Of course our GST is unfair!

I love Kiwis, we are so ‘special’ we can’t see shit in our own country until someone else points it out from overseas…

United Nations report questions fairness of New Zealand’s GST

A statement from a United Nations committee calling for countries to check tax is being applied proportionally to the wealthiest individuals, and questioning the fairness of GST, should prompt scrutiny of New Zealand’s tax settings, commentators say.

…it should prompt scrutiny but Kiwis aren’t really very good at prompt scrutiny.

Of course our tax system is rigged against the people!

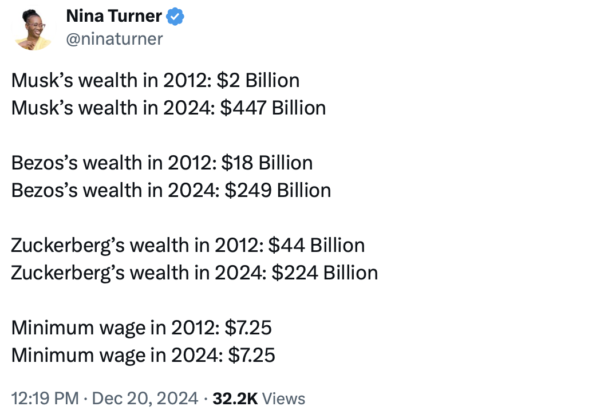

The truth is the Billionaire class and the mega wealthy are killing us…

…in the words of Professor Wayne Hope from his new incredible book, The Anthropocene, Global Capitalism and Global Futures…

The corporate ambit of emissions culpability also includes transnational finance capital. In October 2019, journalist Patrick Greenfield drew from the think tank Influence Map and business data specialists Proxy Insight to examine the investment holdings of BlackRock, Vanguard and State Street. Their combined portfolios presided over US$286.7 billion of oil, coal and gas company shares administered through 1 712 funds. These figures excluded direst and non-listed fund holdings. Such investments were, and are, used to manage major funds involving pensions, university endowments and insurance companies. These figures reiterate the general principle of corporate culpability for carbon emissions and point to the contribution of global finance. Further to this matter, Bank of England Governor Mark Carney surmised that multi trillion-dollar world capital markets were financing projects and activities likely to raise average global temperatures 4% more than pre-industrialised levels.

As global networks of fossil fuel extraction, refining, industrial use and related financial investment produce carbon emissions, wealthy elites dominate carbon consumption. Explaining the process first requires a short excuses on wealth distribution, luxury consumer culture and class. Clearly, global wealth growth benefits super-rich individuals from the TCC. The richest 1% of the world’s population took 38% of all additional wealth between 1995 and 2021. Just 2% went to the bottom 50% of humankind. For the same period, billionaires’ share of total global wealth grew from 1 to 3%. Tim Di Muzio, writing in 2015, depicted such differentials as a global plutonomy whereby economic growth powered and consumed mostly by the wealthy few, excluded the vast majority. With huge money surplus to spend on precious metals, property portfolios, home residences, retreats, first-class travel, cars, yachts, jets, exclusive cultural pursuits and leisure activities, the rich and super rich demarcate social prestige among themselves. Individuals, families and groups strive to symbolically out-consume their class peers, while the upper-middle classes aspire to emulate their superiors. The entire set-up, led by the dominant owners of capital, is ecologically unsustainable.

