seems misplaced when history shows that they are more likely to fail unless they have strong regulations to protect deposits etc.

When education is expensive the natural result is less of it or low level qualifications which is caused by the increasing share of wealth taken by those at the top of the chain so it is perverse that you try to use that as an excuse for low productivity.

For the last half century management has been dominated by a philosophy of milking the assets and investment was well down the list of company expenses as a quick profit was the priority. The low productivity is mostly caused by the owners of capital not having the ability to work smarter instead of harder so they have taken an increased share of a small pie then pat themselves on the back about how clever they are while ignoring the coming judgment on their greed.

There are decent employers who are highly productive paying decent wages so I am not condemning them and all circumstances need to be considered before rushing to judgment.

The Sure to have a Hole in it Mintaro comment! I haven’t read it yet so am jumping to a conclusion. Let’s see.

Dah,dah. the best approach to addressing this is encouraging competition. Higher regulation typically helps incumbent operators. SOS. Save us from the same old shit.