The inflation blame game conceals a capitalist crisis

Inflation is back worldwide and with it is the blame game. So what is the truth behind the claims and counter claims that are being made.

First a little background.

An impending worldwide recession in late 2019, foreshadowed by a freeze in the US repo markets, led to US Federal Reserve to embark on a major amount of money printing. Interest rates were pushed down to free up credit.

In early 2022, world production and trade were then disrupted further by economic closedowns that were imposed as public health measures to combat the health impacts of the Covid-19 Pandemic. Money printing by central banks across the globe and government budget deficits were massively expanded to cope. Interest rates were driven below zero in some cases. People were actually being paid to borrow money – imagine that.

The monopolies that dominate global production and trade also seized whatever opportunities of genuine or manipulated shortages that existed to impose price gouging wherever they could. The profits of energy companies for example simply exploded as a consequence.

Most central banks, including the Reserve Bank of New Zealand, ignored the growing inflation and sought to blame the temporary supply chain disruption for the price increases.

Rightwing economic and political voices schooled in the “monetarist schools” of thought which say inflation is always a monetary phenomenon, stayed silent. They sensed that their system had dodged the bullet of a broader economic collapse. The extraordinary explosion in the asset wealth of the ruling class globally that kicked in over late 2020 and through 2021, was also a factor in muting criticism, I’m sure, as well.

But the monetarists were in charge of economic and monetary policy in 2008 when the US Federal Reserve started the process of money printing, dubbed “Quantitative Easing” for the first time around to get out of the deepest crisis of world capitalism since the 1930s Great Depression. They had ignored their theories to save their system. It had seemed to work that time without triggering broader inflation than in their own assets so maybe it would work this time as well.

But today we have inflation averaging 9-10% over much of the globe. These are numbers not seen for decades. Turkey, Argentina and Sri Lanka have inflation rates of 60-80 percent.

There is now a risk that the continuation of current policies will unleash hyperinflation of the US dollar in particular, which will destroy its value and end its role as the dominant world currency. From the point of view of the 1% owners of the world’s wealth, that is something that must be prevented at all costs.

Hyperinflation was threatened once before in the late 1970s when US inflation hit 13% and there was a flight from the dollar into gold which doubled in value over a few months in late 1979. This required what was dubbed the “Volker Shock” in the name of the then US Federal Reserve Director Paul Volker who stopped monetary expansion and restored confidence in the dollar by pushing the Fed’s official cash rate up to 20%

Government spending on welfare and education was also targeted for cuts. “Austerity budgets” became the norm. Aiming for a budget surplus became economic orthodoxy across the major capitalist nations although this was only achieved temporarily in the US given the demands of its permanent wars of empire across the globe.

After the inflationary 1970s in New Zealand we had our own version of the Volker Shock under the new Labour Government elected in 1984 and the official cash rate reached an all-time high in 1985 of 18%. Variable mortgage rates hit 20%.

Of course capitalists who were in the business of lending money rather than producing goods were massively advantaged by high interest rates. There is no reason to open a business unless the profit rate is above the cost of money. That is the economic origin of financialisation and de-industrialisation in the advanced capitalist countries as literally General Electric became GE Capital.

The one percent don’t care how they make their money. But accumulated wealth needs to be stored in both financial and non-financial assets. Historically this was broadly a 50/50 share but a gap has opened in favour of financial assets since 2008.

The 1% hate inflation with a passion as it reduces their financial asset values by that percentage or more. Working people also get angry at price increases and may join protests and strikes to protect their living standards. And, in normal circumstances, central banks will move to raise interest rates and slow the economy to stop it. This will, at least temporarily, hurt profits and sharemarket prices as a result.

But in 2008 and 2020 central banks tried to keep the economy from contracting further than it already had (in 2008) or was expected to do (in 2020) by printing money through what is known as “Quantitative Easing”. In 2008 this did not lead to much inflation as the recession had already hit hard so the money was hoarded by the 1% or used to settle debts among themselves, rather than used to boost spending more broadly.

