PROGRESS AND POVERTY

If all the earnest essays ever posted on The Daily Blog have anything in common it is that they express a yearning for something better And most, regardless of the writers’ politics or prejudices, promote ideas which, in their view, we would all be better off for embracing.

And that’s a good thing. But the question is; when has it ever not been so, and where has it all actually gotten us?

Of the countless social equity debates that have gone on since forever, few seem to have produced the goods. At best writers’ gets some dirty water off their chests and readers get to argue what’s potable.

And still we’re no closer to Nirvana. The one thing that would make the sea-change that’s needed, and on which we can all agree, still eludes us. For all our supposed sophistication, we remain locked into the boom-bust cycle that bedevils all Capitalist economies, with no end in sight.

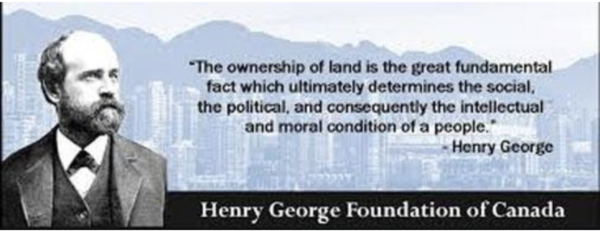

Ubiquitous to the Capitalist system, and at the core of the problem, is the inability of those who create society’s improved living standards, to afford the ever-increasing cost of the progress their endeavours produce. And critical to that conundrum is land.

Capitalism is a system that “capitalises” on improving living standards by producing more products to absorb the surplus, which, to work, requires more land on which to build the enterprises producing the new goods.

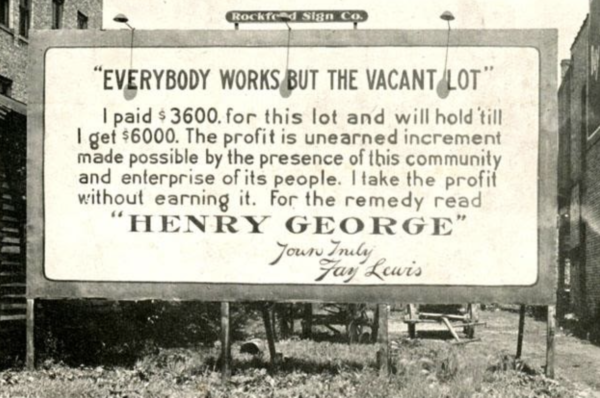

And inevitably this is where speculators, “banking” on the inevitability of that progress, buy up the land in advance of the progress, not only making a killing once it happens, but thereby pushing up the price of all land as a consequence.

Our system of Capitalism requires that those whose labours produce the progress, must then buy the bounty of their own sweat – the increased value of land – just to maintain Capitalism’s momentum.

And so we get the crazy house/land price situation we’re in right now.

Producing not one iota of productive enterprise, land-banking or land speculation, is not entrepreneurial Capitalism at work, but just venal opportunism.

Not only does it induce a gross waste of capital that could be used to fund job/wealth creation, it fuels a ballooning social equity imbalance, such as we‘re currently experiencing, which ultimately produces the boom/bust cycle that plagues us!

That’s not right – that’s not kind – that’s crazy!

The good news is the answer to the problem was solved 150 years ago. And, because speculators are not Capitalists, but “venal opportunists,” we don’t have to take “left” or “right” positions to embrace it.

This might be a good time to suggest that nobody is more acutely aware of the part land plays in the securing and maintenance of community prosperity, than Maori.

Maori had no concept of private ownership of land, which to them, since, you couldn’t physically take it home, made no sense and was just silly. In Maori society land was/is regarded as a communal good and its development, like establishing a pah site or a vegetable garden, was/is the responsibility of everyone, from which everyone profited.

And haven’t they paid a price for their naivety.

Colonial governments treated the purchase of land from Maori as a cash cow they could milk as they on-sold it to new immigrants, to fund yet more immigration. And so land values increased exponentially, and totally out of all proportion to the price paid for it.

The price paid Maori for land was never fair. The very act of its transfer from a communal system to a Capitalist system immediately changed its value out sight. And when finally the penny dropped, literally, Maori went to war.

And so should we now!

Just as Maori, in recognition of the material and social harm done to them, had huge areas of land returned, so we too should demand that the land which our endeavours have made flower, be returned to common ownership, or some equivalent.

And before you dismiss such an idea as Utopian navel gazing, it’s something we already do, but only in the public sector. We build roads and railways, for instance, on land we don’t have to buy because we already own it in common. But if the land was owned by speculators, the cost of those developments would be prohibitive – like the cost of houses today!

