Parasite Property Speculators vs Grant Robertson vs narrative manipulation

Grant Robertson, under immense pressure to explain how him giving billions to the corporate banks to lend out to speculators has priced property out of the reach for entire generations, has entered the debate acknowledging it’s a problem and made some soothing noises about doing something…

The Finance Minister on Tuesday gave a sneak peek of what to expect from the Government this year when it comes to the economy. A big part of his speech focused on the housing crisis – skyrocketing prices in the past year making it increasingly difficult for people to cobble together the massive deposits required to secure lending.

“There is a crisis when it comes to the housing situation right now in New Zealand,” Robertson said at a breakfast hosted by BNZ. “In a sign of how economic forecasts have swung wildly during COVID, mid-way through last year, economists were lock-step in predicting that house prices were going to fall 5 to 10 percent over the next year due to the COVID-19 downturn.

…the sad truth is that Government are too frightened to challenge the neoliberal hegemonic structure that has commodified housing because any move could spark an avalanche of problems they won’t want to own.

Any move that triggers inflation will start a cascade event, but if Labour wanted actual solutions, these 3 would do it.

1 – FLOOD MARKET WITH MASS STATE HOUSING REBUILD: End the scum landlord subsidy of housing allowances end putting money into the pockets of unscrupulous motel owners by rapidly building 50 000 new state homes. Scum Landlords can do as they please because the level of desperation amongst renters gives them total power. Flooding the market with 50 000 new state houses would rob scum landlords of that desperation.

2 – STATE HOUSE FOR LIFE: Allow beneficiaries to stay in their state home for life so that they can create stable communities and that their desperation is never transported back to Landlords.

3 – DEPOSIT RESTRICTIONS: First time home buys should be required to have 10% deposit, but the more properties you own, the higher the deposit. The reason the speculators can out buy any first time home owner is because they can use their multiple properties to leverage more debt. If you are a property speculator, you need to turn up with a 70% deposit to counter the leverage multiple properties allows them.

…the political fear however is inflation and who will get blamed for unleashing it.