But the latest round of quantitative easing involved both central bank money printing and government budget deficits to save the system. The money was also given to ordinary people to spend. Inflation was inevitable. I warned of this fact in a 2019 article headed The coming economic crisis, “unorthodox” monetary policy, and Donald Trump.

It is the owners of wealth that determine central bank and government policies on these matters and the war on inflation will be declared absolutely essential for a nation’s economic survival.

For the rightwing politicians and their economic “thinkers” dubbed monetarist economists, the fault lies with too much government spending and too much central bank money printing and they are correct without fully understanding why. The question they need to be asked is why they stayed silent when it was happening.

In the 1970s the principal means of creating money and fuelling inflation was to run budget deficits. The US also needed to do this to finance the war in Vietnam. The economic orthodoxy at that time became known as Keynesianism after the UK economist John Maynard Keynes. Keynes was an upper-class, classical, pro-capitalist, free-market economist but accepted something must be wrong with the classical view when the economic depression that couldn’t happen under those theories did happen in the 1930s. He came to the view that the economy may need the assistance of lower interest rates from central banks or a budget deficit at times to stimulate demand and employment. Robert Muldoon in New Zealand, Prime Minister and Minister of Finance from 1975 to 1984 and US President Richard Nixon (1969-1974) were public supporters of Keynesian policies despite their right-wing politics. Keynes, also, was not a friend of workers. He thought the cure for inflation was to cut wages through wage controls.

However, in the period after World War Two budget deficits became endemic. The end result was dubbed “Stagflation” a combination of inflation and economic stagnation. This is the worst of both worlds for working people because wages are being cut by inflation while our ability to resist is being undermined by high unemployment. That is why socialists don’t favour Keynesian policies over monetarist polices. It’s the capitalist system and its inevitable crises that is the problem not the policies designed to manage the crises.

The Keynesians were removed from operational control and replaced by adherents of the Monetarist school. The principal theorists of monetarism were from the Chicago School of Economics lead by Milton Friedman. As well as allegedly wanting to control inflation they were also radical free-market dogmatists who favoured austerity for workers, free trade in goods, free movement for capital, free interest rates and the privatisation of everything, including education and health care. They also support eliminating the minimum wage and unions because these “interfere with the market”. The Act Party in New Zealand is an adherent of this school.

With monetarists in charge, budget deficit financing was sharply curtailed – especially on spending that assisted working people – like welfare, health and education. Infrastructure spending was starved.

Central Banks like New Zealand were made “independent’ with the exclusive goal of targeting inflation to keep it low. Money supply was to be controlled through interest rate increases each time the economy started growing a little and unemployment began falling. Conveniently for the right wing political leaders, their theories are also deeply anti-working class.

The Chicago Boys were invited to Chile to transform the economy in favour of the rich under the military dictatorship of General Augusto Pinochet after he seized power from a socialist-minded government in a coup in 1973. A Slate Magazine report from January 12, 2016, headed “The Boys Who Got to Remake the Economy explains the policies of the people put in charge of the economy:

Their program centered on reductions to fiscal spending to solve high inflation and economic difficulties. They opened the economy to foreign imports, privatized dozens of state companies, and removed most government controls on private economic activity. At the same time, as it was opening up the Chilean economy, the regime was clamping down on political opposition. In Pinochet’s nearly 20 years in power, thousands of people were killed or “disappeared.”

But while it came under heavy human rights criticism, Chile was the first country to apply Friedman’s economic principles, and, years later, the famous economist called this process, lead by his disciples, “the Miracle of Chile.” Friedman himself visited Chile and met with Pinochet in 1975, where he praised the economic measures taken by the Chicago Boys and Pinochet’s government. The connection with the dictator has been one of the most controversial aspects of Friedman’s legacy in the United States.

The UK followed Chile’s policies under Prime Minister Margaret Thatcher in 1979, the US under President Ronald Reagan in 1981 and New Zealand in 1984 led by a Labour Party government Finance Minister and future Act Party leader, Roger Douglas.

