THANK BABY JESUS: Supporting the Greens finally pays off! Why their tax solution is a great start!

Oh sweet Jesus – THANK YOU!

ACT are already screaming ‘politics of envy’ – This isn’t ‘envy’ – it’s taxing rich pricks who have used their wealth to politically insulate their interests!

Finally the Greens deliver beyond their alienating middle class identity politics bullshit and manage to drag the issue from social justice to economic justice.

Sure, it’s taken 2 and a half fucking years, but they are finally here and it’s a great first step!

The true demarcation of power in a liberal progressive democracy is not some tribal affiliation to your genitalia, skin colour or identity, it is between the 1% richest plus their 9% enablers vs the 90% rest of us!

It’s neat that the Green Party have only taken 2 and a half years to finally get to that point as ACT race away on double digits thanks to the ongoing culture war political ammunition Green Party supporters keep giving David Seymour with their woke cancel culture dynamics.

Poor people are not sitting around the kitchen table canceling each other for misusing pronouns, they are trying to pay the fucking bills!

Here’s what they are suggesting:

- The Green Party will campaign on introducing a wealth tax of 2.5 per cent on assets over $2 million owned by individuals or $4m on assets owned by couples.

This is smarter setting the threshold higher for a wealth tax, as you are hitting the .7% richest.

- The tax plan also included a 1.5 per cent tax on trust assets, and an increase in the top rate of income tax from 39 per cent to 45 per cent paid on income over $180,000.

This needs to be set at $300 000 not $180 000. We bring in top specialists be it surgeons to engineers that start at $250 000, where as a $300 000 threshold will hit the Wellington Bureaucrat Class the hardest and fuck I want to see those pricks sizzle rather than just top smart people.

- The party hiked other income taxes too, although these are paired with income tax cuts at the lower end of the scale. People earning less than $125,000 would pay less tax, those who earn more than $125,000 would pay more.

Good

- The 33 per cent tax rate would be hiked to 35 per cent, although the threshold for paying that rate would be $75,000, rather than $70,000 as currently.

Should be $80 000, $75 000 is too low.

- The party would drop the 39 per cent threshold to income earned above $120,000, meaning far more income earners would begin paying it.

Should be higher at $130 000

- The tax changes also included tax cuts for people on more modest incomes. Income earned up to $10,000 would not be taxed at all, which would give most income earners a $1500 tax cut.

- The party will also hike the corporate tax rate from 28 per cent to 33 per cent, which is where the rate stood under the last Labour Government. New Zealand already has one of the highest taxes on corporate profits in the world – although it is still lower than Australia’s, which is currently 30 per cent.

Good.

Ok, great starts.

Here’s where it needs to step up if it is to be meaningful.

Nationals 3 biggest donors (Hart, Mowbray and Bolton) have a combined net worth of 15 billion!

The Bottom 50% of NZ has 23 billion.

The top 5% of NZers own roughly 50% of NZs wealth, while the bottom 50% of NZers own a miserable 5%!

IRD proved NZ Capitalism is rigged for the rich and Bernard Hickey calculates that if we had a basic capital gains tax in place over the last decade, we would have earned $200billion in tax revenue.

$200billion would have ensured our public infrastructure wouldn’t be in such an underfunded ruin right now!

Bread and Butter cost of living pressures are what the electorate want answers to, and that’s where the Left need to step up and push universal policy that lifts that cost from the people.

The Commerce Commission is clear that the Supermarket Duopoly should be broken up and the State should step in and provide that competition.

We need year long maternity leave.

We need a nationalised Early Education Sector that provides free childcare for children under 5.

We need free public transport.

We need free breakfast and lunches in schools.

We need free dental.

We need 50 000 new State Houses.

We need more hospitals, more schools and a Teachers aid in every class room.

We need climate change adaptation and a resilient rebuilt infrastructure.

We need all these things and we need to fund them by taxing the rich who the IRD clearly showed were rigging the system.

That requires political courage and there is none!

No one is willing to fight for tomorrow, they merely want to pacify the present!