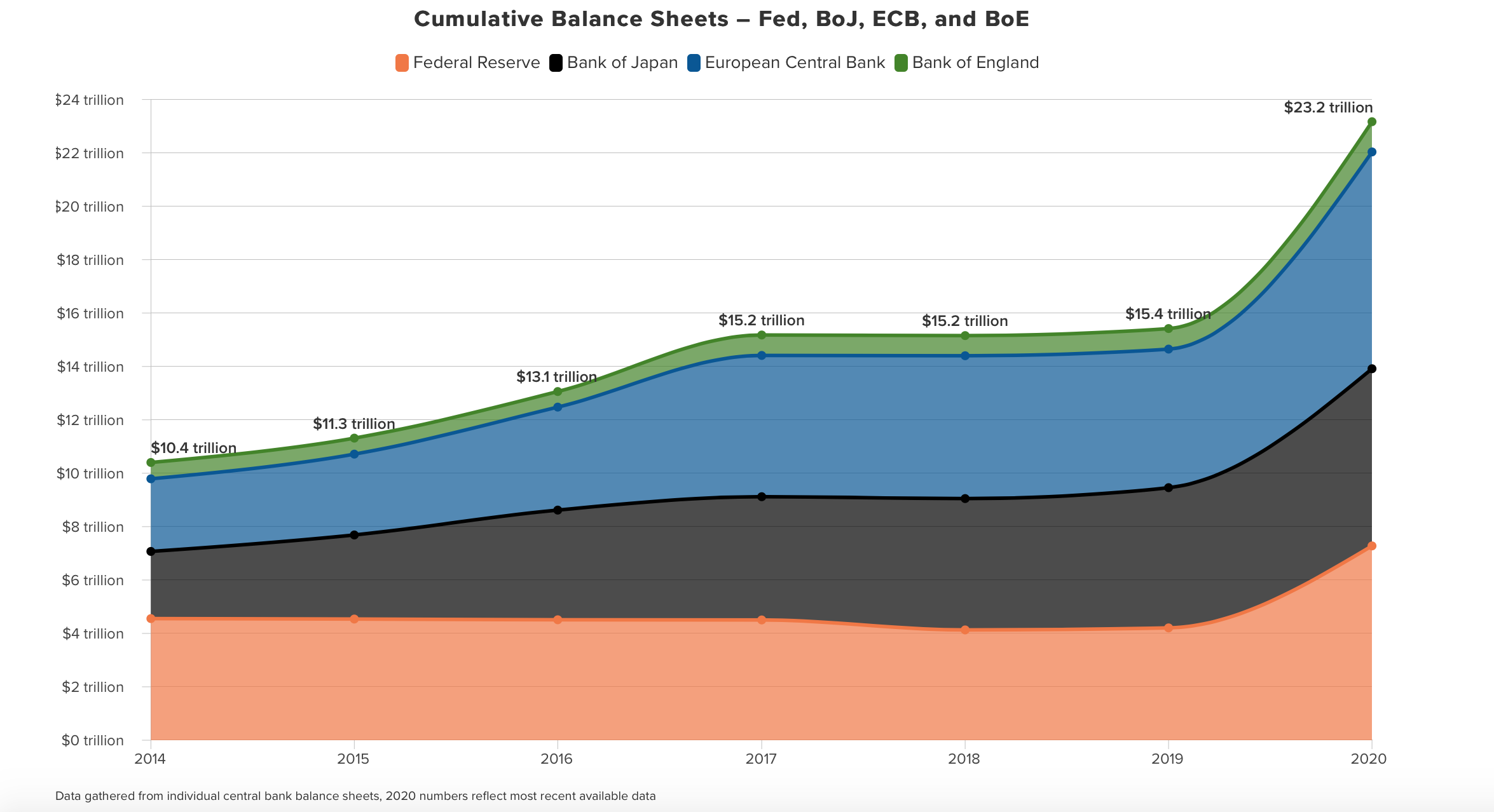

One of the great surprises in modern economics was that the avalanche of quantitative easing used to save the global economy from American Corporate bank greed in the 2008 financial meltdown didn’t create an explosion in hyper inflation in the day to day lives of ordinary people.

Because of the ease of global labour supply, wages didn’t increase, prices of goods stagnated, inflation disappeared but it did create the false conditions for the lowest interest rates in 5000 years, and saw all that quantitative easing balloon into speculative house and stock prices.

Covid has seen the main banks of the West sink trillions more into quantitive easing to deal with the economic whiplash the pandemic has created and in NZ we saw with the pumping of billions into the pockets of property speculators how our own house prices have skyrocketed.

This game of printing money to pump into property and stock market speculation to create a false illusion of wealth can continue playing as long as hyper inflation doesn’t overturn the apple cart.

But what happens if it does?

What happens if hyper inflation does suddenly explode out of nowhere?

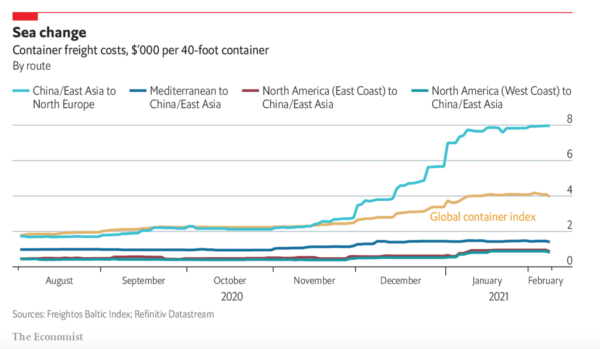

To date all the inflationary pressures caused by this mass printing has led to driving up property prices and stock markets without touching the essentials and basics of life, but one of the impacts of Covid has been to shut down the global supply chains which is now creating scarcity of products that can’t get to market because they are bottlenecked at a Port.