These policies were dubbed “neoliberalism” to mark them out from the previous Keynesianism. It was, of course, theoretically possible for a government to stop the budget deficits and fight their inflationary impact by taxing the rich or eliminating war budgets. No capitalist government from that time tried to do that, of course. Adherents of monetarism and its free-market dogmas were put in charge of every aspect of government policy. For example, that is why the economists at the New Zealand government agency responsible for the labour market policies – the Ministry of Business Innovation and Employment – predict every year that the proposed rise in the minimum wage will lead to more unemployment, when the opposite has happened year after year.

The monetary side of these policies were abandoned almost overnight when the 2008 crisis hit. This was considered necessary to stop a system-wide collapse of the banking and financial in the US and Europe in particular. All forms of debt debt exploded across the globe but this was seen as the price of the rescue of the private profit seeking system. But then the recovery of world capitalism following that was the slowest in the history of capitalism. It was becoming clear that the world was gearing up for a renewed slowdown in late 2019 and then the pandemic hit.

The capitalist rulers knew that they needed new doses to money printing and government spending to save their system. Capitalists only produce if the can sell goods for a profit. They only lend money if the feel they will get their money back with interest. Essentially the state in almost every country in the world has stepped in to protect those profits whenever they got threatened.

A central bank can create money by simply printing it electronically. What that gets used for, however, is something that can be different in different periods. In the US during the most recent crisis they used the money to buy up bonds from distressed banks and industrial corporates to prevent them going under.

In New Zealand $28 billion was given virtually free to the banks to lend directly to whoever they wanted. They gave most of it to property speculators who drove up prices by 30% in one year. Another $100 billion was made available to the government to use to prop up businesses during the pandemic.

This allows the government to run big budget deficits without horrendous interest rates being demanded by the private financial capitalists for the bonds they issue to finance the debt. This is “unorthodox” by any measure but considered necessary by everyone as the crisis hit.

The return to orthodoxy means the central bank must retire the bonds that it has created by buying them back and needs to push up interest rates to do so. But, in the absence of taxes on wealth, the budget deficits are also being targeted because they are also a way of creating spending artificially – a form of money creation but different from the central banks printing money directly.

This will inevitably induce a recession in New Zealand over the next year or so. This is true also for Europe and the US and therefore the whole globe. The cost of the rescue of the capitalist profit seeking system will now be unloaded on working people because the crisis that is coming has been made that much bigger and more dangerous by the escalating debt levels.

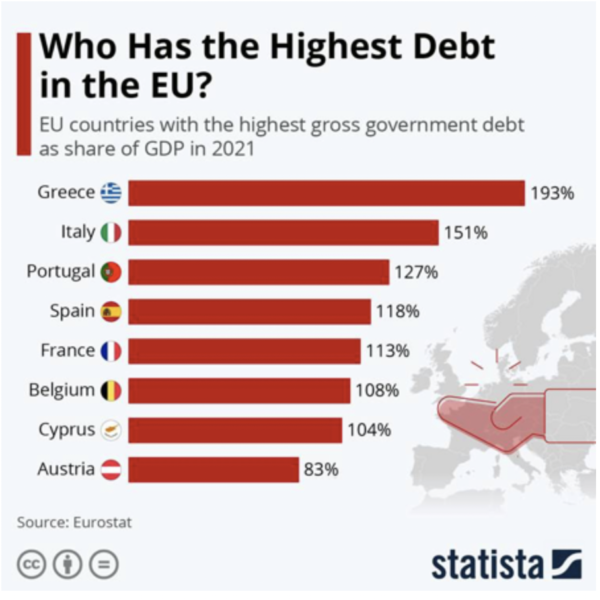

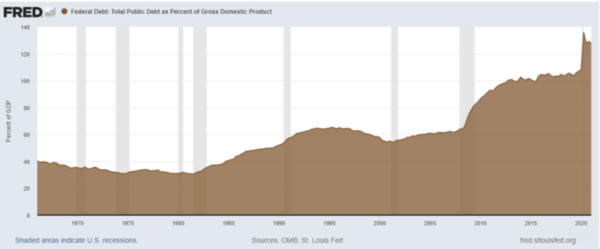

World capitalism got out of the 2008 and 2020 crisis with massive debt creation. As a result, US public debt exceeded 130% of GDP. In the EU, the average debt-to-GDP ratio was 88% at the end of 2021. Although the EU’s founding Maastricht Treaty provides for a maximum of 60%, many countries are well above the 100% of GDP level, as the table below shows.