Although modest and poorer households also generate greenhouse gases through everyday activities such as shopping, commuting, food preparation and basic leisure activities, high-end discretionary consumption is more carbon intensive. Thus, economy class plane trips compared to first-class passages account for much less carbon dioxide per person. Luxury automobiles encourage a greater individual carbon footprint than standard vehicles, buses and trains. Counter-consumption campaigns such as eco-labelling for food and travel options have not shifted the prevailing pattern of carbon use inequality. As reported by Oxfam in 2015, the richest 10 of people produced half of the planet’s individual consumption-based fossil fuel emissions, while the poorest 50% contributed only 10%. The Top 1% emitted 30 times more carbon dioxide than the poorest 50% and 175 times that of the poorest 10%. The 2022 World Inequality Report broadly confirms these statistical trends and precedents a fascinating intra-class data. As of 2019 the richest 1% of individuals emitted around 100 tonnes of carbon dioxide on average, per person, per annum. More dramatically, those within the top .1% emitted 467 tonnes and the top 0.01% 2550 tonnes. The calculations demonstrate that high echelon gradations of carbon dioxide emission correlate with the gradations of capitalist class wealth. David Kenner’s research on overconsumption posits that rich one-percenters rarely make the link between luxury consumption and climate change impacts such as hurricanes, floods, heatwaves and forest fires. More commonly, they use “their extreme wealth to try and insulate themselves and continue their carbon intensive lifestyles”.

Let’s have a new deal on the Billionaire Class….

….and this too…

Who is brave enough to back Brazil’s global tax on billionaires? The answer will define our future

The response to the pandemic was one test of that proposition. Now the world’s governments face another. Last week, Brazilian climate minister Ana Toni explained a proposal put forward by her government (and now supported by South Africa, Germany and Spain), for a 2% global tax on the wealth of the world’s billionaires. Though it would affect just 3,000 of the super-rich, it would raise around $250bn(£195bn): a significant contribution either to global climate funds or to poverty alleviation.

Radical? Not at all. According to calculations by Oxfam, the wealth of billionaires has been growing so fast in recent years that maintaining it at a constant level would have required an annual tax of 12.8%. Trillions, in other words: enough to address global problems long written off as intractable.

You would need to perform Olympian mental gymnastics to oppose Brazil’s very modest proposal. It addresses, albeit to a tiny extent, one of the great democratic deficits of our time: that capital operates globally, while voting power stops at the national border. Without global measures, in the contest between people and plutocrats, the plutocrats will inevitably win. They can extract vast wealth from the nations in which they operate, often with the help of government subsidies and state contracts, and shift it through opaque networks of shell companies and secrecy regimes, placing it beyond the reach of any tax authority. This is what some of the global “investors” in the UK’s water companies have done. The money they extracted is now gone, and we are left with both the debts they accumulated and the ruins of the system they ransacked. Get tough with capital, or capital will get tough with you.

The Brazilian proposal, which will be put before the G20 summit in Rio in November, has already been dismissed by the US treasury secretary, Janet Yellen, who suggested there was no need for it. On whose behalf does she make this claim? Not ours. Wherever people have been surveyed, including in the US, there is strong support for raising taxes on the rich.

In the two years following the start of the pandemic, the world’s richest 1% captured 63% of economic growth. The collective fortune of billionaires rose by $2.7bn a day, while some of the world’s poorest became poorer still. Between 2020 and 2023, the five richest men on Earth doubled their wealth.

Billionaire wealth impoverishes us all: astonishingly, each of them produces, on average, a million times more carbon dioxide than the average global citizen in the bottom 90%. Billionaires are a blight on the planet.

Yet, because they are the true citizens of nowhere, shifting their wealth and residence between jurisdictions, they pay far lower levels of tax than the most downtrodden of their workers. Oxfam has calculated, using records unearthed by the investigative journalists ProPublica in 2021, that Elon Musk pays a “true tax rate” of 3.27%, and Jeff Bezos less than 1%. Falling tax rates and the clever workarounds designed by the lawyers and accountants serving the ultra-rich help to explain the growth of their fortunes.

Wealth that could otherwise support public services and public wellbeing is siphoned out of nation states. As the global rich accumulate ever greater economic power, and find ever more inventive ways to evade democratic restraint, they become more potent than many governments. There’s a word for this: oligarchy. Some of them use this power to demolish democratic safeguards. To give one example, they have lobbied successfully to pull down the rules and caps on campaign finance, until, in some nations, they appear to wield more influence over elections than the electorate.