This seems insanely dangerous because all those hyper inflation pressures will immediately jump to the very basics everyone uses.

Your Kiwisaver going up and your property value climbing is one thing, paying $15 for a loaf of bread and $20 for milk is completely another.

Look at the pressures right now…

Container-shipping costs have surged in recent months

Rising consumer demand and constrained supply of containers is causing disruption on the seas

..

After every great pandemic throughout history, the peasant revolt in the 1300s, the London riots of the 1600s and the social unrest right after the Influenza pandemic of 1918, society always goes through intense social change brought on by the economic collapse lockdowns generate.

If the bottlenecks of supply chains are blocked unleashing a tsunami of hyper inflation on the goods everyone requires for life, Central Banks will have no choice but to lift inflation rates to desperately attempt to curtail that hyper inflation, which of course will mean the ocean of low interest debt that has been created to fuel hyper speculation will suddenly start feeling the true gravity of trillions in borrowing.

I’m no economist or financial guru, but it seems the basic laws of capitalism’s supply and demand will unleash a terrible tsunami of hyper inflation that the Global Reserve Banks will struggle to contain in any other way than to allow stock markets and house prices to shatter and crash by forcing interest rates back up.

Now if a vaccine can reach the 75% herd immunity threshold, those supply chains will reopen, but if we don’t gain that herd immunity because of new strains…

Germany’s Merkel Warns Coronavirus Variants Could ‘Destroy’ Gains Against Pandemic

German Chancellor Angela Merkel defended her government’s decision to extend a COVID-19 lockdown into March, as she issued a stark warning that new strains of the coronavirus “may destroy any success” already achieved in keeping the pandemic in check.

…quarantine will continue to force those supply chains closed and the prices of scarce ordinary goods will start to dangerously inflate.

All Grant can do is roll out a narrative that sells some type of movement on the issue of housing rather than anything that actually solves the issue because in solving it Grant could trigger inflationary pressures that rupture into hyperinflation when so many are in debt.

I fear all our Black Swans are coming home to roost in 2021.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media.

Wizzle wazzle wizzle… How many half arsed “points” do you think you can cram into one paragraph? Looking at this one, i think you’ve fallen about ten short of your objective.. Love the “insider” bullshit nicknames btw..

1 – FLOOD MARKET WITH MASS STATE HOUSING REBUILD: A fundamental first step. Better, make it 100,000, for lifetime income-related rent for all who want them, not only social welfare beneficiaries. The state (or local body proxies) should ideally be the premier and paragon landlord. Only when tenants can be rescued from private landlords and rehomed by the state will it be possible to abolish the accommodation supplement, which is in reality a social welfare benefit for landlords.

2 – STATE HOUSE FOR LIFE: See 1

3 – DEPOSIT RESTRICTIONS: I suspect much of the reason for a deposit is so the bank can be sure of getting its money back if the market crashes and the house-owner defaults. Perhaps more important for would-be owner-occupiers is a debt-to-income ratio, for both bank and borrower to be sure the ridiculously high mortgage can be paid in this mad market.

Property investors are another matter. I don’t think they should be allowed to borrow ANYTHING from banks to buy existing houses, but they should be able to borrow to build new homes and increase the national housing stock, for the good of all.

Row, row, row your boat

Gently down the stream

Merrily merrily, merrily, merrily

Life is but a dream

It’s a case of magical thinking. The housing issue will not go away, but the politicians keep singing their nursery rhythms. And whilst we don’t repeat history exactly, we do as a species have a tendency to make the same mistakes over and over and over.

Economically we are sitting on a time bombs – lots of them, housing is front and center, but we have issues around our ability to produce excess of what we need, in other words we can produce lots of goods, but have no money to pay for them. We are also sitting on the time boom of anger, anger for how far people have fallen since 2008, and the utter lack of hope. The last time bomb I’ll mention is the temperature, or our inability to predict what the rising temperature’s will do to our society, and for our very existence.

