SPECIAL POLITICAL REPORT: The Daily Blog Economic Justice True Left Tax Proposal

Preamble: The danger of woke middle class identity politics replacing class left analysis is that the politics devolve into a micro aggression deplatforming campaign that alienates rather than builds solidarity against free market capitalism.

The true demarcation of power in a. democratic capitalist state is the 1% richest + their 9% enablers Vs the 90% rest of us.

Identity Politics simply cements into place a caste system of intersectionism alongside a terminal tribal affiliation to your skin colour, gender or identity.

There needs to be far more common ground and shared values.

We need to remove the yoke of taxation from the 90% and reset it to the 10% richest.

The minefield of social justice and it’s never ending pure temple deplatforming of everything that triggers it will only drive people further from the Left in an intense economic downturn because you can’t eat virtue signalling aesthetics.

- $608 million in housing equity was made by landlords

- 9.6% increase in rent for tenants

- 18.4% of children live in households earning less than half the median income after housing costs

- $5.5 billion in profit made by ANZ, BNZ, ASB and Westpac

and the Top 1% own 25% of wealth while the Bottom 50% owns 2% of wealth

If you think the worst inflation in 30 years is bad now, wait until the impact of the Ukrainian war and broken supply chains in China hit.

TDB is proud to present Rev Brian Turner who is spokesperson for EcuActio and his Left Wing Tax Proposal. TDB has been calling for the removal of GST on food, a Financial Transaction Tax and a wealth tax, we endorse a political debate focused on fighting capitalism and not cancelling people for crimes against woke middle class dogma.

This debate is how the Class Left rip the talking stick away from the Wellington Twitteratti and the alienating woke activists.

Broad Church over Pure Temple every day!

We need to be kinder to individuals and crueller to Corporations.

Martyn Bradbury:

Editor of TDB:

The Sherriff of Nottingham rules the roost – where is Robin Hood?

Guest blog by Rev Brian Turner

EcuAction is a small interfaith group based in Christchurch which has worked with a range of people, both inside and outside Church communities, to develop this proposal to reform our tax system. Rev Brian Turner is the spokesperson for EcuAction.

Problem:

Aotearoa New Zealand’s tax system is heavily weighted against those on low and middle incomes.

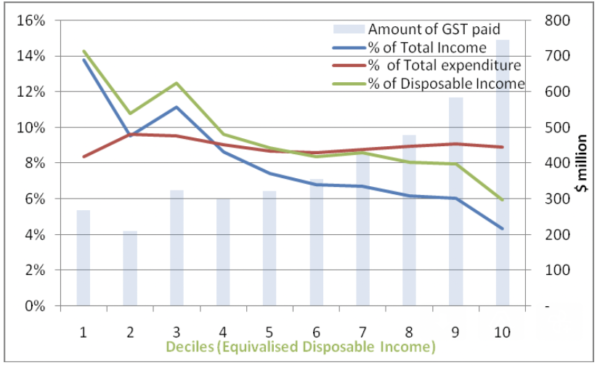

Wage and salary earners pay the highest rates of tax because they pay tax on every dollar they earn and every dollar they spend. And for those on the lowest incomes the tax rates are particularly savage. For example, the lowest 10% of income earners spend 14% of their income on GST while the top 10% spend less than 5% of their income on GST.

Figure 1: Amount of GST paid as a percentage of total income, total expenditure, and disposable income

We have a bizarre and immoral tax policy which says the more you increase your wealth, the lower the tax rates you pay. The Sherriff of Nottingham (rob from the poor to give to the rich!) would be proud of our country’s tax policies.

For example, in the 2014 tax year the HWI (High Wealth Individuals) unit of Inland Revenue found that 87 of the 212 New Zealanders with net wealth over $50 million were declaring incomes of less that $70,000 for income tax purposes. In other words, they are not even in the top income tax bracket!

This is unfair. It is wrong.