…if we want to build the social and physical infrastructure we need to radically adapt to the realities of catastrophic climate change, we need to tax the rich!

I’m not looking for socialism here folks, just basic garden variety regulated capitalism!

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals, let’s start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry.

You should be angry, NZ Capitalism is a rigged trick for the rich and powerful. The real demarcation line of power in a western democracy is the 1% + their 9% enablers vs the 90% rest of us!

Do not allow their smears of ‘Envy’ dilute the righteous rage you should all be feeling!

There’s no point making workers pay more to rebuild our resilience, tax the rich!

-Sugar Tax

-Inheritance Tax

-Wealth Tax

-Financial Transactions Tax

-New top tax rate on people earning over $300 000 per year.

-Capital Gains Tax

-Windfall profit taxes

-First $20 000 tax free

Lift the tax yoke from the workers and the people and place it on the mega wealthy and have them pay their fair share for once!

In 2010, the 388 richest individuals owned more wealth than half of the entire human population on Earth

By 2015, this number was reduced to only 62 individuals

In 2018, it was 42

In 2019, it was down to only 26 individuals who own more wealth than 3.8 billion people.

In 2021, 20 people own more than 50% of the entire planet.

This isn’t democracy, this is a feudal plutocracy on a burning Earth

The Big Tech Tzars have manipulated our collective fear, ego, anger and insecurities through social media in a way that has led to the largest psychological civil war ever launched against one another.

We are but meat bags secreting hormones addicted to dopamine rewards for fat, sugar, salt and sex in a cultural landscape of individualism uber allas where we sing sweet secret lies to ourselves to make sense of a world around us that is frightening and in constant entropy.

Meanwhile, the planet burns and every aspect of our existence is monetarised for big data to sell us more stuff we can’t afford. We are alienated and anesthetized by a consumer culture that keeps us neurotic and disconnected. Our work, our existence, every move we make are all built to suck money to a minority class that sits above us while under neoliberalism, globalization, financialization, and automation, our existence as individuals has only become more disposable.

PS – A legalised Cannabis market would create $1.1billion per year that could be ringfenced for proper drug rehabilitation.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

GST is regressive. the rich DGAF, the poor just pay.

Pay to play society. – all you poors can just stay in your tent because it’ll cost you an arm or a kidney to leave it. just stay down and let us pay and play ya fucking bottom-feeders

And the ‘squeezed middle’ are the winners. Cos they get a tax relief!

A fascinating, if abbreviated, insight into the currents of modern New Zealand progressive thought.

If you dont want to pay GST dont buy shit you dont need like jet skis and other luxury shit .

True Gordon, less consumption less GST. And there’s too much senseless consumption. But GST is everywhere. On your grocery ticket, your plumbers invoice, on the odd bottle of grog you drink.

Wealth disparity. It’s been like that for eons I suspect, in numerous socities, in numerous civilizations. Biblical tales talk of the difficulty of wealthy folk passing through the eye of the needle, a reference to overladen camels not able to squeeze through narrow spaces in the city walls I believe. A good many civilizations were built on human exploitation, slavery and extreme poverty. In the middle ages poor people starved to death because in bad years wealthy folk took their entitlement and left a pittance. Is the modern global world so different? In some ways probably yes. In other ways much the same.

How do some folk get so wealthy? I mean the billionaire class, the 1%ers Inheritance? Hard work? Good fortune? A smart idea? Ruthless exploitation of others? Cunning exploitation of the system? I really don’t know. Even those with lots, a beachfront house, a city apartment, two or more flash cars, how the fuck did they get it all?

Then there’s the poor sods who have nothing, not even roof over their head. And those who struggle to earn a living wage. And those who do but still struggle. And those for whom life has been kind, with ups and downs, able to get by in a modest way, even very comfortably, some dismissive of those beneath them, some envious of those with more, but many more or less content with what they’ve got and quietly relieved things could have been worse.