We need to remove the tax yoke from workers and put it on the rich pricks who have rigged NZ Capitalism in their favour.

The Financial Transaction Tax is that solution and would raise so much revenue we could lower GST!

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals with over $50million each, why not start start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry to pay their fair share before making workers pay more tax!

The Green Party tax policy makes a slightly bigger pie but a Financial Transaction Tax on the other hand hurts the speculators hardest.

The Maori Party are talking about a Financial Transaction Tax this election, I look forward to their announcement on this.

If we want to rebuild our social infrastructure and physical infrastructure, we need more revenue and that revenue shouldn’t come from workers, it should come from the speculators!

There’s no point making workers pay more to rebuild our resilience, tax the rich!

-Sugar Tax ring fenced for dental and health budgets

-Inheritance Tax

-Financial Transactions Tax

-Legalize Cannabis to generate $1.1Billion per year in tax revenue and ring fence 150m for drug rehabilitation programmes.

The Reserve Bank Governor is clearly telling us to raise taxes to pay for the rebuild, if Chippy’s Bread and Butter politics is to mean anything, he has to tax the rich to pay for the rebuild.

What’s the point of Bread and Butter politics of no one can afford to buy Bread or Butter?

Capitalism is rigged, Democracy is supposed to have the moral authority to challenge that.

We need to be kinder to individuals and crueller to corporations.

The tax thresholds Greens want are too low and it doesn’t do enough to raise revenue from new taxes used against speculators to invest in the State upgrade capacity – it’s a first great step but doesn’t go nearly far enough.

I applaud the Greens for finally getting back to issues that matter, but it must go further.

The issue now is do they have the strategists who are smart enough to get this change through.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Yup, fuck National, ACT, TOP, Freedumb Fuckwitz +++ and Benjamin NyetenBrian Tamaki’s Tithing God Corporation FUCK THEM ALL!!

Good luck getting into the Kingdom of Heaven ( or Kingdom of Decency) with your FUCK-POOR-PEOPLE policies.

A close friend of mine on the North Shore told me of the life they left in SA, with 12ft walls topped with RW; teaching their 5&7 yr olds to ‘shoot blacks who came over the wall!’

We’re gonna need taller than 12 feet walls, and bigger guns for our 5&7 yr olds if we exacerbate the inequality in NZ/AO.

Today, I witnessed a shoplifter, try to rob a Farmers Store and the tellers told my wife to ‘stay out of it the Mall Security had it sorted’. Bullshit!. The Mall Security were inefectual, even worse than the càrdboard cut-out police the National Party had.

Fucking country is going to the dogs.

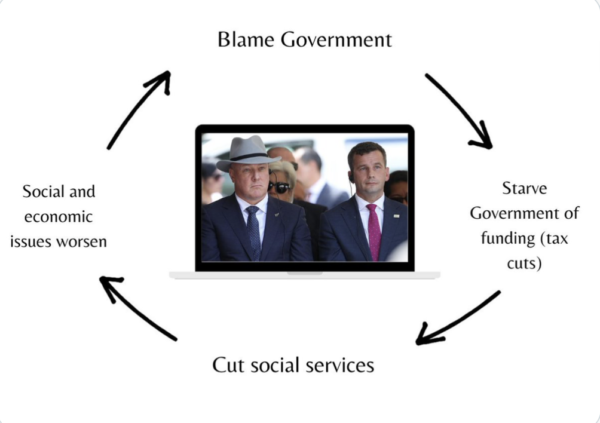

So, its great I saw Chris Luxon flanked by Judith Collins and Sam Uffindel!

Let’s Bully Croime, and Poverty into Submussion.

Let’s make NZGA!!

And National will build roads, give abysmal tax cuts and get down on bended knees to farmers, whilst the other 80% of the country will suffer, dum de do.

Really good blogging reads here to get an idea of what people think.

The main reason this is all hot air: Nearly ALL MPs have assets in trust, including the Greens.