Wage and salary earners cannot avoid tax. It’s taken out of our pay before we get it and is deducted each time we buy something. But for the wealthy and super-wealthy, tax is almost voluntary as they find myriad ways to avoid or reduce their tax responsibilities.

The wealthiest 5% now own 37% of our wealth and their share is growing at the expense of the rest of us. Tax policy is a key reason for this growing inequality.

Aotearoa New Zealand cannot afford to carry those on high incomes. We can no longer allow a small number of people to become fabulously wealthy from not paying tax rates the rest of us cannot avoid. They are a liability to our tax system and to the health and wellbeing of the country. This must change.

We need a change to tax policy so everyone living in Aotearoa can live lives of dignity and self-respect. This tax solution takes us in that direction.

Solution:

Our solution is to remove GST, which has its biggest impact in low-income families, and replace it with three taxes which will impact those paying minimal amounts of tax at the moment.

| Option A – fairer for everyone

Bring in

|

Option B – the Sheriff of Nottingham option (make the rich richer and the poor poorer)

This is what Labour and National are doing now!

|

Our Option A will put more money in the pockets of low and middle-income earners and shift taxation to those not paying their fair share.

Summary of Option A

Removing GST would put $25 billion into the back pockets of New Zealanders. The income needed for the removal of GST would be made up by three taxes.

Financial Transactions tax (FTT) (raising at least $15bn per year)

A small percentage tax (0.1%) would be applied to all financial transactions through banks and financial institutions. For the average person this would amount to about $2 per week but would bring in around $15 billion for the government annually.

(More details in the Q and A below)

Wealth tax (raising approx. $10.9bn per year)

An annual tax on net wealth above $1 million

| Net Wealth | Marginal Wealth Tax rate pa |

| Up to $1m | 0% |

| $1m to $2m | 1% |

| $2m to $5m | 2% |

| $5 to $10m | 3% |

| Over $10m | 5% |

(More details in the Q and A below)

Capital Acquisitions Tax (approx. $2 billion per year)

This is tax on unearned income a person may receive from time to time – for example when receiving an inheritance. It would apply only to those receiving very large unearned incomes. We are proposing:

| Capital Acquired | Marginal CAT rate to apply |

| Up to $1 million | No tax |

| $1 to $5 million | 20% |

| $5 to $50 million | 40% |

| Over $50 million | 60% |

(More details in the Q and A below)

Questions and answers on Option A

GST (Goods and Services Tax)

What is GST?

GST is a tax we pay whenever we purchase goods (eg groceries) or use services (eg taxis) It was introduced by Labour in 1986 at 10% and was increased to 12.5% in 1989. In 2010 a National government increased it to its current rate of 15%.

How much tax does GST collect in Aotearoa each year?

Approximately $25 billion each year.

What’s wrong with GST?

GST is unfair. It is a regressive tax. People on low incomes pay a much higher proportion of their income on GST than people on higher incomes. This is because people on low incomes spend every dollar they earn but those on higher incomes are able to save some of their income so don’t pay GST on the saved money. Some countries, such as Australia, have exemptions for GST on such things as basic foods, medical and health care products. Aotearoa New Zealand has no exemptions.

The rich don’t pay much income tax but at least they will pay lots of GST on luxury things they buy?

Yes that’s true but it doesn’t change how unfair the tax is on low-income New Zealanders and the much lower percentages in tax paid by the wealthy and superwealthy.

FTT (Financial Transactions Tax)

What is an FTT (Financial Transactions Tax)?

It is a tiny percentage of tax on money transfers in or out of our banks and financial institutions. It would be collected by banks and financial institutions and passed on to the government.

What examples of FTT are there in the world today?

There are many examples of FTT in place around the world. The broad scope of FTTs are outlined here.

For example:

- Britain has an FTT (or Stamp Duty) on all shares traded

- The European Union has been discussing an FTT to apply to money moving between banks and financial institutions and trading in company shares and bonds and other financial transactions.

What kind of FTT is being proposed by EcuAction?

We are proposing a simple FTT of 0.1% to apply to all financial transactions. eg bills paid, shares traded and currency speculation would all be covered.