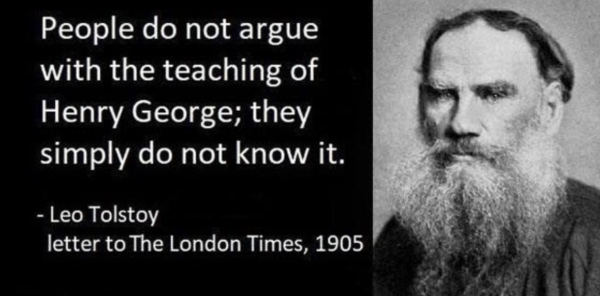

All of which brings me to American economist and social thinker Henry George, and the book he wrote on the subject, “Progress and Poverty” which at the time of its publication exceeded the sale of all other books but the bible.

Wikipedia describes “Progress and Poverty” as; “a treatise on the questions of why poverty accompanies economic and technological progress and why economies exhibit a tendency toward cyclical boom and bust.” in which; “George uses history and deductive logic to argue for a radical solution focusing on the capture of economic rent from natural resources and land titles.”

“Progress and Poverty” helped spark the Progressive Era and a worldwide social reform movement around an ideology now known as ‘Georgism‘. Danish-American social reformer Jacob Riis, for example, explicitly marks the beginning of the Progressive Era awakening as 1879 because it coincides with the date of Henry George’s book.[

Wikipedia records that Progress and Poverty had perhaps even a larger impact around the world, in places such as Denmark, the United Kingdom, Australia, and New Zealand, where George’s influence was enormous.[4] Contemporary sources and historians claim that in the United Kingdom, a vast majority of both socialist and classical liberal activists could trace their ideological development to Henry George.

And George’s popularity was more than a passing phase; even by 1906, a survey of British parliamentarians revealed that the American author’s writing was more popular than Walter Scott, John Stuart Mill, and William Shakespeare.[5] In 1933, John Dewey estimated that Progress and Poverty “had a wider distribution than almost all other books on political economy put together.”

And over the years the idea of taxing land, as a political policy, has attracted supporters from across the political spectrum, from Winston Churchill and Milton Friedman to Clarence Darrow.

Of course nothing as seemingly radical as Henry George’s ideas are ever as simple as might be imagined. But it is significant that in March 2015, the Obama administration discussed them in a Bloomberg op-ed titled “To Fight Inequality, Tax Land,” which was followed by a similar piece in The Economist titled’ “Why Henry George Had a Point” – the case for making landowners pay for the benefits which location gives them. And both articles sprang from a paper given by Joseph Stiglitz, the Nobel Prize–winning economist, arguing for a land-value tax.

There – I’m glad I’ve got that off my chest.

References: https://www.architectmagazine.com/practice/how-to-fight-wealth-inequality

https://www.bloomberg.com/opinion/articles/2015-03-03/to-fight-inequality-tax-land

https://henrygeorgekent.wordpress.com/

https://www.pbs.org/video/gilded-age-henry-george-fjukvo/

https://www.dallasfed.org/~/media/documents/research/ei/ei0502.pdf

The entire article, like quite a few posted on this site recently, hint at there being an inherent fault with the capitalist system. Fingers have been pointed at business people, landlords, politicians, and people have cited events such as high interest rates, high fuel prices, high food prices.

Until recently, we haven’t had high interest rates or high fuel prices. Is this not the effect of the global pandemic and this country’s effort to spurn a recession by providing financial relief to businesses to cover their losses, just like it was done in most other Western countries?

Until recently, greedy Banks were blamed for the low interest paid on savings. Well, the banks owned share portfolios which took very sharp dives back in 2020 because of the global pandemic. Sure, you can find a chart or two to prove record profits made by banks year after year, but that isn’t the case in reality.

Now the interest on savings has improved, people are complaining about inflation. Sure, in real terms, inflation is eating away at the interest paid to savers. But it could be so much worse.

I read Progress and Poverty many years ago. I’m not sure I agree with George’s views on Malthus – George lived in the USA, where, in the 19th century, land was plentiful – but I wholeheartedly agree with his view that the value derivable from the land itself belongs to the community.

Another book worth reading is Ricardo’s Law, by British economist Fred Harrison. It used to be available from the Wellington Public Library, but I don’t know whether it still is.

Land held in common, which is at the very core of the success of Singapore and Taiwan, would be an absolute game changer. And of course it’s implementation would involve some complexities, but they would be nothing compared this repetitive boom- bust cycle we’re locked into. I make co claim to be an authority on the subject, but merely someone who thinks there has to be a better way, and would urge readers to check out the links I supplied or do their own research.

I have long advocated implementing a land tax. Such a tax would have, I think, a far better chance of making an impact on the housing market.

How would you deal with Maori land? Would you tax it in the same way as land under general title? Would not that end in further alienation of Maori from their land, in particular those blocks of land which support a subsistence lifestyle?

I think we would only tax that part of Maori land that was being used for farming, business, or residential purposes. But whatever we did it should not affect the desirability of implementing a land tax.