Hickory, dickory, dock

The mouse ran up the clock

The clock struck one

The mouse ran down

Hickory, dickory, dock

Tick tock, tick tock, tick tock

Dave how would democratic councils work for those like me with small businesses.

When the Covid 19 first hit one of the things I argued was that gov’t should not bailout business by handing out free money but select businesses worth saving for strategic reasons (infrastructure, food etc) to support by taking shares in these businesses.

Second, to stabilise what is otherwise an anarchic economy, the state should directly invest in massive public works to soak up unemployed and create value to meet an expanded money supply and avoid inflation.

But this would mean the govt has to have the determination to challenge the neoliberal mantras of ‘state out of business’ and ‘small state with balanced budget’ allowing the market to rip, shit and bust.

The class character of the state has to shift from capitalists to workers, the big majority, introducing workers democracy.

The way to promote this is to argue that the market never was the main driver of investment under capitalism. From the robber barons to the billionaires today their wealth is based on control of state patronage.

It was always the capitalist state colonising foreign lands, occupying and stealing the land, then paying for roads to ports and shipping and passing the cost of paying for these market ‘externalities’ onto future generations of the working class as the ‘public debt’.

To avoid the existing capitalist state selling off the nationalised sector back to private vulture capitalists yet again, we need the state to be run by the majority who produce the wealth, specifically wage workers and working farmers.

The producers would replace the bosses’ parliamentary circus with democratic councils or communes, and elect delegates mandated on pain of dismissal, to arrive at majority decisions about economic planning for need and not profit.

The word for this is socialisation. Putting those who produce the wealth in control of production.

Covid plus climate change plus global economic crisis can only be overcome by socialist revolution.

Raise interest rates to 5% and the entire housing crisis vanishes within a year. So does the all the speculative bubbles. It will wipe out billions from the rich, and destroy pension funds. Still, we need more Paul Volcker and less Ben Bernanke right now imo.

https://en.wikipedia.org/wiki/Paul_Volcker

https://en.wikipedia.org/wiki/Ben_Bernanke

But in the age of half-arsed Keynes/MMT, hard fiscal policy choices just aren’t going to happen since the super rich need to be protected.

That might be true, but raising interest rates higher other countries causes its own set of problems – like a soaring New Zealand dollar as overseas investors rush in to take advantage of higher bond yields. That would never do as it would put the business models of our precious milk powder exporters and our wonderful “export” education industry in jeopardy.

For the bulk of TDB readers (not me and Countryboy though!), destroying the income of “dem greedy farmers” will be seen as an added bonus. And think, big screen TV’s and Playstation 5’s will halve in price (as well as all the made in China trash at Briscoes, the Warehouse, Bunnings etc – i.,e. everything we “consoom”) – won’t exactly be seen as an overall negative.

Yes, all the chickens of neoliberalism (and phony economics in general) are coming home to roost.

Don’t imagine politicians will be particularly concerned if interest rates rise spectacularly or if a loaf of bread costs $15. We’ve been down that track before -under the fake Labour government of the 1980s. And the current government is just as fake and just as unconcerned about the suffering of the ‘peasants’ as that one was.

When the shit really hits the fan big time, expect all the usual lies and excuses: “No one could have seen this coming.” “We are victims of global forces beyond our control”…blah, blah, blah.

Quite interesting right now is the further increase in US 10YT to 1.28%. (Been watching this for a while).

‘The UST 10yr yield is sharply higher as the reflation trade gathers steam. It is now up +7 bps to 1.28% which means that from the start of the month it is up a cumulative +20 bps. Their 2-10 rate curve is sharply steeper at 160 bps, their 1-5 curve is also steeper at +48 bps, while their 3m-10 year curve is much steeper at +125 bps. The Australian Govt 10 year yield is up another +5 bps at 1.38%. The China Govt 10 year yield is unchanged at 3.26%, while the New Zealand Govt 10 year yield is up another +6 bps at 1.44%.’

https://www.interest.co.nz/news/109083/dairy-prices-rise-season-high-us-cold-snap-disporting-fuel-prices-us-extends-housing

#1,2,3 excellent, and even more excellent if the Govt. reconstituted the Ministry of Works including a modular/prefab housing division attached to Kainga Ora, to plonk homes and apartments from one end of the country to the other. Also state housing could be transferable for a period by agreement between tenants, say for education, work, or holiday purposes.