How much would I lose from my pay each week in an FTT?

A person earning $1000 a week would pay around $2.00 per week in FTT.

Why put a new tax on ordinary New Zealanders?

Because the FTT would replace GST. The person earning $1000 above would pay just $2 per week in FTT but would save around $100 per week by the removal of GST. They would have $98 more each week for themselves and their family.

So if the average person is paying only $2 per week in a FTT, how could that help collect the billions needed to replace GST?

Because the FTT would also target the hundreds of billions which pass through our banks every year from big business transactions and currency speculators. New Zealand has the 10th most traded currency in the world and accounts for 2% of the $3.2 trillion traded every day around the world. An FTT of 0.1% could bring in $64 million per day (approx. $20 billion per year) from currency trade alone. However, to avoid the tax, speculators would trade less in New Zealand dollars so the actual amount of tax collected from currency trade would be much lower.

Yes, but wouldn’t the banks and financial institutions just pass the cost onto their customers so households and things like Kiwisaver funds would pay the cost?

The banks may pass extra costs on to their customers but these will not be noticeable for most New Zealanders most of the time. However, the removal of GST will be a huge boost to ordinary New Zealanders and the real economy. It will provide a strong economic stimulus as people have much more money to spend each week.

Wouldn’t our financial services just move to Hong Kong?

No. There would be no benefit in doing so because dealing with financial services would still require money to move in and out of our banks and financial institutions. However, there will be many attempts by big business and the super-wealthy to avoid the tax and the government will need to close loopholes so the tax cannot be avoided. Ordinary New Zealanders can’t avoid income tax – it is taken out of our pay by employers every week – so big businesses and the wealthy should not be able to avoid their taxes either.

Could the FTT harm the economy?

No. The rate is set so low that an FTT would have a very small effect on economic activity. The only area where it would dampen economic activity is in currency speculation which would be good for the economy in helping stabilize our currency.

What about when I buy a house – the FTT would be huge – how could I afford it?

If you bought a house for $1 million you would pay about $1000 in FTT – far smaller than estate agent fees. Meanwhile every week you have more money in your pocket to pay the mortgage back quicker because you won’t be paying GST on anything you buy.

What about my Kiwisaver fund? It buys shares so it would be hit by an FTT and I would miss out.

Yes, your Kiwisaver Fund would pay an FTT when it buys and sells shares but this would be a minimal amount compared to the “management fees” you already pay your fund managers. In any case low and middle income earners will have significantly more money each week (remember there will be no GST) to put more into Kiwisaver!

If it is such a good idea why hasn’t the government done it yet?

Because big businesses and the wealthy who donate to political party election campaigns don’t want an FTT. They will raise lots of phony objections and scaremongering against an FTT.

What do economists think about it?

There are mixed opinions but most economists who are concerned about making the tax system fairer are supportive of an FTT. Nobel prize winning economist Joseph Stiglitz supports an FTT. Even some high-profile billionaires like Warren Buffet and Microsoft’s Bill Gates support an FTT because they recognize current taxation in most of the world is unfair.

Wouldn’t people just avoid the tax by using bitcoin or something similar?

No. Good government regulations could ensure the tax is unavoidable.

Will big businesses fight an FTT?

They will complain loudly against it. In 2016/2017 when the European Union were on the verge of introducing an FTT, with both France and Germany keen, big business lobbies went on the attack with scaremongering, lies and half-truths to undermine it. Here are some of the things they did:

- Swamped the public and politicians with many baseless assertions about the disastrous effects of a FTT. They did this in a short period of time. What counted was “quantity, not quality” of the arguments.

- Pretended that the interests of the finance industry were the national interests of each country

- Pretended the interests of governments to finance their debts are in conflict with FTT proposals

- Pretended that a FTT would harm small investors saving for their retirement

- Ignored all arguments of FTT supporters which showed the value to economic stability from an FTT

- Declared the financial sector was willing to carry its fair share of the costs of the global financial crisis so an FTT would not be needed – but of course they didn’t!