The role of the state? The purpose of taxation? You could write a book on it, volumes in fact, not only economics but on the human condition itself. My view for what it’s worth is that the state does have a role in ensuring a fairer taxation regime. Bring it on.

https://www.stuff.co.nz/nz-news/360623674/mps-must-donate-fat-pay-rises-fight-child-poverty-says-sir-ian-taylor

These people you rightard?

Over the centuries the money worshippers have created the world we live in where wealth begets wealth and the poor are trapped in a life of misery. This is why we are brainwashed with lies like tall poppy syndrome and the American dream.

So, we could tax the rich all we like, but with there wealth and power and influence they control the narrative and will always end up increasing their wealth exponentially under the current system.

So we either exterminate them, or the current system needs to be dismantled.

That means getting rid of corporations, limited liability companies, shell companies, tax havens, trusts, electronic money, derivatives, and above all, property rights.

This means anyone who is acting outside the best interests of society can be sued out of existence. There are no legal entities to hide from.

To be fair, it may be worthwhile setting aside a private island for these sovereign individuals that they can call their own and determine whatever rules they like. Perhaps even a planet such as Mars.

We can then study them and see whether they really are the source of al the world’s wealth, innovation and productivity that their narcissistic minds think they are, or just another form of parasitic fungi.

You started all right however your solution will only make things worse, wealth inequality is the problem and people should be fairly rewarded for being productive (workers and owners) with realistic support for those in difficulty. The current system supports those with wealth like you say and both major parties seem content to keep that system with the left providing a few perks to minority groups. Getting a wide agreement on what is a fair reward and realistic support is the problem.

GST is simple and hard to avoid as the inland revenue pointed out this morning with companies who have been collecting it from the customer and not paying IRD .There is now $4 billion outstanding which is a sign that a lot of companies will fold in the next year .Instead of having 20 different taxes maybe we could have the first $50k tax free and then a flat rate of 15% on the rest .At least the rich and famous would be paying 15% more than they do now .Or we could have a transaction fee on all transactions .

That’s not how the wealthy rock Gordon..

If it was tax free to 50k and then 15%, they would never earn a dollar more than 50,000.

You need to get rid of their ability to manipulate their income to minimise taxes. Not just rearrange the tax rates.

What you are proposing as a flat tax sounds very similar to what Roger Douglas was trying to do 30 years ago.

Perhaps Gordi – sounds good.

Brings on a song Perhaps Love – comforting. John Denver and Placido Domingo.

https://www.youtube.com/watch?v=toYfeN0ACDw

50k tax free goes to the wealthy too. how about rebates and free tax advice for low income earners.

Well said Gordon you are more awake than some on this issue

Trevor can’t get his head around GST it’s too complicated for him.

I worked it out well enough to pay it for 25 years and get a ticket from inland revenue from my 2 audits.

I understood it because it is so simple and NZ is recognized world wide for its simple GST.

UK vat is a nightmare with different tax on a pie if it is hot or cold and different tax if a food is a sweet or not.

Gordon’s post below shows he understands its fairness and captures the rich .

Then stop fucking complaining about those that want GST on fruit and veges if you know it so well.

I do not complain about those that want GST on fruit and veg it is those that want it off I complain about

Seriously?

yes its real easy .Charge your customer 15% tax on the product or job you have done .Subtract any GST for the product or materials ,rent and other expenses then pay whats left to IRD .If you move to different rates for different things you will be there all day working it out .When I had to do it it took me about an hour a week .

Thats the only thing the pig farmer got right and the fact it has remained unmolested for 40 odd years proves that it is a good system .

Could not agree more with everything you say here. Except I don’t think that billionaires actually pay a cent in tax as they claim off whatever philanthropy they hand out back. And 2% tax is too little.