The US public debt is the most important indicator of this process, because of the weight of the US economy. From about 60% of GDP before the 2007 crisis, it exceeded 130% after the 2020 recession.

On a global level, according to the International Monetary Fund,

“Global debt [public and private] rose by 28 percentage points, to 256 percent of GDP, in 2020 [i.e., in the course of one year] … The global public debt ratio jumped to a record 99 percent of global GDP.”

Global debt is now 256% of global GDP. At the end of World War Two after the massive borrowing to pay for the war in was around 100%. It remained around that level until the end of the 1970s. Besides acting as a break in terms of fiscal policy, this avalanche of debt, coupled with rising interest rates, will definitely push a number of economies towards default. This applies to some heavily indebted rich countries like Greece and Italy but will savage many poor countries.

The debt problem is not only affecting states but corporations also. Morgan Stanley calculates that 16% of US firms are “zombies” (highly indebted companies that are hanging by a thread). Bloomberg reports that zombie company debts total $900 billion. This is not a US phenomenon. Zombies account for more than 20% of Europe’s companies according to DW.

High-interest rates (meaning the end of the “cheap money” era) will make it much more difficult for these companies to re-finance their debts, and this can lead to defaults – which in turn means mass layoffs of workers.

In fact, they are being hit by a double whammy of war-induced shortages and price rises for basic food, fertiliser and other commodities. This will accentuate the downturn. The US currency is rising against most others in the world because there is a flight of capital to the safety of the world’s biggest and safest financial market. This means the poor countries’ debt which is usually in US dollars is getting more and more unpayable.

As Oxfam notes in a new analysis, during the pandemic’s second year (from March 2021 to March 2022), the IMF approved 23 loans to 22 countries in the Global South – all of which either encouraged or required austerity measures.

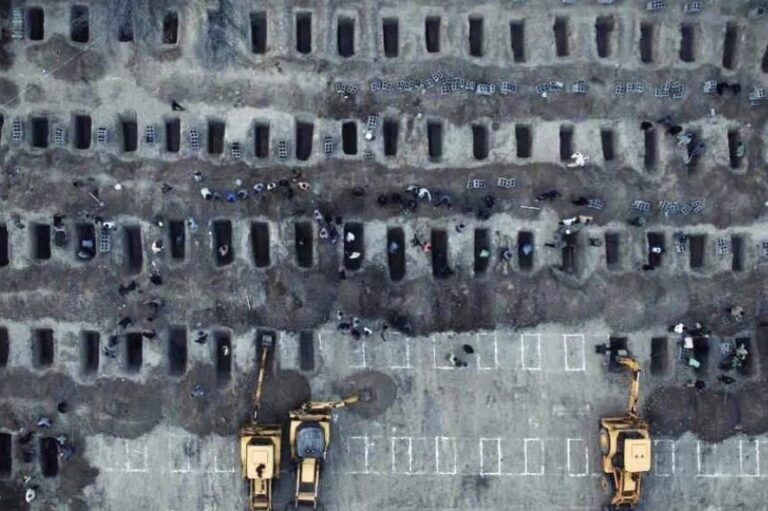

The International Monetary Fund has announced that the global economy is entering a major slowdown, downgrading the growth prospects of 143 countries. At the same time, inflation rates have reached historic levels. Around the world, hundreds of millions of people are falling into poverty, particularly in the Global South. Oxfam has sounded the alarm that we are ‘witnessing the most profound collapse of humanity into extreme poverty and suffering in memory’.