Business lobbies and the wealthy will do the same thing in New Zealand to try and undermine this proposal for an FTT.

How much would an FTT bring in each year?

A conservative estimate is $20 billion per year. An FTT of 0.1% could bring in $64 million per day (approx. $20 billion per year) from currency trade alone. However, the tax would reduce currency trading in New Zealand dollars so the actual amount collected from currency trade would be less.

Wealth tax

What is a wealth tax?

A wealth tax is a small annual tax on a person’s net wealth. Net wealth means the value of a person’s assets (company shares, property etc) minus their liabilities (mortgages, loans)

How much would people pay?

Only the very wealthy would pay a wealth tax. Our proposal starts with people having net wealth of over $1 million as follows:

| Band | Marginal Wealth Tax rate pa |

| Up to $1m | 0% |

| $1m to $2m | 1% |

| $2m to $5m | 2% |

| $5 to $10m | 3% |

| Over $10m | 5% |

Shouldn’t everyone pay a wealth tax rather than just the wealthiest?

No. Those with the greatest wealth have gained this through paying much smaller tax rates for many decades which is why they are now so wealthy. So a wealth tax would bring back some of the taxes lost in previous years.

What countries already have wealth tax?

| Current OECD Countries with a Net Wealth Tax | ||

| Country | Rate | Base |

| Colombia | 1 percent | Net wealth in excess of COP 5 billion (US $1.4 million). |

| France | Progressive from 0.5 percent to 1.5 percent | Net taxable wealth in real estate properties above €800,000 (US $968,000) |

| Norway | 0.7 percent at the municipality level and 0.15 percent at the national level | Fair market value of assets minus debt. Tax applies to value of wealth above NOK 1.5 million (US $180,000) for single/not married taxpayers and NOK 3 million (US $360,000) for married couples. |

| Spain | Progressive from 0.2 percent to 3.75 percent depending on the region | May differ depending on the region, but generally value of assets minus value of liabilities. Regions have autonomy in setting the exemption amount. Madrid provides a full exemption. |

| Switzerland | Varies depending on the Canton (local area where one lives) | Gross assets minus debts. |

| Source: PwC, “Worldwide Tax Summaries.” | ||

How much money would this tax bring in?

Around $10 billion per year as follows:

| Band | Total net wealth | Population | Marginal Wealth Tax rate pa | Total wealth tax from this band |

| Up to $1m | Most of us | 0% | 0% | |

| $1m to $2m | $262bn | 191,600 | 1% | $1.31bn (avg 0.5% of total) |

| $2m to $5m | $249bn | 84,300 | 2% | $3.74bn (avg 1.5% of total) |

| $5 to $10m | $158bn | 22,600 | 3% | $3.16bn (avg 2%of total) |

| Over $10m | $67bn | 4,900 | 5% | $2.68bn (avg 3% of total) |

| TOTAL | $10.9bn |

Capital Acquisitions Tax

What is a capital Acquisitions Tax?

It is a tax on unearned capital received as a gift or inheritance which is paid by the receiver. It would only be applied in cases of large wealth transfer.

How much would it be?

In cases of inheritance we are proposing to exempt the family home from this tax and the first $500,000 inherited by an individual. Beyond that tax would be levied on capital acquisition as follows:

| Capital Acquired | Marginal CAT rate to apply |

| Up to $1 million | No tax |

| $1 to $5 million | 20% |

| $5 to $50 million | 40% |

| Over $50 million | 60% |

Who would it be applied to?

The effect of the tax would apply to acquisitions from the wealthiest 5%.

Wouldn’t a person of great wealth simply break it up into smaller portions and give it as gifts before they die?

Some people who don’t want to pay a fair share of tax would want to try this but robust government regulations would ensure this tax was not able to be avoided. Wage and salary earners can’t avoid tax so the super-wealthy should not be able to avoid taxes either.

Why should this apply just to those with high wealth and not all of us?