Oh No! A Wealth Tax!

cue the Labour government run screaming for the exits.

https://www.rnz.co.nz/news/political/488777/no-cyclone-levy-capital-gains-or-wealth-tax-in-budget-pm-chris-hipkins

Sounds good whole new tax program should be sold as a Gst Tax Cut and removal of Gst on food.

“The party will also hike the corporate tax rate from 28 per cent to 33 per cent, which is where the rate stood under the last Labour Government. New Zealand already has one of the highest taxes on corporate profits in the world – although it is still lower than Australia’s, which is currently 30 per cent.”

Aaaaaaaaaaaaaaand no company will be domiciled here anymore. Golly good. Lets further incentivize all multinationals to move their Australasian headquarters to Sydney, and the high paying corporate jobs with it. Excellent idea Greens.

The Green Party proposal actually implements a number of the 2019 WEAG (Welfare Experts Advisory Group) Report recommendations that Labour was too timid to action. The raised Abatement rate and individualising (payments are made regardless of your personal relationships or household makeup). Get the state out of your bedroom!

The GMI is not as wide as a Basic Income but it is a good beginning and targets need. A Labour/Green/TPM Govt. has to happen on Oct.14, many of the greybeard/bal’head pundits are trying to ignore the coming new gen voter tsunami. If the filthy Natzos and Act can be kept from office at this years general elections then it will be the beginning of the end of Rogernomics and the neo liberal state.

For those whingers above…“oooh it’s not enough from the Greens…” get off your arses and become politically active rather than whimping around on blogs.

…………”get off your arses and become politically active rather than whimping around on blogs.”

I fear you’ll be waiting a while Tigger.

I suspect we’re just going to have to wait for it all to play out, just like “wokedom” (a now utterly meaningless, overplayed and bullshit mangled label) is going to have to burn itself out.

Agreed Tiger Mountain.

Where in the policy is any call for couples to be financially secure before they have children . Most of the poverty children were born into families that were poor and the added burden of a new child took them further down the poverty path.

As Luxon stated we do need more children and help should be given so parents can stay in the workforce if they want to and the child needs access to good medical and educational needs .This is what taxes are for not to support those that do not want to work and see children as a pathway to a life of no work.

With all these new taxes. The government won’t need the fuel tax.

But it’s not do much about the tax, it’s about how is it going to be Spent economically prudently. This is where I am afraid to say, the Greens coalition partner Labour has been terribly disappointing and can’t be trusted.

It’s irrelevant.

Firstly, because if they got elected, Labour wouldn’t implement it.

Secondly, because such a tax would persuade the wealthy to move their assets elsewhere, leaving us all poorer.

Agree

and lastly, Most MPs have trusts in some form, including the Greens themselves. This is really just performative art on the part of the Greens.

So, this is a blip in the 24hr news cycle, at which point that’s the last you’ll hear of it.

And National go all rural to gain the farmers vote…

So, this is a blip in the 24hr news cycle, at which point that’s the last you’ll hear of it.

The proposed guaranteed minimum income of $385 per week isn’t enough to live on, and that’s that.

No mention of how IWI will pay for their wealth taxes. IWI own (through their trusts) $9B + in assets. How will Maori react to these assets being taxed annually at 1.5 per cent tax on trust assets?

Worth a read;

https://www.nzherald.co.nz/business/the-9-billion-iwi-empire-maori-groups-assets-grow-despite-slowdown/QFRLAM7PJFJDKR2W2AY62U4EIM/

And how will the inheritance tax work as the IWI worth slides down through the generations? Different from Non Maori New Zealanders?

I just cant see Te Pati Maori onside with this.

They have stated they support the policy and also want an Ftt tax as have the Greens in the past two elections.

“How will Maori react to these assets being taxed annually at 1.5 per cent tax on trust assets?”

You haven’t read the policy, have you?

I wonder how the Maori would act if the Maori groups were taxed along with churches and other so called charities that are really businesses

My staff get paid because of my company profit enables them to have wages for the great work they do. If this came in I will assess if the business is worth the effort considering I am the owner and staff member who does the stupid hours.

I can stay at home and look after my disabled wife instead.

This is a response that accurately assesses the downsides of the policy but ignores the upsides.