No-one “owns” land in NZ. If you read your title deed, you will find that you are a “tenant of the Crown”. A little old lady in London owns the whole country 🙂

“No-one “owns” land in NZ. If you read your title deed, you will find that you are a “tenant of the Crown”. A little old lady in London owns the whole country”

I don’t think so. Our forebears bought the land from the Maoris and sold it on to settlers. Queen Victoria had nothing to o with it. The crown has sovereignty, but I think that means the crown is entitled to govern us.

So sad.

https://en.wikipedia.org/wiki/Moriori_genocide

No Gerrit, you have it all wrong. The surveys said that all the residents said they were happy to pay an extra “levy” (tax).

Of course, that is an outright lie. Along the lines of the usual AK Council surveys – do you want a 5% or 10% rates increase this year?

However, if I read it correctly, the author is advocating for this type of tax.

This whole land banking trope is getting old. How can someone, that 40 or 50 years ago paid pennies in the dollar for 40 hectares of land (zoned farming/lifestyle) in Flatbush, that no one wanted, as there were no services, and only a dirt road – be called a filthy capitalist pig, when the council rezones the land to residential, and the “value” of the land skyrockets overnight?

This thesis doesn’t stack up to me – there is so much land in NZ. The only reason it costs so much is that governments and councils of all political flavours keep preventing the expansion of towns and cities thereby creating an artificial scarcity to which the market prices accordingly.

Solutions to this? If you’re a big government guy like Martyn just compulsory purchase 100,000’s of hectares and carve it up for sections with the necessary infrastructure built in. Think Savage and all those state house suburbs (emphasis on suburbs)

If on the other hand you’re of the lunatic libertarian right, just remove all regulations and let people build whatever and wherever they want.

Both would see the price of land and therefore the cost of housing collapse.

“This thesis doesn’t stack up to me – there is so much land in NZ.”

It’s not the existence that matters, but rather where it’s located. As those real estate agents say: “Location, location, location.”

If you want to see how “progress” by a Labour government is not helping the poor. Look no further .

https://www.nzherald.co.nz/nz/aucklands-working-class-could-cop-1000-light-rail-tax-being-considered-by-government/ZPTQBA2YANQQLWA7TZ5BTZBXYY/

Labour satisfying the needs of their majority voters to ensure reelection. Certainly not the poor who will be forced to pay an extra “levy” (tax).

The idea isn’t to increase taxation, The idea is to decrease taxation on productive parts of the economy to (businesses and workers) and place the taxation burden on those that try and capture wealth from the productive economy via rent seeking behavior.

Whilst taxing land will raise more revenue, could commentators address the issue of taxation spending. We have professional career politicians whose number one priority is to be reelected.

To be reelected they will “distribute” the tax payers capital to those who will elected them. The poor vote is minimal so not a great volume of the taxpayers capital will flow their way.

The we get party political factions come into play. With 30% of the Labour caucus, 90% focused on ethno-nationalistic concepts, the tax payers capital will be funneled into that direction.

We don’t have a parliament that operates with altruistic concepts. The tax payers capital is spent where the votes are. Simply because of professional career politicians.

Labour with the state servants and increasing their numbers, resulting in even more “paralysis by analysis”. Labour is good at discussing, not doing. Spending money on grandiose ideas but not a single spade turns a sod of grass.

National with Farmers and big business. Working on the trickle down theory. So good at increasing the divide between rich and poor. National is trying to restart the Bill English social investment policy, but again not before enriching those with plenty.

So where will we get a socially responsible government from? One who will spent the tax payers capital wisely and efficiently?

That should be the question.

As for the popularity of investment in land? Simply a condition where all other forms of investment returns are so far below that of land, that a socially responsible investor (including the state with the Cullen Fund, Super Fund and Kiwisaver Fund) invest in land.

So sure go ahead and tax the land value. No problem. Lets see a list of what taxes will decrease and how the poor will benefit through social engineering.

Quick note on capitalism and its followers.

If you have a Kiwisaver account, expect the Super Fund to pay your superannuation in the future, have bank term deposits to try and maintain the value of your money, then you are a capitalist. For without growth in those funds, you are getting poorer by the day. Now that inflation is here, expect your inner capitalist to expect a semblance of growth in your funds.

But don’t expect the state to help you. They are navel gazing and looking at the next election with bribes to their voters. Bribes they have no inclination to keep.

Lets start the whole process of taxation reform by tackling the problem at source. The professional career politician and a moribund civil service so bloated it is paralysed due to pyramid building management structures and lack of accountability.

So 3×3 maximum service for a politician and moving the civil service away from the pyramid management structure (out of Wellington and into the regions).

“And when finally the penny dropped, literally, Maori went to war. ”

Nope.

A tiny fraction of Maori formed the Kingi movement, rebelled and paid the price.