In general people with high wealth have paid very small percentages of tax through their lives because their sources of income (such as capital gains on property or increased share values) have not been taxed like wages and salaries. This is a way wealth can be taxed for the benefit of the community.

What other countries have a Capital Acquisitions Tax?

New Zealand currently has no Capital Acquisitions Tax but many countries have a such a tax in one form or other. The following OECD countries tax capital acquisitions through inheritance as follows:

| Country | Top Rate |

| Japan | 55% |

| South Korea | 50% |

| France | 45% |

| United Kingdom | 40% |

| United States | 40% |

| Ecuador | 35% |

| Spain | 34% |

| Ireland | 33% |

| Belgium | 30% |

| Germany | 30% |

| Chile | 25% |

| Greece | 20% |

| Netherlands | 20% |

| Taiwan | 20% |

| Finland | 19% |

| Denmark | 15% |

| Iceland | 10% |

| Turkey | 10% |

| Vietnam | 10% |

| Brazil | 8% |

| Poland | 7% |

| Switzerland | 7% |

| Croatia | 5% |

| Italy | 4% |

Did we ever have a Capital Acquisitions Tax?

No. However, before they were abolished by National in 1992, we had Estate Duties and Gift Duties under which the family home and the first $450,000 from an estate was tax free with 40% of the remainder paid in tax.

How much revenue would this tax bring in?

Without more detailed information it’s difficult to assess the income from a Capital Acquisitions Tax. However, an estimate based on the total value of the estates for people dying each year can be made and the income from this tax would be approximately $2 billion per year.

(The wealthiest 5% have 37% of total household wealth and the tax would apply largely to this group. Approximately 1746 estates (5% of those dying each year) which would pass on capital acquisitions which would attract the bulk of this tax. The average wealth of this group is around $4 million so a total of around $6 billion inherited each year would be liable to the tax. This would bring in around $2 billion per year)

Creating/printing money is by far and away the most regressive tax in use at the moment.

It reduces working people’s wages in a compounded way. In the first year you loose the (average) 10-20%. The next year you loose it again plus the next 10-20% and so on. It’s been happening since the end of the 70s, accelerated after 2008 and is now totally out of control.

At the same time real assets compensate in value – transferring wealth from people who live off income to the wealthy (those who live off assets).

It also makes workers cheaper to employ so those assets become more efficient at generating wealth for the rich.

It’s also, to most people, totally opaque and unnoticed. It helps that the measurement is calculated by the people benefiting from the scam – the ruling classes.

Roger Douglas has a lot to answer for. The Labour Party are still living with it.

Our aging population is a media mantra.

The abolition of the “welfare state” was brutal and even more brutally reinforced by R. Richardson (The “mother of all budgets”) and J. Shipley.

We are all living with the utopian dreams of “free market bs”

The special pleading of the business sector is an irrelevancy within the context of global pandemics and climate change. How much CO2 is pumped into the atmosphere by tourist ships and planes?

Encouraging tourism encourages more CO2 emissions.

Interesting! Its all about having a negative feedback system. Wealth begets wealth as an example of positive feedback. Positive feedback leads to excess and collapse. A fair system would be a negative feedback system. Negative feedback leads to stability. Bears considering and comparing feedback attributes.

Good article

Out of idle curiosity, what is 1992’s $450,000 worth on today’s money?

$830,000 for groceries. $1,097,000 for wages $3,750,000 for houses. Reserve Bank Inflation Calculator.

Which is total crap.

I have seen everything (but for my pay) at least double since 2016. Add on an extra quarter century and it’s going to be much more than what the reserve bank (part of the system) claims it is.

With house prices the way they are, money is largely worthless.

Some people are thick, but lots aren’t. The non-thick aren’t going to give 100% effort in a rigged system. They’ll say “thanks for the bread” and that will be that.

The landed gentry will have some success in importing modern-day-slaves, but the global market for quality slaves is tight..

They think they’re going to be able to build a stadium here in Christchurch, we will see.