Unless your business caters to the rich, this is a policy that will result in more of the thing that your business depends on. Not tax cuts: more customers with money in their pocket. Because a small number of people who are probably not your customers will pay more tax, but a large number of people who probably are your customers will pay less tax. Which means they will have more disposable income. Instead of packing it in, you should be positioning your business to cash in on this. Your staff do not get paid because of your company profit, your staff get paid because you have customers with money in their pocket who allow you to make a profit.

What would be better for your business, slightly lower tax rates, or significantly richer and more numerous customers?

Unfortunately most of my clients ironically are govt departments and we compete for contracts against larger corporates.

They expect lower govt pricing which already lowers profits.

You are right in all you say – but for me not much is applicable.

As a smaller operator of I lower prices again the large corporates just employ us on crap rates to install as they make their money on supply.

They don’t apply made in NZ or any local content provincially but prefer to ignore the freight cost of shipping all around the country.

Sorry you got me started.

RE, surely staff wages are a business ‘cost’ and get deducted before profit (and tax) are calculated?

NO – wages are paid from business profit. You cannot claim anything on them at all. They are not like a wholesale product you offset GST on by claiming. All employment contracts also require Kiwi Saver, Sick Days and Holiday Pay costs also coming from company profit.

I am not in hospitality for example – I have no idea how they cope as they will be hit harder then me.

Some people will just take drawings instead of PAYE and label them as labour costs until they get caught my IRD – scary – it’s happening now in the courts.

Thanks R+E, very interesting. Seems to me that is a huge problem and one that should become a political debate in election year with the whole tax system up for change. Wages are clearly a required, essential, and legitimate business expense, to treat it as some sort of discretionary ‘add-on’ to come out of profits makes no sense IMO. Good luck in navigating the minefield.

So without employees, without wages as profit, there is no profit, there is no business? So any business should be grateful to their employees right?

Good I’m pleased we cleaned that up.

Agreed – they make the work environment a richer place etc. But the fact s they are a cost from business profit. However, their job is due to customers/clients purchasing goods or services. There is no complaint about this – it’s a great standard system for hundreds of years.

Raising the business tax on profit eats into a business’s ability to maintain the staff requirements or business viability in the current times for many industries. Some will always do well – but w don’t want to lose many NZ industries etc to international corporates. Support local.

R+E, from https://www.business.govt.nz/tax-and-accounting/reducing-your-tax/claiming-expenses/

“Business expenses are: Day-to-day revenue expenses for running your business, eg advertising or wages.”

So, from that ‘wages’ are a deductible expense before tax is calculated. I’m not sure how you say “wages are paid from business profit” unless you consider all ‘income revenue’ to be profit.

R + E was guessing; you provide critical evidence from source.

Kind of simple – I need to make a profit to pay wages.

Where the hell else do wage values in a business come from – the tooth fairy.

R+E, NO- you need to have ‘income’ to pay wages; you make a ‘profit’, or ‘loss’, when you have paid your ‘expenses’; and it’s that ‘profit’ you pay tax on. ‘Income’ is not ‘profit’, never has been, and never will be.

I think you want to stick to a silly fundamental argument of terminology. If I buy 100 items and sell them for more I have a profit. Out of that profit I will pay my wages.

You don’t have ‘profit’ until you cover your expenses. I can only suggest you use the correct terminology if you want to be taken seriously.

So at the heart of this wages are an expense before profit. But if I don’t make a profit I have nothing to pay my renumeration. Hence why I need to make a surplus before renumeration is taken. A profit is needed to make money available for wages. However, I take the point that business income tax is less wages. Actually I thank you for continuing this thread to remind me pf this after looking at my EOY accounts. Actually it shows me that have not spent enough time looking at the EOY accounts by just trusting the Accountant instead of understanding what they are doing more.

That’s great RE. Respectful dialogue is the way forward for all of us. Cheers, PK.

We need a Commissioner for Children.

We need to be kinder to children and crueller to politicians who will not stand up for them.