As much as grasping neo rentiers are to be despised, incrementally lowering house prices is probably the way to go rather than crashing the market before adequate numbers of state houses and apartments are actually built. But, a capital gains tax and high LVRs for more than 3 houses would affect speculators more than genuine buyers, so charge ahead I say!

Next trick is figuring out how to pressure the Labour Caucus to adopt #1,2,&3! I have noticed Labour loyalists I have known for decades are well pissed off with this once in a generation majority MMP Government’s timidity and unwillingness to shift from Rogernomics. Ex MP Sue Moroney has been a prominent critic. Time for LP members to stand up for the working class at LECs, and party forums. To help them along all the NGOs and supporters could start picketing appearances by Labour Ministers, occupying emptying buildings and homes, and visiting the new provincial Labour MPs. Emily Henderson, a family law specialist, now Whangārei MP, did target Rogernomics in her maiden speech–she needs support to encourage her to keep it up. The Caucus cannot sit on the electorate MPs like they do the list MPs. Martyn’s totally sensible plan will only be enacted with direct action from the NZ working class.

“The reason the speculators can out buy any first time home owner is because they can use their multiple properties to leverage more debt.”

There will probably never be a better time, than the present, to make interest rates non deductible for tax purposes.

At some stage the low interest rates will climb and that will have a dramatic effect on all those who have over extended themselves. This has happened before and the results were dire for many with builders going broke and homes and dreams lost .

Eric Watson is a NZ business icon who loves ripping everyone off.

Jenny Shipley helped other companies with loans from Mainzeal that led to it’s demise and many ordinary people out of pocket.

Mainzeal loan generated hundreds of millions in wealth, court hears

https://www.rnz.co.nz/news/business/375760/mainzeal-loan-generated-hundreds-of-millions-in-wealth-court-hears

NZ’s not really a place to invest (apart from property and even then with Mainzeal the developers seem to be able to run scams and leave others 110million out of pocket).

Until the NZ government and officials clean up all the rips offs in our company laws and actually start taking the NZ rip off culture active in NZ more seriously, nothing is going to change.

Who wants to invest in NZ in other areas when taking advantage of people through white collar crime, visa scams that undermine honest businesses and money laundering is becoming the norm. No wonder gang crime is increasing 13% per year. If you can’t beat them, join them.

Hard to run or start an honest business in NZ with the amount of competition from new and established crooks who get away with constant scams and expect to do so.

The junior versions…

From hype to gripe: Unfiltered collapse sparks shareholder anger

https://www.nzherald.co.nz/business/from-hype-to-gripe-unfiltered-collapse-sparks-shareholder-anger/JSXIZ2I2YV24S4XIXMVMAX7UPE/

Crimson Consulting: The court file they fought for a year to keep hidden

https://www.nzherald.co.nz/nz/crimson-consulting-the-court-file-they-fought-for-a-year-to-keep-hidden/73S2FXAUS5QCPWZJUQHNGUW2LY/

Allegations against Jamie Beaton’s $220m start-up Crimson Consulting to stay secret, court rules

https://www.nzherald.co.nz/business/allegations-against-jamie-beatons-220m-start-up-crimson-consulting-to-stay-secret-court-rules/CEBX5N5HHQEXMU6GSGIRRGL4NE/

Many of Jamie Beaton’s shareholders are multimillionaires like John Key, Keep the rich getting richer off the labour of others.

Rip offs all sealed in secrecy so more victims can be added into the mix and the perpetrators can keep preying on others!