A Wealth Tax, especially at this time, would suspend investment and in fact may possibly even decrease it. This would mean that tenants would be at the mercy of the richest, and mostly meanest, landlords.

What I would like to see is an increase in cultures living here but a decrease in foreigners being able to invest here until they’ve lived here for a certain period of time. And be more flexible about the KiwiSaver regulations pertaining to home ownership. And be more generous with the government’s contribution to individual KiwiSaver accounts. That would open up and encourage investment opportunities amongst a whole new generation of New Zealanders. Now, don’t me wrong, I don’t have any issues with foreigners investing here but I do believe that they should at least have residency status and not be an overseas based company.

An FTT over GST will be loved by small businesses due to its hassle and compliance cost and hated by their accountants who will lose half their lunch.

I keep seeing the word fair written down.

Yet there is a proposal to take over half (60%) as a CAT for amounts over $50 million.

How is it fair to take more than half of anything from anyone?

One of the claims that a CAT is acceptable (have paid a small % of tax through their lives), sounds like a retroactive application of tax to me.

Have a look at what taxes others pay when they have $50 million, we used to have a much higher tax rate for the super rich.

Always new that an FTT was good but just how good is it when combined with a scrapped scrapped GST? Transformative!

Great proposal especially the CAT which as it only brings in $2billion can be let go in the horse trading with NZFirst.

As a further fix for housing – give government first rights to buy any residential property not the family home that comes up for sale.

Any house empty and not listed/rented for x months required to be sold.

Among the many problems of this tax system proposal is that it won’t have any level of bipartisan support. All effective tax systems have the support, at least to some extent, of both left and right.

An effective tax system has to be able to withstand changes of government. This proposal fails that test. As soon as there was a change of government, it would be almost entirely repealed.

Contrast that to the CGT, in Australia a relatively modest CGT first introduced by the Hawke government, has survived for multiple changes of government.

The fundamental problem of this proposed system is that it is a radical economic revolution in disguise, essentially a form of extreme socialism.

The reason I say that is the effect of farming, just to give an an example. Though the same would apply to virtually all businesses employing any more than 10 people. Virtually all farms are worth over $5 million, with many approaching $10 million. Such a farm owned by two people would still be $5 million per person A wealth tax of 3% on $5 million is $150,000. On top of income tax, this would strip out the entire profit. How on earth does farming and small to medium business survive such a tax system?

All the proposal are about swinging taxes on wealth, effectively this means the value of business assets. Destroy the asserts of a business and you destroy the business.

While you are correct about this proposal not being able to get bipartisan support (or any major party support?) your response also meets the definition of insanity which is to keep doing the same thing but expect a different result. As you mention farming is an obvious case where capital values are totally out of line with what the property can earn although this is also due to the majority of farmers only being average producers since they are farming for lifestyle & not high production. That means that an obvious implication of the proposed tax system could be that better-motivated owners lift production or that property values fall which would both be positive for renewing farm systems.

While those with wealth have gotten used to having governments that protect their financial position the inevitable consequence of that is having most of the population owning very little, there have been numerous examples over the years where people power has reset the balance of power in a country although I would not like to see that happen in NZ which is why sensible proposals to adjust the distribution of wealth need to be considered.

Do you really think it is reasonable that the typical family farm or typical small to medium size business (10 to 20 employees) has to be sold to pay an annual tax?

I would also suggest that farms prices are not really that far out of line. A $10 million dairy farm will be 300 hectares and have 600 or so cows. A couple of farm workers. Such a business will generate around $300,000 profit after all costs (excluding interest) including an imputed salary for the owner/farm manager. So about a 3% return on capital.

I can see the argument for wealth taxes on those who have great wealth (in my view mote than $50 million) but taxing small to medium businesses at a level that would destroy them seems crazy.

Of course I don’t actually need to concern myself about such a tax. It is simply not going to happen. No major political party is going to promote such a tax, at least not at a level that would obviously destroy small to medium businesses.

Sounds overly complicated: An annual Capital Value Levy on non-owner-occupied residential accommodation.