David Beasley, the director of the UN World Food Programme describes the situation in the following terms:

“Even before the Ukraine crisis, we were facing an unprecedented global food crisis … Then, we thought it couldn’t get any worse, but this war has been devastating.”

He added:

“…the number of people suffering from ‘chronic hunger’ had risen from 650 million to 810 million in the past five years… the number of people experiencing ‘shock hunger’ had increased from 80 million to 325 million over the same period. They are classified as living in crisis levels of food insecurity, a term he described as ‘marching towards starvation and you don’t know where your next meal is coming from’…

“… after the economic crash of 2007-09, riots and other unrest erupted in 48 countries around the world as commodity prices and inflation rose… The economic factors we have today are much worse than those we saw 15 years ago,”

If the crisis was not addressed, he said, it would result in:

“famine, destabilisation of nations and mass migration”.

And concluded:

“It is a very, very frightening time. We are facing hell on earth if we do not respond immediately.”

But the World Bank and IMF solutions for the crisis these nations face is more free market and privatisation policies. This is what is now being imposed on the bankrupt Sri Lanka as the price of a bail out from bankruptcy. It is the price the Zelenksy regime in Ukraine has agreed to pay for Nato support against Russia.

In this blog I haven’t addressed the climate crisis. This is now being compounded because the capitalist crises and imperialist wars are driving up the production of planet destroying energy sources. Capitalists have no alternative but to be capitalists and the planet is doomed if we continue business as usual.

We need a programme of solutions that transcend the world we live in. The only future is a future that puts people and the planet, not profits first. There is no other solution available to humanity but socialism where we can own and democratically control the major means of production and plan for a future that allows humanity to survive.

Thank you Mike for this clear explanation. What we don’t need, in my opinion, is another clique of ‘economists’ with a catchy byline, or another ‘rock star’ whizz kid from Stanford University or L.S.E. pocketing another generation’s wealth. ‘Economics’ is the equivalent of religion these days, or is it vice versa? I like the Vandana Shiva approach of listening to the earth whilst blocking out the spin doctors.

Very good – only thing missing is the cost of energy which is, at the end of the day, the only thing that matters. We are approaching or on the down side of the fossil fueled binge so it ain’t going to get any better and solutions will only become harder to swallow. Until someone can put sunlight into a tank and use it to power the economy it’s all downhill for a while.

Inflation is, and has always been, a monetary phenomena. The rampant budget deficits to pay for covid lockdowns created massive amounts of money out of thin air chasing fewer supplies (since a lot of supply chains were shut down). Inflation was literally the only possibly outcome of printing money for people to buy goods and services that were in limited supply for the same reason! This is not hard to figure out.

The issue now is putting the genie back in the bottle. Inflation is now in people’s psyche, so they assume things they don’t buy now will be more expensive tomorrow, encouraging them to spend into a diminishing supply. If interest rates are not hiked to match inflation and budget deficits are not balanced, people have no incentive to save which throws more money onto the inflation pyre. There really isn’t a “free lunch”, regardless of what pseudo-Keynesians and Krugmanites (like you’re likely yo find here) say.

Thank you Mike Treen.

Any solution must put people first, must maintain this principle even as personal feelings of threat trigger panic responses.

I’m glad you’ve joined the dots from 2008.

Thank you Mike Treen.

Any solution must put people first, must maintain this principle even as personal feelings of threat trigger panic responses.

I’m glad you’ve joined the dots from 2008.

Inflation can certainly be readily controlled by a serious government. But the biggest driver of inflation here at the moment is oil price increases. It was the government’s decision to let our refinery be shut down, and their decision to side with the American empire and pay more than we need to for overly expensive and environmentally destructive yankee shale oil instead of more rationally priced fuel from Iran or Venezuela or Russia.

High operating expense-leverage is anticipated to continue. We shall see if I am correct in 10 hours 30 minutes.

I seem to remember our own Ruth Richardson Limited also went with The Chicago Boys to wreak havoc in South America – was it Chile? The company website I accessed a few years back had a reference to her involvement in an advisory capacity from memory. Ew. Ghastly woman!