We need to stop exploiting the innocence of children and their sexualisation at an age when most cannot even differentiate between specific body parts, and we need to stop forcing non science- based sex dogma upon them in schools.

We need to consider what the UNO proposes on this subject, and why.

We need to feed our children, not brainwash them.

We need to clothe our children, cuddle them, keep them warm, and do everything we can to keep them safe and healthy.

We do indeed

We need a Commissioner for Children.

Unfortunately it is too late for the Greens.

Their alienating middle class identity politics bullshit has made them unelectable.

Agree.Marama and the Green girls’ vilification of white New Zealanders to the bereaved shell-shocked Muslim community was unjustifiable, and a bad thing to do to folk already feeling under siege.

Meh, their tax bracket moves are mere shuffling. When you crunch the numbers you’re only saving about $1000 due to the first 10k. Doesn’t even compare to inflation since the last time brackets changed.

Better than the $104 a year Luxon tax cut!

Strike one up for the Greens, lets see how far (or not) this goes…

Looking at those tax bands, thresholds, & trigger points, isn’t it cheap to be “rich” in New Zealand.

The “rich” won’t remain as NZ tax residents if the Greens look anything like holding the Govt bridle after the election.

So Robbie are they going to run to another country with higher taxes? That’s the same bullshit Nicola Willis used this morning. She used Norway as an example! Relative to other oecd countries where do we sit on tax rates?

Just because you don’t have a visceral reaction to progressive taxation doesn’t mean that wealthier people won’t. They’ll still have family connections or ties to a particular town. High income earners still want protection. They’re not just moving to places with lower taxation they’ve got something valuable which usually means woman or a particular type of technology. Panama City has some of the lowest tax rates in the world but you don’t see hordes of wealthy people flooding across its border. Look the short of it is I think that if we buy fighter jets and battleships and 3d colour imaging medical censors and probes or whatever based on the recommendations of science and engineering then a lot of people won’t have any reason to leave infact people might start reverse migration but it’s a lot of checks and balances and a lot of truth talk.

Agreed Wheel!

Where are they gonna go lol

Aussie where the top tax rate is 49%?

USA where you’re paying state, federal taxes and there’s cgt and inheritance taxes?

UK which is still higher than NZ ?

Those countries still have plenty of rich people and the sky didn’t fall.

Look. I don’t want to get into it. Just can’t be bothered. But only public servants pay the Topntax rate like doctors and shit. Plumbers and everyone else use loopholes. That’s how you get rich you just steal it basically

I suspect they are embarrassed by what the Australian Greens are up to — threatening to sink the new A.L.P. housing legislation, and demanding new public housing spending of $2.5 Bn. per annum, 275,000 new public housing dwellings, and a two-year federal rent freeze.

The tax policy is hardly enough to get anybody excited. Where is the 47% income tax bracket? (Let alone the old 76.5% bracket, or F.D.R’s 79% bracket.) Where is the promise to dump the G.S.T., or at least cut it?

Yes they can’t even highlight a top tax rate that their voters would see as revenge and that would be a necessary negotiating starting position to actually get a significant change.

Fuck those stupid cunts at the standard beginning with Weka are making fucking it all up stupid greed and envy narratives. Martyn is correct these wealth taxes should be aimed at the productive capacity it should be directed at speculation and asset stripping. But all good. I think if Marama for one can hold back on the all cus men are evil narrative and sit down with some single mums and a nice cuppa for photo ops while talking about how nice her new microwave is going to be those fuckwitts at the standard will to focus on the fundamentals.

Sam Marama is out of her depth in everything she does. She may hate white cisgender men, but her appointment as inept Minister for family violence can be seen as part of the war against all women.

Look guys. When I say a “forcing error” I mean what is the answer to these questions. I may come up with a lot of hypothetical forcing questions and Marama may lash out at hypothetical evil but she can’t live in a system where all white men are evil. Let’s assume that all white men are evil. How will this new income garuantee protect all non-white men. It’s a classic reasoning error. She’s answering non questions by answering completely different questions not being asked. Something the standard Muppets do Infinitely. They’re important questions not being answered right? Lucky we have Bomber.